DOWNLOAD A PDF OF THIS REPORT pdf(0.1MB)

Contact

Melissa BurekFounding Partner [email protected] 212-921-9354 Shaun Bisman

Principal [email protected] 212-921-9365

Compensation Advisory Partners (“CAP”) reviewed companies from the S&P 500 that filed their 2014 proxy between November 2013 and February 2014. The proxy disclosure sample of 44 companies (“Early Filers”) represents eight industry groups. The industry groups reviewed include Information Technology, Consumer Discretionary, Industrials, Consumer Staples, Healthcare, Materials, Financials, and Energy. Our research identified early trends to be found in the 2014 proxy season.

Among the 44 company sample, median revenue was $11B, median market capitalization was $23B and median 12 month Total Shareholder Return (TSR) was 27% at the end of February 2014.

What We Found

The early findings and trends from these filers generally showed a continuation of trends from the 2013 proxy season. Early in 2014 companies:

- Received high levels of shareholder Say on Pay support

- Awarded CEO bonuses that were slightly higher as a percent of target compared to prior year earned bonuses, and

- Shifted more of the long-term incentive “LTI” program to performance based vehicles and decreased the emphasis on stock options

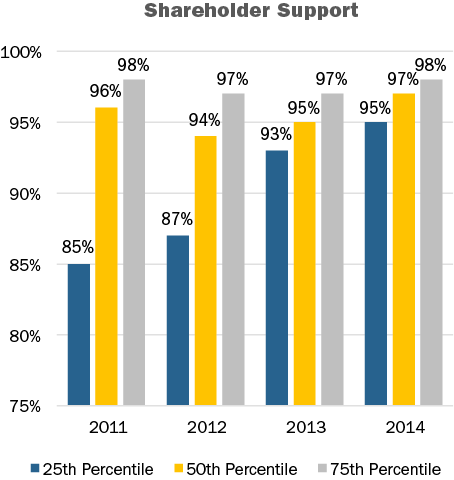

Say On Pay (SOP) Vote Results

In 2014, all Early Filers that released SOP results to-date (n=38) received majority shareholder support and 87% of companies received greater than 90% support. Among these companies there has been a steady uptick in the level of support at the 25th percentile over the last four years.

CAP Comment: SOP levels in early 2014 to-date continue to be strong. We expect similar SOP support levels for calendar year-end companies as we approach the 2014 annual meeting dates.

CHANGES IN SHORT AND LONG-TERM COMPENSATION

Base Salary

Among Early Filers, 46% of companies disclosed an increase to the CEO’s base salary in 2013 and the overall average base salary increase was 2.7%.2 CEOs in the Industrials industry received the largest average base salary increase (8.7%) followed by Consumer Staples (3.9%).

CAP Comment: The average executive base salary increase among the Early Filers is consistent with projected merit increases in the broader market where we are generally seeing 3.0% increases for 2014.

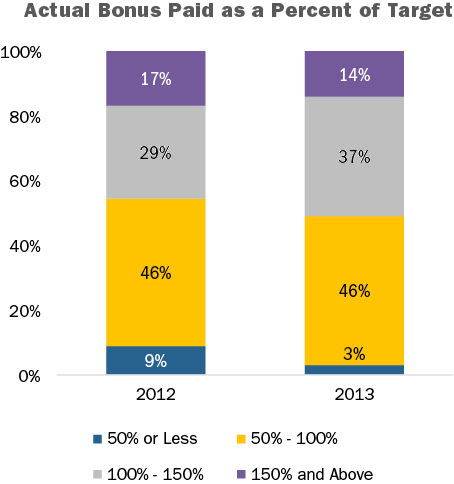

Short-term Incentive Payouts

Bonus payouts as a percent of target for the Early Filers increased slightly at the median. The median CEO bonus payout for 2013 was 100% of target compared to 97% in 2012. In general, there was a slight shift upwards in the bonus payouts when compared to the prior year. This is in-line with overall expectations as companies’ earnings and income also had modest growth year-over-year.

|

|

Annual Incentive Payout as a % of Target |

|

|

Summary Statistics |

2012 |

2013 |

|

75th Percentile |

118% |

119% |

|

50th Percentile |

97% |

100% |

|

25th Percentile |

74% |

84% |

51% of Early Filers paid above target in 2013, compared to 46% in 2012. Of the companies that paid above target, median year-over-year increases in revenue, earnings and income growth were in the 10-20% range, compared to 5% for all Early Filers companies.

CAP Comment: Year-over-year financial performance results are aligned with CEO bonus payouts for the Early Filers. Companies are putting more time and effort into the goal setting process to ensure an appropriate pay and performance alignment; investors and proxy advisory firms increasingly focus on the performance goals and rigor of the incentive plan targets.

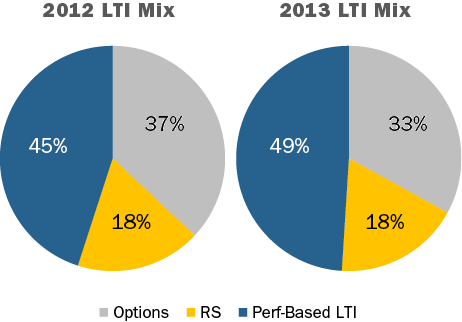

Long-term Incentive Mix

Over the last two years, the portion of the LTI mix delivered in a performance-based vehicle has increased in the general market. Early Filers showed a continuing, consistent shift, placing more emphasis on performance-based LTI and less emphasis on stock options; the weighting on time based restricted stock remained flat.

Approximately 85% of the Early Filers use two or three vehicles to deliver their long-term incentives.

CAP Comment: A general trend over the last couple of years has been a de-emphasis on stock options as part of the LTI program and an increase on the portion of performance based LTI. ISS is supporting this shift as they do not consider options to be performance-based.

Disclosed changes to compensation programs and polices

Companies continue to modify their compensation programs as they reassess program features in light of business/strategic changes and/or evolving shareholder and proxy advisory groups’ hot buttons. 36 of the 44 companies (82%) we researched disclosed making a change to their compensation programs or policies. The most prevalent change among the Early Filers was a modification to the company’s benchmarking peer group. Peer group changes are typically a result of companies trying to better align the peer group median size with that of their own company.

|

|

2013 |

% of Cos. |

|

Type of Change Reported in CD&A |

No. of Cos. |

n=44 |

|

Modified peer group |

22 |

50% |

|

Decreased weighting of options in LTI mix |

10 |

23% |

|

Increased weighting on perf.-based LTI |

9 |

20% |

|

Adopted / expanded clawback policy |

6 |

14% |

|

Adopted hedging and/or pledging |

5 |

11% |

Note: Percentages add up to greater than 100% due to multiple responses

CAP Comment: Modifications to a company’s peer group is common as Compensation Committees and management review appropriate peers for benchmarking on an annual or biennial basis. Given that ISS and Glass Lewis consider a company’s peer group when conducting their analyses, it is another reason that assessing the appropriateness of peer companies is a valuable exercise.

Similar to last year, companies continue to modify their clawback policy as a sign of good corporate governance. Companies are not universally waiting for final Dodd-Frank regulations before making adjustments to their policy. The uptick in the disclosure of hedging/pledging policies also continued, and overall, 86% of Early Filers disclose having both. Lastly, 14% of Early Filers voluntarily disclosed a supplemental table, graph or discussion of realized/realizable pay. In-line with CAP’s recent research on this topic and disclosure in 2013 proxies, these companies tend to compare realized/realizable pay with target or Summary Compensation Table pay values, as well as alignment with TSR.

Conclusions

While the Early Filers research is a sneak preview into the upcoming proxy season, we expect to see directionally consistent trends with these changes and practices indicated from our research. Companies are continuing to demonstrate good corporate governance and policies / programs that enhance company performance and pay linkages. Since there have not been significant changes in proxy advisory firm policies or expanded Dodd- Frank legislation, we do not expect to see significant program overhaul in the current proxy season. Companies with low SOP support will likely disclose more significant program modification.