Congress approved the Tax Cuts and Jobs Act on December 20th, 2017, achieving its objective of delivering a bill for President Trump’s signature before Christmas. The Act makes many dramatic changes to the tax code, including sharp reductions in the corporate tax rate, modest reductions in individual tax rates and some progress in simplifying the tax code. The biggest change from an executive compensation perspective involves amendment of Section 162(m).

Since going into effect in 1994, Section 162(m) has limited the deductibility of remuneration to covered employees to the extent the amount exceeds $1,000,000. Under current law, important exceptions to the limits on deductibility apply to stock options, other performance-based compensation and commissions. The amendments in the Act greatly expand the limits on deductibility by eliminating these exceptions.

Highlights of the Amendments to Section 162(m)

|

Amendment |

Implication |

|

Exceptions allowing deductibility of stock options, other qualifying performance-based compensation and commissions are eliminated |

Effectively caps deductibility of senior executive compensation to $1 million per year and raises company cost of compensation |

|

Definition of covered employees aligned with SEC disclosure rules |

Expands coverage to include any person serving as Principal Executive Officer (PEO) and Chief Financial Officer (CFO) during the tax year, as well as the three highest paid executive officers other than the PEO and CFO |

|

Expands coverage to include compensation of covered employees for all future years of employment whether or not they remain in the proxy, payments made after retirement, death or other termination of employments and payments to beneficiaries |

Widens the net by eliminating loopholes allowed under current law, such as leaving the role of PEO before the last day of the year and making non-qualified deferrals of compensation until after termination |

|

Amendments apply to taxable years beginning after December 31, 2017, except that the amendments shall not apply to remuneration provided pursuant to a written binding contract in effect on November 2, 2017, and not modified in any material respect on or after such date |

Effectively grandfathers existing arrangements and provides companies with an opportunity to capture tax deductions as existing arrangements wind down over time |

Possible Benefit from Amended Section 162(m): More Flexibility for Compensation Committees

Public companies subject to Section 162(m) use a variety of techniques to comply with the current law and maximize tax deductibility. Going forward, for new awards that are not made under grandfathered written binding contracts, these techniques will no longer be needed. Tax deductibility will be capped at $1,000,000 regardless of plan design:

- “Plan within a plan” structure, also known as an “umbrella plan,” will no longer be necessary, providing companies with an opportunity to simplify current plans

- Tax incentives to grant performance-based compensation will be eliminated in most instances, encouraging greater use of time-based awards.

- Potentially more flexible performance metrics may be instituted over time. Non-GAAP metrics, individual goals and metrics that incorporate discretion are likely to occur more frequently.

- Tax penalties for adjusting or restating performance targets will be eliminated in most instances.

- Compensation committees will have greater opportunities to exercise discretion, including positive discretion.

- While amendments clearly raise the cost of compensation for companies, the corporate tax rate cut makes the lost tax deductions less valuable, with a deduction on $1 million of compensation declining from $350,000 to 210,000.

What Should Companies Do Now?

Companies should take the following steps now to develop a clear picture of their particular situation with respect to the amendment of Section 162(m):

- Take an inventory. Make a list of outstanding compensation arrangements and awards to determine which may continue to be deductible going forwards. These would include contractual benefits and other awards made under written binding contracts in place on or before November 2, 2017.

- Double check your assessment with tax counsel. Make sure internal resources and outside advisors agree with your analysis and conclusions.

- Determine administrative processes needed to capture tax deductions going forward. For example, achievement of the goals of a grandfathered performance share award must be certified by the Compensation Committee prior to payment to comply with current Section 162(m) rules.

- If contractual arrangements and awards will continue over time, continue to seek re-approval of the material terms of incentive plans every 5 years. Shareholder approval of metrics, maximum awards and the class of participants are required to comply with current law. Obtaining shareholder approval of these proposals is almost always easy to accomplish.

- Be wary of making changes. Modification to awards or arrangements in effect on or before November 2, 2017 could result in the loss of valuable tax deductions.

- Determine which executives appear in the proxy and become covered employees under amended Section 162(m).

- Do your best to limit new entrants into the proxy disclosed group. Once an executive becomes subject to amended Section 162(m), the limits on deductibility become permanent.

- Prepare a pro forma showing current law and amended law to review with the Compensation Committee. It is important to brief the Committee and senior management to avoid surprises. All will benefit from understanding the magnitude of lost deductions.

- Review your proxy disclosure. Determine how best to address the issue of tax deductibility in the CD&A.

- Follow case law as it develops. Without a doubt, companies will test the amendments and new thinking will develop. You will benefit if you track the issue as it is tested in the marketplace.

We will keep our readers informed of new developments. Undoubtedly the Tax Cuts and Jobs Act will have other implications for executive compensation.

The House Ways and Means Committee amended The Tax Cuts and Jobs Act twice within a week of its issuance. Several amendments have significant compensation implications.

Section 3801

Nonqualified Deferred Compensation (NQDC) is Eliminated

The biggest change is that proposed Section 3801 is stricken from the Act, preserving the current tax treatment of NQDC, including equity and stock options. This amendment will be applauded by corporate issuers and human resource professionals. It means that:

- Cash-based NQDC, including elective deferrals, SERPs, top hat 401(k) plans and severance, will not have to be unwound and cashed out to cover an accelerated tax event.

- The Act will not create strong incentives for companies to grant current cash and time vested stock, rather than performance conditioned awards.

- Stock options will continue as a viable alternative for companies that want to offer them.

- Complex rules under 409A continue to govern deferred compensation.

Section 3804

Stock Options

The amendment provides some relief for employees of private companies who are compensated with equity that lacks a ready public market. The amendment provides that certain employees who receive stock options or restricted stock units as compensation may elect to defer recognition of income for up to 5 years, if the corporation’s stock is not publicly traded. Note that earlier taxation may apply if a liquidity event occurs, if the executive is highly compensated or under other circumstances.

Section 3805

Modification of treatment of qualified equity grants

This amendment merely clarifies that restricted stock units (RSUs) are not eligible for Section 83(b) elections. Instead, Section 83(b) elections, i.e., elections to be taxed at grant, rather than at vesting, are limited to restricted stock awards. This is consistent with current tax law.

Summary

To date, the headline is that the proposed limitation on tax deductibility of compensation of named executive officers in public companies that exceeds $1 million remains in the House proposal. This certainly aligns with a populist agenda. We will wait and see what the Senate's tax bill contains and keep our readers updated.

The House Ways and Means Committee released its long anticipated proposal on tax reform, the “Tax Cuts and Jobs Act” on November 2, 2017. If passed, the bill would go into effect in 2018. Notably, the bill is lengthy and complex, weighing in at a whopping 426 pages! Our early read indicates that the compensation related provisions of the Act would result in profound change.

The major provisions of the bill involve tax reform and simplification resulting in a total revenue reduction of $1.5 trillion from 2018 to 2027.

|

Key Provision of the Tax Cuts and Jobs Act |

|

Permanent reduction in corporate tax rate from 35% to 20% |

|

Consolidation and simplification of individual tax rates by moving from 7 brackets to 4 brackets of 12%, 25%, 35% and 39.6% |

|

A portion of income generated by a pass through entity taxed at a maximum rate of 25%, with safeguards to prevent re-characterization of wages as business income |

|

Repeal of personal exemptions |

|

Increase in standard deduction |

|

Increase in credit against estate tax and repeal of estate tax in 2024 |

|

Elimination of Alternative Minimum Tax |

In order to stay within the $1.5 trillion allowance approved by the Senate, the House had to work hard to build in provisions that accelerate income and raise revenue. There is also a strong populist impulse to deliver on the administration’s promise of a middle class tax cut. The jury is still out on whether the House has delivered a bill that will pass and become law.

At minimum, the Act provides insight on how the political establishment perceives executive compensation. The rationale that the House articulated for the new executive compensation provisions includes:

- Repeal of benefits that are generally only available to highly compensated employees;

- Simplification of the tax code; and

- Desire to limit perverse consequences caused by executives who focus on short-term, quarterly results rather than the long-term success of companies.

Several provisions of the bill have very significant implications for executive compensation. If these provisions are enacted we expect large scale change to occur. Highlights are summarized below with more detailed discussion following:

|

Section |

Compensation Related Provisions of the Tax Cuts and Jobs Act |

Projected Revenue Impact Over 2018-2027 |

|

3801 |

Accelerate taxation of Nonqualified Deferred Compensation, including stock options and other forms of equity compensation |

$16.2 billion increase |

|

3802 |

Limit tax deductibility of compensation over $1 million for top 5 highest paid Named Executive Officers |

$9.3 billion increase |

|

3803 |

20% excise tax on compensation in excess of $1 million for five highest paid employees in tax-exempt organizations |

$3.6 billion increase |

|

1501 -1506 |

Technical amendments to simplify and reform savings, pension and retirement, related to repeal of Roth recharacterizations and loosening of regulations related to in-service distributions, hardship distributions, rollovers and nondiscrimination testing |

$14.3 billion increase |

|

Total |

$43.4 billion increase |

None of these provisions have a big impact on the bottom line. The total increase of $43.4 billion in projected revenues represents Less than 3% percent of the $1.5 trillion price tag. But if these provisions become law, we can confidently predict lots of change in executive compensation plans as the implications are better understood.

Section 3801

Accelerate taxation of Nonqualified Deferred Compensation (NQDC), including stock options and other forms of equity compensation.

This provision calls for a major change to the tax treatment of NQDC. NQDC would be taxed as soon as the compensation is no longer subject to a substantial risk of forfeiture, defined as when receipt of the compensation is not subject to future performance of substantial services. In other words taxation would occur at vesting, rather than upon payment or settlement. Performance conditions would not constitute a substantial risk of forfeiture.

NQDC is defined broadly to include any plan or individual arrangement that provides deferred compensation, other than qualified employer plans and bona fide vacation leave, sick leave, compensatory time, disability pay or death benefit plans. Surprisingly, the bill wraps equity compensation under NQDC, specifically including any arrangement that provides the value of, or the appreciation in value of, a specified number of equity units (whether paid in cash or stock), stock options and stock appreciation rights.

This tax treatment would change practically all forms of executive compensation:

- Complex rules governing NQDC under 409A would be eliminated

- Elective deferrals of compensation would be eliminated.

- SERPs, severance benefits and other non-qualified retirement plans would be taxed at vesting, making lump sum distributions the only practical solution.

- Stock options and stock appreciation rights would be taxed at vesting, rather than at exercise.

- To the extent that performance conditions applied to cash or equity compensation, service-based vesting would also be required to avoid early taxation.

- Performance share units and long-term cash awards would continue without adverse tax consequence under the proposed rules, provided the vesting period aligned with the performance period.

- Performance plans with installment vesting or plans that allow executives to bank a portion in the first year of a multi-year performance period would need to be reassessed to ensure that early taxation is not triggered.

- The tax code would provide a strong incentive to companies to pay current cash and service-based restricted stock

The proposed tax treatment of stock options seems particularly ill-advised. It is not clear how it would work and there are a number of aspects that would potentially create serious unintended consequences. For example, if the in-the-money value of options were indeed taxed as ordinary income at the vesting date of the option, there would be a strong incentive to grant options that vest immediately. If an option vested on the date of grant, there would be no in-the-money value and taxes would be zero. Assuming no change in the tax code, an executive would establish basis for capital gains on the vesting date and all future appreciation would be treated as a capital gain. We don’t believe that the House Ways and Means Committee intended this outcome. More clarity on how stock options would be treated and even better, a different treatment for stock options, is needed.

The new rules would apply for compensation attributable to services performed after 2017. Current tax treatment would apply to existing non-qualified deferred compensation until 2025, when the new rules would apply to all compensation arrangements.

Section 3802

Limit tax deductibility of compensation over $1 million for top 5 highest paid Named Executive Officers.

This provision would expand current limits on tax deductibility of executive compensation over $1 million by eliminating the exceptions for commissions and performance-based compensation, including stock options. The new limits on deductibility would align with SEC disclosure requirements by including the principal executive officer, the principal financial officer and the next three highest paid executive officers. Notably, once an individual executive is subject to the deduction limit, the limit would continue to apply as long as the employer pays compensation to the executive or any beneficiaries.

This provision certainly would raise the after-tax cost of senior executive compensation, but we don’t expect compensation to decline. We believe most companies would simply absorb the cost. One positive implication is the elimination of all the time and energy devoted to complying with Section 162(m) as currently written.

Section 3803

20% excise tax on compensation in excess of $1 million for five highest paid employees in tax-exempt organizations.

Under the provision, tax-exempt organizations would be subject to a new 20% excise tax on compensation over $1 million paid to any of its five highest paid employees. This would create greater parity with the tax treatment afforded public companies and discourage excessive compensation in tax-exempt organizations.

Sections 1501-1506

Technical amendments to simplify and reform savings, pension and retirement, related to repeal of Roth recharacterizations and loosening of regulations related to in-service distributions, hardship distributions, rollovers and nondiscrimination testing.

The new tax rules generally left the core benefits available under 401(k) plans untouched. Current limits on contributions remain intact. Instead a series of technical amendments will loosen some of the current rules governing in-service distributions, hardship distributions, rollovers and nondiscrimination testing.

We will see how the public, corporate America, and importantly, the Senate react to the House’s bill in the coming days. We will keep our readers informed of new developments.

Highlights

Requirements of the SEC’s Final Rules:

Disclosure of

- the median of the annual total compensation of all employees, excluding the Principal Executive Officer (“PEO”), defined as A;

- the annual total compensation of the PEO, defined as B;

- the ratio of the amount in B to the amount in A, where A equals one, or alternatively, expressed narratively as a multiple

Example:

If A equals $50,000 and B equals $2,500,000, the pay ratio may be described as either “50 to 1” or “50:1” or the company may disclose that “the PEO’s annual total compensation is 50 times that of the median annual total compensation of all employees.”

Timing:

- Reporting required for the first full fiscal year beginning on or after January 1 2017.

- For calendar year companies, this means the proxy statement for the 2018 Annual Meeting

Exclusions: Smaller reporting companies, foreign private issuers, MJDS filers, and emerging growth companies

Assessing the Size and Scope of the Task:

The size and complexity of the task of preparing pay ratio disclosure will vary greatly from company to company. Factors such as the number of employees, their location and the integration of payroll and HRIS systems will determine the amount of work involved.

| Complexity of Pay Ratio Disclosure and Information Gathering | |

| Less Complex | More Complex |

| Smaller number of employees | Larger number of employees |

| Full-time employees only | Mix of full-time, part-time, temporary or seasonal workers |

| US only | Multiple international locations |

| Single corporate registrant with no consolidated subsidiaries | One or more consolidated subsidiaries in addition to corporate registrant |

| Single HRIS/payroll system | Multiple HRIS/payroll systems |

| Compensation plans limited to salary, cash bonus and equity | Additional compensation plans, such as commissions or multiple incentive plans and “spot” bonuses housed in different systems |

| Retirement plans limited to defined contribution plans | Defined benefit pension plan and/or company contributions to non-qualified deferred compensation plans |

| Limited perks | Extensive perks |

Advance Planning

We strongly advise companies to begin the process early, particularly if your company’s situation is “more complex.” In these cases, we advise that you calculate the pay ratio during the last three months of 2016 – a full year in advance. This will give you an opportunity to clearly identify where the data will come from, how the data will be obtained and what type of assumptions must be made.

It will also allow plenty of time to craft the required disclosure language, evaluate any repercussions and communicate it to interested parties – including HR leadership, senior management and the Compensation Committee.

Overview of the Implementation Process

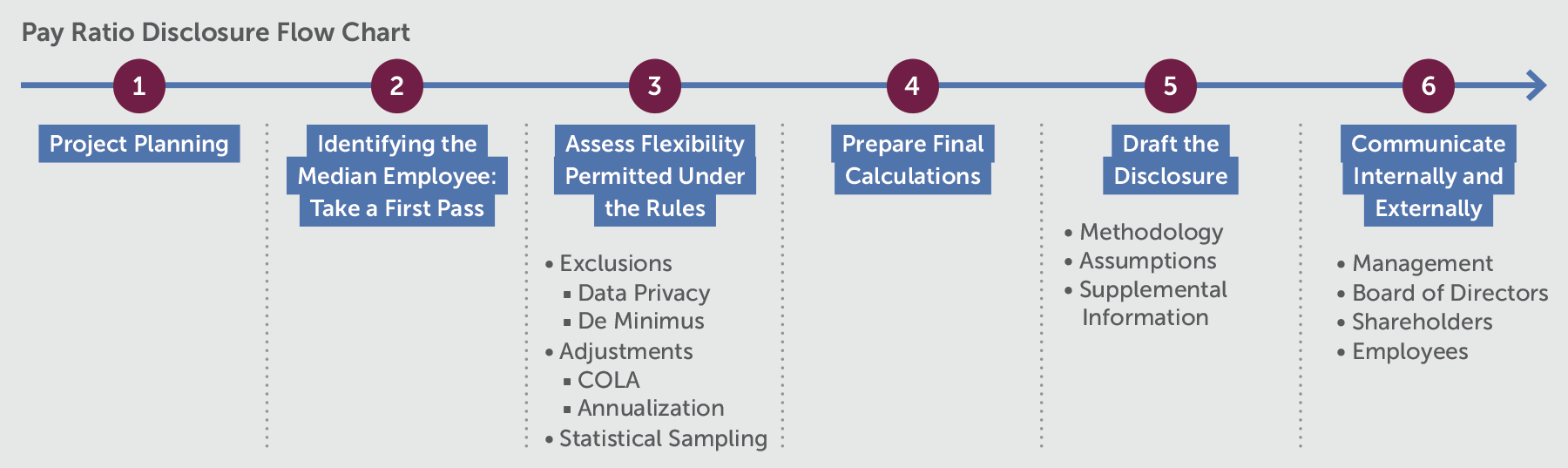

CAP recommends that companies adopt an implementation process that encompasses six phases:

Phase I: Project Planning

- Confirm that your company is required to provide pay ratio disclosure. Make sure your company is not in one of the excluded categories where pay ratio disclosure is not required.

- Determine who “owns” the project. In most companies, we expect either HR, Legal or Finance staff to be responsible for preparing pay ratio disclosure.

- Identify internal resources. We expect most companies to establish a cross-functional team to complete this work. HR and Finance staff will benefit from assistance from Technology staff, particularly if multiple HRIS and payroll systems exist. A member of the Legal staff can help the team draft the text of the disclosure and coordinate with overall proxy preparation.

- Identify external resources. Decide whether the internal team charged with preparation of the pay ratio disclosure would benefit from partnering with outside resources. An outside consultant could provide the team with learnings gleaned from client situations and other experience. If multiple non-US locations are involved, the team will require expertise in data privacy laws, and a legal opinion will be required in certain circumstances.

- Create an inventory of data sources. Tally up the number of HRIS or payroll systems. Can you access a single integrated system or will you be forced to tap into multiple systems? Overlay the countries in which your company operates to ensure data source(s) for each country are identified. Obtain samples of the data fields that may be retrieved to begin the process of defining a methodology for identifying the median employee. The answer to these questions will be critical in determining whether to use statistical sampling, as well as identifying the pay elements that determine the median employee.

- Create a preliminary time line for the project. Coordinate with the schedule for overall proxy statement preparation. Allow sufficient time for communication to the various stakeholders.

Phase II: Identifying the Median Employee: Take a First Pass

- Chart the number and types of employees – full-time, part-time, temporary and seasonal — by country. Approximate as necessary to get a rough headcount. Reach out to your HR network as needed to fill in the blanks.

- Identify consolidated subsidiaries and include your best estimate of these employees in the preliminary headcount.

- Overlay basic compensation data on the preliminary headcount. Use what is most readily available from the payroll and HRIS systems – for example, the average amount, or the median, of annual cash compensation by location.

- Assuming your company’s PEO is paid in US dollars and international employees are part of the picture, convert the international compensation data into US dollars.

- Step back and analyze the data. Depending on degree to which employees are concentrated, either by category or by location, it may be obvious where the median employee resides.

Here is an example of employee counts for a major retailer with operations in the U.S., Europe and Canada. Keep in mind that the median employee will be the employee whose pay is higher than one-half of the pay of all employees and lower than the pay of the other half. With a total of 47,000 employees, the median employee at this company will be the employee whose pay is higher than 23,500 employees out of the total. The company in our example has a very large group of part-time employees who are store associate, including more than 27,000 such employees in the US. We know that the typical part-time employee in the US works 20 hours per week at an average rate of $12 per hour and annual compensation of about $12,000. Given the high concentration, of U.S. part-timers, we can conclude that in this company the median employee will almost certainly be found in the U.S. part-time category. While additional work is necessary, a picture begins to emerge.

| Full Time Employees | Part-Time Employees | |

| U. S. | 12,665 | 27,285 |

| Europe | 1,788 | 3,852 |

| Canada | 447 | 963 |

| Total | 14,900 | 32,100 |

| Estimate: 14,900 full-time employees + 8,600 U.S. part-time employees = Median (ranked 23,500 out of 47,000 total employees) | ||

Naturally, each company will have a unique profile. Many companies may not have an obvious concentration of employees, so the preliminary estimates may not be predictive of the final result. But even in that case, the team will know that more work – and more precise data – will be necessary to complete the picture.

Phase III: Assess Flexibility under the Rules

- Determine if the Foreign Data Privacy Law exemption applies. Under this exemption companies are allowed to exclude employees residing in locations where data privacy laws or regulations prevent companies from complying without violating such data privacy laws or regulations.

But the bar is high, since companies must make “reasonable efforts” to obtain the necessary data. Reasonable efforts include listing the excluded jurisdiction, identifying the specific law or regulation that prevents compliance, explaining how compliance violates the law or regulation, seeking an exemption or other relief and even obtaining a legal opinion from counsel. If you can create a list of the pay for each employee and not include any personally identifiable information (e.g., just number the employees without using their regular employee number), then you likely will have to include them in the calculation.

We strongly urge clients to bring their privacy officer or legal counsel into the picture early to make this determination up front.

- Determine if the De Minimus exemption applies. This exemption allows companies to exclude non-U.S. employees if they account for 5% or less of total employees. If non-U.S. employees exceed 5% of the total U.S. and non-U.S. employees, up to 5% may be excluded. However if any non-U.S. employees are excluded from a particular jurisdiction, all non-U.S. employees in that jurisdiction must be excluded. Both the jurisdiction and the approximate number of employees excluded must be disclosed.

- If both exemptions are used, coordinate the two exemptions as required under the rules. When calculating the number of non-U.S. employees that may be excluded under the de minimis exemption, companies much count any non-U.S. employees excluded under the data privacy exemption. This number may exceed 5%, but if it does, the de minimis exemption may not be used to exclude additional non-U.S. employees. On the other hand, if the number of non-U.S. employees excluded under data privacy exemption is less than 5%, additional non-U.S. employees may be excluded under the de minimis exemption provided the total equals 5% or less and all employees in a given jurisdiction are excluded.

- Assess efficacy of using COLA adjustments. The final rules allow companies to adjust actual compensation amounts of non-U.S. employees to reflect COLA, or cost of living allowance adjustments. Assuming that the U.S. tends to be a relatively high cost jurisdiction, unadjusted wages in non-U.S. jurisdictions will trend lower, increasing the final pay ratio. Upward adjustments to non-U.S. wage rates will decrease the reported pay ratio – a desirable outcome for most companiesBut once again, meeting the requirements to take advantage of the allowed flexibility will be challenging. Before embarking on this path, companies need to determine if it is indeed worthwhile. Discuss pros and cons and whether additional disclosure is required.

- Determine whether to annualize cash compensation of permanent employees. Companies are allowed to correct for mid-year hires of permanent employees by annualizing compensation, but if the number of mid-year hires is small, this adjustment may not be worthwhile.

- Evaluate the pros and cons of using statistical sampling to identify the median employee. Remember that to perform valid statistical sampling, the underlying data must be reasonably comprehensive and accurate. In addition, statistical sampling complicates your disclosure, since disclosure of the methodology and your assumptions is required. Best use may be for companies with defined benefit pension plans, since total compensation will be impacted by age and years of service.

- Identify how you will measure compensation in a consistent fashion for purposes of identifying the median employee. The rules allow companies considerable flexibility to choose an appropriate methodology for identifying the median employee. Employers can select a methodology that makes sense for them. Reasonable estimates are allowed. In addition, the median employee can be selected by using any compensation measure, provided it is consistently applied. Furthermore, companies may use their actual population to select the median employee or use statistical sampling or any other reasonable method.

While some companies will take advantage of these flexibilities, others will focus on their actual population and compensation levels. Since statistical sampling depends on valid data, it may not reduce the workload associated with preparing the calculations. - Consider the pros and cons of using various dates within the last three months of the fiscal year. The rules allow employers to identify the median employee on any date within the last three months of the fiscal year. We expect that this decision will most often align with payroll dates when payroll data is used to measure compensation of the median employee.

Phase IV: Prepare Final Calculations

- Select a final date during last three months of the year for the calculation based on preliminary analysis.

- Obtain updated roster of employees by location as well as final compensation data. Make sure compensation data is consistently applied.

- Apply the various exemptions, adjustments and other methodologies reviewed and agreed on during Phases I – III. Review and confirm your methodology and document any assumptions.

- Identify the median employee and determine a set of other comparable employees in case of a change in status of the median employee. The rules allow companies to identify the median employee only once every three years. Over time, this will significantly reduce the cost of compliance. Interestingly, the rules require the identification of an actual employee as the median employee, rather than a range of employees or a hypothetical profile employee.

The exception to the three-year rule involves instances where a change in the employee population or a change in employee compensation arrangements could reasonably result in a significant change in pay ratio disclosure. Assuming no significant changes, the company must calculate annual compensation of the median employee using the methodology for proxy disclosure, subject to reasonable estimates, for years one, two and three. If the median employee leaves the company or has anomalies in his or her compensation, the company may substitute a comparably situated employee.

- Evaluate any anomalies related to the PEO’s compensation. Two methodologies are available if turnover resulting in two incumbents during a single year occurs. Under the first approach, a company may add the total compensation reported in the Summary Compensation Table for the two incumbents. As an alternative, companies may annualize the compensation of the PEO in the position on the date selected to identify the median employee.

- Determine the final pay ratio. Test and retest. Get a final level of comfort with the data and the methodology.

Phase V: Draft the Disclosure

- Prepare a draft of pay ratio disclosure. For disclosure purposes, companies must describe the methodology used to identify the median employee and to determine total compensation and any material assumptions, adjustments (including any cost of living adjustments) or estimates.

- Consider whether disclosure of supplemental information would be beneficial. Final rules allow companies to disclose additional ratios or other information to supplement the final ratio. While this is not required, companies may find it beneficial. For example, a company with a large number of part-time or seasonal workers may want to disclose the ratio applicable to full-time employees.

Phase VI: Communicate Internally and Externally

- Communication of pay ratio disclosure will be important. The project team has a number of critical stakeholders in the communications process. Plan to communicate progress early and often. Schedule periodic check-ins with HR leaders and senior leadership during the analysis and review process. In addition, brief the board of directors, particularly the Compensation Committee. There is a high potential for negative publicity associated with pay ratio disclosure. Get in front of it and anticipate employee reactions to the disclosure. Provide talking points to the leadership team so that they can respond to employee concerns in a consistent manner.

- Talk to peers and outside advisors about trends in disclosure. As companies actually prepare disclosure, trends and best practices will crystallize. Tap into the knowledge and experience that other companies and your advisors can provide.

Interpretive Guidance from SEC

On September 21, 2017 the US Securities and Exchange Commission (SEC) issued interpretive guidance designed to assist registrants prepare their pay ratio disclosures. The interpretive release was designed to respond to concerns raised by registrants about how to identify the median employee and calculate the pay ratio.

Importantly, the SEC confirmed that rules are intentionally crafted to give flexibility to registrants since they allow for reasonable estimates, assumptions and methodologies, including statistical sampling; and reasonable effort to prepare the disclosure. The SEC acknowledged that the ratio may include a degree of imprecision. Further, the SEC clarified that the pay ratio disclosure would not trigger an enforcement action unless the disclosure was made “without a reasonable basis or was provided other than in good faith.” Given that many clients have been intensely debating the pros and cons of various methodologies, this is a very important clarification from the SEC.

The SEC reaffirmed that existing internal records, such as tax or payroll records, may be used to identify the median employee. These records may be used even if they do not include every element of compensation. Use of existing records are certainly in line with the concept of using reasonable estimates.

The SEC also reaffirmed that if the compensation of the selected median employee, as calculated using the Summary Compensation Table methodology, proved to be anomalous, a registrant could select another similarly-situated employee based on the consistently applied compensation measure used in its selection process.

All of this interpretative guidance confirms that the pay ratio calculation is complex. While it is very helpful for the SEC to address concerns about potential liability and reaffirm that registrants have flexibility, one must question whether the pay ratio disclosure actually serves a legitimate business purpose.

The final issue addressed by the SEC involved the definition of independent contractors. In cases where workers are employed by, and whose compensation is determined by an unaffiliated third party, they may be classified as independent contractors and excluded from the calculation. The SEC affirmed that independent contractors defined by widely recognized tests applicable in other legal or regulatory contexts could also be excluded.

Division of Corporation Finance Guidance

In addition to the SEC’s interpretive release, the Division of Corporation Finance released additional guidance and hypothetical examples of the use of statistical sampling and other reasonable methodologies.

This included the following:

- Registrants are allowed to combine the use of reasonable estimates with the use of statistical sampling. For example a registrant with multi-national operations or multiple lines of business may use sampling in some areas/businesses and other methodologies or reasonable estimates elsewhere.

- Examples of sampling methods that may be used are below. Additionally a combination of methods is acceptable.

- Simple random sampling by selecting random number or percentage of employees from the entire population;

- Stratified sampling by dividing employees into strata, based on factors like location, business unit, type of employee, etc., and sampling within each strata;

- Cluster sampling by dividing employees into clusters, drawing a subset of clusters and sampling within clusters; and

- Systematic sampling where every nth employee is included in the sample.

- Examples of where registrants may use reasonable estimates include but are not limited to:

- Analysis of the workforce;

- Characterizing the statistical distribution of the company’s employees;

- Calculating a consistent measure of compensation and annual total compensation or its elements;

- Determining the likelihood of significant changes from year to year;

- Identifying the median employee;

- Identifying multiple employees who fall around the middle of the compensation spectrum; and

- Using the midpoint of a compensation range to estimate compensation.

- Examples of other reasonable methodologies, include:

- Making one or more distributional assumptions, provided that the company has determined that the assumption is appropriate given its own distributions;

- Reasonable methods of imputing or correcting missing values; and

- Reasonable methods of addressing outliers or other extreme observations.

Finally the Guidance provides three hypothetical examples of various approaches that may be applied. While all of the Guidance is helpful, we believe that the extra detail on reasonable assumptions and reasonable methodologies is particularly helpful.

In contrast, complex methods of sampling are less helpful. Our sense at this point in time is that most companies will not employ extensive statistical sampling. Basically the thinking is that if a registrant has the data necessary to perform robust statistical sampling, the registrant will have the data to array employee compensation levels and calculate a median. But we shall see how this plays out next year when the new disclosure is actually implemented.

Conclusion

Pay ratio disclosure represents a significant effort for most companies. It is important to develop an airtight process to support the company’s analysis. The rules are complex and companies will be working through the rules for the first time. The results will undoubtedly get a great deal of scrutiny from senior leadership, the Board, employees and the business press. Recent interpretive guidance gives companies more leeway to employ reasonable estimates and methodologies, but nevertheless companies must be comfortable that their disclosure is accurate. This practical guide to implementation can serve as a guide to achieving a successful result for all.

On September 21, 2017 the US Securities and Exchange Commission (SEC) issued interpretive guidance on the CEO pay ratio calculation and disclosure. The pay ratio rule was adopted by the SEC on August 5, 2015 under the Dodd-Frank Wall Street Reform and Consumer Protection Act. It requires companies to disclose their CEO’s annual total compensation as a multiple of the annual total compensation of the median employee for the first fiscal year beginning in 2017.

The guidance came in the following three areas:

- As long as the company uses reasonable estimates, assumptions, or methodologies (to identify the median employee or calculating any elements of annual total compensation for employees), the pay ratio itself and related disclosure would not provide the basis for an enforcement action from the SEC

- A company may use internal records (such as tax or payroll records) to identify its median employee

- For determining whether independent contractors are “employees”, companies may apply a widely recognized test under another area of law (e.g., tax or employment laws) that they would otherwise use to determine whether their workers are employees

- Provides guidance and detailed examples on the use of statistical sampling

Revised Compliance and Disclosure Interpretations (C&DIs)

- Adds a new C&DI that issuers can state the ratio is an “estimate”

- Withdraws C&DI that primarily addressed the treatment of independent contractors and leased workers

The latest guidance now provides more flexibility for companies in determining the median employee, specifically as it relates to the use of statistical sampling and clarification of independent contractors. We will track pay ratio disclosure over the coming year and keep you informed of new developments as they occur.

On February 6, 2017 the Acting Chairman of the US Securities and Exchange Commission (SEC) issued a Public Statement on Reconsideration of Pay Ratio Rule Implementation. The pay ratio rule was adopted by the SEC on August 5, 2015 under the Dodd-Frank Wall Street Reform and Consumer Protection Act. It requires companies to disclose their CEO’s annual total compensation as a multiple of the annual total compensation of the median employee for the first fiscal year beginning in 2017.

The statement indicated that “some issuers have begun to encounter unanticipated compliance difficulties that may hinder them in meeting the reporting deadline.” The SEC began a 45-day comment period for issuers to submit detailed comments on challenges they have experienced in preparing for compliance with the rule. Additionally, the staff was directed to determine whether additional guidance or relief is necessary.

Click on this link to see the full text of the Public Statement.

We believe pay ratio disclosure is an example of regulation that will be costly to implement and serves no clear purpose to benefit investors or American companies. We expect that a number of issuers will provide their comments on the challenges, cost and effort related to the preparation of compliance with the rule. This may be a first step in a major overhaul, delay or reversal of the rule.

In addition to the SEC’s Public Statement, it was reported by Bloomberg BNA that House Republicans “plan to introduce legislation to roll back the Dodd-Frank Act in mid-February”. Depending on the timing of any changes to the Dodd-Frank Act or the results of the comment review process, issuers may not have definitive direction before the summer.

We will track these issues over the coming year and keep you informed of new developments as they occur.

On February 3, 2017 President Trump issued an Executive Order entitled “Core Principles for Regulating the United States Financial System. “ While the Executive Order does not specifically mention the Dodd-Frank Act, it is widely viewed as the first step in a roll back of Dodd-Frank.

The Executive Order lays out Core Principles that are to be used by the Trump Administration to regulate the US financial system. The Core Principles talk about:

- empowering the American consumer;

- making American financial markets supportive of growth;

- preventing tax-payer funded bailouts;

- better enabling American companies to compete in global markets; and

- making regulation efficient and subject to public accountability.

Click on https://www.whitehouse.gov/the-press-office/2017/02/03/presidential-executive-order-core-principles-regulating-united-states to see the full text of the Executive Order.

The Order directs the Secretary of the Treasury to consult the member agencies of the Financial Stability Oversight Council and report back to the President within 120 days, and periodically after that. The agencies are charged with reporting on the ability of existing regulations to promote the Core Principles, reporting on actions taken to promote the Core Principles and identifying any laws and regulations that are inconsistent with the Core Principles.

We expect the regulatory agencies to focus on regulatory oversight of the financial markets. Discussion to date in the business press has focused on issues such as bank capital requirements, the Volcker Rule and the designation of “systemically important financial institutions.” However, implementation of the Core Principles may impact executive compensation. As you know, the Dodd-Frank Act contains a number of regulations related to executive compensation, including Say-on-Pay and pay ratio disclosure, among others.

What do we expect to see? How will the Trump Administration impact executive compensation from a regulatory perspective?

Since the first report by the regulators is due by early May, we don’t expect the roll back to have a direct impact on the 2017 proxy season. By early May, most calendar year companies will have filed proxies and, in many cases, conducted their annual shareholder meetings. We expect that the regulations that have already been implemented, including Say-on-Pay, hedging disclosure, and Compensation Committee independence, will continue in effect for the foreseeable future. Not least because companies have already implemented these regulations and they are relatively benign. One could even argue that Say-on-Pay aligns with a populist agenda.

We do believe that a number of changes will occur over the course of the year. More than likely, we think pay ratio disclosure will be rolled back. It is a good example of regulation that will be costly to implement and serves no clear purpose to benefit investors or American companies. Certainly the business community does not support it. We expect the Trump Administration to roll it back and that would likely occur before the 2018 proxy season, when the new rules are scheduled to go into effect.

Regarding the regulations that have not been finalized, including clawbacks and pay and performance disclosure, we think it is more likely than not that neither will be implemented. Both of these issues are complex. One can argue that they duplicate existing policies and practices at many companies and that it is not necessary to give these rules the weight of law. As an example, shareholders have voted affirmatively to conduct Say-on-Pay votes on a regular basis, generally annually. In addition, our research indicates that most major companies have a clawback policy in effect. Even if these are no longer required under the Act, we expect most companies to continue current practices that support good governance.

We will track these issues over the coming year and keep you informed of new developments as they occur. It will certainly be interesting to watch as the Trump Administration makes its mark on our country’s regulatory framework.