DOWNLOAD A PDF OF THIS REPORT pdf(0.3MB)

Contact

Melissa BurekFounding Partner [email protected] 212-921-9354 Margaret Engel

Founding Partner [email protected] 212-921-9353 Kelly Malafis

Founding Partner [email protected] 212-921-9357

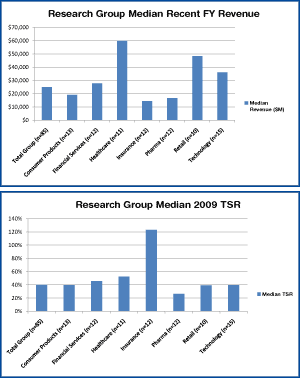

Compensation Advisory Partners (“CAP”) reviewed 2010 proxy disclosure for the 2009 performance year for a sample of the Fortune 500 companies. Our study includes 85 companies, representing seven industry groups. The industry groups we targeted include Consumer Products, Financial Services, Health Care, Insurance, Pharmaceuticals, Retail, and Technology. Our research gives insight into current trends that explain how executive compensation practices changed in 2009.

The component companies are large industry leaders. The total sample had median revenue of $25B, market cap of $37B and Total Shareholder Return (TSR) of 40% during 2009. The charts below include summary statistics by industry group. Practices at these leading companies are scrutinized closely by shareholders and the shareholder advisory groups. The responses of these companies to the financial strains in the economy during 2009 gives valuable insight into current practice and changes we expect to see in 2010.

What We Found

Highlights of our research results for the entire sample are below. Future CAP-Flashes will focus on particular industry groups and important topical areas, such as annual and long-term incentive design trends.

Compensation Strategy Changes

Outside of Financial Services, few companies reported changes to compensation strategy—i.e., the targeted pay positioning for executives and the targeted pay mix. Most stayed the course despite the challenging economic conditions in 2009.

Within the Financial Services group, most companies reported changes to compensation strategy, responding to their experience under TARP. Changes within the financial services industry include different pay mixes—examples include:

- Increased emphasis on fixed compensation by reducing incentive compensation and increasing base salary

- Increased emphasis on at risk, incentive compensation

- Majority of compensation delivered in restricted stock, deferred for 5 years

- Reduced portion of bonuses paid in cash and increased the portion of bonuses paid with deferred long-term awards subject to clawback

We expect Financial Services companies to continue to re- evaluate their compensation strategies as they exit TARP and emerge from the financial crisis and enter a more steady state.

Peer Groups Used For Benchmarking

Most companies did not make significant changes to their peer groups used for compensation benchmarking. Of those that did make changes, the majority of changes reported were primarily due to M&A activity in the Consumer Products, Insurance and Pharmaceutical industries. Others tweaked their selection criteria to focus more on companies in their industry and within a reasonable size range.

Base Salary Actions

Senior executive base salary actions continued to be restrained by the poor economy in 2009. Slightly more than half the sample did not increase or reduced salaries in 2009. Industry groups where salary freezes and reductions were widespread included Consumer Products, Health Care, Retail and Technology. Industries where salary increases were more common included Insurance and Pharmaceuticals. Merit increases were generally in the range of 2 – 3% when they were awarded.

| Type of Salary Change Reported in 2010 CD&A | No. of Cos. | % of Cos. (n = 85) |

| No Increase / Salary Freeze – All NEOs | 32 | 38% |

| No Increase / Salary Freeze – CEO Only | 6 | 7% |

| No Increase / Salary Freeze – Select NEOs | 1 | 1% |

| Salary Reduction – All NEOs | 4 | 5% |

| Salary Reduction – CEO Only | 1 | 1% |

| Salary Increase – All NEOs | 17 | 20% |

| Salary Increase – Select NEOs | 14 | 16% |

| Salary Increase – CEO Only | 1 | 1% |

| Salary Increase – TARP Related | 6 | 7% |

| Not Specified | 11 | 13% |

Note: Percentages do not add up to 100% due to multiple responses.

Annual Incentive Plan Design

Overall, 34 companies (40% of the full sample) disclosed making a change to their AIP design in 2009 or for 2010. While there was not a universal trend in the type of design changes being made, most companies are dealing with challenges in the goal setting process and maintaining meaningful performance linkages, linking rewards to the company’s ability to pay, and appropriately considering the impact of overall market conditions. In a nutshell, companies are trying to maintain a precise pay and performance calibration while also allowing for appropriate recognition of significant executive accomplishments.

The breakdown of reported AIP changes is as follows:

| Type of Change Reported in 2010 CD&A | No. of Cos. | % of Cos. Reporting Changes (n = 34) |

| Change in performance metrics used to fund awards | 15 | 44% |

| Increased target award opportunities | 9 | 26% |

| Reduced maximum award payout leverage | 4 | 12% |

| Added discretionary award component | 3 | 9% |

| Use of performance scorecard | 3 | 9% |

| New annual incentive plan (overhaul) | 2 | 6% |

| Other changes | 3 | 9% |

Note: Percentages do not add up to 100% due to multiple responses.

Change in Performance Metrics

Of the companies that changed their performance metrics and/or the mix of those metrics, a majority created a stronger linkage to corporate performance results and strategic priorities to support business changes forced by economic conditions. For example,

McKesson: For FY 2010, bonus goals need to significantly exceed the strategic plan to earn a target payout

Computer Sciences: Reduced the number of performance criteria to focus on key financial goals consistent with the company’s business strategy

T. J. Maxx – Eliminated divisional performance measures and focused on total company income

Sara Lee: Eliminated individual objectives and reallocated to corporate adjusted operating income goal

Merck: For 2010 incentive pool will be determined solely on company performance (as reflected by company scorecard)

There was no distinct trend in the changes made to the financial metrics used, though many changes included more emphasis on earnings, and to a lesser degree, revenue growth. Companies in the Insurance, Pharmaceutical and Retail industries made the most changes to metrics.

Discretion and Broad Performance Assessments

Some companies are increasing the role of discretion or broader retrospective performance assessment, to help ensure that significant market factors are considered at year end. For example, Genworth’s compensation committee uses discretionary judgment of performance against strategic objectives, including key financial criteria, to determine payouts. Microsoft’s compensation committee uses business judgment to help determine awards, and considers executive performance across a range of financial, operational, and strategic measures.

Another approach used by some companies includes use of a scorecard, which typically provides parameters for financial, operational, strategic, customer, and/or individual performance measurement. BNY-Mellon adopted such an approach to determine annual bonuses; and for 2010 Merck disclosed new incentive pool funding based on a company scorecard (solely company performance).

Changing Long-Term Incentive Practices

Most companies made changes to long-term incentive programs that either took effect in 2009 or will become effective in 2010—70% (60 out of 85) of companies reported changes. The most commonly reported changes involved changes to the mix of long-term incentive award vehicles granted and changes to the metrics used for long-term incentives. Here is a breakdown of what we found:

| Type of Change Reported in 2010 CD&A | No. of Cos. | % of Cos. Reporting Changes (n = 60) |

| Different mix of award vehicles | 33 | 55% |

| Different long-term performance metrics | 23 | 38% |

| Change in size of long-term award guidelines | 12 | 20% |

| Limits on dividend equivalents | 7 | 12% |

| Change in leverage in performance scales | 6 | 10% |

| Other changes | 9 | 15% |

Note: Percentages do not add up to 100% due to multiple responses.

Long-Term Award Mix

Among the companies that changed the mix of long-term award vehicles, two trends emerged. More than 50% of companies reporting a change in long-term award mix increased the emphasis on performance-based awards. Increased use of time-based awards – particularly among companies that had difficulty setting long-term financial goals during the recent period of economic uncertainty—was also common, but much less so. Finally, a few companies used options to a greater extent citing the difficulty in setting goals and attractive stock prices.

| Changes In Long-Term Incentive Award Mix | No. of Cos. | % of Cos. Reporting Changes (n = 33) |

| Greater emphasis on performance-based awards | 18 | 55% |

| Greater emphasis on time-based restricted stock/unit awards | 8 | 24% |

| Greater emphasis on options | 3 | 9% |

| Other | 4 | 12% |

Size of Long-Term Award Guidelines

Relatively few companies – only 14% of the total sample of 85 companies and 20% of the companies reporting changes to long-term programs—reported changing the size of long-term award target guidelines in 2009. Of the companies reporting a change, 67% decreased award guidelines and 25% increased award guidelines. One company reported migrating from fixed share guidelines to value-based guidelines, but did not indicate whether the change represented an increase or a decrease in value.

Long-Term Performance Metric Changes

Changes in long-term performance metrics were widespread. 25% of the total sample reported changing long-term incentives by adding new metrics; an additional 4% reduced the number of metrics used. Both relative and absolute TSR were selected as metrics by a number of companies. Return on equity/capital, revenue growth and cash flow were also popular choices.

| New Performance Metric | No. of Cos. | % of Cos. (n = 21) |

| Relative TSR | 5 | 24% |

| Absolute TSR of Stock Price Growth | 3 | 14% |

| Return on Equity or Capital | 4 | 19% |

| Revenue Growth | 3 | 14% |

| Cash Flow | 3 | 14% |

| Other Financial Metrics | 7 | 33% |

Note: Percentages do not add up to 100% due to multiple responses

Treatment of Dividend Equivalents and Other Plan Changes

Changes in the treatment of dividend equivalents was the most common plan design change reported. Seven companies moved to limit the payment of dividend equivalents until shares were earned or vested. Other design changes were more subtle, such as changes to the length of performance periods or the amount of leverage in performance scales.

Conclusions

Absent regulatory constraints, we did not see wholesale changes in 2009. Companies tended to stay the course in 2009 as the economic cycle bottomed out and the first signs of a recovery began to appear, but several clear trends did emerge. These include continued restraint on base salary increases, refinements to annual incentive and long-term incentive plan metrics and greater use of performance based long term incentives. These are all shareholder friendly developments that should improve the alignment between executive compensation and shareholders. We expect companies to continue to re-examine their programs as the economy improves and shareholders continue to demand performance and compensation program alignment.

***

Please contact us at (212) 921-9350 if you have any questions about the issues discussed above or would like to discuss your own executive compensation issues. You can access our website at www.capartners.com for more information on executive compensation.