- Modified burn rate policy

- Recommendation for annual Say on Pay vote frequency

- Modified definition of “egregious” pay practices

- No longer accepting future commitments to revise practices as a means to prevent or reverse a negative vote recommendation

- A policy for vote recommendations on Say on Golden Parachutes

Changes in Equity Compensation Plan Burn Rate Policy

As a means of limiting the impact of market volatility on its equity burn rate analysis, ISS decided to limit “year-to-year changes possible in allowable [burn rate] caps” (important as ISS uses its burn rate cap to assess a company’s use of equity relative to industry peers) to no more than two percentage points.

Later this month, ISS plans to publish the related (updated) industry-specific burn rate table that will be used to determine its equity plan approval (or additional share request) vote recommendations.

Say on Pay Vote Frequency

Under the recent Dodd-Frank legislation, companies are required to provide shareholders with a non-binding choice on the frequency of a non-binding Say on Pay vote, with the options being every 1, 2, or 3 years. ISS is strongly advocating annual Say on Pay votes; ISS believes that annual Say on Pay votes provide for the “most consistent and clear communication channel for shareholder concerns about companies’ executive pay programs.”

Therefore, if a company plans to recommend / support a non-annual vote frequency, we recommend that the company’s management (possibly with the assistance of their outside advisors) reach out to major shareholders as their proxy filing is prepared. This is important to do ahead of time as ISS has a policy to recommend Withhold or Against votes for the entire Board of Directors if the Board fails to act on a shareholder proposal that received approval by a majority of the shares outstanding. That said, it is remains to be seen how this policy will apply to companies that do not comply with the voting preferences of the plurality of shareholders for Say on Pay frequency. This is an issue that will likely receive attention from ISS in the future.

Individual Problematic Pay Practices / Negative Say on Pay Recommendations

ISS highlighted specific problematic pay practices that it views as particularly egregious and may independently, “by themselves, [be] sufficiently problematic to warrant Withhold or Against votes in most circumstances.” These “egregious” pay practices include:

- Repricing or replacing underwater stock options / SARs without shareholder approval (including cash buyouts and voluntary surrender of underwater options)

- Excessive perquisites or tax gross-ups, including any gross-up related to a secular trust or restricted stock vesting

- New or extended agreements that provide for:

- CIC (Change in Control) payments exceeding 3x base salary and average/target/most recent bonus

- CIC severance payments without involuntary job loss or substantial diminution of duties (“single” or “modified single” triggers)

- CIC payments with excise tax gross-ups (including “modified” gross-up)

Companies with these “egregious” practices can generally expect:

- Against vote recommendations for Say on Pay

- Against / Withhold recommendations on Compensation Committee members:

- In egregious situations (ISS does not define what this is)

- When no Say on Pay vote is on the ballot (potentially an argument for annual Say on Pay votes)

- When Board has failed to respond to concerns from prior Say on Pay votes

- Against equity incentive plan proposal if excessive non-performance-based equity awards are major contributors for pay-for-performance misalignment.

ISS also states that agreements with evergreen provisions will receive “particular scrutiny,” possibly because they provide an avenue for grandfathering “egregious” pay practices indefinitely. What is somewhat unclear is that despite the above mentioned policy update, ISS continues to state that it will continue to evaluate programs on a case-by-case basis in the context of a company’s overall pay program and historic pay actions, including other problematic pay practices cited in the past.

In all likelihood, a result of this policy update will be more companies receiving negative vote recommendations from ISS. Therefore, if companies plan to maintain or add any of these compensation program features, it is especially important that they proactively initiate dialogue with their largest shareholders to provide the rationale for why these pay practices are in shareholders’ interests.

Future Commitments / Negative Recommendations

ISS says that it will no longer accept “future commitments on problematic pay practices as a way of preventing or reversing a negative vote recommendation,” with the associated rationale that its policies are widely available and have been well known for some time. ISS also goes a step further in critiquing the corporate governance process, by stating that companies need to spend more time considering a “cure” for such practices.

There are, however, some exceptions to this policy. ISS states that exceptions now include:

- Pay-for-performance and burn rate commitments

- Plan language related to certain equity grant practices (e.g., liberal CIC definition)

Criteria for Recommendations on Say on Golden Parachutes

ISS’ policy is to take a case-by-case approach regarding recommendations for the vote on golden parachute compensation. The vote recommendation will be consistent with ISS’ pre-existing policies on problematic pay practices related to severance packages. Specific features identified as potentially leading to an Against vote include:

- Recently adopted or materially amended agreements that include excise tax gross-up provisions (since prior annual meeting)

- Recently adopted or materially amended agreements that include modified single triggers (since prior annual meeting)

- Single trigger payments that will happen immediately upon a change in control, including cash payment and such items as the acceleration of performance-based equity despite the failure to achieve performance measures

- Single trigger vesting of equity based on a definition of change in control that requires only shareholder approval of the transaction (rather than consummation)

- Potentially excessive severance payments

- Recent amendments or other changes that may make packages so attractive as to influence merger agreements that may not be in the best interests of shareholders

- In the case of a substantial gross-up from pre-existing/grandfathered contract: the element that triggered the gross-up (i.e., option mega-grants at low point in stock price, unusual or outsized payments in cash or equity made or negotiated prior to the merger)

- The company’s assertion that a proposed transaction is conditioned on shareholder approval of the golden parachute advisory vote. ISS would view this as problematic from a corporate governance perspective

ISS indicated that in cases where the golden parachute vote is incorporated into the overall Say on Pay vote for the company, ISS may place a heavier weight on golden parachute compensation in determining its vote recommendations for Say on Pay. In our view, the new guideline is largely consistent with ISS’ existing policies on severance compensation and should not present problems for companies that have moved to address their change-in-control severance practices.

Conclusions

Due to ISS’ level of influence, it is important for companies / Committee members to be aware of its policies. If ISS voting recommendations strongly influence a company’s shareholder base, those companies should regularly review their programs against ISS policies and educate their directors on the impact of the policies, so as to not be surprised by an ISS voting recommendation.

Further, Say on Pay will receive a lot of attention during the upcoming proxy season, and ISS has expressed a clear preference for annual votes. If companies do not provide for an annual Say on Pay vote, ISS will likely use Against or Withhold vote recommendations on director elections as its means to express dissatisfaction with compensation programs.

***

Please contact us at (212) 921-9350 if you have any questions about the issues discussed above or would like to discuss your own executive compensation issues. You can access our website at www.capartners.com for more information on executive compensation.

The timing of the final rules may create challenges for companies with shareholder meetings the first quarter of 2011, as Say on Pay is required for all proxy statements filed for annual meetings after January 21, 2011. For companies with annual meetings after January 21, 2011, but before the final rules are issued, the proposed rules will have to serve as the final guidance for developing their Say on Pay proposals.

Highlights of the Guidance on Say on Pay

The proposed rules contain some good news for companies, as the SEC confirmed that the new advisory votes on Say on Pay and Say on Pay frequency will not trigger the filing of a preliminary proxy statement. The SEC also directed that broker discretionary voting of uninstructed shares is not permitted for Say on Pay or Say on Pay frequency votes. Below are highlights of the proposed rules for the Say on Pay and Say on Pay Frequency votes.

Advisory Vote on Say on Pay

The SEC guidance does not specify a form for the language of the Say on Pay vote resolution. However, the proposed rules state that the resolution should indicate that the vote is advisory only and that the vote will cover all aspects of executive compensation for the Named Executive Officers of the company as disclosed in the CD&A, compensation tables and accompanying narrative. Compensation of directors and the risk assessment of the compensation programs for all employees are not intended to be included in the Say on Pay vote. In future CD&A disclosure, companies will need to discuss how their compensation policies and decisions have been influenced by past Say on Pay votes.

Vote on Frequency of Say on Pay Votes

The SEC guidance on the frequency of Say on Pay votes confirms that shareholders will have to be provided with four choices on frequency:

- Every year

- Every two years

- Every three years

- Abstain

While companies are required to provide shareholders with all four of the above choices, the proposed rules do not preclude the company from stating its preference among the alternatives. In the proposed rules, the SEC also confirmed that the vote on the frequency of the Say on Pay vote is advisory in nature and not binding on the company. That is, if a company’s stated frequency preference does not win the plurality of votes, the company can still go ahead and conduct the Say on Pay vote with its preferred frequency.

However, as proposed, the rules will require companies to disclose in the 10-Q or 10-K immediately following the Say on Pay vote whether the company expects to conduct future Say on Pay votes with the frequency selected by the plurality of shareholder votes. Separate shareholder proposals on Say on Pay or Say on Pay frequency may be excluded from the proxy statement provided that the company’s policy is consistent with plurality of votes cast in the most recent vote. Given the above, companies may have a strong incentive to structure the frequency of their Say on Pay votes in accordance with shareholder preferences.

The SEC recognizes that a vote with four choices will raise implementation challenges for companies, as shareholder voting typically follows a yes/no voting format. However, based on the way the Dodd-Frank rules were written, there was little room to interpret the rules as providing for anything other than four choices.

Finally, companies participating in TARP (which are required to conduct a Say on Pay vote annually) will not be required to conduct a vote on the frequency of the Say on Pay vote until the shareholder meeting immediately following the repayment of TARP funds.

Highlights of the Guidance on Say on Parachutes

The SEC’s proposed rules for new enhanced disclosure of golden parachute payments and an advisory vote on parachute payments state that the rules will be effective for proxy or consent solicitations to approve mergers or other transactions after the effective date of SEC amendment to disclosure rules (expected in the first quarter of 2011). This timing is later than expected and is helpful to companies as the new disclosure rules may be challenging to implement.

Disclosure of Golden Parachute Payments

In response to Dodd-Frank’s requirement of disclosure of golden parachute compensation in a “clear and simple form”, the proposed rules will require a new compensation table covering golden parachute compensation to NEOs, including the following elements for each named executive officer:

- Cash severance payments

- Dollar value of accelerated stock awards, in-the-money value of options accelerated, and payments to cancel stock or options

- Pension and deferred compensation enhancements

- Perks and benefits

- Tax reimbursement and gross-up payments

- Other

- Total

Footnotes to the table will require disclosure of what payments are single trigger (triggered by change in control only) and double trigger (triggered by a change in control and termination of employment). In the tabular disclosure, equity will need to be valued based on the stock price as of the last practicable date before the proxy filing. The table will be accompanied by narrative disclosure of the timing of the payments and any conditions that would apply to payments, including covenants (e.g., non-compete, non-solicitation).

Say on Golden Parachute Payments

The new rules require a separate non-binding shareholder advisory vote on golden parachute compensation, to the extent not previously subject to a prior general Say on Pay vote. In order to ensure that parachute payments are subject to the general Say on Pay vote, companies will have to disclose golden parachute compensation in their proxy statements with the new tabular disclosure and enhanced narrative disclosure of golden parachute payments.

It is not clear whether companies will decide to adopt the new disclosure in their proxy statements to ensure that they are subject to the general Say on Pay vote. While there will be some additional disclosure burden involved in providing the new tabular disclosure, many companies are already providing tabular disclosure of termination payments in their annual proxy statements. For these companies, it may be a simple extension of their current disclosure to comply with the new requirements. In any case, disclosure in compliance with the new rules will be required in the merger proxy statement.

Conclusion

The proposed rules have provided adequate clarity for companies to begin developing their Say on Pay and Say on Pay frequency resolutions. While the SEC is seeking comment on a number of aspects of the proposed rules, we expect the final rules to be largely consistent with the proposed rules. In developing the Say on Pay frequency resolution, we expect that most companies will state a preference for the frequency of the vote. Immediately following the passage of Dodd-Frank, our sense was that most companies would prefer biennial or triennial Say on Pay vote frequency; however, based on our discussions with clients we are seeing a trend toward a preference for an annual vote frequency.

The proposed rules for the Say on Golden Parachutes increase the disclosure requirements for companies, but will likely improve the quality of the disclosure from a shareholder’s perspective. It will be interesting to see whether companies choose to voluntarily adopt the new disclosure requirements for golden parachute compensation in annual proxy statements to ensure that golden parachute compensation is subject to the general Say on Pay vote.

Seventy companies were invited to participate in the survey and nineteen completed the full survey. Several companies that did not participate expressed interest, but said that they were too early in the decision-making process to respond.

We asked seven questions in the survey. Here is what we found:

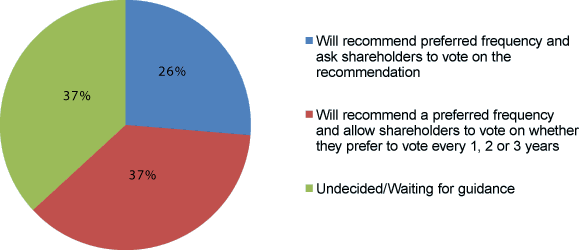

1) Dodd-Frank mandates that companies must solicit a non-binding advisory Say-on-Pay vote from shareholders at least once every three years. Do you anticipate your Board recommending that shareholders approve a specific (preferred) frequency for Say-on-Pay or will you allow shareholders to decide by voting?

The new legislation requires companies to hold a non-binding advisory vote on their executive compensation at least once every three years and to give shareholders the opportunity to vote on the frequency of the Say-on-Pay vote at least every six years. The legislation does not specify the method for the frequency vote (e.g., give shareholders the full range of choices without a recommendation, recommend a preferred frequency but let shareholders pick from the full list, or give the shareholders a yes/no vote on a frequency recommended by management and Board).

The survey results indicate that companies are fairly evenly split between recommending a preferred approach but allowing shareholders to vote on the range of choices (37%) and asking shareholders to vote yes/no on a specific frequency (26%). The remainder of the sample (37%) is undecided or waiting for guidance.

Recommending a Say-on-Pay Vote Frequency to Shareholders

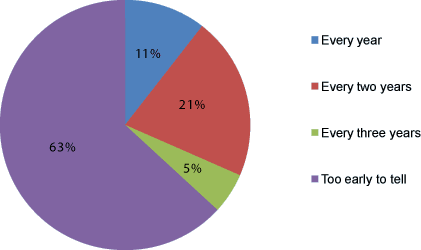

2) If you are going to recommend a preferred frequency to shareholders for Say-on-Pay voting, what do you expect to recommend?

Most companies (63%) say it is too early to tell which frequency they will recommend. Of those that did specify a time period, two years was the most common (21%). But keep in mind that this represents four companies. Given discussions we are having with clients, we would not be surprised if one or three years becomes the more common approach when companies finally implement Say-on Pay.

Choosing a Say-on-Pay Vote Frequency

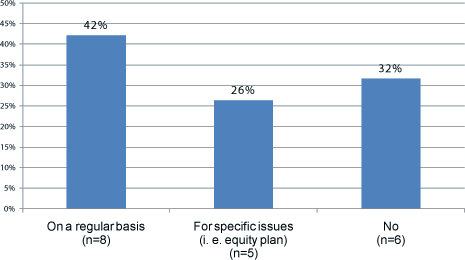

3) Does your company currently engage in active dialogue with your 10 largest shareholders at least once a year on your Company’s executive compensation practices?

Even absent Say-on-Pay, we believe engaging in open and meaningful dialogue with large shareholders is a best practice and can provide insights and avoid surprises. 42% of companies say they currently engage in active dialogue with their shareholders and 26% do so for specific issues (e.g., approval of a new equity plan).

Dialogue with Largest Shareholders

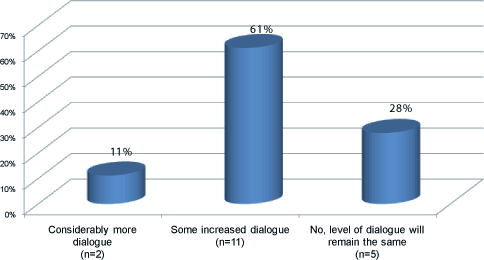

4) Do you anticipate increasing dialogue with your largest shareholders, relative to your executive compensation practices, as a result of the legislation?

We believe companies will increasingly engage their shareholders in dialogue to gain greater insight from them on their views on executive compensation, since this is more informative than a yes/no vote on the full executive compensation program. This is supported by the survey which finds that 70% of respondents expect to increase dialogue with shareholders to at least some degree.

Increasing Dialogue with Largest Shareholders

5) Do you anticipate making meaningful changes to any of your executive compensation practices/programs as a result of the Say-on-Pay requirements?

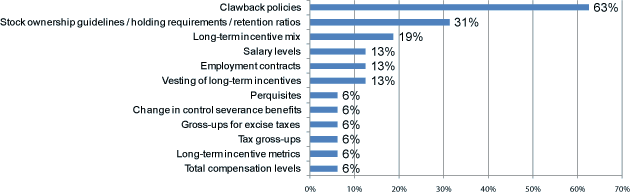

The most commonly anticipated change to executive compensation programs is clawbacks, which is a requirement of the new legislation (63%). Just under one-third of companies anticipate changing their stock ownership and holding requirements. While ownership requirements have been very common, holding requirements (where an executive must hold all or a portion of net shares realized from option exercise (net of taxes and exercise price) and vested equity (net of taxes)) for a specified period time has been an emerging trend. Many more companies may begin to adopt this practice as they try to provide for greater alignment between executives and shareholders.

Anticipated Changes to Executive Compensation Programs*

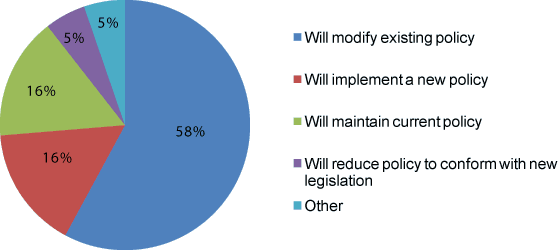

6) Do you anticipate changing or implementing a clawback policy?

Many companies implemented or enhanced their clawback policies in the recent past; however, the new legislation specifies that the period covered span 3 years. Many companies (58%) must adjust their policy to comply with the new requirements.

Clawback Policy

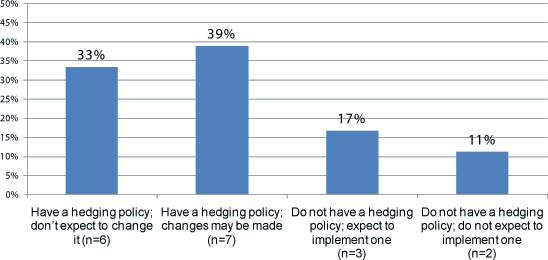

7) Do you anticipate changing or implementing hedging policies?

Unlike the clawback requirement, the new legislation does not require a company to implement a hedging policy; however, a company must disclose if it does not have such a policy. 33% of companies currently have a hedging policy and will leave it unchanged. 56% of companies will either implement a policy or anticipate reviewing or changing their current policy. Only 11% state they do not have a hedging policy and do not anticipate implementing one. These companies will have to disclose that they do not have a hedging policy and this may be a negative for shareholders.

Hedging Policy

We hope you find these early findings helpful. Since the SEC will be providing guidance and there is a lot of uncertainty, where companies land on these issues is something of a moving target. Some of the key steps we believe companies should take in the interim include:

- Discussing the implications of the legislation with their Compensation Committee

- Forming a working team to develop a response, including: Human Resources/Compensation, Legal, Investor Relations, outside consultant and legal counsel

- Engaging in dialogues with large institutional shareholders

If you would like to participate in our CAPFlash survey topics going forward, please feel free to sign up at https://www.capartners.com/signup-surveys

* Responses add to more than 100% due to multiple responses by company

***

Please contact us at (212) 921-9350 if you have any questions about the issues discussed above or would like to discuss your own executive compensation issues. You can access our website at www.capartners.com for more information on executive compensation.