DOWNLOAD A PDF OF THIS REPORT pdf(0.3MB)

Contact

Melissa BurekFounding Partner [email protected] 212-921-9354 Kelly Malafis

Founding Partner [email protected] 212-921-9357

Companies use annual bonuses as a tool to reward executives for achieving short-term financial and strategic goals. Setting appropriate annual performance goals is essential to establishing a link between pay and performance. Goals should achieve a balance between rigor and attainability to motivate and reward executives for driving company performance and creating returns for shareholders.

Key Takeaways:

- Based on our analysis of actual incentive payouts over the past 6 years, the degree of difficulty, or “stretch”, embedded in annual performance goals translates to:

- A 95% chance of achieving at least Threshold performance

- A 75% chance of achieving at least Target performance

- A 15% chance of achieving Maximum performance

- This pattern indicates that target performance goals are challenging, but attainable, and maximum goals are achievable through highly superior performance

- The majority of companies use two or more metrics when assessing annual performance

- Annual incentive payouts have been directionally linked with earnings growth over the past 6 years

Summary of Findings

Plan Design

For the purposes of this study, we categorized annual incentive plans as either goal attainment or discretionary. Companies with goal attainment plans define and disclose threshold, target and maximum performance goals and corresponding payout opportunities. Alternatively, companies with discretionary plans do not define the relationship between a particular level of performance and the corresponding payout. Discretionary programs provide committees with the opportunity to determine payouts based on a retrospective review of performance results.

| Annual Incentive Plan Type | |||

| Industry | Sample Size | Goal Attainment | Discretionary |

| Auto | n= 8 | 100% | 0% |

| Consumer Discretionary | n= 10 | 90% | 10% |

| Consumer Staples | n= 12 | 67% | 33% |

| Financial Services | n= 12 | 17% | 83% |

| Healthcare | n= 9 | 89% | 11% |

| Industrials | n= 14 | 71% | 29% |

| Insurance | n= 12 | 67% | 33% |

| IT | n= 12 | 83% | 17% |

| Pharma | n= 10 | 80% | 20% |

| Total | 72% | 28% | |

Consistent with the findings from our study conducted in 2014, 72% of sample companies have goal attainment plans. Our study focuses on these companies.

Performance Metrics

Most companies (61%) use 3 or more metrics to determine bonus payouts. This reflects a shift from 2014, where 48% of companies used 3 or more metrics. Companies annually review metrics to ensure that they align with the business strategy.

Many companies use financial metrics such as revenue and profitability, which are indicators of market share growth and stock price performance. Some bonus plans also include strategic metrics, which incentivize executives to achieve goals that may contribute to long-term success, but may not be captured by short-term financial performance. Companies in the pharmaceutical industry often use strategic goals, such as pipeline development. Similarly, companies with large manufacturing operations often use quality control metrics.

| # of Metrics Used in Goal Attainment Plan | ||||

| Industry | 1 Metric | 2 Metrics | 3 Metrics | 4+ Metrics |

| Auto | 13% | 13% | 25% | 50% |

| Consumer Discretionary | 11% | 44% | 45% | 0% |

| Consumer Staples | 0% | 37% | 38% | 25% |

| Financial Services | 0% | 50% | 50% | 0% |

| Healthcare | 0% | 38% | 12% | 50% |

| Industrials | 20% | 40% | 20% | 20% |

| Insurance | 37% | 13% | 25% | 25% |

| IT | 10% | 30% | 40% | 20% |

| Pharma | 0% | 0% | 63% | 37% |

| Total | 11% | 28% | 34% | 27% |

Pay and Performance Scales

Compensation committees annually approve threshold, target, and maximum performance goals, and corresponding payout opportunities, for each metric in the incentive plan. Target performance goals are typically set in line with the company’s internal business plan. Executives most often earn 50% of their target bonus opportunity for achieving threshold performance and 200% for achieving maximum performance. Actual payouts are often interpolated between threshold and target and target and maximum.

Annual Incentive Plan Payouts Relative to Goals

All Companies

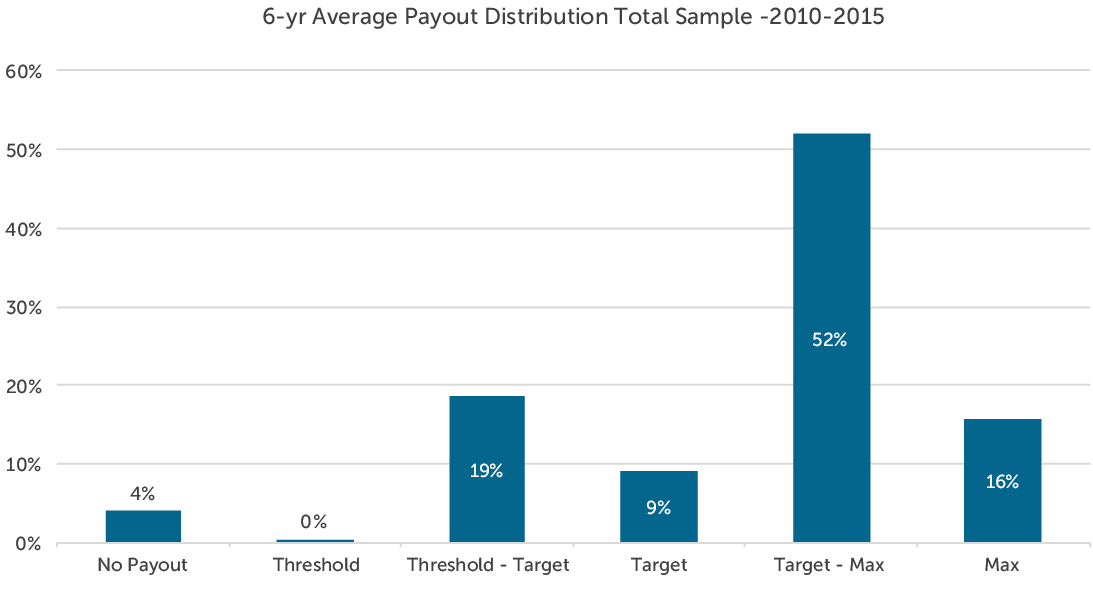

Based on CAP’s analysis, companies paid annual bonuses 95% of the time. Payouts for the total sample are distributed as indicated in the following charts:

This payout distribution indicates that committees set annual performance goals with a degree of difficulty or “stretch” such that executives have:

- A 95% chance of achieving at least Threshold performance

- A 75% chance of achieving at least Target performance

- A 15% chance of achieving Maximum performance

From 2010-2015, no more than 10% of companies failed to reach threshold performance in any given year. By comparison, in both 2008 and 2009, which were challenging years, approximately 15% of companies failed to reach threshold performance goals.

When looking back over 8 years (2008-2015), companies achieved at least threshold and target performance with slightly less frequency. Based on CAP’s analysis of this 8-year period, executives have:

- A 90% chance of achieving at least Threshold performance

- A 70% chance of achieving at least Target performance

- A 15% chance of achieving Maximum performance

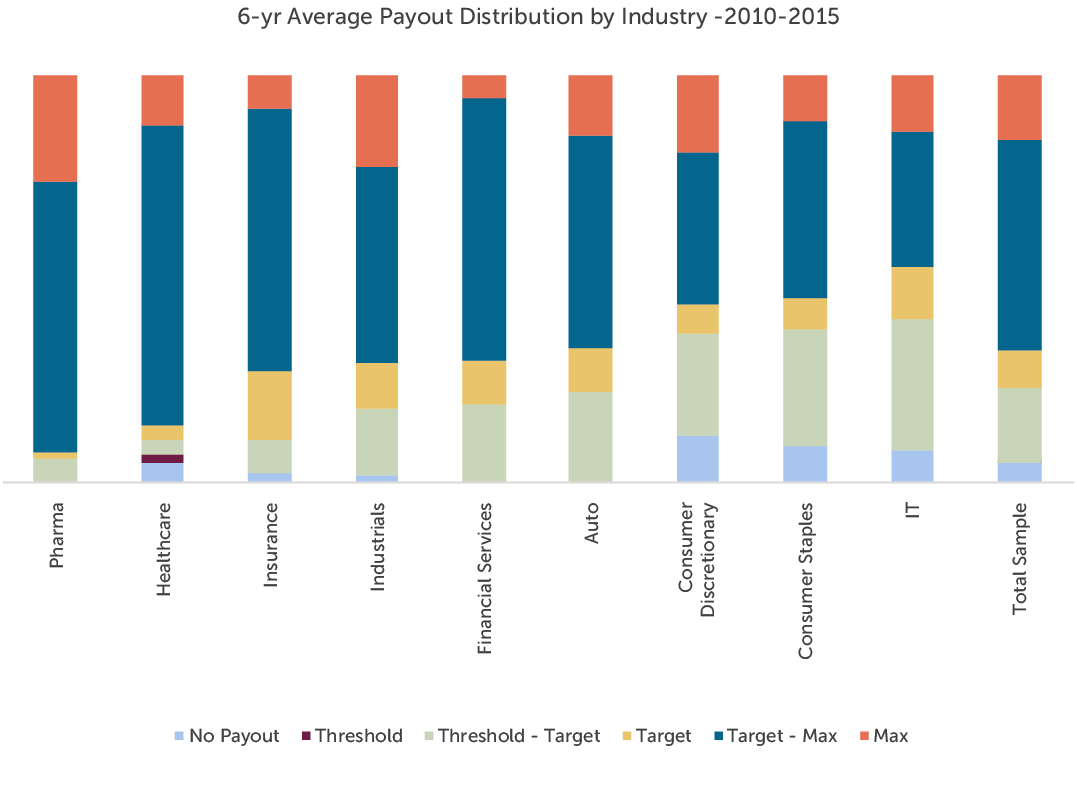

By Industry

Pharmaceutical and healthcare companies have paid at or above target more frequently than companies in any other industry over the past 6 years. Both industries have experienced significant growth over the period in part due to consolidation. The companies in the IT, Consumer Discretionary and Consumer Staples industries tend to pay below target at a higher rate. Average payouts for each industry are distributed as indicated in the following chart:

Relative to Performance

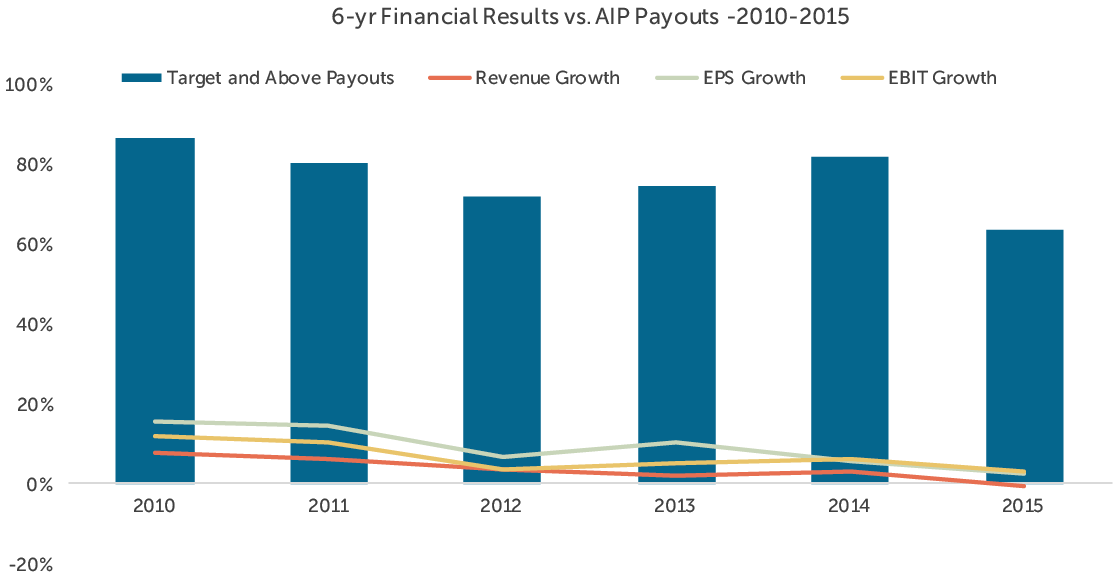

CAP reviewed the relationship between annual incentive payouts and company performance with respect to three metrics: revenue growth, earnings per share (EPS) growth and earnings before interest and taxes (EBIT) growth. While payouts were generally aligned with revenue and EPS growth, they most closely tracked with EBIT growth over the period studied (2010-2015). Companies may seek to align bonus payouts with operating measures, such as EBIT, as they capture an executive’s ability to control costs and improve operational efficiency.

The chart below depicts the relationship between median revenue, EPS, and EBIT growth and target and above annual incentive payouts among the companies studied.

Conclusion

In the first quarter of 2017, committees will certify the results and payouts for the fiscal 2016 bonus cycle and approve performance targets for fiscal 2017. Given the uncertain economic outlook following the 2016 presidential election, establishing performance targets for 2017 may be more challenging than usual. Companies may choose to use a range of performance from threshold to maximum to build flexibility into their plans given the unpredictable environment. Our study of annual bonus payouts over the past 6-8 years supports setting goals such that the degree of difficulty, or “stretch”, embedded in performance goals translates to:

- A 90-95% chance of achieving at least Threshold performance

- A 70-75% chance of achieving at least Target performance

- A 15% chance of achieving Maximum performance.

Companies should continue to set target performance goals that are challenging, but attainable and maximum goals that are achievable through outperformance of internal and external expectations – therefore, establishing a bonus plan that is attractive to executives and responsible to shareholders.

Methodology

CAP’s study consisted of 100 companies from 9 industries, selected to provide a broad representation of market practice across large U.S. public companies. The revenue size of the companies in our sample ranges from $18 billion at the 25th percentile to $70 billion at the 75th percentile.

CAP analyzed the annual incentive plan payouts of the companies in the sample over the past 6-8 years to determine the distribution of incentive payments and the frequency with which executives typically achieve target payouts. In this analysis, CAP categorized actual bonus payments (as a percent of target) into one of six categories based on the following payout ranges:

| Payout Category | Payout Range |

| No Payout | 0% |

| Threshold | Up to 5% above Threshold |

| Threshold – Target | 5% above Threshold to 5% below Target |

| Target | +/- 5% of Target |

| Target – Max | 5% above Target to 5% below Max |

| Max | 5% below Max to Max |