DOWNLOAD A PDF OF THIS REPORT pdf(0.6MB)

Contact

Melissa BurekFounding Partner [email protected] 212-921-9354 Margaret Engel

Founding Partner [email protected] 212-921-9353

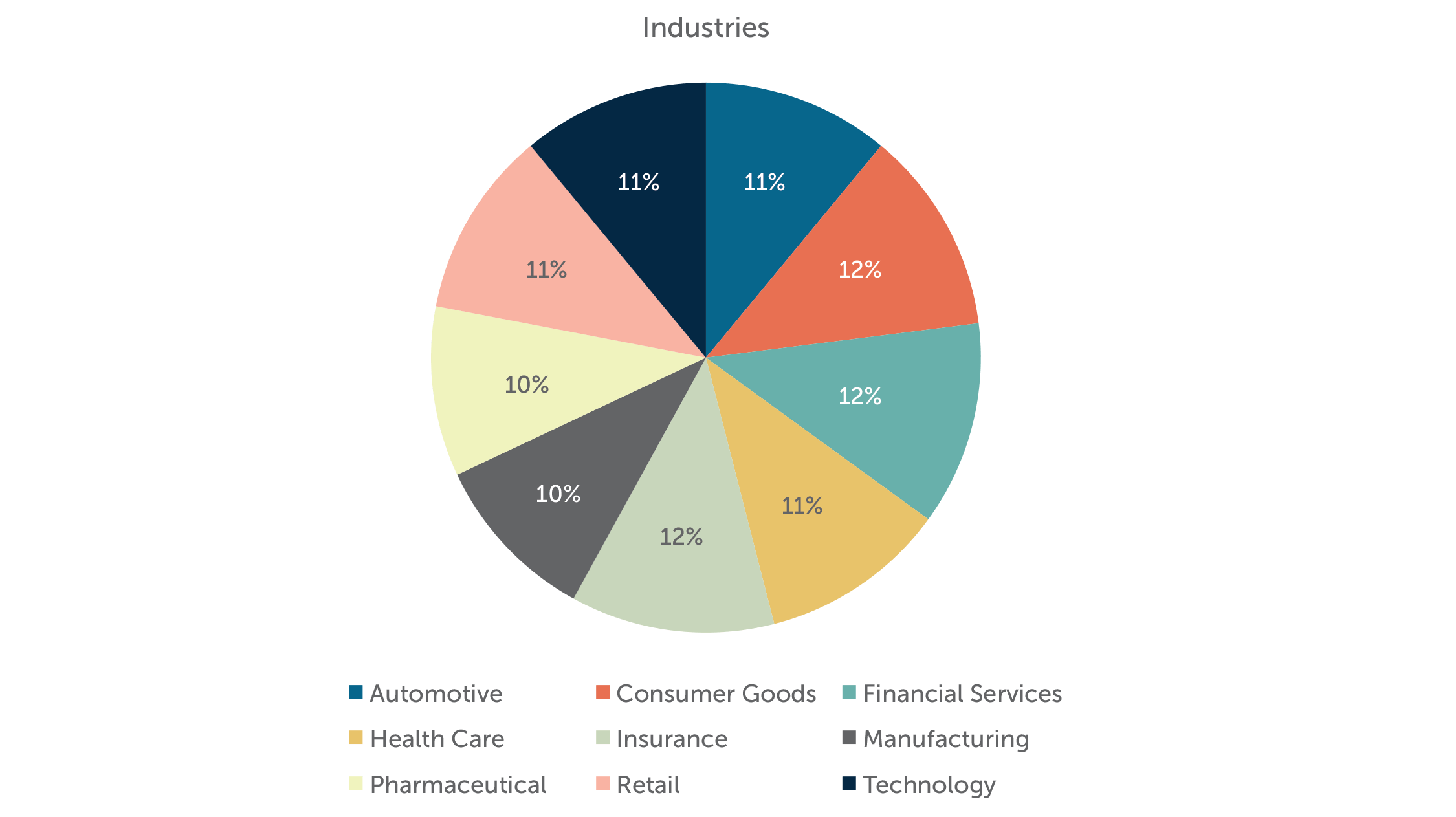

The CAP 100 Company Research consists of 100 companies from 9 industries, selected to provide a broad representation of market practice among large U.S. public companies. In this report, CAP reviewed Pay Strategies, Annual Incentives, Long-Term Incentives, Perquisites, and Shareholder Friendly Provisions of these companies in order to gauge general market practices and trends.

Characteristics of the CAP 100 Company Research Sample

The CAP 100 Company Research Study consists of 100 companies selected from nine industries intended to provide a broad representation of market practice among large U.S. public companies. The revenues of the companies in our sample range from $18 billion at the 25th percentile to $64 billion at the 75th percentile, with median revenues of $32 billion.

| Percentile Rank | Revenue | Net Income | Assets | Market

Cap |

Cumulative TSR for Periods ending on 12/31/2016 | ||

| 1-Year | 3-Year | 5-Year | |||||

| 75th | $63,783 | $6,379 | $177,135 | $106,570 | 94% | 78% | 49% |

| Median | $31,928 | $2,814 | $62,396 | $49,149 | 64% | 52% | 31% |

| 25th | $18,029 | $1,303 | $28,107 | $25,261 | 41% | 35% | 19% |

Pay Strategy

Among companies in CAP’s 100 Company Research, 100% disclose using a peer group of public companies for pay benchmarking purposes. The median number of companies in a peer group is 18 companies.

Approximately one-third of these companies (31%) use more than one peer group. Companies with two or more peer groups may use an industry specific peer group as well as a general industry peer group for benchmarking purposes. Alternatively, an industry peer group may be used for benchmarking purposes and a second broader peer group, typically from an index of stocks, may be used for relative performance comparisons.

| Peer Group | ||

| % of companies with a disclosed peer group | % of companies with more than one peer group (among companies with a peer group) | Median # of companies in peer group |

| 100% | 31% | 18 |

54% of the companies disclose a target pay philosophy for total compensation. The vast majority of these companies (91%) use median as a benchmark, with only 9% of companies targeting compensation above the median. This reflects a 10 percentage point decrease from last year in companies targeting pay above median.

| Target Pay Philosophy | |||||

| Element | Base | Bonus | Cash | Long-Term Incentive | Total Compensation |

| % Disclosing | 39% | 28% | 27% | 31% | 54% |

| % Target Median Pay | 92% | 100% | 100% | 97% | 91% |

| % Target Above Median Pay | 3% | 0% | 0% | 0% | 9% |

Annual Incentive

Award Leverage

CAP reviewed proxy disclosure to understand how companies are establishing the annual incentive payout ranges (i.e., the threshold payout and the maximum payout expressed as a percentage of the target payout) for annual incentives. Most companies that we reviewed identify the minimum payout as zero and do not separately disclose a threshold level of performance. For the 41 companies that did disclose a threshold bonus payout other than zero, a payout of 50% of target is the most common percentage. 19 companies disclose a minimum bonus payout of less than 50% of target.

84 companies disclose a maximum bonus opportunity. A majority of companies (70%) have a maximum bonus opportunity of 200% of target. Four companies have a maximum bonus of 250% of target or higher, with 300% of target being the highest.

| Annual Incentive Plan Payout Range | ||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

|||||||||||||||||||||||||||||||||||||||

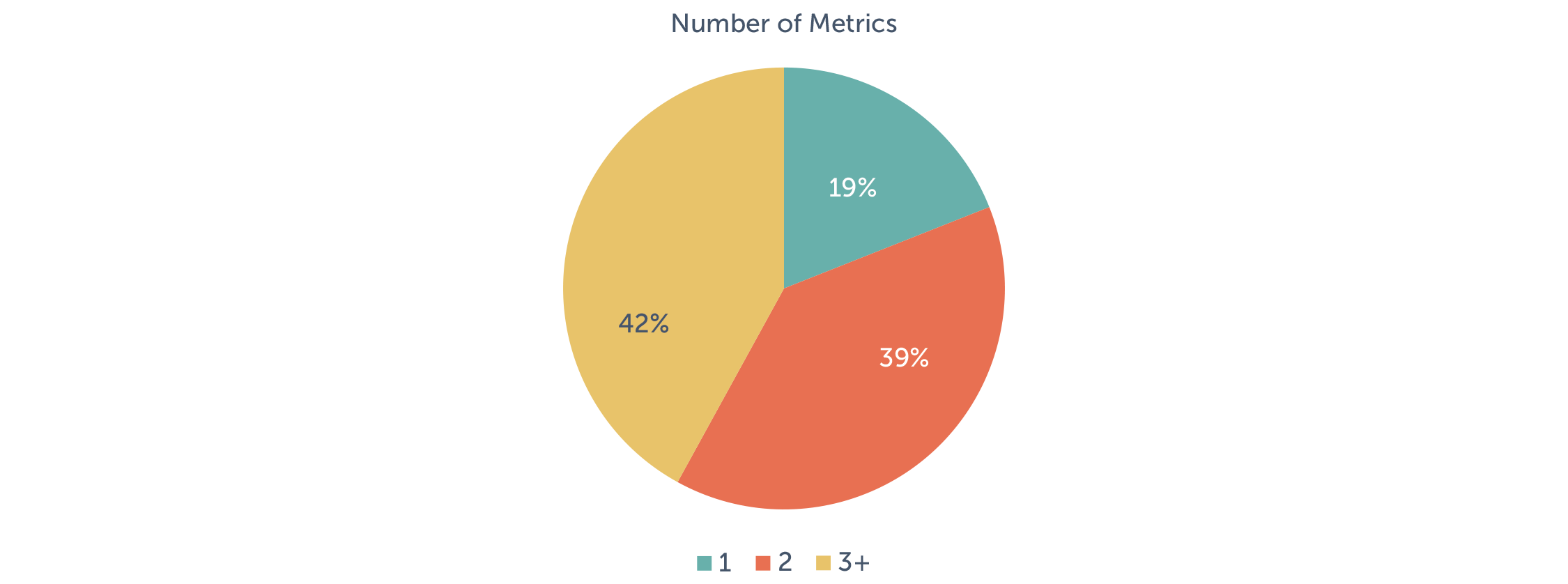

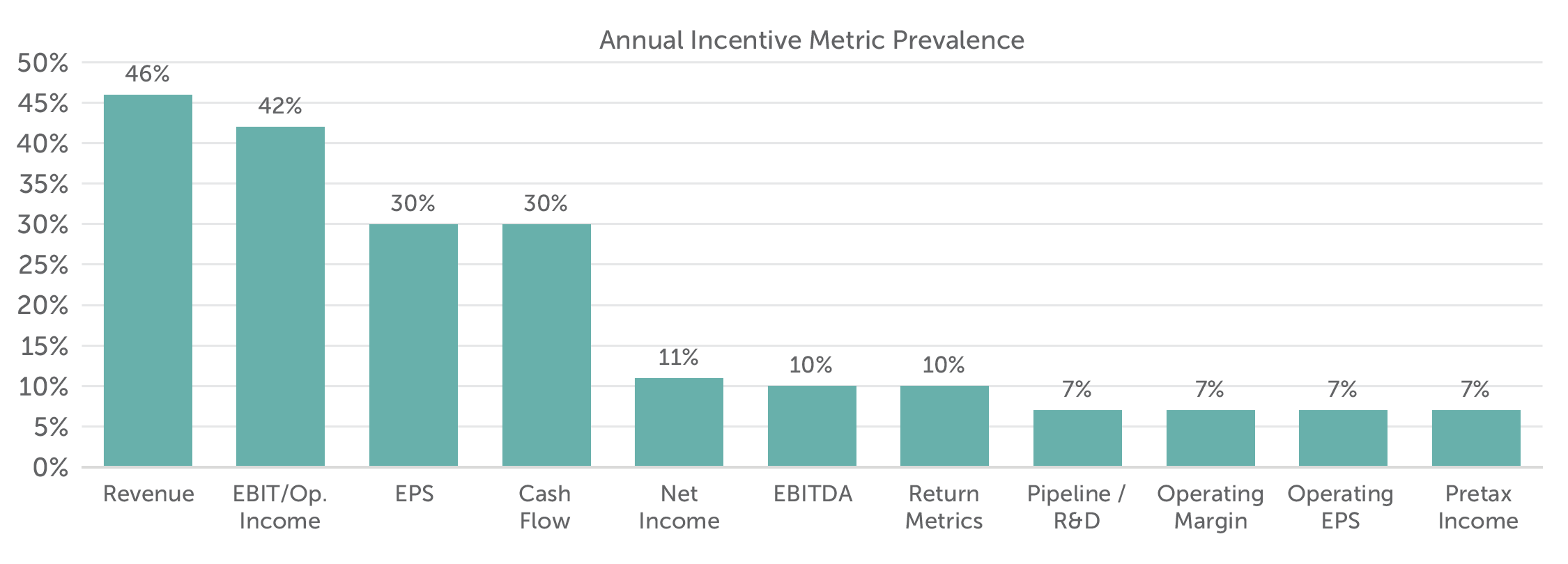

Annual Incentive Plan Metrics

Revenue, Operating Income, EPS, and Cash Flow are the most common metrics used in annual incentive plans. Most companies use two or three performance metrics to fund their annual incentive plans. Absolute financial performance targets based on a company’s budget predominate, with relative metrics used infrequently in annual incentive plans.

The use of multiple performance metrics allows for annual incentive payouts to be tied more closely to overall company performance in a balanced fashion. For example, companies using bottom-line measures in the annual incentive plan will often also include top-line measures for balance.

The use of revenue as an annual incentive metric is prevalent across most industries, along with a profit metric (e.g. operating income, EPS, net income, etc.) and cash flow.

The chart below shows the three (3) most common metrics by industry in 2016:

| Industry | Metrics | ||

| Metric #1 | Metric #2 | Metric #3 | |

| Automotive | EBIT / Op. Inc. (55%) | Cash Flow (55%) | ROA / ROE (36%) |

| Consumer Goods | Revenue (67%) | EPS (58%) | EBIT / Op. Inc. (42%) |

| Financial Services | EPS (17%) | n.m. | n.m. |

| Health Care | EPS (55%) | EBIT / Op. Inc. (36%) | Revenue and Cash Flow (both 27%) |

| Insurance | EBIT / Op. Inc. (50%) | Op. EPS (33%) | Op. ROE (25%) |

| Manufacturing | Cash Flow (60%) | EPS (40%) | EBIT / Op. Inc. (30%) |

| Pharmaceuticals | Revenue (80%) | Pipeline / R&D (70%) | EPS (60%) |

| Retail | Revenue (73%) | EBIT / Op. Inc. (73%) | n.m. |

| Technology | Revenue (64%) | Cash Flow (55%) | EBIT / Op. Inc. (45%) |

Note: Percentages reflect the prevalence of companies disclosing the metric.

2016 Actual Bonus Payouts

Overall, the median CEO bonus payout for 2016 performance was 101% of target – generally flat compared to the median payout for 2015 performance of 104%. Across industries, bonuses for Pharmaceutical and Consumer Goods CEOs exceeded target by the greatest amount (125% and 123% of target, at median, respectively). Three of the nine industries CAP surveyed had a median bonus payout of less than 100%: Financial Services, Manufacturing, and Retail. Compared to bonuses paid for 2015 performance. Compared to bonuses paid for 2015 performance, Consumer Goods experienced the greatest increase and Retail the greatest decrease, year-over-year.

Median CEO bonus payouts for 2016 compared to 2015

| Industry | CEO Bonus Payout at a Percent of Target | |||||

| 75th Percentile | Median | 25th Percentile | ||||

| 2016 | 2015 | 2016 | 2015 | 2016 | 2015 | |

| Automotive | 160% | 163% | 109% | 100% | 76% | 75% |

| Consumer Goods | 149% | 146% | 123% | 98% | 109% | 71% |

| Financial Services | 98% | 124% | 86% | 113% | 81% | 91% |

| Health Care | 129% | 156% | 106% | 138% | 86% | 117% |

| Insurance | 133% | 117% | 100% | 102% | 84% | 82% |

| Manufacturing | 116% | 108% | 99% | 102% | 85% | 96% |

| Pharmaceutical | 145% | 165% | 125% | 155% | 117% | 113% |

| Retail | 98% | 153% | 57% | 102% | 38% | 84% |

| Technology | 118% | 105% | 100% | 94% | 94% | 81% |

| Total Sample | 131% | 152% | 101% | 104% | 85% | 84% |

Note: Most companies in the Financial Services industry do not disclose a target bonus for the CEO. For these companies, three-year average actual bonus was used as a substitute for target.

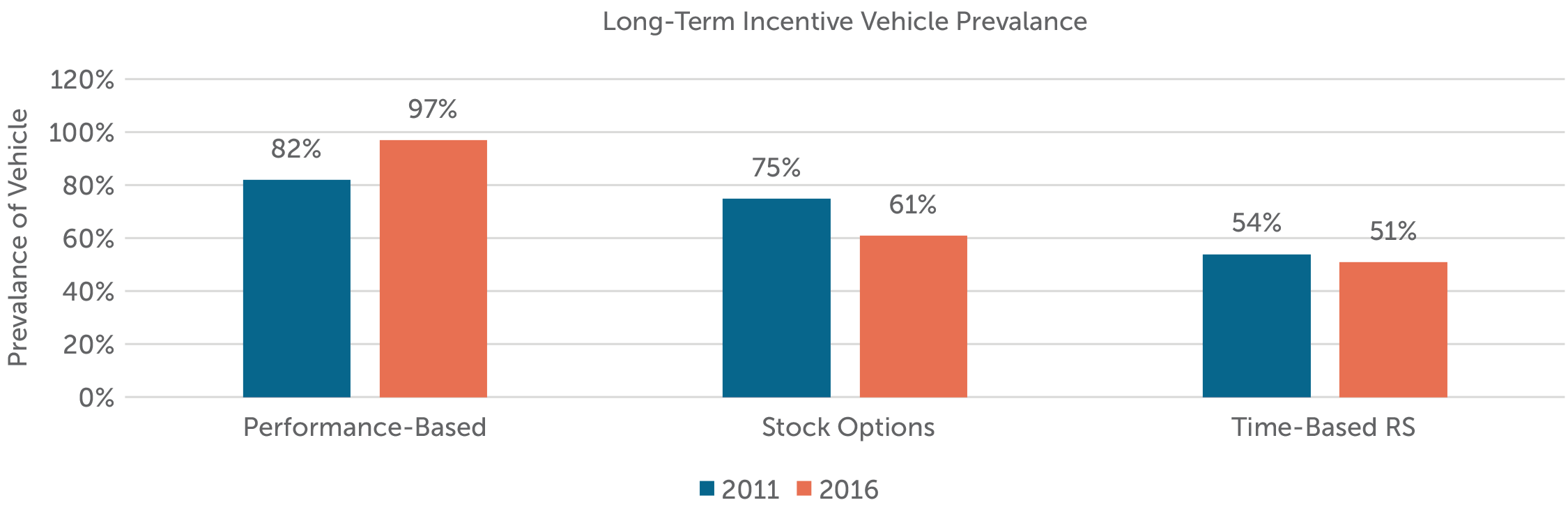

Long-Term Incentives

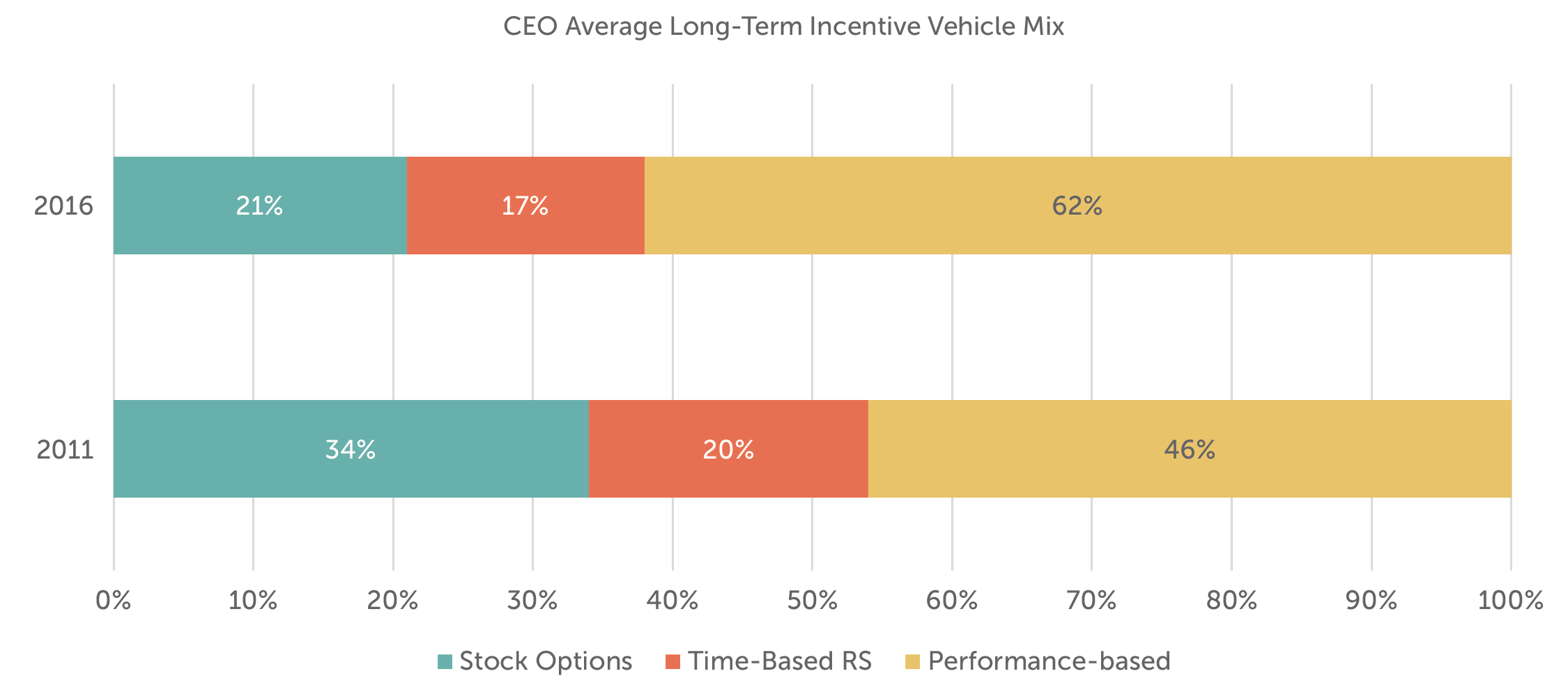

Over the past six years, the percentage of companies using stock options declined by 14 percentage points to 61%. The prevalence of time-based restricted stock/units declined by three percentage points. Performance-based vehicles have replaced stock options and time-based restricted stock/units over the last five years.

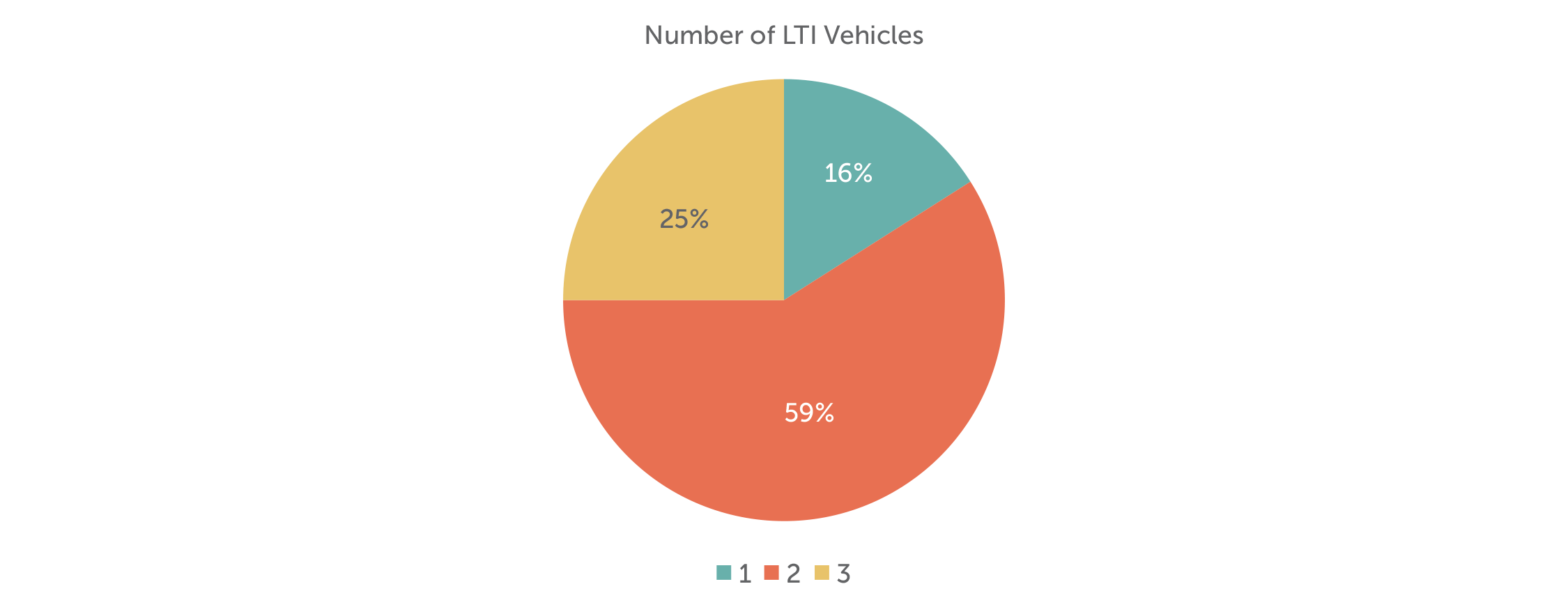

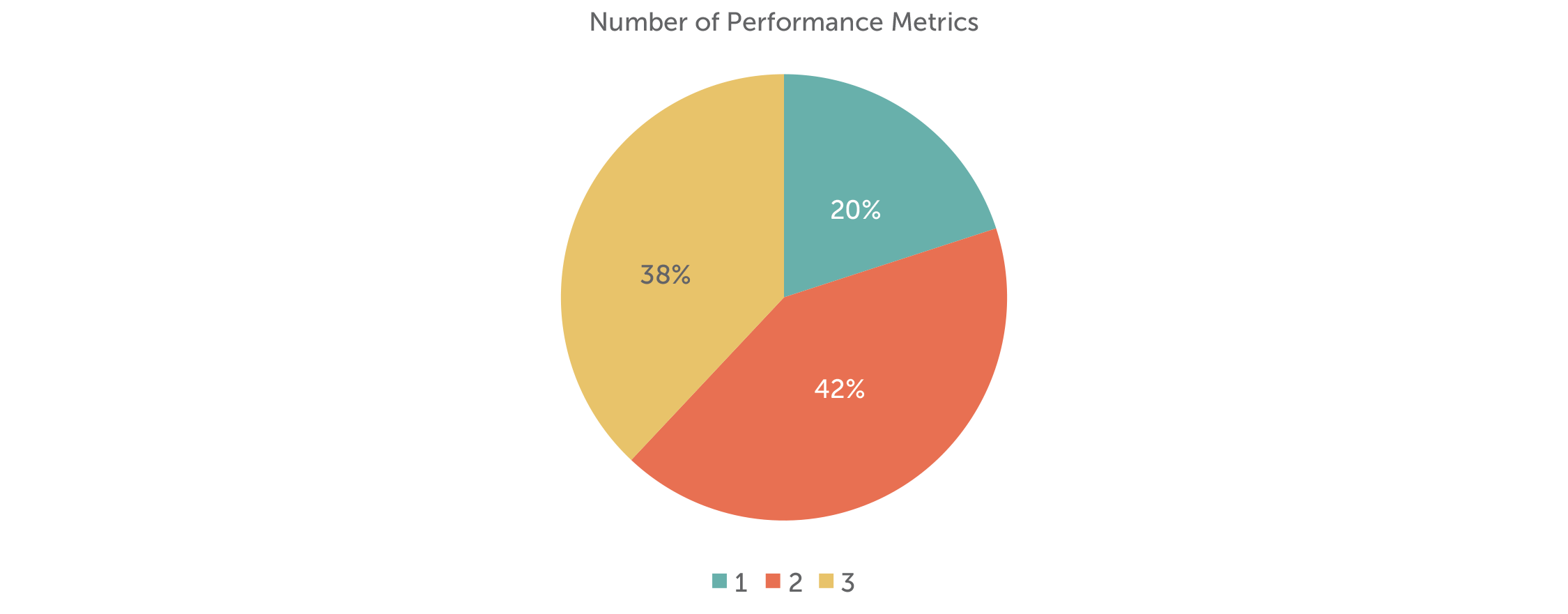

The majority of companies (59%) use two vehicles to deliver long-term incentives. Of these companies, most use a combination of a long-term performance plan and stock options (57%). The next most common approach is to use three vehicles (25% of companies), and the least common approach is to use only one vehicle (16% of companies). Among companies only using one vehicle, all but two use a long-term performance plan.

LTI AWARD MIX

Since 2011, there has been a significant shift away from the use of stock options and time-based RS/RSUs, towards performance-based awards in the overall CEO LTI award mix.

Restricted Stock / Units (RS/RSU)

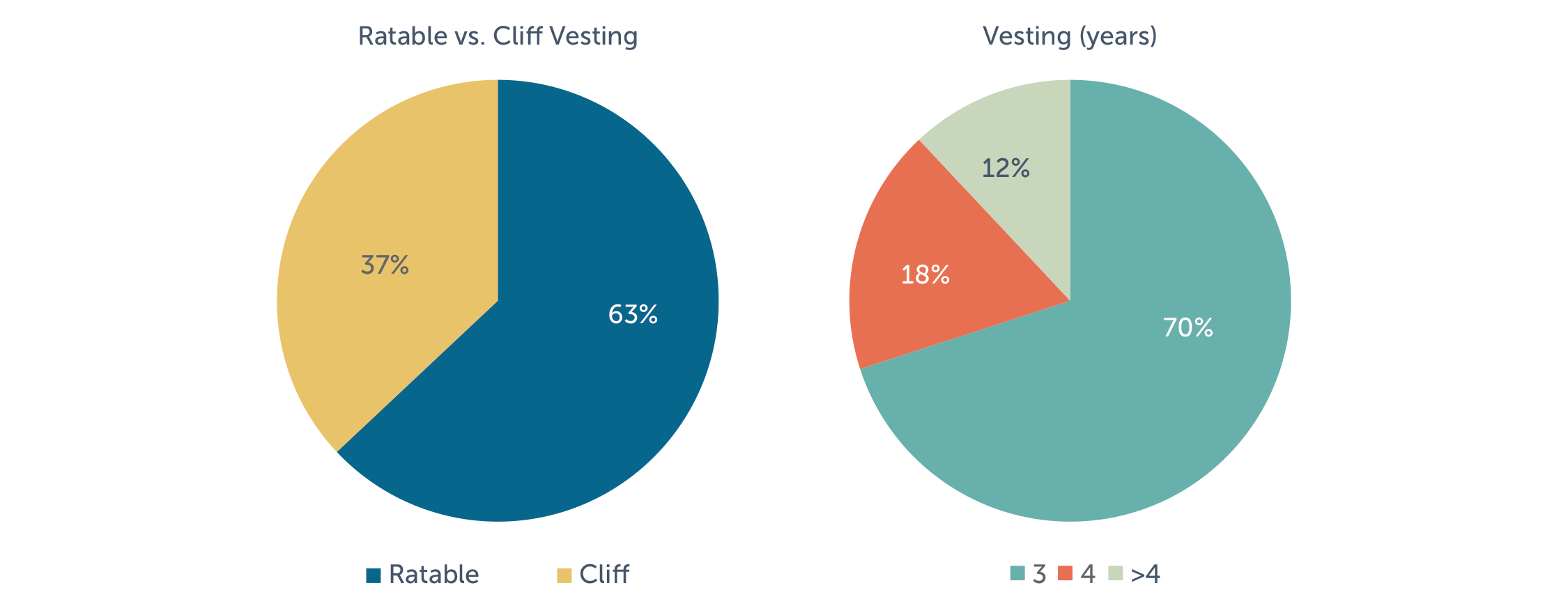

The majority of companies use ratable vesting over a period of three years for time-based RS/RSU awards. 30% of companies use a vesting schedule of four years or more.

| Ratable Vesting | Cliff Vesting | Vesting (years) | ||

| 3 | 4 | >4 | ||

| 63% | 37% | 70% | 18% | 12% |

Stock Options

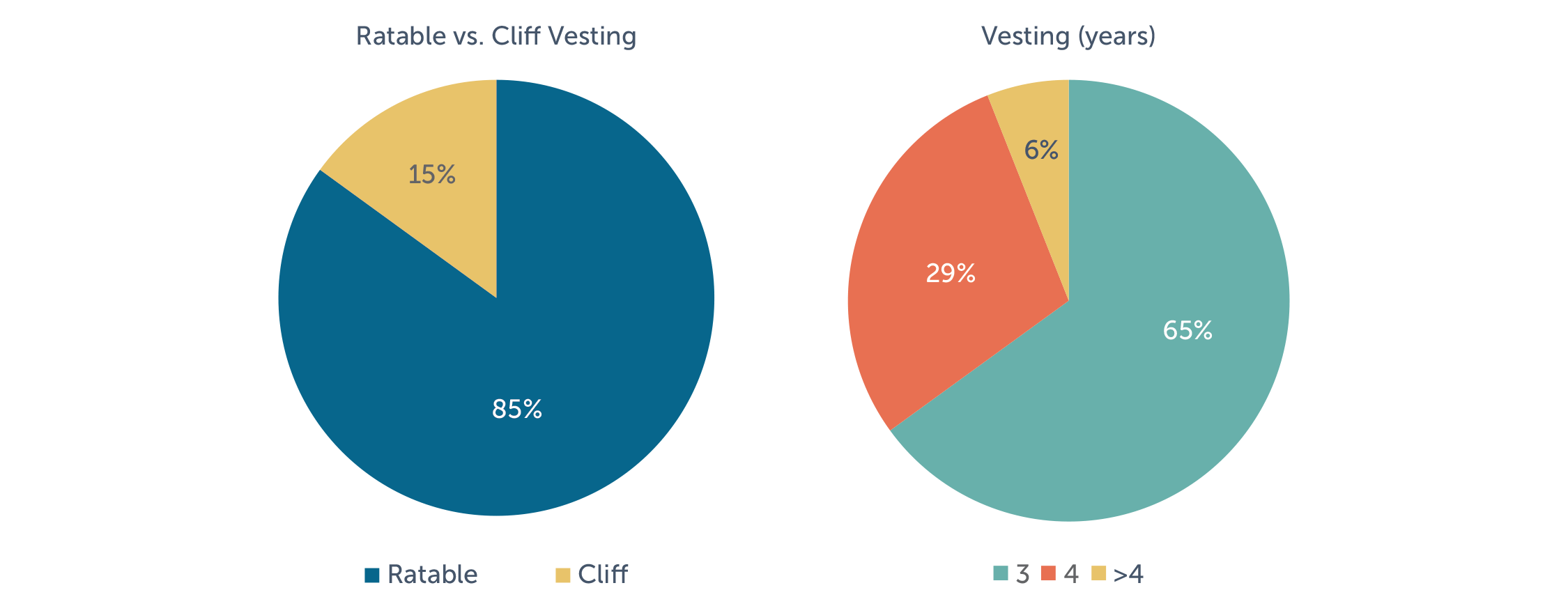

The majority of companies use a three-year ratable vesting schedule for stock options. An option term of ten years is most common.

| Option

Term |

Ratable Vesting | Cliff Vesting | Performance Vested | Vesting (years) | ||

| 3 | 4 | >4 | ||||

| 90% 10 yrs. | 85% | 15% | 1% | 65% | 29% | 6% |

Performance Based Awards

Among companies that grant performance-based awards with downside leverage, 97% of companies define the threshold payout as 50% of target or less. At maximum, the most common payout opportunity is 200% of target with only 3% of companies providing payout opportunities greater than 200%.

|

|

||||||||||||||||||||||||

Performance Metrics

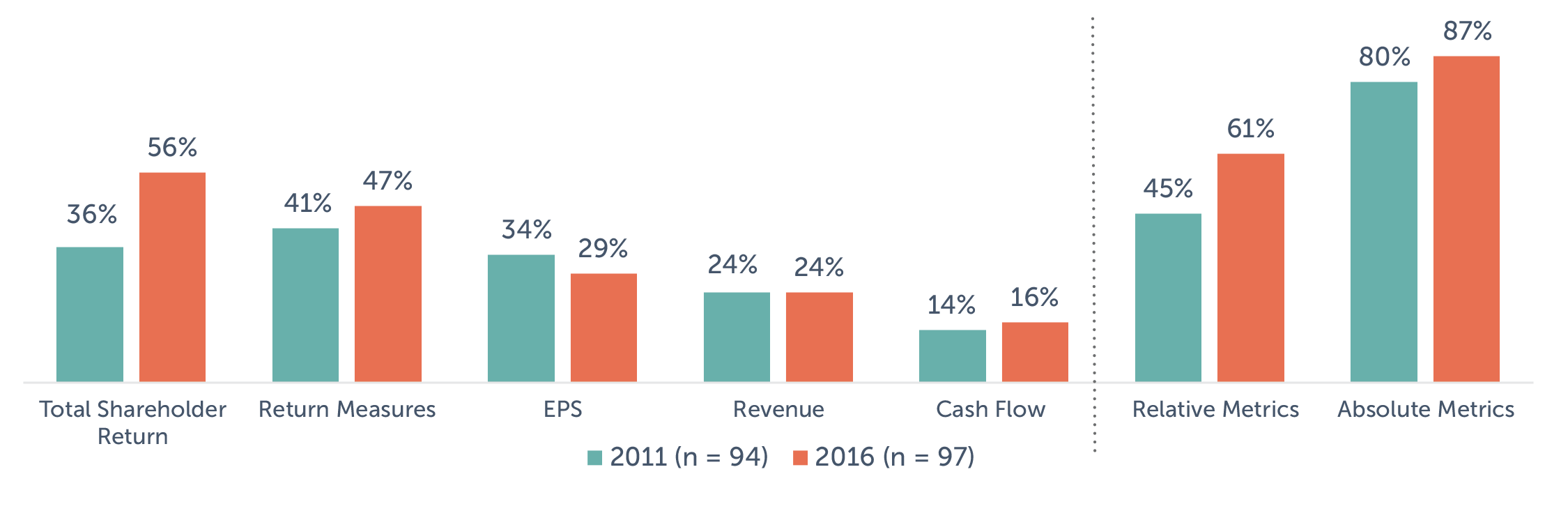

Among companies in our study, Total Shareholder Return (TSR) is the most prevalent performance metric in long-term performance plans (used by 56% of companies with an LTIP). Most companies (87%) that use TSR as a performance metric measure TSR on a relative basis, while only a few companies (13%) measure TSR on an absolute basis versus pre-established goals. In general, TSR is viewed as a shareholder friendly design feature. It also provides a credible way for companies to measure multi-year success, while avoiding challenges with setting multi-year financial or operational goals.

TSR does have short-comings though. It is an outcome of business strategy, rather than a driver of longer term company success. Relative TSR can also be heavily influenced by a company’s position in the cycle. For example, a period of lower performance can be followed by a sharp upswing or vice versa. However, most companies (91%) that use TSR as a metric use it with another metric—most commonly, a return metric or EPS. Further, among companies that use TSR, 32% use it as a modifier only.

Return measures are the second most prevalent (47% of companies) type of performance metric, followed by EPS (29%) and Revenue (24%). Companies use these metrics – often in combination – in long-term performance plans to support operational efficiency and/or profitable growth.

When selecting specific performance metrics and adjustments, if any – companies should consider metrics that support long-term value creation in their industry. For example, many companies in the Technology and Pharmaceutical industries use TSR as a metric. Companies in these industries want to motivate executives to drive success through the development of new products. As successes in new product development impact a company’s stock price before impacting its financial statements, TSR is a good indicator of future growth and profitability and aligns executives’ interests with those of shareholders.

Companies tend to use multiple metrics to create balance in their performance plans.

Performance Measurement – Absolute Vs. Relative

Among the companies in our study, 51% use a combination of absolute and relative performance goals in their long-term performance plans, up from 48% in the prior year. This approach motivates executives to achieve the company’s internal financial goals, while also balancing results relative to comparable companies. When goals are relative, goal setting is also, typically, substantially simplified.

Note: Percentages add to greater than 100% due to multiple responses. Return measures reflect ROE, ROI, ROIC, and ROA.

Performance Measurement Period

Among companies that use a long-term performance plan (stock/units or cash), 96% have at least one plan with a three-year performance measurement period. Only two companies have a plan with a longer measurement period.

Perquisites:

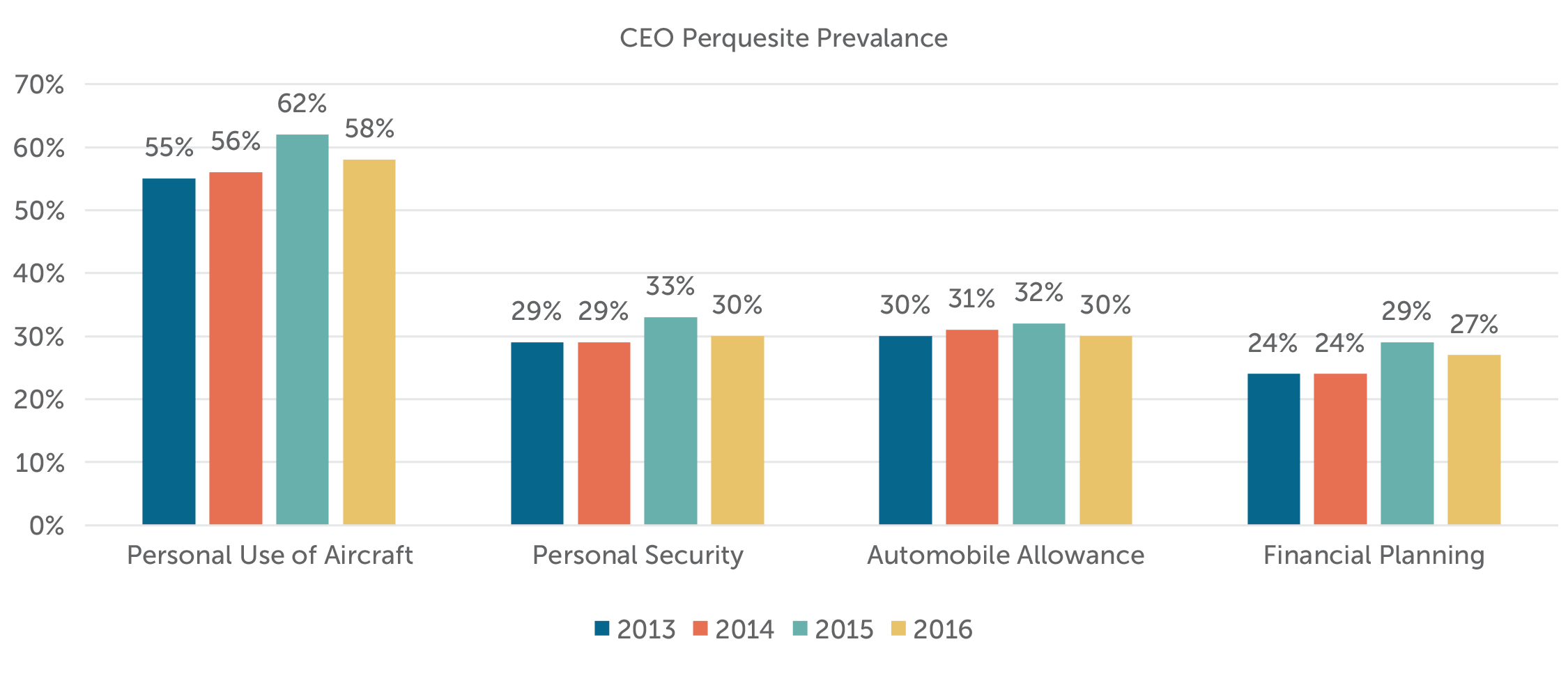

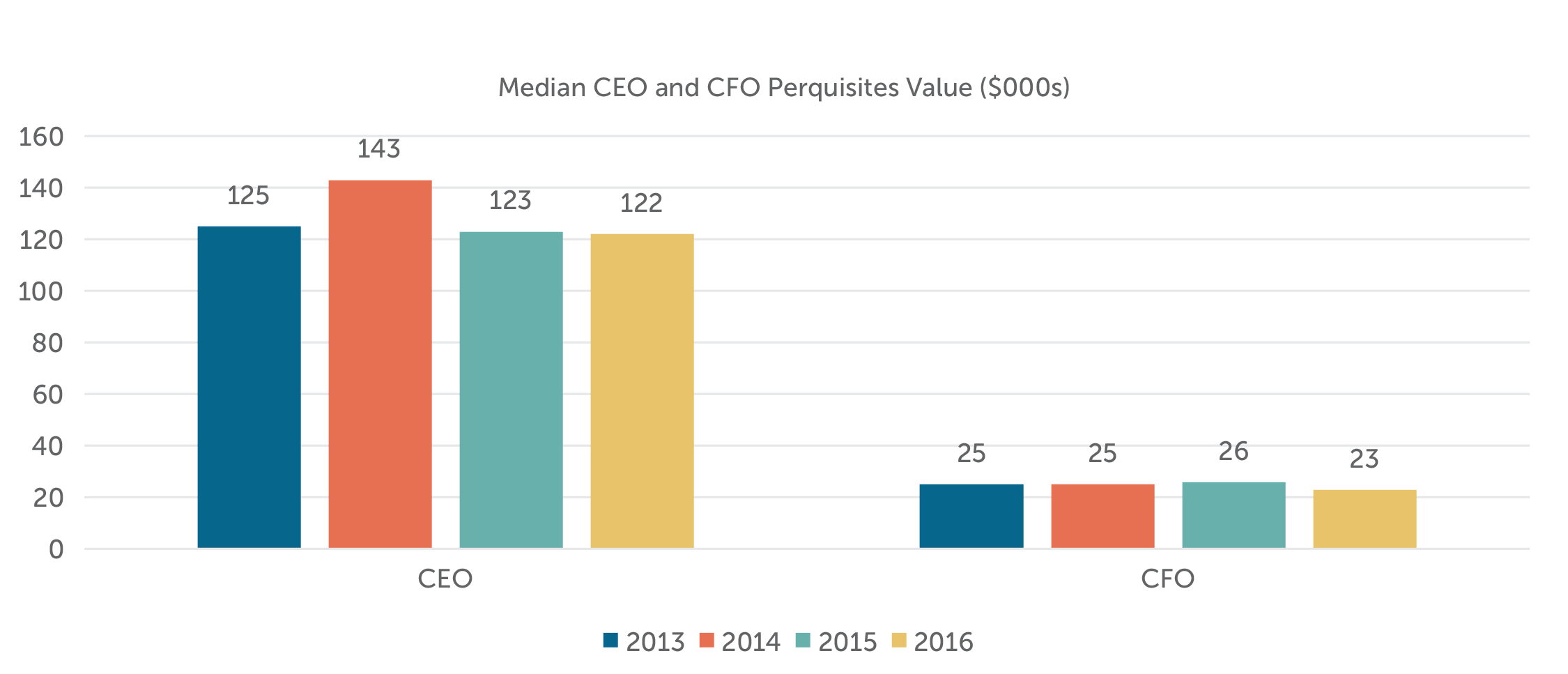

The percentage of companies in our research providing perquisites to their CEO increased from 82% in 2013 to 87% in 2016. The percentage of companies providing perquisites to CFOs was 73% in 2016.

In 2016, the four most common CEO perquisites were: personal use of corporate aircraft (58%), personal security (30%), automobile allowance (30%) and financial planning (27%).

The median total value of CEO perquisites in 2016 remained steady vs. 2015 at ~$122,000. This value has ranged from $122,000 to $143,000 over the last four years. For CFOs, the median value of perquisites has also been relatively flat year-over-year and has ranged from $23,000 to $26,000 since 2013.

Shareholder Friendly Provisions:

Stock ownership guidelines (SOG), hedging, pledging, and clawback policies have become very common for publicly traded companies. Companies are encouraged to implement these polices by pending legislation/rules, proxy advisory firms, and by shareholders.

| Stock Ownership Guideline | Hedging | Pledging | Clawback |

| 96% | 97% | 82% | 98% |

In addition to stock ownership guidelines, many companies, particularly larger companies, have instituted stock holding policies. Among companies with stock ownership guidelines, 55% have a holding policy associated with the SOG. Among these companies, 89% require holding until the stock ownership guideline is met. Independent of stock ownership guidelines, 33% of companies have instituted a “stand-alone” holding requirement.

| Holding Policy in Relation to SOG | If there is a holding policy in relation to SOG | Holding requirement, independent of SOG | ||

| Until Guideline Met | After Guideline met | |||

| 55% | 89% | 32% | 33% | |

For questions or more information, please contact:

Melissa Burek Partner [email protected] 212-921-9354

Margaret Engel Partner [email protected] 212-921-9353

Michael Keebaugh Associate [email protected] 646-532-5931

Michael Bonner Associate [email protected] 646-486-9744

Michael Biagi Associate [email protected] 646-486-9743

Ryan Colucci provided research assistance for this report.