DOWNLOAD A PDF OF THIS REPORT pdf(0.3MB)

Contact

Bertha MasudaPartner Emeritus [email protected] 310-541-6233 Ryan Colucci

Principal [email protected] 646-486-9745 Louisa Heywood

Associate [email protected] 646-568-1160 Joshua Hovden

[email protected] 212-921-9350

2020 was a particularly robust year for initial public offerings (IPOs) and special purpose acquisition companies (SPACs). Many companies took advantage of favorable capital markets, and we saw much-anticipated IPOs such as Snowflake, DoorDash and Airbnb hit the public markets in 2020. Founders, employees, and investors unlocked significant value in these IPO events.

CAP’s review of technology company equity practices around IPO reveals several emerging compensation trends: a shift in equity award vehicles from stock options to restricted stock units (RSUs), increased use of double-trigger vesting for restricted stock, and large, company-friendly equity authorizations. Additionally, some companies implemented noteworthy founder compensation practices.

Pre-IPO Equity Grant Practices

CAP reviewed a sample of 20 high-profile, technology companies with IPOs in recent years to understand their equity practices leading up to the IPO.

List of companies:

| Airbnb | Fitbit | Palantir | Slack | Square |

| Asana | GoPro | Peloton | Snap | Uber |

| DoorDash | Grubhub | Snowflake | Unity Software | |

| Dropbox | Lyft | Roku | Sonos | Zoom Video |

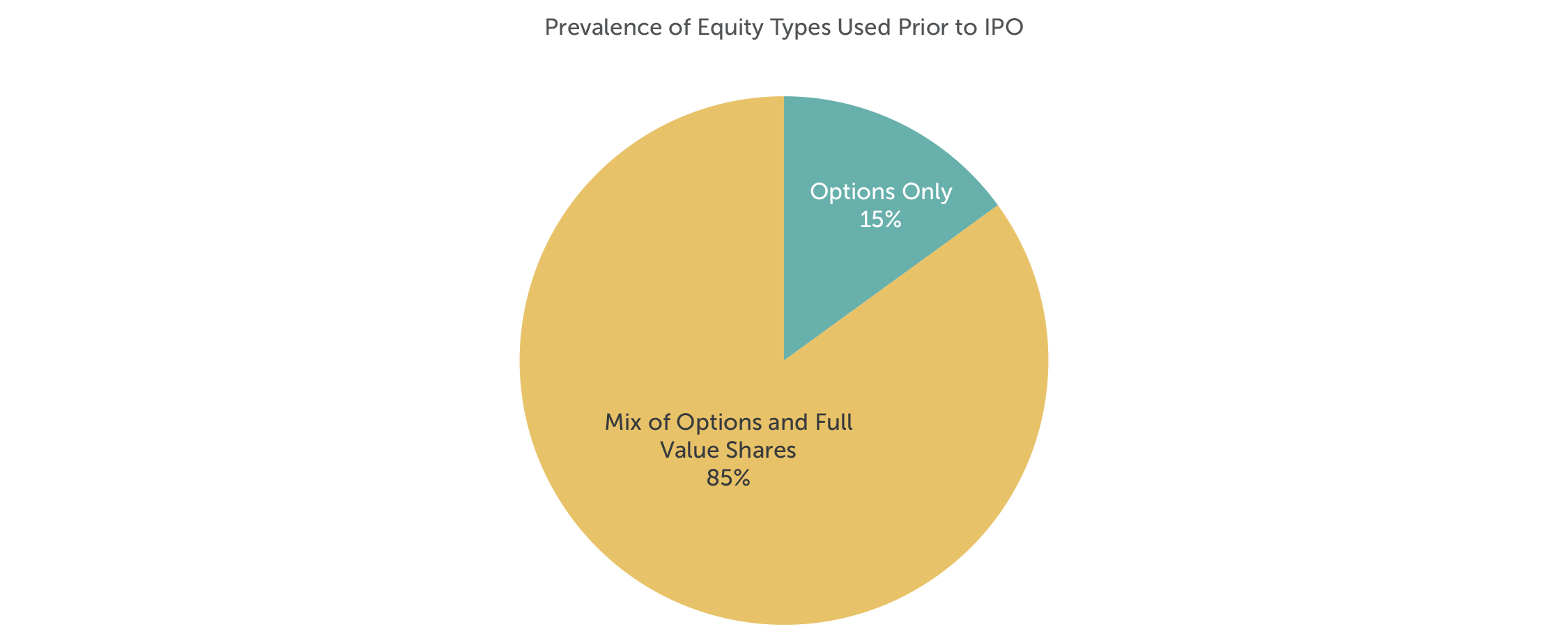

Options are still predominant. For companies anticipating growth, options continue to be the favored equity award for a variety of reasons. For employees, there is no tax burden at vest, and the employee has control over the settlement of the award and associated taxation. If incentive stock options (“ISOs”) are used, the employee receives capital gains treatment upon disposition of shares, assuming the required holding period is met. Options are also favorable from the shareholder (often financial sponsors) perspective. Options align the interests of employees with their shareholders, as no award value is realized unless the company value appreciates. Typically, stock options are granted at-hire and allow employees to share in the value of the company as it grows and matures.

Increased use of RSUs with unique features. Some companies (such as Lyft, Uber, and Dropbox) shifted to granting more RSUs in the years leading up to IPO. In these cases, RSUs have double-trigger vesting, which requires both time-based service (typically four years) and event-based requirements (typically a qualifying capital event such as an IPO) be satisfied in order for the RSUs to vest.

Companies naturally shift from granting options to RSUs as they grow and mature. Reasons for this include changes in a company’s growth expectations post-IPO, the need to conserve shares, and a desire for differentiated equity grant programs as companies grow in size and complexity. However, as seen with recent IPOs, favoring RSUs could be attributed to the fact that award values are easier to understand and are somewhat protected, even if company valuations fluctuate between funding rounds. Companies also benefit, from an accounting perspective, with vesting being dependent on a qualifying capital event as no accounting charge is incurred until such event takes place.

Adopting double-trigger RSUs has potential downsides, though. These include mounting pressure to go public (as evidenced by media coverage of the long-delayed IPO of Airbnb), and a significant tax burden for employees whose equity vests upon IPO. Employees are exposed to the financial risk of being taxed on stock compensation that has since declined in value since IPO. Also, when employees leave the company before the IPO event, their unvested shares are forfeited. This may pose an issue for recruitment unless the IPO timeline is clear. For the company, event-based vesting triggers a major accounting expense, and the large number of shares being sold may temporarily impact the company’s share price.

Note: No companies in the sample granted only full value shares prior to IPO.

Equity Authorization Pre- and At-IPO Practices

Before going public, companies often need to adopt multiple equity plans for incentive purposes. Not surprisingly, long time horizons and numerous funding rounds before IPO require companies to authorize additional equity share pools for compensation purposes. Private company investors are asked to approve incentives so that the company has enough “dry powder” to scale the executive team and grow its employee base. At median, equity overhang1 pre-IPO is 21.5% among the sample group.

In conjunction with the IPO, most companies (95% of companies in the sample), asked for an additional equity authorization. Median at-IPO overhang is 27.7% of common shares outstanding (CSO). In addition to the share request, companies often seek annual evergreen provisions (typically 5% of CSO per year) and liberal share recycling provisions.

Note: Pre-IPO and At-IPO equity overhang reflects the sample of 20 companies. Equity overhang for mature companies2 reflects sample (n=195) of S&P 1500 companies in the Information Technology sector, excluding companies that have gone public in the past three years.

Employee Stock Purchase Plans (ESPPs)

Many of the technology companies that went public implemented ESPPs in conjunction with their IPOs. ESPPs enable employees to purchase company stock, often at a discount, through payroll deductions. Most ESPPs are designed to be qualified plans under Internal Revenue Code Section 423, and from the standpoint of proxy advisory firms, such as ISS and Glass Lewis, are considered non-controversial. ESPPs are an appealing way for all employees to voluntarily acquire company shares after the IPO event. This is especially important as companies shift from granting equity to all employees to granting equity on a more selective basis (e.g., senior manager and up). An ESPP is an employee benefit that can be structured in ways (such as rollover provisions or extended offering periods) that make it an attractive recruiting and retention tool.

Founder Compensation

Every company has a different growth trajectory in its early years after formation. Founders typically must dilute personal ownership of the company in order to raise necessary capital. Companies in our study typically had multiple founders; however, not all founders contribute in the same way as the company evolves. Founders are often uniquely positioned and are key assets to their companies, which makes their retention crucial especially since finding a suitable replacement may be both difficult and expensive.

Founders who remain in executive roles after IPO have varied compensation packages depending on the specific circumstances. In some cases (Snap and Airbnb) founders reduced their base salaries to $1 post-IPO in exchange for significant equity grants in conjunction with the IPO. This is not typical as most founders maintain cash compensation (base salary and target bonuses) at market competitive levels.

With respect to equity compensation, some companies (including Airbnb and DoorDash) provided significant equity grants at or just prior to IPO. These grants often vest based on the achievement of performance criteria (e.g., stock price or market capitalization goals) and have long vesting periods that correspond with the magnitude of the award. Companies view these additional, often significant, equity grants to founders as necessary to incent continued service and focus, to maintain alignment with stockholder interests, and to mitigate the dilutive effects of public offerings on founder equity stakes.

Conclusion

Despite no “one-size-fits-all” approach to compensation, it is important to understand the various equity compensation tools available for companies preparing for an initial public offering. CAP’s review of recent technology IPOs highlights the latest trends in equity compensation needed to attract and retain skilled talent. Equally important is proactively and frequently communicating the value and mechanics of equity to participants for these awards to have maximum impact. Aligning pay philosophy with company culture and shareholder interests are important guiding principles to consider as companies design their equity incentive practices around IPO.

1 Overhang for IPO companies: Numerator = [Outstanding full value shares & options + shares available for grant + additional share requests] / Denominator = [Numerator + common shares outstanding as per the record date of the S-1 filing]

2 Overhang for Mature Companies: Numerator = [Outstanding full value shares & options + shares available for grant + additional share requests] / Denominator = [Diluted weighted average shares outstanding]