The 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”) directed the SEC to enact rules that require disclosure in the annual proxy statement of the ratio of Chief Executive Officer (CEO) compensation to that of the median employee, including the absolute value for each input that goes into the ratio calculation. More than five years later, final pay ratio rules have been released by the SEC. These rules will go into effect requiring companies to provide disclosure of their pay ratios for their first fiscal year beginning on or after Jan. 1, 2017.

While many companies are preparing for the new pay ratio disclosure requirements from the SEC, ratios of CEO pay to other NEOs are also something companies should pay close attention to. Committees can use these ratios as a starting point to assess issues such as retention, talent development, and succession planning. A high ratio can be an indicator that the CEO is potentially carrying too much of the company, a disconnect exists between the pay practices for the CEO vs. other senior leaders, or that there is no succession plan in place. Having healthy internal equity with appropriate ratios of pay for leadership, and an eye on general market norms, is an important factor in talent acquisition and retention.

This CAPflash focuses on three NEO pay ratio calculations:

- CEO versus Chief Operating Officer (COO);

- CEO versus Chief Financial Officer (CFO); and

- CEO versus General Counsel (GC).

In this study, we provide market practice among S&P 500 companies, as well as the policies of proxy advisory firms, ISS and Glass-Lewis. In our analysis, we use the following target pay elements per proxy disclosure: disclosed base salary, target annual incentive, and target/grant date value of LTI awards.

Please note that the ratios used in this analysis are calculated from proxy disclosure. Therefore, if a COO or GC is not among the top 5 highest paid, as required in proxy disclosure, they are not included in the analysis—CFO pay disclosure is required.

What does our research show?

To evaluate market norms, Compensation Advisory Partners (“CAP”) conducted an analysis of senior executive target pay ratios among S&P 500 companies during the most recent three fiscal years (as of August 22, 2016).

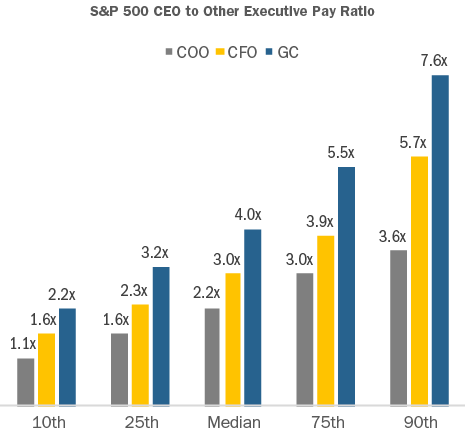

- At median, CEO pay was 2.2x the COO; i.e., for every $1.00 paid to the COO, the CEO was paid approximately $2.20

- At median, CEO pay was 3.0x the CFO; i.e., for every $1.00 paid to the CFO, the CEO was paid approximately $3.00

- At median, CEO pay was 4.0x the GC; i.e., for every $1.00 paid to the GC, the CEO was paid approximately $4.00

CAP also analyzed the S&P 500 senior executive pay ratios by industry.

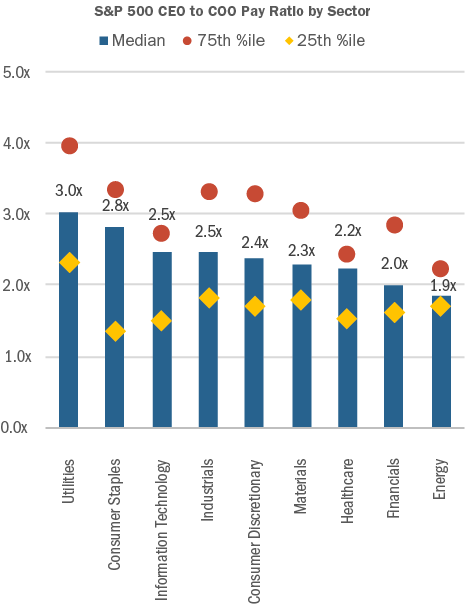

- For the CEO vs. COO ratio, the Utilities sector had the highest ratio of 3.0x at median, while Energy had the lowest ratio of 1.9x at median

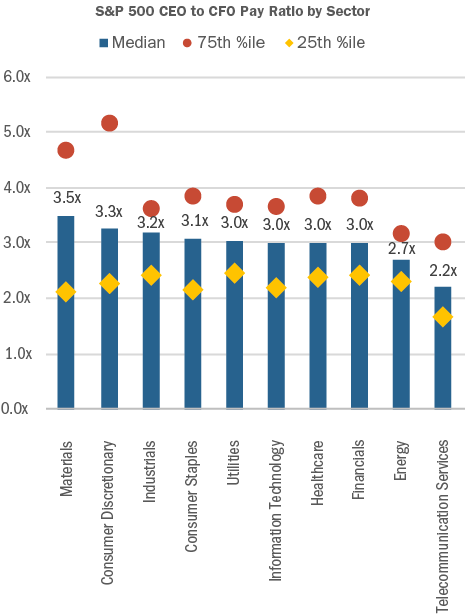

- For the CEO vs. CFO ratio, the Materials sector had the highest ratio of 3.5x at median, while Telecommunication Services had the lowest ratio of 2.2x, at median

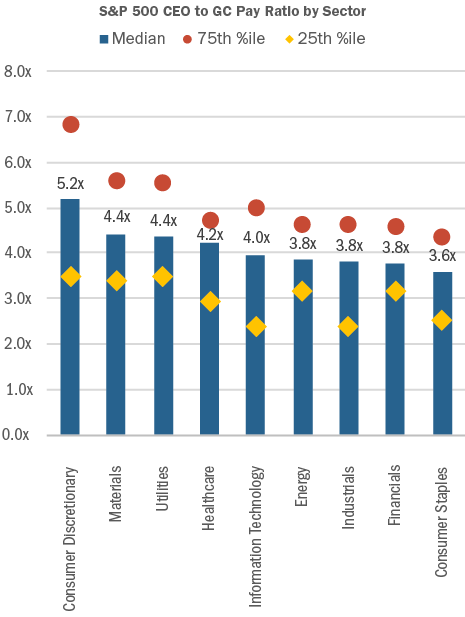

- For the CEO vs. GC ratio, the Consumer Discretionary sector had the highest ratio of 5.2x at median, while Consumer staples had the lowest ratio of 3.6x, at median

Note: Telecommunication Services was not included because the sample was too small.

Note: Telecommunication Services was not included because the sample was too small.

How do ISS and Glass-Lewis use pay ratios?

Both proxy advisory firms include senior executive pay ratios in their annual proxy analyses.

- ISS includes the ratio of CEO pay versus the second highest paid active NEO, as well as the ratio of CEO pay versus the average of the other active NEOs. “Pay” includes all elements from the Summary Compensation Table; however, the grant-date value of stock options is updated to reflect ISS’ methodology which differs from accounting rules

- Glass-Lewis includes the ratio of CEO pay versus the average of other NEOs during each of the past three years. “Pay” includes select elements from the Summary Compensation Table: Salary, Bonus, Non-Equity Incentive Plan, Stock Awards, and Option Awards

ISS also uses pay ratio as one of the inputs to the Compensation score it assigns companies in its QuickScore 3.0 tool, which is meant to influence investment decisions through an assessment of risk factors. The ratio of CEO pay versus the second highest paid active NEO is included in QuickScore 3.0.

When do proxy advisors perceive there to be a possible issue?

To our knowledge, these ratios have not been used by ISS or Glass-Lewis to justify an Against Say on Pay vote recommendation. However, large pay discrepancies can reinforce other negative assessments. In general, comments from ISS and Glass-Lewis are likely when the CEO to NEO ratio exceeds 4x. Ratios exceed 4x at 5-10% of S&P companies, depending on which ratio is used (see ISS and Glass-Lewis definitions above). Ratios rising to 5-6x, or greater, will receive more strongly worded commentary.

Conclusion

Since companies are very different in their organizational and operational structures, we believe that there is limited utility in the CEO pay ratio disclosure that will be required by the SEC under Dodd-Frank. However, looking at the ratios of leadership pay at companies in the same business sector and/or of the same size, can provide important information and insights. It is worthwhile for compensation committees to track this information internally and on a relative basis. Such information can be used as an input in the pay benchmarking process and as a barometer of healthy succession planning, as well as contributing to effective talent acquisition and retention.

Each year CAP analyzes non-employee director compensation programs among the 100 largest companies. We believe these companies provide insight into where the market will be going in terms of practices. Below is a summary of trends – for pay levels and pay practices – based on 2016 proxy filings.

Key CAP Findings

Board Compensation. pay levels went up

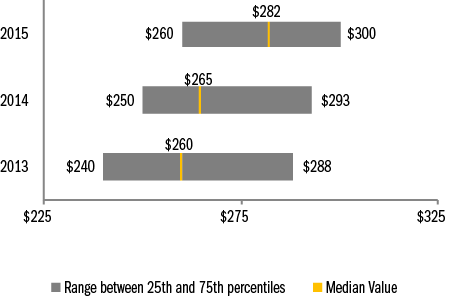

- Total Fees. Increased 6 percent (median is $282K, versus $265K in prior year), which is the biggest single year increase we have seen in more than 4 years, though still within historic norms

- Retainers. Large companies rely on annual retainers (cash and equity) to compensate directors. Pay programs are typically simple and viewed more as an “advisory fee” than an “attendance fee.”

- Meeting fees. Provided by only 11 percent of companies (versus 12 percent in prior year). In general, companies have moved to a fixed retainer pay structure, with a component in cash and a component in equity. We support this approach as it simplifies administration and the need to define “what counts as a meeting.” However, companies may want to consider having a mechanism for paying meeting fees if the number of meetings in a single year far exceeds the norm. For example, if the number of meetings is well above historic norms (e.g., 12 meetings/year), companies could consider paying meeting fees above a specified number of meetings. Three companies in our dataset use this approach to meeting fees.

- Equity. Full-value awards (shares/units) are most common. Only 8 percent of companies use stock options with, surprisingly, only one of these companies being in the traditional technology sector. 97 percent of companies denominate equity awards (stock or options) as a fixed value, versus a fixed number of shares, which is considered best practice as it manages the value each year. Approximately two-thirds of equity awards vest within 1 year of grant (either immediately or cliff vest after 1 year). Nearly 60 percent of equity awards settle at vest, with the remainder settling at or post retirement.

- Pay Mix. On average, 61 percent equity-based versus 39 percent cash-based. Alignment with long-term shareholders is reinforced by delivering a majority of compensation in equity.

Committee Member Compensation. little/no change

- Overall Prevalence. Only 48% of companies paid committee-specific member fees, relying on board-level compensation to recognize committee service, with the general expectation being that all independent directors contribute to committee service needs1.

- Total Fees. Of the companies that pay committee member compensation, the median is $16.8K.

Committee Chair Compensation. little/no change

- Overall Prevalence. Approximately 90 percent of companies provide additional compensation to committee Chairs, typically through an additional retainer and not meeting fees, to recognize additional time requirements, responsibilities, and reputational risk1.

- Fees. At median, $20K in additional compensation (vs. members) was provided to Audit and Compensation Committee Chairs, and $15K additional to Nominating/Governance Committee Chairs.

Independent Board Leader Compensation. little/no change

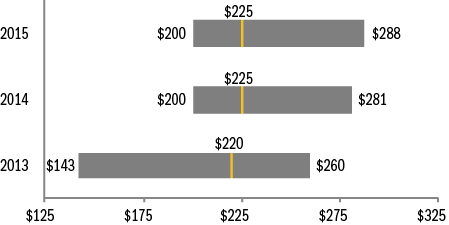

- Non-Exec Chair. Additional compensation is provided by all companies with this role, $225K at median. As a multiple of total Board Compensation, total Board Chair pay is 1.9x a standard Board member, at median.

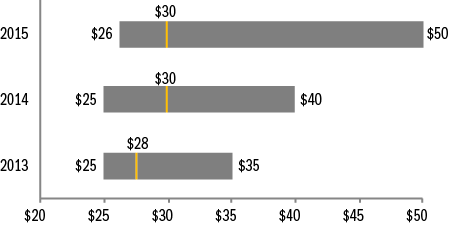

- Lead Director. Additional compensation – $30K, at median – is provided by nearly all companies with this role3. The differential in pay versus non-executive Chairs is in line with typical differences in responsibilities. 75th percentile additional compensation was $50K, up from $40K last year and up from $35K two years ago.

Pay Limits. prevalence of limits went up

- There were 17 companies in our data set that amended an equity plan this year; 2 of these companies already had a shareholder approved limit in place for director compensation. Among the remaining 15 companies, 9 of them (60 percent) implemented a new shareholder approved limit for director compensation.

- In total, 39 percent of the largest 100 companies now have such limits, up from 27 percent in prior year.

- Limits range from $250K to $3.6 million, and were $760K at median. Among companies that denominate the limit in shares, the median is $1.05M, while the median for the companies with value-based limits is $525K.

- Limits typically apply to just equity-based compensation; however, some companies have applied the limits to both cash and equity-based compensation (i.e., total pay) and we anticipate the prevalence of this practice will increase further. Other companies exclude initial at-election equity awards, committee Chair pay, and/or additional pay for Board leadership roles from the limit.

- The limits are largely due to advancement of litigation where the issue has been that directors approve their own annual compensation and are therefore inherently conflicted. Companies have a stronger legal defense – protecting them under the business judgement rule – by having “meaningful limits” approved by shareholders on the maximum award that could be granted to a director. The “business judgment rule” is judicial presumption that directors acted “on an informed basis, in good faith and in the honest belief that the action taken was in the best interests of the company.” An action protected by the business judgment rule will not be second-guessed by the courts. There is a chance that the business judgement rule can be called into question without a meaningful limit. When the business judgment rule does not protect directors’ awards of compensation to themselves, the awards are subject to heightened scrutiny under the “entire fairness test” under which both the process and the amount of the compensation must be found to be entirely fair to the company.

Appendix

Total Board Compensation ($000s)

Equity Compensation

|

Equity Vehicle |

2013 |

2014 |

2015 |

|

Full-Value Equity (Shares/Units) |

95% |

96% |

92% |

|

Stock Options |

2% |

1% |

1% |

|

Both |

3% |

3% |

7% |

|

Award Denomination |

2013 |

2014 |

2015 |

|

Fixed Valued |

88% |

90% |

92% |

|

Fixed Shares |

8% |

6% |

3% |

|

Both |

4% |

4% |

5% |

Additional Compensation for Independent Board Leaders ($000s)

Lead/Presiding Directors

Non-Executive Chairs

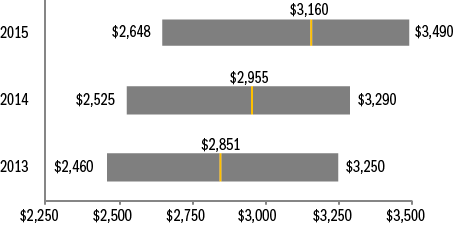

Total Company Cost for Board Service ($000s)

1 Audit, Compensation and/or Nominating and Governance committees.

2 Excludes controlled companies. Also excludes instances where Lead Director role is assumed by Chair of Nominating and Governance Committee, who receives compensation for the role.

ISS released the results of its 2016-2017 policy survey on September 29, 2016. The survey results will play an important role in shaping ISS’ policies for the 2017 proxy season. ISS Indicated that a draft of their 2017 policy updates will be published in late October, subject to public comment. Final policy updates are scheduled for publication in mid-November, with policy updates effective February 1, 2017.

417 organizations participated in ISS’ survey, including 115 institutional investors and 270 corporate issuers. 33% of investor responses came from institutions with $100 billion in assets or more, while 25% came from institutions with $10 – $100 billion in assets.

Highlights of the survey results related to U.S. executive compensation and corporate governance topics are summarized below:

Say on Pay Frequency: Survey participants were asked whether they favored annual, biennial or triennial say on pay proposals. Fully 66% of investors favored annual say on pay votes. Corporate issuers were more likely to favor biennial or triennial votes, but fully 42% voted for annual say on pay proposals. Based on the results of the survey, we do not expect ISS to make any changes to its existing policy of supporting annual say on pay vote frequency.

Metrics for Pay-for-Performance Alignment: ISS currently uses Total Shareholder Return (“TSR”) to assess pay-for-performance alignment, measuring relative TSR performance compared to peers over 3 years and measuring the absolute trend in TSR over 5 years. Survey participants were asked if other metrics should be incorporated in the initial screen. High levels of support were recorded for metrics other than TSR, with 79% of investors and 68% of corporate issuers voting in favor.

Investors identified Return on Investment metrics, such as Return on Invested Capital (ROIC), as the best metrics to be incorporated into pay-for-performance alignment screens. Detailed results are shown below:

|

Metrics |

% of Investors Favoring |

% of Non-Investors Favoring |

|

Return on Investment metrics |

47% |

23% |

|

Other Return metrics (i.e, ROA or ROE) |

35% |

18% |

|

Earnings metrics |

26% |

38% |

|

Cash Flow metrics |

25% |

20% |

|

Economic Profit metrics |

22% |

9% |

|

Revenue metrics |

18% |

24% |

|

Other metrics |

16% |

10% |

We suspect that ISS may modify its pay-for-performance model to incorporate additional measures in the future, based on this feedback. However, it may be challenging to implement for the coming year as it is difficult to find a single financial performance measure that is useful for performance comparisons in all industries. We will closely monitor ISS’ proposed policy revisions to see what changes, if any, that they make to the pay-for-performance assessment.

Board Refreshment: Lack of board refreshment is viewed as problematic by more than 50% of investors. Refreshment measurements that caused concern include lack of newly appointed directors (i.e., within the last 5 years), average tenure greater than 10 or 15 years and/or a high proportion of directors with long tenure.

Overboarding: More than 60% of investors indicated a preference for applying the same standard for overboarding to active executive chairs as currently applies to active CEOs – no more than three total boards. A minority supported the more lenient standard applicable to non-executive directors – no more than five total boards.

Next Steps

We will monitor ISS’ draft policy proposal (expected in October) and final policy issuance (expected in November) and will provide an updated CAPflash highlighting any material changes from ISS’ current policies. Based on this year’s survey results, there is potential for significant changes from the current policy, particularly for Pay-for-Performance alignment. Movement away from TSR as the sole metric would be welcomed by many companies as well as by most investors.

Full results of ISS’ policy survey can be found at www.issgovernance.com. If you wish to discuss the results, you can reach us at 212-921-9350.

Annually, Compensation Advisory Partners (CAP) evaluates pay levels for Chief Financial Officers (CFOs) and Chief Executive Officers (CEOs). This year, the analysis is based on a sample of 100 companies with median revenues of $13 billion. For more information on criteria used to develop the sample of companies, please see Appendix.

Highlights

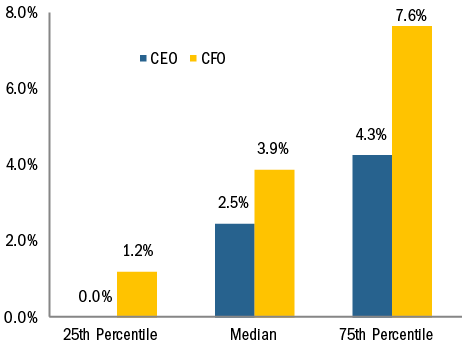

- Annual salary increases are increasing in prevalence for the third year in a row among CEOs and CFOs, with median increases of 2.5% and 3.9% respectively

- Similar to prior years, salary increases are provided much more frequently to CFOs than to CEOs, with over three quarters of CFOs studied receiving a salary increase in 2015

- The 2015 median increases in actual total direct compensation (i.e., cash plus equity) for both CEOs and CFOs were modest, 2.2% and 1.4% respectively

- At median, there was no growth in actual bonuses, partly reflective of a weaker performance year in 2015 vs 2014

- Median target bonus opportunities were flat for CEOs over the past 3 years; for CFOs median target bonuses were flat in 2015 after an increase from 2013 to 2014

- Growth in long-term incentive opportunities at median was in the mid-single digits for both positions

- CFO total compensation on an absolute basis approximates one-third of CEO total compensation, consistent with our findings in prior years

- Long-term incentive program structure has remained consistent over the past few years; performance-based equity continues to represent the largest component of LTI for CEOs and CFOs

Study Results

Salaries

In the last three years, we have seen a steady growth in the number of CEOs and CFOs receiving salary increases in a given year. Only 48% and 69% of CEOs and CFOs, respectively, received increases for the 2012-2013 period compared with 58% of CEOs and 77% of CFOs for the 2014-2015 period. Median 2015 salary increases were 3.9% for CFOs and 2.5% for CEOs.

|

% of Executives Receiving Salary Increases |

||||

|

2013 – 2014 |

2014 – 2015 |

|||

|

No Increase |

Receiving Increase |

No Increase |

Receiving Increase |

|

|

CEO |

49% |

51% |

42% |

58% |

|

CFO |

28% |

72% |

23% |

77% |

2015 Salary Increases

Actual Pay Levels

Based on our findings, the median rate of increase in actual total direct compensation levels for both CEOs and CFOs was approximately 2% for 2015. The median increases over the last two years ranged between 3% and 5%. The lower increases in total compensation for 2014-2015 are partially a result of no increase in bonuses, at median, and only slightly higher single digit increase in long-term incentives.

|

Median Percentage Change in Pay Components |

||||

|

2013 – 2014 |

2014 – 2015 |

|||

|

Pay Components |

CEO |

CFO |

CEO |

CFO |

|

Salary |

0.3% |

3.0% |

2.5% |

3.9% |

|

Actual Bonus |

4.3% |

7.8% |

0.0% |

-0.1% |

|

Long-Term Incentives |

3.7% |

4.2% |

6.8% |

7.6% |

|

Actual Total Direct Compensation |

3.2% |

5.2% |

2.2% |

1.4% |

As seen in the table above, the median 2015 increases by pay component were similar for both CFOs and CEOs. Similar to actual bonuses, median target bonuses remained flat for both CFOs (100% of base salary) and CEOs (150% of base salary).

|

Target Bonus as % of Salary |

||||

|

2014 |

2015 |

|||

|

CEO |

CFO |

CEO |

CFO |

|

|

75th Percentile |

165% |

105% |

180% |

120% |

|

Median |

150% |

100% |

150% |

100% |

|

25th Percentile |

125% |

80% |

130% |

80% |

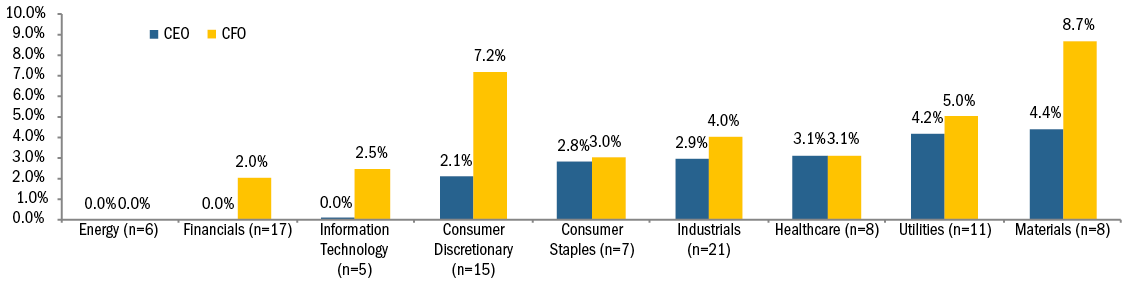

Median Salary Increase by Industry

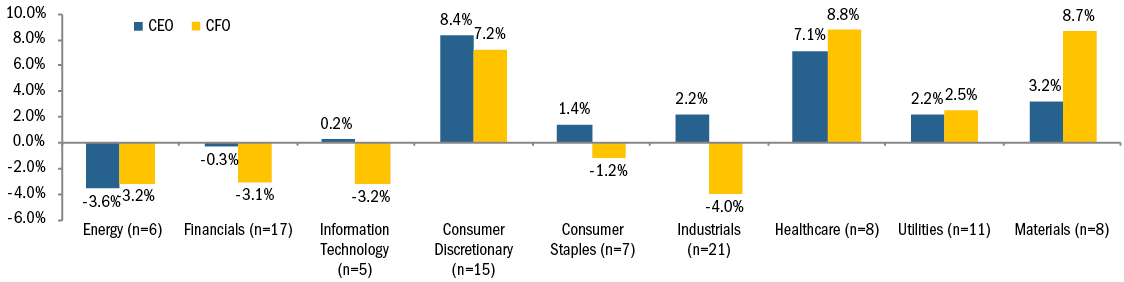

Median Actual Total Compensation Increase/Decrease by Industry

Median salary increases in salary are generally aligned for CEOs and CFOs within each specific industry, except for the Consumer Discretionary and Materials industries. Among the Consumer Discretionary industry, the median CEO increase was 2.1% compared to the CFO median increase of 7.2%. In the Materials industry, the median CEO increase was 4.4% compared to the CFO median increase of 8.7%. The Energy industry increases were 0% for both CFOs and CEOs. The salary freeze in the industry comes as no surprise given that some companies in the industry implemented salary freezes for 2015 after oil prices collapsed.

Differences by industry were more pronounced when looking at actual total direct compensation. There were more decreases in CEO or CFO total actual compensation in 2015 compared to 2014, primarily driven by weaker company performance and the annual incentive award paid as a result of performance. The Energy industry was the single industry where both CFOs and CEOs experienced similar declines in compensation, at median. Some of the largest increases in compensation levels were observed in Consumer Discretionary, Healthcare and Materials.

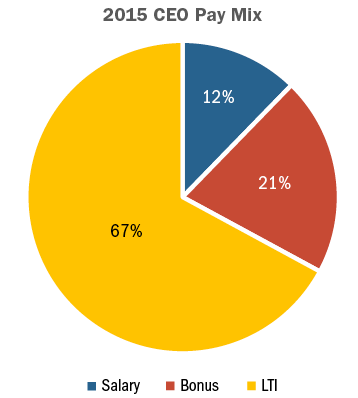

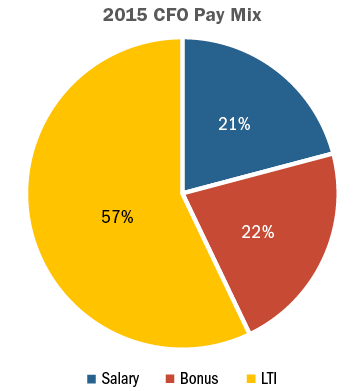

Target Pay Mix

The structure of the overall pay program (salary, bonus, LTI) has remained largely unchanged since 2011. CEOs continue to receive less in the form of salary and more in variable pay components, especially LTI, than CFOs.

Long-Term Incentive (LTI) Vehicle Prevalence and Mix

We have seen very little change in the type of vehicles used to deliver LTI awards. Overall LTI mix also remains similar to the past several years. The majority of companies continue to use two different vehicles to deliver long-term incentives to CEOs/CFOs with approximately a quarter of companies studied using all 3 equity vehicles (stock options, time-based stock awards, and awards under a performance plan)

Performance plans account for roughly 50% of LTI awards on average. The other half of LTI is delivered almost equally between stock options and time-vested restricted stock awards. The overall weighting of performance-based awards (performance plans and stock options) for both CEOs and CFOs continues to range between 75% – 80%.

|

LTI Mix |

||||

|

2014 |

2015 |

|||

|

CEO |

CFO |

CEO |

CFO |

|

|

Stock Options |

26% |

25% |

24% |

23% |

|

Time Vested Restricted Stock |

21% |

26% |

20% |

25% |

|

Performance Plans |

53% |

49% |

56% |

52% |

Conclusion

2015 was not as strong a performance year as 2014. Median revenue growth was -1% (vs 6% in 2014), net income growth was -1% (vs 9% in 2014) and total shareholder return was -2% (vs 16% in 2014). Overall total pay increases were also smaller than in 2014, which we believe were directionally aligned with performance. While salary and long-term incentive increases for CFOs were slightly higher in 2015, actual bonus amounts were flat. This pattern was similar for CEOs in the study.

We expect overall pay mix to continue to emphasize the variable, at-risk components of pay. We also expect the current approach to delivering long-term incentives, with an emphasis on performance-based LTI plans to continue. In this era of increased scrutiny and Say on Pay, we anticipate that aligning pay outcomes with company performance will continue to be an imperative for companies and Boards.

APPENDIX

Sample Screening Methodology

Based on the screening criteria below, we arrived at a sample of 100 public companies with median 2015 revenue of $13B.

|

Revenue |

At least $5B in revenue for fiscal year 2015 |

|

Fiscal year-end |

Fiscal year-end between 9/1/2015 and 1/1/2016 |

|

Proxy Statement Filing Date |

Proxy statement filed before 3/31/2016 |

|

Tenure |

No change in CEO and CFO incumbents in the past three years |

Partner Bertha Masuda discusses special considerations for short-term incentives for companies under $500 million in revenue with WorldatWork.

The past year has been characterized by significant stock price volatility. Research indicates that the S&P 500 index has either gained 1% or more or lost 1% or more in a single day on 102 days during 2015. Individual stocks have experienced even higher volatility, with some industries (e.g., oil and gas, financial services) being hardest hit. This extreme variability in stock prices has continued through the period when most companies make annual grants of equity-based compensation to their directors, officers and employees. Since the overall stock price movement over this period has been down, many companies are finding that they need to grant more shares than they anticipated to deliver their targeted long-term incentive values to employees. In this CAPflash, we will lay out the nature of the issue and address alternative approaches that companies can use to respond to stock price decreases.

| Date | S&P 500 | S&P 500 Financials Sector | S&P 500 Energy Sector | S&P 500 Health Care Sector | ||||

| Value | ? vs. 8/15 | Value | ? vs. 8/15 | Value | ? vs. 8/15 | Value | ? vs. 8/15 | |

| 8/1/15 | $2,104 | – | $339 | – | $508 | – | $885 | – |

| 1/31/16 | $1,940 | -7.78% | $293 | -13.56% | $435 | -14.44% | $769 | -13.03% |

| 2/15/16 | $1,865 | -11.36% | $276 | -18.69% | $417 | -17.98% | $743 | -15.97% |

| 3/1/16 | $1,978 | -5.96% | $294 | -13.33% | $433 | -14.78% | $780 | -11.79% |

| 3/15/16 | $2,016 | -4.18% | $301 | -11.24% | $458 | -9.77% | $775 | -12.44% |

| 4/1/16 | $2,073 | -1.48% | $306 | -9.64% | $456 | -10.24% | $794 | -10.28% |

RECENT STOCK PRICES: A DOWNWARD TREND

In August 2015, around when many companies began their year-end compensation planning process, the S&P500 Index was at $2,104 and the S&P 500 Financials, Energy and Health Care sectors were at $339, $508 and $885, respectively. Scroll forward to January 31, 2016 and the S&P 500 Index was at $1,940 and the S&P 500 Financials, Energy and Health Care sectors were at $293, $435 and $769, respectively. The table below lays out the movements from August 1, 2015 into the current year, highlighting five common equity award dates.

While the overall indices moved significantly, the 25th percentile change through each of the above dates for companies in each of the above indices was as follows, indicating that for the lowest-performing one quarter of companies, stock prices fell by about 15% to 30%, or more, over this period.

| Date | S&P 500 | S&P 500 Financials | S&P 500 Energy | S&P 500 Health Care |

| 25th %ile ? vs. 8/15 | 25th %ile ? vs. 8/15 | 25th %ile ? vs. 8/15 | 25th %ile ? vs. 8/15 | |

| 8/1/15 | – | – | – | – |

| 1/31/16 | -20.21% | -21.14% | -35.26% | -22.72% |

| 2/15/16 | -25.24% | -29.25% | -45.40% | -25.25% |

| 3/1/16 | -18.29% | -22.02% | -37.35% | -21.86% |

| 3/15/16 | -17.22% | -19.37% | -27.40% | -22.76% |

| 4/1/16 | -14.78% | -18.10% | -31.67% | -19.32% |

MARKET NORMS FOR BURN RATE

CAP’s research indicates that burn rate (i.e., the number of shares granted during a given year divided by the weighted average number of common shares outstanding) among large public companies in the S&P 500 Index trends toward 1% of common shares outstanding when calculated excluding the factor of approximately 2X that ISS applies to full value awards to create equivalency with stock options. When the ISS conversion factor of approximately 2X is included, burn rate trends toward approximately 1.5% at median. On the lower end, burn rate of .5% or 1%, excluding or including the 2X conversion factor, respectively, is common. At the 75th percentile, burn rate of 2% to 4% is seen. This suggests that for a broad swath of public companies, ranging from $1 billion to $100 billion in revenues, burn rate in excess of 2% to 4% is difficult to sustain. Research on specific company peer groups could provide more refined comparisons, but this data gives the reader a general benchmark that applies across industries and size categories.

| Summary Statistics | Three-Year Average Burn Rate (including ISS Conversion Factor) | ||

| S&P Top 50 | S&P $5 B Cos. | S&P $1 B Cos. | |

| 75th Percentile | 2.13% | 2.55% | 3.82% |

| Median | 1.36% | 1.70% | 1.68% |

| 25th Percentile | 1.01% | 1.12% | 1.11% |

| Summary Statistics | Three-Year Average Burn Rate (excluding ISS Conversion Factor) | ||

| S&P Top 50 | S&P $5 B Cos. | S&P $1 B Cos. | |

| 75th Percentile | 1.03% | 1.32% | 1.88% |

| Median | 0.79% | 0.90% | 1.02% |

| 25th Percentile | 0.47% | 0.53% | 0.56% |

Note: S&P Top 50 reflects the 50 largest companies in the S&P 500 in terms of revenue with average trailing twelve month revenue of $108 billion. S&P $5 B Cos. reflects a 50 company subset of the S&P 500 with an average trailing twelve month revenue of $5 B. S&P $1 B Cos. reflects a 50 company subset of the S&P MidCap 400 with an average trailing twelve month revenue of $1 B.

IMPACT ON EQUITY GRANTS

Most companies make their annually equity grants based on a target dollar value for the long-term incentive award, rather than as a fixed number of shares. For example, a company may target a long-term incentive grant of $200,000 per year to a Vice President. For simplicity’s sake, let’s assume that the grant is made 100% in Restricted Share Units (RSUs). Most companies determine the number of shares to grant by dividing the target long-term incentive value by a stock price. Since companies are required to use the stock price on the date of grant for purposes of the disclosed value of equity grants, many companies use the stock price on the date of grant for converting award values into shares.

When the stock price declines significantly over a short period of time, there will be a significant increase in the number of shares required to deliver the target value. For example, let’s assume that the stock price was trading at $50.00 in September of 2015 when the company began their compensation planning and fell by 40% to $30.00 on March 1, 2016 when they make equity awards. In this situation, the number of shares required to deliver a $200,000 equity grant would increase by 67% from 4,000 shares to 6,667.

If the company is granting stock options, the share usage resulting from a decline in stock price is even more pronounced. Assuming a 3:1 ratio of options to RSUs, the grant required to deliver a $200,000 equity grant would increase from 12,000 options to 20,000 options.

Applied across the total employee population, this can create major concerns for the company with the potential to exhaust the reserve of shares available for grant under shareholder approved plans more quickly than anticipated. This will also increase the company’s annual share usage.

To the extent that equity plans reserves are exhausted and burn rates exceed industry norms, companies can run into difficulty when seeking shareholder approval of additional shares. If share usage is judged to be imprudent, or if shareholders see disconnects between pay and performance, particularly if facilitated by the equity plan, they are much less likely to support a request for new shares. The potential for perceived disconnects is heightened since higher burn rates typically occur when share prices are lower.

APPROACHES TO ADDRESS EQUITY GRANTS WHEN STOCK PRICE DECLINES

In our experience, companies address declining stock price in several different ways. The following are a few of the most common approaches:

Approach 1. Continue granting based on stock price at date of grant (i.e., do nothing)

In some cases, companies may feel that continuing to use their standard operating procedure for converting long-term incentive value into shares is the best approach. This could be because the company has been conservative in using shares in the past and has adequate shares available to cover multiple years of equity grants even with a significant stock price decline. The company may feel that a one year spike in their share usage will not raise significant concerns with shareholders or shareholder advisory firms. Another rationale that these companies may use for making grants as usual is that the value of any outstanding equity that executives hold will have fallen with the stock price. If the company reduces the value of equity grants as well, this may be a “double whammy” for long-term incentive participants. In our experience, Approach 1 can be untenable if the stock price falls by 30% or more.

- Advantages: Maintains target LTI award value for employees

- Disadvantages: Dilutive to shareholders; potential for “windfall” if stock price quickly recovers

Approach 2. Use an average stock price over a period of time to establish grants

This is a common approach companies use to mitigate the impact of short-term swings in stock price on the number of shares granted. Among companies that do not convert grant values into shares based on the stock price on the date of grant, the most common approach is to use an average stock price over a relatively short time period. We see a 20-trading day average most frequently. This approach avoids significant swings in the number of shares granted (up or down) based on stock price movement on the date of grant away from its near-term average. When companies have significant volatility over a sustained period of time, they may use a longer term average stock price (e.g., six months or one year) to mitigate the impact of volatility on grant size. The following chart lays out an illustration of this approach:

| Price Used | Target Value | Price | Shares | Acctng Value |

| Date of grant | $200,000 | $30.00 | 6,667 | $200,000 |

| 20-day average | $200,000 | $35.00 | 5,714 | $171,429 |

| 90-day average | $200,000 | $40.00 | 5,000 | $150,000 |

| 180-day average | $200,000 | $45.00 | 4,444 | $133,333 |

While using an average stock price helps manage the share usage when there is a stock decline, it will create disconnects between the target value of long-term incentives and the accounting value of the awards. Supplemental communication to employees is typically required to explain why the company thinks the average stock price methodology is a better estimate of value than the stock price on the date of grant. If the company uses this approach consistently over time, employees may recognize that the average price can be above or below the stock price on the date of grant.

- Advantages: Limits dilutive impact of stock price decrease

- Disadvantages: Potentially challenging to communicate to employees; disconnect between target LTI value and accounting value

Approach 3. Cap the run rate and pro rate grants accordingly

Some companies have committed to a maximum level of annual share usage or run rate. For example, a company may have committed to its shareholders or Compensation Committee that its annual run rate will not exceed 1.5% of common shares outstanding. If their stock price falls significantly, they may find that to deliver the target long-term incentive values under their program, they would need to grant 2.25% of common shares outstanding. In this situation, the company can pro rate all grants to keep the run rate at 1.5% of common shares outstanding. For example, if an executive’s target long-term incentive value was $200,000 and the stock price was $30.00, they would require 6,667 shares for this executive. Each grant would have to be multiplied by a factor of 1.5/2.25 or 2/3. In this case, the grant to the executive would be reduced from 6,667 shares to 4,444 shares and the accounting value of the award would be $133,333 instead of $200,000.

- Advantages: Limits dilutive impact of stock price decrease; simple; equitable treatment across employees

- Disadvantages: Reduces value of long-term incentive award to all employees

Approach 4. Limit participation in equity grants to conserve shares

Instead of making an across the board reduction in all equity grants, some companies will eliminate or significantly reduce long-term incentive awards for a portion of the population, while maintaining full awards for the remainder of the population. In practice, this often involves maintaining awards for senior executives where long-term incentives are viewed as most critical from a competitive perspective. For lower level long-term incentive participants, the company may limit grants to only those employees with performance that exceeds expectations or with critical skills. This approach may be acceptable if it is applied for one year, but may raise internal equity issues if extended beyond one year.

- Advantages: Limits dilutive impact of stock price decrease; targets awards at most critical employees

- Disadvantages: Potential strong negative response from excluded employees

Approach 5. Apply a discount to long-term incentive award guidelines

Another fairly simple way to address the issue of a stock price decline is to apply a discount to the long-term incentive award guidelines. Suppose that the stock price has fallen from $50 to $30 (or a 40% decline). In such a situation, the company would have to grant 67% more to maintain the LTI award target values. To mitigate the pressure that this will put on share usage, the company can apply a discount to the LTI target award value that partially adjusts for the impact of the stock price decline. For example, they could discount their LTI award guidelines by 25%. In this case, a $200,000 LTI award would be reduced to $150,000 and the grant would require 5,000 shares at a $30.00 stock price. This is more than the 4,000 shares that would have been required to deliver $200,000 at a $50.00 stock price, but is significantly less than the 6,667 shares required to deliver the full $200,000 at $30.00.

- Advantages: Limits dilutive impact of stock price decrease; simple; equitable treatment across employees

- Disadvantages: Reduces value of long-term incentive award to all employees

Approach 6. Use RSUs instead of stock options

To deliver a given long-term incentive award value, stock options require more shares than full value awards like RSUs or PSUs. Depending on the Black-Scholes value of stock options, the ratio of options to full value shares may be as low as 2:1 or as high as 5:1. For companies with equity plans that are not based on a fungible pool that treat options and full value shares the same, shifting the long-term incentive mix away from stock options towards full value shares can help ensure that equity grants will not exhaust the available pool.

For example, suppose a company has a mix of 50% stock options and 50% RSUs for its long-term incentive program. The company was planning on granting 1 million RSUs and 3 million stock options, but the stock price falls by 1/3 and now the company needs to grant 1.5 million RSUs and 4.5 million stock options. Unfortunately, their shareholder approved plan only has 5 million shares available for grant and the current 50%/50% LTI mix requires 6 million shares (1.5 million RSUs plus 4.5 million stock options). If they shift the mix from 50% RSUs / 50% stock options to 100% RSUs, the company will only need 3 million shares to deliver the target long-term incentive award value and they will not exhaust the share reserve.

- Advantages: Maintains target long-term incentive award value, potentially avoids exhausting share reserve, simple; equitable treatment across employees

- Disadvantages: Shareholders/Compensation Committee may prefer use of stock options to RSUs; shareholder advisors view RSUs as more dilutive than options on a per share basis

Approach 7. Use long-term cash instead of full value equity awards

Companies can conserve shares and reduce burn rate by replacing equity awards with cash. The most common approach is to grant long-term cash incentive awards instead of performance shares. Both types of award can be constructed with similar time frames, identical metrics and identical target values. But there are two significant differences. First, the ultimate value of performance shares will leverage up or down over the performance period in line with the value of the underlying shares. This exposes compensation realized by participants to additional volatility during periods when stock prices are uncertain. Cash awards will have more certainty and may therefore be valued more highly. Second, long-term cash awards are almost always settled in cash. Therefore, ancillary considerations, such as stock ownership guidelines, post-vesting holding periods, blackouts and insider trading policies are off the table.

In addition, long-term cash awards are not factored into burn rate calculations or into the estimates shareholders apply to the cost of equity plans. For example, ISS’ Equity Plan Scorecard does not value long-term cash, but would value outstanding performance shares. Similarly, long-term cash awards are not counted in calculations of overhang from equity plans or counted against equity plan share reserves, provided the awards are not denominated in share units settled in cash. Companies are required to book an accounting charge for the full cost of cash compensation, but effectively get a free pass on cash for other formulations of equity plan impact.

Awards of deferred cash designed to replace time-vested RSUs are seen less frequently, but could also be offered. The biggest decision involves whether to award fixed amount of cash for satisfying future service requirements or to provide either an interest component or some leverage tied to stock price performance.

- Advantages: Maintains target long-term incentive award value, potentially avoids exhausting share reserve, simple; equitable treatment across employees

- Disadvantages: Shareholders/Compensation Committee may prefer use of stock to cash to maintain alignment with shareholders

ADDITIONAL EQUITY COMPENSATION CONSIDERATIONS

In a time of severe stock price volatility, a company’s compensation program may be under pressure from multiple dimensions, beyond the current year’s equity grants:

- Reduced value of outstanding unvested full value shares: As the stock price declines, the value of any unvested equity held by employees will fall as well. This can reduce the value of outstanding equity as retention “handcuffs” and lowers the cost for competitors to buy executives out of their unvested equity. To the extent that all companies are affected equally by a stock price decline, this is not a major issue, but if the company’s stock price has declined more than the market overall, retention concerns will be heightened. If the company has a performance share plan, based on relative TSR and is underperforming on an absolute and relative basis, the retention issues will be even worse as the performance shares may be at risk of having no value

- Underwater stock options: A decline in stock price can reduce the intrinsic value of full value share awards, but as long as the stock price is above zero they still maintain some value. With stock options, the impact of a stock price decline can be more acute, as once the stock price falls below the exercise price the stock options no longer have any intrinsic value and employees may not place much value on the options at all.

- Economic uncertainty: To the extent that the stock price decline is driven by economic fundamentals (e.g., lower growth or lower profits), the company may have uncertainty about the likelihood of achieving its annual budget or long-term financial plan. This can further devalue the compensation program from the perspective of employees.

Unless the stock price decline is severe and sustained, it is uncommon for companies to cancel and replace underwater stock options or to make supplemental awards of full value shares to restore value to executives. However, when making compensation decisions in a year where the stock price has declined, it is useful to consider the context of employees’ total equity holdings and to err on the side of generosity for going forward equity grants to the extent possible.

CONCLUSIONS

Sudden stock price decreases can upset plans for annual equity grants by significantly straining the available share reserve and increasing the annual equity run rate. While there is no silver bullet approach that works for all companies, there are a number of alternative approaches that companies use to address stock price fluctuations. In choosing the approach that works best for your company, it is critical to determine the appropriate balance between the competing concerns of attracting and retaining employees with managing share dilution and protecting shareholder interests.

CAP’s industry report is based on an examination of 19 companies in the Consumer Products industry with median 2015 revenue and market cap of approximately $18B and $46B, respectively.

The Consumer Products sector faced its challenges in 2015; 1-year Revenue and EBITDA growth were down slightly at median, while the S&P 500 as a whole experienced modest growth. Many of the Consumer Products companies operate in countries outside the U.S. and were impacted by the relative strengthening of the U.S. dollar in 2015. Despite the slight declines in financial performance, 1-year Total Shareholder Return (“TSR”) for companies in the Consumer Products industry was very strong (+17%) and significantly outpaced the S&P 500 which was flat overall (+0.6%). Strong TSR performance signals that the market may be more influenced by a Consumer Products company’s strategic direction and product innovation than short-term financial performance which can be impacted by macro-economic factors including a potential rebound in certain global markets compared to expectations at the end of 2014.