On July 21, 2010 President Obama signed the Wall Street Reform and Consumer Protection Act of 2010 into law. The legislation will affect all public companies and several provisions impact executive compensation. For a full discussion of the law’s implications for executive compensation, see our CAPFlash dated Jul 1, 2010 (http://www.capartners.com/news/18/61/Legislative-Update). SEC guidance will be provided over the course of the next year, but many companies are beginning to plan now. CAP conducted a survey to get a sense of early thinking from companies on how they anticipate dealing with the requirements of the new legislation.

Seventy companies were invited to participate in the survey and nineteen completed the full survey. Several companies that did not participate expressed interest, but said that they were too early in the decision-making process to respond.

We asked seven questions in the survey. Here is what we found:

1) Dodd-Frank mandates that companies must solicit a non-binding advisory Say-on-Pay vote from shareholders at least once every three years. Do you anticipate your Board recommending that shareholders approve a specific (preferred) frequency for Say-on-Pay or will you allow shareholders to decide by voting?

The new legislation requires companies to hold a non-binding advisory vote on their executive compensation at least once every three years and to give shareholders the opportunity to vote on the frequency of the Say-on-Pay vote at least every six years. The legislation does not specify the method for the frequency vote (e.g., give shareholders the full range of choices without a recommendation, recommend a preferred frequency but let shareholders pick from the full list, or give the shareholders a yes/no vote on a frequency recommended by management and Board).

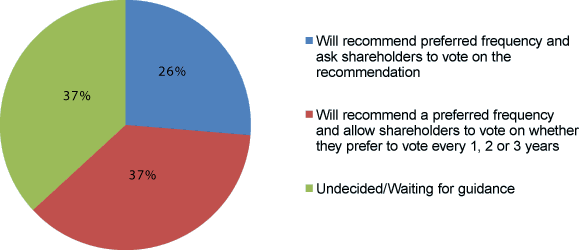

The survey results indicate that companies are fairly evenly split between recommending a preferred approach but allowing shareholders to vote on the range of choices (37%) and asking shareholders to vote yes/no on a specific frequency (26%). The remainder of the sample (37%) is undecided or waiting for guidance.

Recommending a Say-on-Pay Vote Frequency to Shareholders

2) If you are going to recommend a preferred frequency to shareholders for Say-on-Pay voting, what do you expect to recommend?

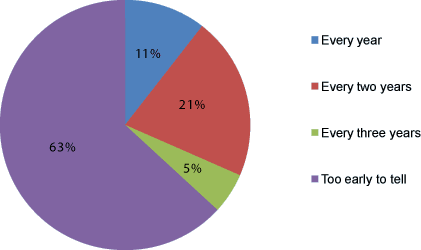

Most companies (63%) say it is too early to tell which frequency they will recommend. Of those that did specify a time period, two years was the most common (21%). But keep in mind that this represents four companies. Given discussions we are having with clients, we would not be surprised if one or three years becomes the more common approach when companies finally implement Say-on Pay.

Choosing a Say-on-Pay Vote Frequency

3) Does your company currently engage in active dialogue with your 10 largest shareholders at least once a year on your Company’s executive compensation practices?

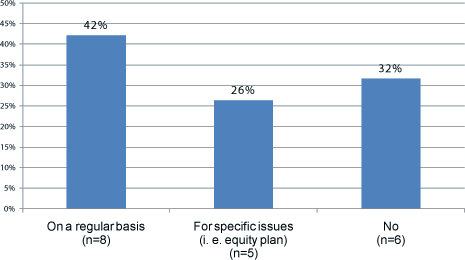

Even absent Say-on-Pay, we believe engaging in open and meaningful dialogue with large shareholders is a best practice and can provide insights and avoid surprises. 42% of companies say they currently engage in active dialogue with their shareholders and 26% do so for specific issues (e.g., approval of a new equity plan).

Dialogue with Largest Shareholders

4) Do you anticipate increasing dialogue with your largest shareholders, relative to your executive compensation practices, as a result of the legislation?

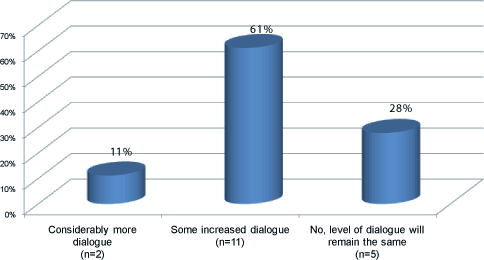

We believe companies will increasingly engage their shareholders in dialogue to gain greater insight from them on their views on executive compensation, since this is more informative than a yes/no vote on the full executive compensation program. This is supported by the survey which finds that 70% of respondents expect to increase dialogue with shareholders to at least some degree.

Increasing Dialogue with Largest Shareholders

5) Do you anticipate making meaningful changes to any of your executive compensation practices/programs as a result of the Say-on-Pay requirements?

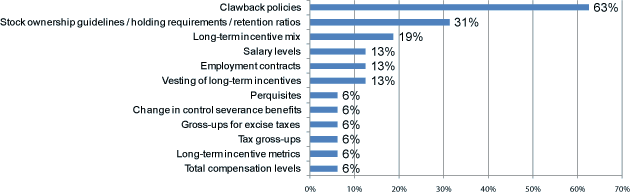

The most commonly anticipated change to executive compensation programs is clawbacks, which is a requirement of the new legislation (63%). Just under one-third of companies anticipate changing their stock ownership and holding requirements. While ownership requirements have been very common, holding requirements (where an executive must hold all or a portion of net shares realized from option exercise (net of taxes and exercise price) and vested equity (net of taxes)) for a specified period time has been an emerging trend. Many more companies may begin to adopt this practice as they try to provide for greater alignment between executives and shareholders.

Anticipated Changes to Executive Compensation Programs*

6) Do you anticipate changing or implementing a clawback policy?

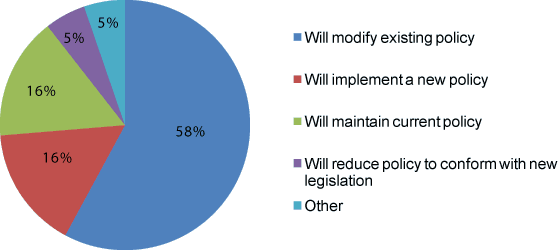

Many companies implemented or enhanced their clawback policies in the recent past; however, the new legislation specifies that the period covered span 3 years. Many companies (58%) must adjust their policy to comply with the new requirements.

Clawback Policy

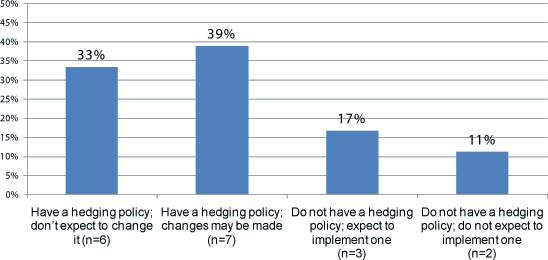

7) Do you anticipate changing or implementing hedging policies?

Unlike the clawback requirement, the new legislation does not require a company to implement a hedging policy; however, a company must disclose if it does not have such a policy. 33% of companies currently have a hedging policy and will leave it unchanged. 56% of companies will either implement a policy or anticipate reviewing or changing their current policy. Only 11% state they do not have a hedging policy and do not anticipate implementing one. These companies will have to disclose that they do not have a hedging policy and this may be a negative for shareholders.

Hedging Policy

We hope you find these early findings helpful. Since the SEC will be providing guidance and there is a lot of uncertainty, where companies land on these issues is something of a moving target. Some of the key steps we believe companies should take in the interim include:

- Discussing the implications of the legislation with their Compensation Committee

- Forming a working team to develop a response, including: Human Resources/Compensation, Legal, Investor Relations, outside consultant and legal counsel

- Engaging in dialogues with large institutional shareholders

If you would like to participate in our CAPFlash survey topics going forward, please feel free to sign up at https://www.capartners.com/signup-surveys

* Responses add to more than 100% due to multiple responses by company

***

Please contact us at (212) 921-9350 if you have any questions about the issues discussed above or would like to discuss your own executive compensation issues. You can access our website at www.capartners.com for more information on executive compensation.