DOWNLOAD A PDF OF THIS REPORT pdf(0.1MB)

Contact

Melissa BurekFounding Partner [email protected] 212-921-9354 Margaret Engel

Founding Partner [email protected] 212-921-9353 Lauren Peek

Partner [email protected] 212-921-9374

Compensation Advisory Partners (“CAP”) reviewed 2013 proxy disclosure at a sample of 100 companies representing nine industry groups for the 2012 performance year. The industry groups reviewed include Automotive, Consumer Goods, Financial Services, Health Care, Insurance, Manufacturing, Pharmaceuticals, Retail, and Technology. Our research examines changes in executive compensation practices in 2012, including observations on current trends and pay program design. This CAPflash focuses on annual incentive plan design and notable trends including changes made in 2012 or planned for 2013.

CHANGES IN ANNUAL INCENTIVE PLAN DESIGN

Overall, 37% of companies made changes to their annual incentive plan design in 2012 or 2013. The most common changes were to increase the target incentive opportunity for the CEO and/or CFO (43% of companies making a change to increase target award opportunities) or to change to the annual incentive performance metrics (35%). Companies continue to review and enhance the pay-for-performance relationship through changes to the annual incentive program.

|

Type of Change Reported in CD&A |

2012 No. of Cos. |

% of Cos. Reporting Changes |

|

|

2012 (n = 37) |

2011 (n = 43) |

||

|

Increase target award opportunities (CEO and/or CFO) |

16 |

43% |

28% |

|

Change in performance metrics used to fund awards |

13 |

35% |

42% |

|

Change in performance metric weighting/mix |

4 |

11% |

21% |

|

Adopt mandatory deferral mechanism |

4 |

11% |

n/a |

|

Change in maximum award payout |

3 |

8% |

12% |

|

Other Changes |

8 |

22% |

19% |

Note: Due to multiple responses, does not add up to 100%.

Change in Target Bonus Opportunity

Last year median target bonus opportunities for the CEO and CFO positions increased by 6 and 1 percentage points to 159% and 101% of salary, respectively. The target bonus opportunity for CEOs in the Technology industry increased by 50 percentage points in 2012 due to an increase in the target opportunity at Apple (from 50% to 100% of salary) and Verizon (from 187.5% to 250%). Conversely, in the Consumer Goods industry, target bonus opportunities decreased year over year due to new incumbents in these roles.

|

Industry |

Median Target Bonus as a % of Salary |

|||||

|

CEO |

CFO |

|||||

|

2012 |

2011 |

Change in %age Pts. |

2012 |

2011 |

Change in %age Pts. |

|

|

Automotive |

138% |

130% |

+8% |

88% |

88% |

0% |

|

Consumer Goods |

160% |

170% |

-10% |

90% |

100% |

-10% |

|

Financial Services |

n/m |

n/m |

n/m |

n/m |

n/m |

n/m |

|

Health Care |

145% |

145% |

0% |

101% |

100% |

+1% |

|

Insurance |

200% |

200% |

0% |

130% |

120% |

+10% |

|

Manufacturing |

142% |

156% |

-14% |

93% |

95% |

-2% |

|

Pharmaceutical |

150% |

150% |

0% |

97% |

91% |

+6% |

|

Retail |

190% |

168% |

+12% |

90% |

85% |

+5% |

|

Technology |

250% |

200% |

+50% |

135% |

121% |

+14% |

|

Total Sample |

159% |

153% |

+6% |

101% |

100% |

+1% |

Note: Financial Services industry is excluded since most companies in our study do not disclose target bonus opportunities for the Named Executive Officers.

Change in Performance Metrics

Of the companies that changed or plan to change the performance metric:

- Nine (9) companies added metrics to the current plan

- Two (2) companies reduced the number of metrics, and

- Two (2) companies kept the same number of metrics but replaced a metric in the incentive plan.

Several companies indicated that their rationale for changing annual incentive metrics was, in large part, to better align executive pay with the business strategy and shareholder interests:

- Caterpillar: Incorporated Operating Profit After Capital Charge (OPACC) as a measure, to reflect how the Company is utilizing its assets in order to generate shareholder value

- CIGNA: Added a customer loyalty metric in 2013 to emphasize its business strategy and focus on the customers it serves

- Hewlett Packard: Introduced year over year improvement in Return on Invested Capital as an annual incentive metric to focus executives on the business turnaround

ANNUAL INCENTIVE PLAN DESIGN / PRACTICES

Award Leverage

Most companies reviewed did not disclose a threshold level of performance required to receive a bonus payment. Instead, these companies disclosed a minimum bonus of $0. For the 37 companies that did disclose a threshold bonus, 50% of target is the most prevalent payout percentage. However 20 companies, disclose a minimum bonus payout of less than 50% of target with a majority of these companies paying out for results based on one of multiple plan metrics. A majority of companies (58%) have a maximum bonus opportunity of 200% of target bonus. Thirteen (13) companies have a maximum bonus of 250% of target or higher. Four (4) of these companies are in the Consumer Goods industry and three (3) are in the Technology industry.

|

Threshold as a % of Target (n=37) |

||

|

Range |

# of Cos. |

% of Cos. |

|

< 25% |

10 |

27% |

|

25% < 50% |

10 |

27% |

|

50% |

12 |

32% |

|

50% < 75% |

1 |

3% |

|

75 <100% |

4 |

11% |

|

Maximum as a % of Target (n = 78) |

||

|

Range |

# of Cos. |

% of Cos. |

|

100% < 150% |

2 |

3% |

|

150% < 200% |

16 |

21% |

|

200% |

45 |

58% |

|

200% < 250% |

2 |

3% |

|

> 250% |

13 |

17% |

Of the six (6) companies that made changes to their maximum bonus potential in 2012/2013, three (3) companies increased the maximum bonus potential and three (3) companies reduced the maximum. Two (2) of these companies (Allstate and Colgate-Palmolive) changed the maximum payout for the CEO only.

Annual Incentive Plan Metrics

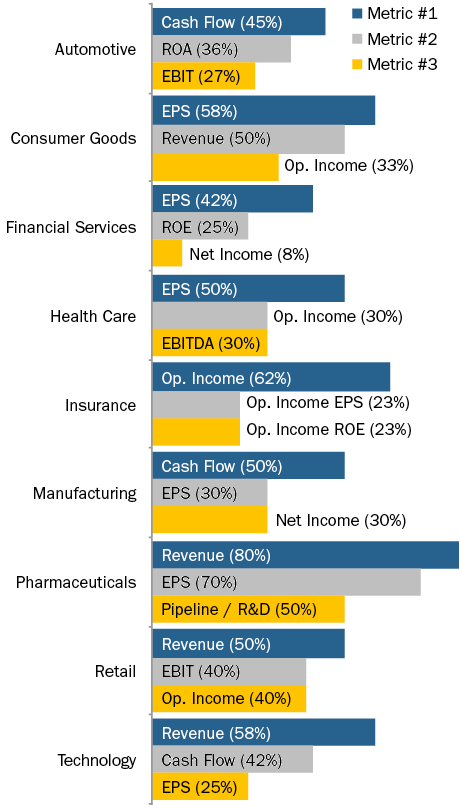

Similar to 2011, Revenue, EPS, Cash Flow and Operating Income continue to be the most prevalent metrics used across all companies, although we see some variation in metrics by industry. In 2013, 30% of companies disclose using two (2) metrics in their annual incentive programs, 29% use three (3) metrics, and 12% of companies use four (4) or more metrics. Approximately 85% of these companies use a profit-based metric in combination with Revenue and/or Cash Flow.

Refer to the chart below for the three (3) most prevalent metrics by industry:

|

Industry |

Actual Bonus as a % of Target Bonus – CEO |

|||||

|

2012 |

2011 |

|||||

|

25th%ile |

Median |

75th%ile |

25th%ile |

Median |

75th%ile |

|

|

Automotive |

69% |

102% |

131% |

130% |

153% |

186% |

|

Consumer Goods |

94% |

103% |

137% |

78% |

132% |

149% |

|

Financial Services |

44% |

80% |

120% |

111% |

114% |

130% |

|

Health Care |

103% |

127% |

157% |

116% |

127% |

159% |

|

Insurance |

112% |

130% |

144% |

85% |

106% |

130% |

|

Manufacturing |

100% |

107% |

146% |

119% |

136% |

162% |

|

Pharmaceutical |

125% |

142% |

156% |

130% |

144% |

161% |

|

Retail |

79% |

117% |

136% |

112% |

129% |

147% |

|

Technology |

90% |

99% |

124% |

75% |

100% |

149% |

|

Total Sample |

93% |

112% |

144% |

105% |

133% |

156% |

Note: Most companies in the Financial Services industry does not disclose target bonus. Figures for the Financial Services industry reflects actual bonus as a percentage of 3-year average actual bonus.

2012 Actual Bonus Payout

Similar to 2011, approximately 95% of companies awarded bonuses to their Named Executive Officers for 2012 performance. Overall, the median CEO bonus was 112% of target compared to 133% in 2011, indicating that 2012 performance generally exceeded par, but was not as strong as 2011 performance. Median 2012 bonus payouts in the Health Care, Insurance, Pharmaceutical and Retail industries exceeded target by 15 – 40 percentage points while payouts in the Automotive, Consumer Goods, Manufacturing and Technology industries were closer to target.

15% of companies in our study require executives to defer all or a portion of their annual incentive payout. Nearly 50% of companies that require a portion of the annual incentive award to be deferred are in the Financial Services industry. Among companies with mandatory deferrals outside of the Financial Services industry, two (2) companies pay a portion of the annual incentive in restricted stock units if the total payout exceeds a specific level:

- HCA Holdings: Any bonus payout above target is delivered 50% in cash and 50% in restricted stock units

- 3M: Annual incentive payouts in excess of 200% of target are paid in the form of restricted stock units

CONCLUSIONS

Companies are continuing to refine their annual incentive program to ensure executive pay is aligned with the Company’s business strategy and key success indicators. These recent trends also indicate that companies are modestly increasing CEO pay through the bonus opportunity and award leverage. Actual payouts for 2012, however, indicate stronger performance goals and moderately above target payouts, yet lower than the previous year. Revenue, EPS, Cash Flow and Operating Income continue to be the most prevalent annual incentive plan metrics with a majority of companies using two (30%) or three (29%) metrics to reward executives for company performance. We expect companies to continue to refine metrics and performance goals / leverage linkages in the annual incentive plan as shareholders and proxy advisory firms scrutinize the executive compensation program.