Highlights

Requirements of the SEC’s Final Rules:

Disclosure of

- the median of the annual total compensation of all employees, excluding the Principal Executive Officer (“PEO”), defined as A;

- the annual total compensation of the PEO, defined as B;

- the ratio of the amount in B to the amount in A, where A equals one, or alternatively, expressed narratively as a multiple

Example:

If A equals $50,000 and B equals $2,500,000, the pay ratio may be described as either “50 to 1” or “50:1” or the company may disclose that “the PEO’s annual total compensation is 50 times that of the median annual total compensation of all employees.”

Timing:

- Reporting required for the first full fiscal year beginning on or after January 1 2017.

- For calendar year companies, this means the proxy statement for the 2018 Annual Meeting

Exclusions: Smaller reporting companies, foreign private issuers, MJDS filers, and emerging growth companies

Assessing the Size and Scope of the Task:

The size and complexity of the task of preparing pay ratio disclosure will vary greatly from company to company. Factors such as the number of employees, their location and the integration of payroll and HRIS systems will determine the amount of work involved.

| Complexity of Pay Ratio Disclosure and Information Gathering | |

| Less Complex | More Complex |

| Smaller number of employees | Larger number of employees |

| Full-time employees only | Mix of full-time, part-time, temporary or seasonal workers |

| US only | Multiple international locations |

| Single corporate registrant with no consolidated subsidiaries | One or more consolidated subsidiaries in addition to corporate registrant |

| Single HRIS/payroll system | Multiple HRIS/payroll systems |

| Compensation plans limited to salary, cash bonus and equity | Additional compensation plans, such as commissions or multiple incentive plans and “spot” bonuses housed in different systems |

| Retirement plans limited to defined contribution plans | Defined benefit pension plan and/or company contributions to non-qualified deferred compensation plans |

| Limited perks | Extensive perks |

Advance Planning

We strongly advise companies to begin the process early, particularly if your company’s situation is “more complex.” In these cases, we advise that you calculate the pay ratio during the last three months of 2016 – a full year in advance. This will give you an opportunity to clearly identify where the data will come from, how the data will be obtained and what type of assumptions must be made.

It will also allow plenty of time to craft the required disclosure language, evaluate any repercussions and communicate it to interested parties – including HR leadership, senior management and the Compensation Committee.

Overview of the Implementation Process

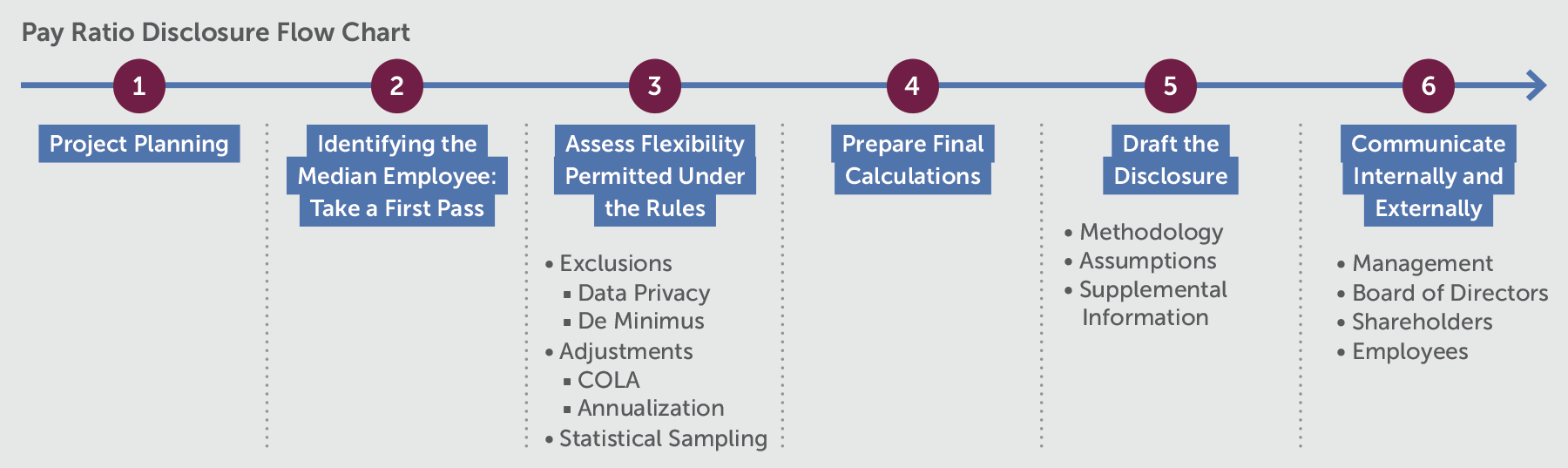

CAP recommends that companies adopt an implementation process that encompasses six phases:

Phase I: Project Planning

- Confirm that your company is required to provide pay ratio disclosure. Make sure your company is not in one of the excluded categories where pay ratio disclosure is not required.

- Determine who “owns” the project. In most companies, we expect either HR, Legal or Finance staff to be responsible for preparing pay ratio disclosure.

- Identify internal resources. We expect most companies to establish a cross-functional team to complete this work. HR and Finance staff will benefit from assistance from Technology staff, particularly if multiple HRIS and payroll systems exist. A member of the Legal staff can help the team draft the text of the disclosure and coordinate with overall proxy preparation.

- Identify external resources. Decide whether the internal team charged with preparation of the pay ratio disclosure would benefit from partnering with outside resources. An outside consultant could provide the team with learnings gleaned from client situations and other experience. If multiple non-US locations are involved, the team will require expertise in data privacy laws, and a legal opinion will be required in certain circumstances.

- Create an inventory of data sources. Tally up the number of HRIS or payroll systems. Can you access a single integrated system or will you be forced to tap into multiple systems? Overlay the countries in which your company operates to ensure data source(s) for each country are identified. Obtain samples of the data fields that may be retrieved to begin the process of defining a methodology for identifying the median employee. The answer to these questions will be critical in determining whether to use statistical sampling, as well as identifying the pay elements that determine the median employee.

- Create a preliminary time line for the project. Coordinate with the schedule for overall proxy statement preparation. Allow sufficient time for communication to the various stakeholders.

Phase II: Identifying the Median Employee: Take a First Pass

- Chart the number and types of employees – full-time, part-time, temporary and seasonal — by country. Approximate as necessary to get a rough headcount. Reach out to your HR network as needed to fill in the blanks.

- Identify consolidated subsidiaries and include your best estimate of these employees in the preliminary headcount.

- Overlay basic compensation data on the preliminary headcount. Use what is most readily available from the payroll and HRIS systems – for example, the average amount, or the median, of annual cash compensation by location.

- Assuming your company’s PEO is paid in US dollars and international employees are part of the picture, convert the international compensation data into US dollars.

- Step back and analyze the data. Depending on degree to which employees are concentrated, either by category or by location, it may be obvious where the median employee resides.

Here is an example of employee counts for a major retailer with operations in the U.S., Europe and Canada. Keep in mind that the median employee will be the employee whose pay is higher than one-half of the pay of all employees and lower than the pay of the other half. With a total of 47,000 employees, the median employee at this company will be the employee whose pay is higher than 23,500 employees out of the total. The company in our example has a very large group of part-time employees who are store associate, including more than 27,000 such employees in the US. We know that the typical part-time employee in the US works 20 hours per week at an average rate of $12 per hour and annual compensation of about $12,000. Given the high concentration, of U.S. part-timers, we can conclude that in this company the median employee will almost certainly be found in the U.S. part-time category. While additional work is necessary, a picture begins to emerge.

| Full Time Employees | Part-Time Employees | |

| U. S. | 12,665 | 27,285 |

| Europe | 1,788 | 3,852 |

| Canada | 447 | 963 |

| Total | 14,900 | 32,100 |

| Estimate: 14,900 full-time employees + 8,600 U.S. part-time employees = Median (ranked 23,500 out of 47,000 total employees) | ||

Naturally, each company will have a unique profile. Many companies may not have an obvious concentration of employees, so the preliminary estimates may not be predictive of the final result. But even in that case, the team will know that more work – and more precise data – will be necessary to complete the picture.

Phase III: Assess Flexibility under the Rules

- Determine if the Foreign Data Privacy Law exemption applies. Under this exemption companies are allowed to exclude employees residing in locations where data privacy laws or regulations prevent companies from complying without violating such data privacy laws or regulations.

But the bar is high, since companies must make “reasonable efforts” to obtain the necessary data. Reasonable efforts include listing the excluded jurisdiction, identifying the specific law or regulation that prevents compliance, explaining how compliance violates the law or regulation, seeking an exemption or other relief and even obtaining a legal opinion from counsel. If you can create a list of the pay for each employee and not include any personally identifiable information (e.g., just number the employees without using their regular employee number), then you likely will have to include them in the calculation.

We strongly urge clients to bring their privacy officer or legal counsel into the picture early to make this determination up front.

- Determine if the De Minimus exemption applies. This exemption allows companies to exclude non-U.S. employees if they account for 5% or less of total employees. If non-U.S. employees exceed 5% of the total U.S. and non-U.S. employees, up to 5% may be excluded. However if any non-U.S. employees are excluded from a particular jurisdiction, all non-U.S. employees in that jurisdiction must be excluded. Both the jurisdiction and the approximate number of employees excluded must be disclosed.

- If both exemptions are used, coordinate the two exemptions as required under the rules. When calculating the number of non-U.S. employees that may be excluded under the de minimis exemption, companies much count any non-U.S. employees excluded under the data privacy exemption. This number may exceed 5%, but if it does, the de minimis exemption may not be used to exclude additional non-U.S. employees. On the other hand, if the number of non-U.S. employees excluded under data privacy exemption is less than 5%, additional non-U.S. employees may be excluded under the de minimis exemption provided the total equals 5% or less and all employees in a given jurisdiction are excluded.

- Assess efficacy of using COLA adjustments. The final rules allow companies to adjust actual compensation amounts of non-U.S. employees to reflect COLA, or cost of living allowance adjustments. Assuming that the U.S. tends to be a relatively high cost jurisdiction, unadjusted wages in non-U.S. jurisdictions will trend lower, increasing the final pay ratio. Upward adjustments to non-U.S. wage rates will decrease the reported pay ratio – a desirable outcome for most companiesBut once again, meeting the requirements to take advantage of the allowed flexibility will be challenging. Before embarking on this path, companies need to determine if it is indeed worthwhile. Discuss pros and cons and whether additional disclosure is required.

- Determine whether to annualize cash compensation of permanent employees. Companies are allowed to correct for mid-year hires of permanent employees by annualizing compensation, but if the number of mid-year hires is small, this adjustment may not be worthwhile.

- Evaluate the pros and cons of using statistical sampling to identify the median employee. Remember that to perform valid statistical sampling, the underlying data must be reasonably comprehensive and accurate. In addition, statistical sampling complicates your disclosure, since disclosure of the methodology and your assumptions is required. Best use may be for companies with defined benefit pension plans, since total compensation will be impacted by age and years of service.

- Identify how you will measure compensation in a consistent fashion for purposes of identifying the median employee. The rules allow companies considerable flexibility to choose an appropriate methodology for identifying the median employee. Employers can select a methodology that makes sense for them. Reasonable estimates are allowed. In addition, the median employee can be selected by using any compensation measure, provided it is consistently applied. Furthermore, companies may use their actual population to select the median employee or use statistical sampling or any other reasonable method.

While some companies will take advantage of these flexibilities, others will focus on their actual population and compensation levels. Since statistical sampling depends on valid data, it may not reduce the workload associated with preparing the calculations. - Consider the pros and cons of using various dates within the last three months of the fiscal year. The rules allow employers to identify the median employee on any date within the last three months of the fiscal year. We expect that this decision will most often align with payroll dates when payroll data is used to measure compensation of the median employee.

Phase IV: Prepare Final Calculations

- Select a final date during last three months of the year for the calculation based on preliminary analysis.

- Obtain updated roster of employees by location as well as final compensation data. Make sure compensation data is consistently applied.

- Apply the various exemptions, adjustments and other methodologies reviewed and agreed on during Phases I – III. Review and confirm your methodology and document any assumptions.

- Identify the median employee and determine a set of other comparable employees in case of a change in status of the median employee. The rules allow companies to identify the median employee only once every three years. Over time, this will significantly reduce the cost of compliance. Interestingly, the rules require the identification of an actual employee as the median employee, rather than a range of employees or a hypothetical profile employee.

The exception to the three-year rule involves instances where a change in the employee population or a change in employee compensation arrangements could reasonably result in a significant change in pay ratio disclosure. Assuming no significant changes, the company must calculate annual compensation of the median employee using the methodology for proxy disclosure, subject to reasonable estimates, for years one, two and three. If the median employee leaves the company or has anomalies in his or her compensation, the company may substitute a comparably situated employee.

- Evaluate any anomalies related to the PEO’s compensation. Two methodologies are available if turnover resulting in two incumbents during a single year occurs. Under the first approach, a company may add the total compensation reported in the Summary Compensation Table for the two incumbents. As an alternative, companies may annualize the compensation of the PEO in the position on the date selected to identify the median employee.

- Determine the final pay ratio. Test and retest. Get a final level of comfort with the data and the methodology.

Phase V: Draft the Disclosure

- Prepare a draft of pay ratio disclosure. For disclosure purposes, companies must describe the methodology used to identify the median employee and to determine total compensation and any material assumptions, adjustments (including any cost of living adjustments) or estimates.

- Consider whether disclosure of supplemental information would be beneficial. Final rules allow companies to disclose additional ratios or other information to supplement the final ratio. While this is not required, companies may find it beneficial. For example, a company with a large number of part-time or seasonal workers may want to disclose the ratio applicable to full-time employees.

Phase VI: Communicate Internally and Externally

- Communication of pay ratio disclosure will be important. The project team has a number of critical stakeholders in the communications process. Plan to communicate progress early and often. Schedule periodic check-ins with HR leaders and senior leadership during the analysis and review process. In addition, brief the board of directors, particularly the Compensation Committee. There is a high potential for negative publicity associated with pay ratio disclosure. Get in front of it and anticipate employee reactions to the disclosure. Provide talking points to the leadership team so that they can respond to employee concerns in a consistent manner.

- Talk to peers and outside advisors about trends in disclosure. As companies actually prepare disclosure, trends and best practices will crystallize. Tap into the knowledge and experience that other companies and your advisors can provide.

Interpretive Guidance from SEC

On September 21, 2017 the US Securities and Exchange Commission (SEC) issued interpretive guidance designed to assist registrants prepare their pay ratio disclosures. The interpretive release was designed to respond to concerns raised by registrants about how to identify the median employee and calculate the pay ratio.

Importantly, the SEC confirmed that rules are intentionally crafted to give flexibility to registrants since they allow for reasonable estimates, assumptions and methodologies, including statistical sampling; and reasonable effort to prepare the disclosure. The SEC acknowledged that the ratio may include a degree of imprecision. Further, the SEC clarified that the pay ratio disclosure would not trigger an enforcement action unless the disclosure was made “without a reasonable basis or was provided other than in good faith.” Given that many clients have been intensely debating the pros and cons of various methodologies, this is a very important clarification from the SEC.

The SEC reaffirmed that existing internal records, such as tax or payroll records, may be used to identify the median employee. These records may be used even if they do not include every element of compensation. Use of existing records are certainly in line with the concept of using reasonable estimates.

The SEC also reaffirmed that if the compensation of the selected median employee, as calculated using the Summary Compensation Table methodology, proved to be anomalous, a registrant could select another similarly-situated employee based on the consistently applied compensation measure used in its selection process.

All of this interpretative guidance confirms that the pay ratio calculation is complex. While it is very helpful for the SEC to address concerns about potential liability and reaffirm that registrants have flexibility, one must question whether the pay ratio disclosure actually serves a legitimate business purpose.

The final issue addressed by the SEC involved the definition of independent contractors. In cases where workers are employed by, and whose compensation is determined by an unaffiliated third party, they may be classified as independent contractors and excluded from the calculation. The SEC affirmed that independent contractors defined by widely recognized tests applicable in other legal or regulatory contexts could also be excluded.

Division of Corporation Finance Guidance

In addition to the SEC’s interpretive release, the Division of Corporation Finance released additional guidance and hypothetical examples of the use of statistical sampling and other reasonable methodologies.

This included the following:

- Registrants are allowed to combine the use of reasonable estimates with the use of statistical sampling. For example a registrant with multi-national operations or multiple lines of business may use sampling in some areas/businesses and other methodologies or reasonable estimates elsewhere.

- Examples of sampling methods that may be used are below. Additionally a combination of methods is acceptable.

- Simple random sampling by selecting random number or percentage of employees from the entire population;

- Stratified sampling by dividing employees into strata, based on factors like location, business unit, type of employee, etc., and sampling within each strata;

- Cluster sampling by dividing employees into clusters, drawing a subset of clusters and sampling within clusters; and

- Systematic sampling where every nth employee is included in the sample.

- Examples of where registrants may use reasonable estimates include but are not limited to:

- Analysis of the workforce;

- Characterizing the statistical distribution of the company’s employees;

- Calculating a consistent measure of compensation and annual total compensation or its elements;

- Determining the likelihood of significant changes from year to year;

- Identifying the median employee;

- Identifying multiple employees who fall around the middle of the compensation spectrum; and

- Using the midpoint of a compensation range to estimate compensation.

- Examples of other reasonable methodologies, include:

- Making one or more distributional assumptions, provided that the company has determined that the assumption is appropriate given its own distributions;

- Reasonable methods of imputing or correcting missing values; and

- Reasonable methods of addressing outliers or other extreme observations.

Finally the Guidance provides three hypothetical examples of various approaches that may be applied. While all of the Guidance is helpful, we believe that the extra detail on reasonable assumptions and reasonable methodologies is particularly helpful.

In contrast, complex methods of sampling are less helpful. Our sense at this point in time is that most companies will not employ extensive statistical sampling. Basically the thinking is that if a registrant has the data necessary to perform robust statistical sampling, the registrant will have the data to array employee compensation levels and calculate a median. But we shall see how this plays out next year when the new disclosure is actually implemented.

Conclusion

Pay ratio disclosure represents a significant effort for most companies. It is important to develop an airtight process to support the company’s analysis. The rules are complex and companies will be working through the rules for the first time. The results will undoubtedly get a great deal of scrutiny from senior leadership, the Board, employees and the business press. Recent interpretive guidance gives companies more leeway to employ reasonable estimates and methodologies, but nevertheless companies must be comfortable that their disclosure is accurate. This practical guide to implementation can serve as a guide to achieving a successful result for all.