DOWNLOAD A PDF OF THIS REPORT pdf(0.3MB)

Contact

Margaret EngelFounding Partner [email protected] 212-921-9353 Lauren Peek

Partner [email protected] 212-921-9374 Ryan Colucci

Principal [email protected] 646-486-9745

Beginning with fiscal years ending on or after December 31, 2017, companies are required to disclose the ratio that compares the compensation of the CEO to the compensation of the median employee (pay ratio). This disclosure was part of the Dodd-Frank Wall Street Reform and Consumer Protection Act signed into law in 2010.

Compensation Advisory Partners LLC (CAP) researched early pay ratio disclosures. As of March 9, 2018, we obtained pay ratios from 150 companies with a median revenue of $2.1B from a cross-section of industries.

Pay Ratio

The median pay ratio disclosed by these companies is 87x. The lowest ratio is 1x (Apollo Global Management, Dorchester Minerals and The Carlyle Group) and the highest ratio is 1465x (Fresh Del Monte Produce Inc.).

| Summary Statistics | Median Employee Pay | Median CEO Pay | Pay Ratio |

| 75th percentile | $88,612 | $10.5M | 172x |

| Median | $58,256 | $5.6M | 87x |

| 25th percentile | $43,966 | $2.5M | 36x |

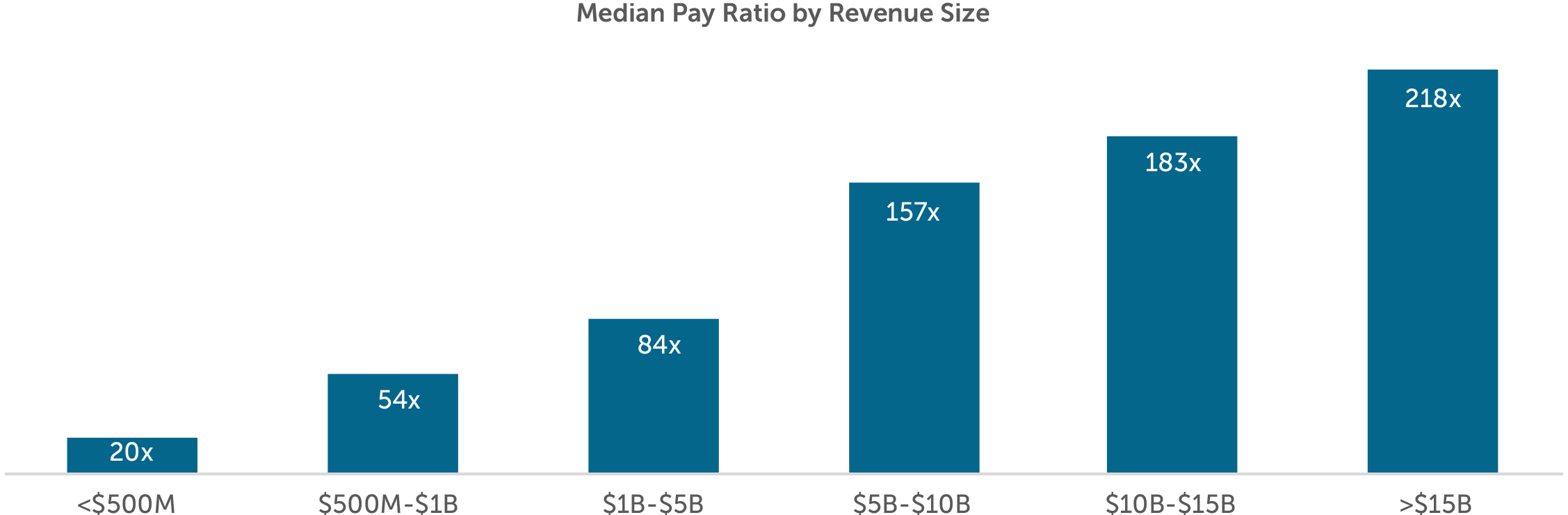

As expected, the pay ratio correlates with company size, with larger companies disclosing higher ratios. CEO pay varies greatly depending on the size and complexity of the organization. Employee pay has less variability since it reflects the job function and does not vary significantly based on the size of the organization. The median ratio in our sample of 150 companies ranges from 20x for companies with revenue less than $500M to 218x for companies with revenue greater than $15B.

Few companies, 15, disclose a supplemental pay ratio with only a handful of companies (three) disclosing more than one additional ratio. These companies with supplemental ratios are typically adjusting the CEO’s pay which may exclude anomalies such as a one-time special bonus or equity award. Interestingly, three companies disclosed a higher supplemental pay ratio likely to provide context for a large year over year increase in the 2019 proxy statement.

Location of Disclosure

Nearly 70% of companies disclose the pay ratio after the Potential Payments upon Termination or Change in Control section of the proxy statement. Approximately 25% of companies disclose the pay ratio just before or after the Summary Compensation Table and a small minority, 5%, disclose it in the Compensation Discussion and Analysis (CD&A).

Pay ratio is typically not disclosed in the CD&A, signaling to shareholders that the pay ratio is not used to determine CEO pay levels. Additionally, around 25% of companies include language in the disclosure that the ratio should not be used to compare pay levels to other companies within the industry, region of the country or revenue size.

Measurement Date

The SEC’s final rules give companies the flexibility to use any date within the last quarter of the fiscal year to identify the median employee. Companies most commonly used the last day of the fiscal year or a date within the last month of Q4. It is also common for companies to use a day within the first month of Q4 to identify the median employee.

| Measurement Month | Prevalence | Measurement Date | Prevalence | |

| First Month of Q4 | 29% | Last day of Q4 | 44% | |

| Second Month of Q4 | 8% | First day of Q4 | 17% | |

| Third Month of Q4 | 57% | Other | 33% | |

| Not Disclosed | 6% | Not Disclosed | 6% |

Exclusions from Median Employee Determination

Approximately one-third of companies excluded a portion of their workforce when determining the median employee. The most common rationale is the de minimis exemption (approximately 55%) whereby a company can exclude up to 5% of its non-U.S. employee workforce. Companies also commonly cited an acquisition or corporate not responsible for setting pay (e.g., independent contractors) as rationales for excluding certain employee groups.

Conclusion

As more companies continue to file their proxy statements in the coming weeks, we will likely see larger pay ratios, particularly as companies with a significant part-time workforce begin to disclose their ratios. We do not anticipate an increasing trend in the number of companies filing supplemental pay ratios though it will be interesting to see the rationale for those that do. We expect to continue to see companies placing the pay ratio outside of the CD&A with most disclosing it after the Potential Payments upon Termination or Change in Control section.