- Perquisites represent only a small portion of the total pay program for a CEO or CFO. However, perquisite based pay is – and we expect will continue to be – highly scrutinized

- In 2014 83% of companies provided perquisites to their CEO, and 81% of companies provided perquisites to their CFO

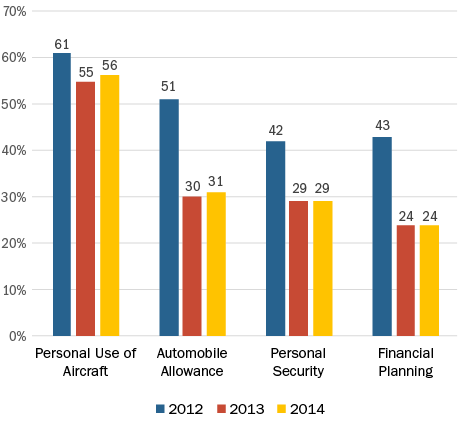

- The four most common CEO/CFO perquisites in 2014 were: personal use of corporate aircraft, auto allowance, personal security and financial planning

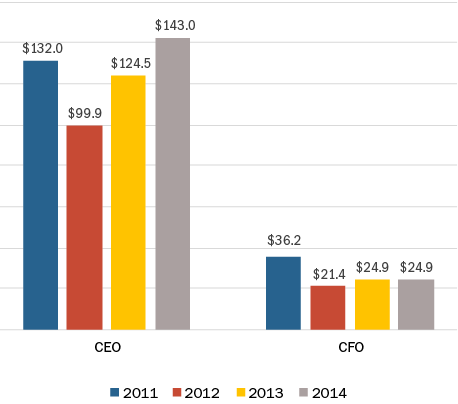

- The median value of total perquisites provided to CEOs increased by approximately 15% to $143,000 in 2014, and was flat at approximately $25,000 for CFOs

Our Survey Sample

Compensation Advisory Partners (“CAP”) reviewed 2015 proxy disclosures at a sample of 100 companies among the Fortune 500, representing nine industry groups. Industry groups included: Automotive, Consumer Goods, Financial Services, Health Care, Insurance, Manufacturing, Pharmaceutical, Retail, and Technology. For the companies studied, the median revenue size and market capitalization was $34 billion and $56 billion respectively.

What We Found

The percentage of companies in our research sample providing perquisites to their CEO stayed constant at 83% from 2013 to 2014. The percentage of companies providing perquisites to CFOs increased 5% from 2013 to 2014 to 81%.

In 2014, the four most common CEO perquisites were: personal use of corporate aircraft (56%), automobile allowance (31%), personal security (29%) and financial planning (24%). While the prevalence of personal use of corporate aircraft was generally flat from 2012 to 2014, the prevalence of automobile allowances, personal security and financial planning decreased sharply (approximately 30– 40%) over the past two years.

CEO Perquisite Prevalence

Although the prevalence of major perquisites remained steady in 2014 for CEOs compared to the prior year, the median total value for CEO perquisites increased 15% to $143,000. This value has ranged from $100,000 to $143,000 over the last four years. In contrast, the median value of perquisites for CFOs was relatively flat year-over-year, and has ranged from $21,000 to $36,000 since 2011.

Median CEO and CFO Perquisites Value ($000s)

Perquisites represent only a small portion of an executive’s total compensation, yet are often highly scrutinized. Shareholders prefer that pay be delivered in performance-based vehicles instead of through perquisites. Over the past few years, a number of companies changed their perquisite programs in reaction to increased shareholder scrutiny and specific feedback received from shareholders or proxy advisory firms. However, given fairly consistent prevalence over the past 2 years, data suggests that changes to company perquisite programs may have leveled off. PNC was the only company making a change to a perquisite program in our sample for 2014, increasing their annual perquisite limit from $10,000 to $20,000 for each NEO, other than for the CEO.

|

Perquisites Change Reported in CD&A |

2014 n=1 |

2013 n=7 |

2012 n=9 |

2011 n=14 |

||||

|

# of Cos. |

# of Cos. |

# of Cos. |

# of Cos. |

# of Cos. |

# of Cos. |

# of Cos. |

# of Cos. |

|

|

Eliminated perquisites |

0 |

0% |

6 |

75% |

2 |

22% |

9 |

56% |

|

Eliminated tax gross-ups on perquisites |

0 |

0% |

1 |

13% |

4 |

44% |

6 |

38% |

|

Reduced perquisite program/value |

0 |

0% |

1 |

13% |

2 |

22% |

1 |

6% |

|

Changed perquisite program |

1 |

100% |

0 |

0% |

1 |

11% |

0 |

0% |

Note: Percentages do not add up to 100% due to multiple changes by companies

Conclusion

While Compensation Committees continue to monitor the appropriateness (and competitiveness) of perquisite programs, as well as dollar values and overall executive usage, the degree to which executive perquisites are provided appears to have leveled off. We expect that companies will continue to closely align executive compensation with shareholder interests by limiting non-performance-based compensation, such as perquisites. We caution that any potential (perceived) misuse of executive perquisites will continue to raise the ire of shareholders and proxy advisory firms and provide for headline news.