Partner Bertha Masuda discusses special considerations for short-term incentives for companies under $500 million in revenue with WorldatWork.

CAP’s Pharmaceutical Industry Report analyzes the executive compensation practices of 19 large pharmaceutical and biotechnology companies. As of December 31, 2015, the companies in our sample had median revenues of $23B and median market cap of $113B. In addition to reviewing the entire sample, we assessed U.S. companies (n=12) and non-U.S. companies (n=7) separately to discern trends in pay, performance and practices.

2015 Financial Results: Pharmaceutical companies experienced strong stock price appreciation and revenue growth relative to the broader market.

Click here to download the full report

The past year has been characterized by significant stock price volatility. Research indicates that the S&P 500 index has either gained 1% or more or lost 1% or more in a single day on 102 days during 2015. Individual stocks have experienced even higher volatility, with some industries (e.g., oil and gas, financial services) being hardest hit. This extreme variability in stock prices has continued through the period when most companies make annual grants of equity-based compensation to their directors, officers and employees. Since the overall stock price movement over this period has been down, many companies are finding that they need to grant more shares than they anticipated to deliver their targeted long-term incentive values to employees. In this CAPflash, we will lay out the nature of the issue and address alternative approaches that companies can use to respond to stock price decreases.

| Date | S&P 500 | S&P 500 Financials Sector | S&P 500 Energy Sector | S&P 500 Health Care Sector | ||||

| Value | ? vs. 8/15 | Value | ? vs. 8/15 | Value | ? vs. 8/15 | Value | ? vs. 8/15 | |

| 8/1/15 | $2,104 | – | $339 | – | $508 | – | $885 | – |

| 1/31/16 | $1,940 | -7.78% | $293 | -13.56% | $435 | -14.44% | $769 | -13.03% |

| 2/15/16 | $1,865 | -11.36% | $276 | -18.69% | $417 | -17.98% | $743 | -15.97% |

| 3/1/16 | $1,978 | -5.96% | $294 | -13.33% | $433 | -14.78% | $780 | -11.79% |

| 3/15/16 | $2,016 | -4.18% | $301 | -11.24% | $458 | -9.77% | $775 | -12.44% |

| 4/1/16 | $2,073 | -1.48% | $306 | -9.64% | $456 | -10.24% | $794 | -10.28% |

RECENT STOCK PRICES: A DOWNWARD TREND

In August 2015, around when many companies began their year-end compensation planning process, the S&P500 Index was at $2,104 and the S&P 500 Financials, Energy and Health Care sectors were at $339, $508 and $885, respectively. Scroll forward to January 31, 2016 and the S&P 500 Index was at $1,940 and the S&P 500 Financials, Energy and Health Care sectors were at $293, $435 and $769, respectively. The table below lays out the movements from August 1, 2015 into the current year, highlighting five common equity award dates.

While the overall indices moved significantly, the 25th percentile change through each of the above dates for companies in each of the above indices was as follows, indicating that for the lowest-performing one quarter of companies, stock prices fell by about 15% to 30%, or more, over this period.

| Date | S&P 500 | S&P 500 Financials | S&P 500 Energy | S&P 500 Health Care |

| 25th %ile ? vs. 8/15 | 25th %ile ? vs. 8/15 | 25th %ile ? vs. 8/15 | 25th %ile ? vs. 8/15 | |

| 8/1/15 | – | – | – | – |

| 1/31/16 | -20.21% | -21.14% | -35.26% | -22.72% |

| 2/15/16 | -25.24% | -29.25% | -45.40% | -25.25% |

| 3/1/16 | -18.29% | -22.02% | -37.35% | -21.86% |

| 3/15/16 | -17.22% | -19.37% | -27.40% | -22.76% |

| 4/1/16 | -14.78% | -18.10% | -31.67% | -19.32% |

MARKET NORMS FOR BURN RATE

CAP’s research indicates that burn rate (i.e., the number of shares granted during a given year divided by the weighted average number of common shares outstanding) among large public companies in the S&P 500 Index trends toward 1% of common shares outstanding when calculated excluding the factor of approximately 2X that ISS applies to full value awards to create equivalency with stock options. When the ISS conversion factor of approximately 2X is included, burn rate trends toward approximately 1.5% at median. On the lower end, burn rate of .5% or 1%, excluding or including the 2X conversion factor, respectively, is common. At the 75th percentile, burn rate of 2% to 4% is seen. This suggests that for a broad swath of public companies, ranging from $1 billion to $100 billion in revenues, burn rate in excess of 2% to 4% is difficult to sustain. Research on specific company peer groups could provide more refined comparisons, but this data gives the reader a general benchmark that applies across industries and size categories.

| Summary Statistics | Three-Year Average Burn Rate (including ISS Conversion Factor) | ||

| S&P Top 50 | S&P $5 B Cos. | S&P $1 B Cos. | |

| 75th Percentile | 2.13% | 2.55% | 3.82% |

| Median | 1.36% | 1.70% | 1.68% |

| 25th Percentile | 1.01% | 1.12% | 1.11% |

| Summary Statistics | Three-Year Average Burn Rate (excluding ISS Conversion Factor) | ||

| S&P Top 50 | S&P $5 B Cos. | S&P $1 B Cos. | |

| 75th Percentile | 1.03% | 1.32% | 1.88% |

| Median | 0.79% | 0.90% | 1.02% |

| 25th Percentile | 0.47% | 0.53% | 0.56% |

Note: S&P Top 50 reflects the 50 largest companies in the S&P 500 in terms of revenue with average trailing twelve month revenue of $108 billion. S&P $5 B Cos. reflects a 50 company subset of the S&P 500 with an average trailing twelve month revenue of $5 B. S&P $1 B Cos. reflects a 50 company subset of the S&P MidCap 400 with an average trailing twelve month revenue of $1 B.

IMPACT ON EQUITY GRANTS

Most companies make their annually equity grants based on a target dollar value for the long-term incentive award, rather than as a fixed number of shares. For example, a company may target a long-term incentive grant of $200,000 per year to a Vice President. For simplicity’s sake, let’s assume that the grant is made 100% in Restricted Share Units (RSUs). Most companies determine the number of shares to grant by dividing the target long-term incentive value by a stock price. Since companies are required to use the stock price on the date of grant for purposes of the disclosed value of equity grants, many companies use the stock price on the date of grant for converting award values into shares.

When the stock price declines significantly over a short period of time, there will be a significant increase in the number of shares required to deliver the target value. For example, let’s assume that the stock price was trading at $50.00 in September of 2015 when the company began their compensation planning and fell by 40% to $30.00 on March 1, 2016 when they make equity awards. In this situation, the number of shares required to deliver a $200,000 equity grant would increase by 67% from 4,000 shares to 6,667.

If the company is granting stock options, the share usage resulting from a decline in stock price is even more pronounced. Assuming a 3:1 ratio of options to RSUs, the grant required to deliver a $200,000 equity grant would increase from 12,000 options to 20,000 options.

Applied across the total employee population, this can create major concerns for the company with the potential to exhaust the reserve of shares available for grant under shareholder approved plans more quickly than anticipated. This will also increase the company’s annual share usage.

To the extent that equity plans reserves are exhausted and burn rates exceed industry norms, companies can run into difficulty when seeking shareholder approval of additional shares. If share usage is judged to be imprudent, or if shareholders see disconnects between pay and performance, particularly if facilitated by the equity plan, they are much less likely to support a request for new shares. The potential for perceived disconnects is heightened since higher burn rates typically occur when share prices are lower.

APPROACHES TO ADDRESS EQUITY GRANTS WHEN STOCK PRICE DECLINES

In our experience, companies address declining stock price in several different ways. The following are a few of the most common approaches:

Approach 1. Continue granting based on stock price at date of grant (i.e., do nothing)

In some cases, companies may feel that continuing to use their standard operating procedure for converting long-term incentive value into shares is the best approach. This could be because the company has been conservative in using shares in the past and has adequate shares available to cover multiple years of equity grants even with a significant stock price decline. The company may feel that a one year spike in their share usage will not raise significant concerns with shareholders or shareholder advisory firms. Another rationale that these companies may use for making grants as usual is that the value of any outstanding equity that executives hold will have fallen with the stock price. If the company reduces the value of equity grants as well, this may be a “double whammy” for long-term incentive participants. In our experience, Approach 1 can be untenable if the stock price falls by 30% or more.

- Advantages: Maintains target LTI award value for employees

- Disadvantages: Dilutive to shareholders; potential for “windfall” if stock price quickly recovers

Approach 2. Use an average stock price over a period of time to establish grants

This is a common approach companies use to mitigate the impact of short-term swings in stock price on the number of shares granted. Among companies that do not convert grant values into shares based on the stock price on the date of grant, the most common approach is to use an average stock price over a relatively short time period. We see a 20-trading day average most frequently. This approach avoids significant swings in the number of shares granted (up or down) based on stock price movement on the date of grant away from its near-term average. When companies have significant volatility over a sustained period of time, they may use a longer term average stock price (e.g., six months or one year) to mitigate the impact of volatility on grant size. The following chart lays out an illustration of this approach:

| Price Used | Target Value | Price | Shares | Acctng Value |

| Date of grant | $200,000 | $30.00 | 6,667 | $200,000 |

| 20-day average | $200,000 | $35.00 | 5,714 | $171,429 |

| 90-day average | $200,000 | $40.00 | 5,000 | $150,000 |

| 180-day average | $200,000 | $45.00 | 4,444 | $133,333 |

While using an average stock price helps manage the share usage when there is a stock decline, it will create disconnects between the target value of long-term incentives and the accounting value of the awards. Supplemental communication to employees is typically required to explain why the company thinks the average stock price methodology is a better estimate of value than the stock price on the date of grant. If the company uses this approach consistently over time, employees may recognize that the average price can be above or below the stock price on the date of grant.

- Advantages: Limits dilutive impact of stock price decrease

- Disadvantages: Potentially challenging to communicate to employees; disconnect between target LTI value and accounting value

Approach 3. Cap the run rate and pro rate grants accordingly

Some companies have committed to a maximum level of annual share usage or run rate. For example, a company may have committed to its shareholders or Compensation Committee that its annual run rate will not exceed 1.5% of common shares outstanding. If their stock price falls significantly, they may find that to deliver the target long-term incentive values under their program, they would need to grant 2.25% of common shares outstanding. In this situation, the company can pro rate all grants to keep the run rate at 1.5% of common shares outstanding. For example, if an executive’s target long-term incentive value was $200,000 and the stock price was $30.00, they would require 6,667 shares for this executive. Each grant would have to be multiplied by a factor of 1.5/2.25 or 2/3. In this case, the grant to the executive would be reduced from 6,667 shares to 4,444 shares and the accounting value of the award would be $133,333 instead of $200,000.

- Advantages: Limits dilutive impact of stock price decrease; simple; equitable treatment across employees

- Disadvantages: Reduces value of long-term incentive award to all employees

Approach 4. Limit participation in equity grants to conserve shares

Instead of making an across the board reduction in all equity grants, some companies will eliminate or significantly reduce long-term incentive awards for a portion of the population, while maintaining full awards for the remainder of the population. In practice, this often involves maintaining awards for senior executives where long-term incentives are viewed as most critical from a competitive perspective. For lower level long-term incentive participants, the company may limit grants to only those employees with performance that exceeds expectations or with critical skills. This approach may be acceptable if it is applied for one year, but may raise internal equity issues if extended beyond one year.

- Advantages: Limits dilutive impact of stock price decrease; targets awards at most critical employees

- Disadvantages: Potential strong negative response from excluded employees

Approach 5. Apply a discount to long-term incentive award guidelines

Another fairly simple way to address the issue of a stock price decline is to apply a discount to the long-term incentive award guidelines. Suppose that the stock price has fallen from $50 to $30 (or a 40% decline). In such a situation, the company would have to grant 67% more to maintain the LTI award target values. To mitigate the pressure that this will put on share usage, the company can apply a discount to the LTI target award value that partially adjusts for the impact of the stock price decline. For example, they could discount their LTI award guidelines by 25%. In this case, a $200,000 LTI award would be reduced to $150,000 and the grant would require 5,000 shares at a $30.00 stock price. This is more than the 4,000 shares that would have been required to deliver $200,000 at a $50.00 stock price, but is significantly less than the 6,667 shares required to deliver the full $200,000 at $30.00.

- Advantages: Limits dilutive impact of stock price decrease; simple; equitable treatment across employees

- Disadvantages: Reduces value of long-term incentive award to all employees

Approach 6. Use RSUs instead of stock options

To deliver a given long-term incentive award value, stock options require more shares than full value awards like RSUs or PSUs. Depending on the Black-Scholes value of stock options, the ratio of options to full value shares may be as low as 2:1 or as high as 5:1. For companies with equity plans that are not based on a fungible pool that treat options and full value shares the same, shifting the long-term incentive mix away from stock options towards full value shares can help ensure that equity grants will not exhaust the available pool.

For example, suppose a company has a mix of 50% stock options and 50% RSUs for its long-term incentive program. The company was planning on granting 1 million RSUs and 3 million stock options, but the stock price falls by 1/3 and now the company needs to grant 1.5 million RSUs and 4.5 million stock options. Unfortunately, their shareholder approved plan only has 5 million shares available for grant and the current 50%/50% LTI mix requires 6 million shares (1.5 million RSUs plus 4.5 million stock options). If they shift the mix from 50% RSUs / 50% stock options to 100% RSUs, the company will only need 3 million shares to deliver the target long-term incentive award value and they will not exhaust the share reserve.

- Advantages: Maintains target long-term incentive award value, potentially avoids exhausting share reserve, simple; equitable treatment across employees

- Disadvantages: Shareholders/Compensation Committee may prefer use of stock options to RSUs; shareholder advisors view RSUs as more dilutive than options on a per share basis

Approach 7. Use long-term cash instead of full value equity awards

Companies can conserve shares and reduce burn rate by replacing equity awards with cash. The most common approach is to grant long-term cash incentive awards instead of performance shares. Both types of award can be constructed with similar time frames, identical metrics and identical target values. But there are two significant differences. First, the ultimate value of performance shares will leverage up or down over the performance period in line with the value of the underlying shares. This exposes compensation realized by participants to additional volatility during periods when stock prices are uncertain. Cash awards will have more certainty and may therefore be valued more highly. Second, long-term cash awards are almost always settled in cash. Therefore, ancillary considerations, such as stock ownership guidelines, post-vesting holding periods, blackouts and insider trading policies are off the table.

In addition, long-term cash awards are not factored into burn rate calculations or into the estimates shareholders apply to the cost of equity plans. For example, ISS’ Equity Plan Scorecard does not value long-term cash, but would value outstanding performance shares. Similarly, long-term cash awards are not counted in calculations of overhang from equity plans or counted against equity plan share reserves, provided the awards are not denominated in share units settled in cash. Companies are required to book an accounting charge for the full cost of cash compensation, but effectively get a free pass on cash for other formulations of equity plan impact.

Awards of deferred cash designed to replace time-vested RSUs are seen less frequently, but could also be offered. The biggest decision involves whether to award fixed amount of cash for satisfying future service requirements or to provide either an interest component or some leverage tied to stock price performance.

- Advantages: Maintains target long-term incentive award value, potentially avoids exhausting share reserve, simple; equitable treatment across employees

- Disadvantages: Shareholders/Compensation Committee may prefer use of stock to cash to maintain alignment with shareholders

ADDITIONAL EQUITY COMPENSATION CONSIDERATIONS

In a time of severe stock price volatility, a company’s compensation program may be under pressure from multiple dimensions, beyond the current year’s equity grants:

- Reduced value of outstanding unvested full value shares: As the stock price declines, the value of any unvested equity held by employees will fall as well. This can reduce the value of outstanding equity as retention “handcuffs” and lowers the cost for competitors to buy executives out of their unvested equity. To the extent that all companies are affected equally by a stock price decline, this is not a major issue, but if the company’s stock price has declined more than the market overall, retention concerns will be heightened. If the company has a performance share plan, based on relative TSR and is underperforming on an absolute and relative basis, the retention issues will be even worse as the performance shares may be at risk of having no value

- Underwater stock options: A decline in stock price can reduce the intrinsic value of full value share awards, but as long as the stock price is above zero they still maintain some value. With stock options, the impact of a stock price decline can be more acute, as once the stock price falls below the exercise price the stock options no longer have any intrinsic value and employees may not place much value on the options at all.

- Economic uncertainty: To the extent that the stock price decline is driven by economic fundamentals (e.g., lower growth or lower profits), the company may have uncertainty about the likelihood of achieving its annual budget or long-term financial plan. This can further devalue the compensation program from the perspective of employees.

Unless the stock price decline is severe and sustained, it is uncommon for companies to cancel and replace underwater stock options or to make supplemental awards of full value shares to restore value to executives. However, when making compensation decisions in a year where the stock price has declined, it is useful to consider the context of employees’ total equity holdings and to err on the side of generosity for going forward equity grants to the extent possible.

CONCLUSIONS

Sudden stock price decreases can upset plans for annual equity grants by significantly straining the available share reserve and increasing the annual equity run rate. While there is no silver bullet approach that works for all companies, there are a number of alternative approaches that companies use to address stock price fluctuations. In choosing the approach that works best for your company, it is critical to determine the appropriate balance between the competing concerns of attracting and retaining employees with managing share dilution and protecting shareholder interests.

For many years, common practice in U.S. public companies has been to combine the roles of chief executive officer (“CEO”) and chairman of the board (“COB”), typically assigning the COB title and responsibilities to the sitting CEO. More recently, due to increased focus on governance and risk management, companies frequently separate the two roles. In some cases, companies will transition outgoing CEOs to the COB role. The duties of a separate COB can vary a great deal between companies, and expectations for the role as well as time served in the role will impact compensation. This review focuses primarily on the transition from CEO to COB and highlights compensation practices and factors influencing pay.

Prevalence of COB Role

Based on a review of companies ranging from $1 billion to $20 billion in revenue, we found that approximately 10% of companies operate with an Executive Chair and 45% have a Non-Executive Chair. Among the 10% with an Executive Chair, approximately one-half are founders (or have significant ownership in the company, i.e., more than 15% of shares outstanding), and the majority were former CEOs. This fact pattern is a very rational and effective progression, providing a smooth transition and advantages to the new CEO, shareholders, and the company’s overall operating efficiency. In the case of Non-Executive chairs, it is more common for the role to be filled from outside the company or by a member of the board of directors.

The need for and role of a separate COB evolves for different reasons. The responsibilities and time commitment of this role can vary greatly by company. Many founders step out of the CEO role to reduce their time commitment, but continue on as COB for many years so they can oversee the results of the company and weigh in on the company’s performance and strategy. Alternatively, the board may ask an exiting CEO to stay on for a year to help with the transition to a new CEO and provide continuity to the organization. It may be that an exiting CEO stays on to oversee a major initiative that needs dedicated oversight. The role could evolve as a result of a spin-off from an existing public entity. While difficult to generalize, there are certain duties that may be a part of any separate COB role such as executive coaching and mentoring, succession planning, and long-term strategy development. The COB is most often an advisory role, with no oversight of daily operations. These responsibilities dictate the planned timing of the role itself, be it short or long-term service in the position.

Overall Pay Levels and Pay Practices for Chairman Role

Pay Levels

While there is variation in pay practices that we discuss below, our research shows that the following pay practices, expressed as a relationship between compensation of the Executive COB and CEO roles.

Pay Summary Stats

|

Scenario (at Median) |

Base |

Bonus |

LTI |

TDC |

|

CEO Transition to Chairman |

||||

|

Chair Role Pay as a Percentage of Pay while Serving as CEO |

~100% |

~100% |

~40% |

~50% |

|

Chair Role Pay as a % of New CEO Pay |

95 – 105% |

85 – 95% |

55 – 65% |

65 – 75% |

|

Chairman that is founder/significant shareholder |

||||

|

Chair Role Pay as a % Current CEO Pay |

~90% |

~85% |

~25% |

~60 |

The background of the incumbent assuming the COB role may create some variations to pay levels and practices. For example, Executive Chairs that are founders/significant owners of their company make about 35% more, at median, than non-founder Executive COBs.

Pay Practices

We frequently see the following pay practices:

- Since many COBs have transitioned from the CEO role and have accumulated a large equity stake, or are founders with significant equity ownership, equity compensation tends to account for a smaller portion of the compensation package when compared to current CEOs.

- More companies grant stock options or restricted stock with time-based vesting, instead of granting long-term performance-based compensation. We believe time-based vesting is appropriate because the Executive COB role is often more advisory in nature, rather than contributing to operational decisions that impact long-term financial performance. There may also be uncertainty associated with the length of the role.

- Equity awards may include a one-time grant or annual grants, depending on the estimated timeframe of the role. Vesting of equity awards is generally in installments over 3 or 4 years or vesting that aligns with the time in the role or the time that the Chair might remain an employee of the company.

- Executive COBs most often participate in the company’s bonus program, using the same corporate performance metrics that apply to the CEO. Individualized metrics are rarely used.

Transition of an Active CEO to an Executive COB Role

When a successful, long-tenured Chairman and CEO begins to plan for retirement, companies may strategically approach the succession process over time. Boards may keep the retiring CEO on as an employee of the company, as Executive COB, for a period of time. This period allows for a smooth succession of responsibilities. It may also mitigate uncertainty about new leadership. It is possible that a Lead Director, outside Board member, or other executive may fill the role of Executive (or Non-Executive) Chair, yet most often the role is filled by a retiring CEO.

Executive Chair Scenarios and Fact Patterns Influencing Compensation:

While pay practices vary, there are considerations to be made as it relates to compensation based on the expected timing that the Chairman role will exist or that the individual incumbent will be in the role. There are some patterns in the compensation structure if the role is shorter or longer- term.

|

Fact Pattern |

Practice |

|

Short Time Period of COB Role (1-year or less) |

|

|

Longer Time Period of COB Role (more than 1-year) |

|

|

Executive COB whot is a Founder/Significant Shareholder |

|

|

Consultant or Special / Senior Advisor |

|

|

Non-Executive COB – Executive COB, outside Director or New Hire transition |

|

Executive COB Role – Short Time Period (1 year or less)

When a CEO transitions to an Executive COB role, planned for a shorter period of time, the CEO often changes roles near the end of the fiscal year or near the annual shareholder meeting. There tends to be minimal adjustment to the base salary or annual incentive target for this period in the role. If the annual equity grant has not been made for the year, companies tend to reduce the value of the equity award and the form of the award may be modified. Companies differ on the treatment of outstanding equity awards. There are two potential scenarios:

- The company may allow outstanding equity to vest normally, according to the plan (retirement vesting if the executive is eligible), or

- The company provides some type of “enhanced-vesting” for the time that the retiring executive serves as chairman

If the transition is made after the annual equity grant, companies tend not to decrease the equity grant amount in the year of the change. Companies should consider which approach is most appropriate given the vesting period that remains, the type of outstanding award (e.g., 10-year option, 3-year performance award), the cumulative value that the COB may receive due to any enhancement, and potential shareholder reaction.

Executive COB Role – Longer Time Period (Greater than 1 year)

When the Executive COB role is expected to be greater than one year, adjustments are made to the level of pay and the forms of compensation used. Overall, base salary and annual incentive targets may be 85% to 95% of the current CEO’s pay levels. Equity may be decreased to 40% of what it was while serving as CEO, resulting in total direct compensation that is 65% and 75% of the compensation of the current CEO.

Equity awards tend to have time based vesting and are commonly not tied to longer term company performance. Vesting schedules may be modified, if necessary, to align with the expected timeframe of the Executive COB’s service. Companies often make annual equity awards, yet those that have clarity around expected timeframes may grant one-time awards intended to cover the entire time in the role.

A related benefit for CEOs in this situation may be the continued vesting of large outstanding equity grants that were received while serving as CEO. When award vesting follows the normal course, shareholders and proxy advisory services firms may view this more favorably than enhanced vesting arrangements that may be provided when the CEO retires sooner.

Non-Executive COB Role

Non-Executive COBs have a smaller time commitment. They tend not to have a specific strategic or operational oversight role, yet they do lead the board of directors. Non-Executive COBs often serve as the primary liaison between the board and the CEO and provide additional leadership and guidance. Most commonly, Non-Executive COBs participate in the regular compensation program for the company’s outside directors and receive a premium. When the premium is added to the regular board compensation, median Non-Executive COB compensation is approximately 1.6x – 1.8x the compensation paid to regular outside directors.

Conclusion

Pay for Executive COBs varies a great deal and depends on a company’s particular situation. However, when specific situations are examined closely, patterns do emerge. For example, our research indicates that a COB who is a founder or significant shareholder tends to get paid more than COBs who are not founders or significant shareholders. We also found that exiting CEOs who transition into a COB role for a short period of time may frequently receive preferable equity vesting treatment. General pay norms will help provide direction, but the responsibilities, time commitment, incumbent’s tenure with the company, ownership status, etc. should all be factored into the compensation program provided.

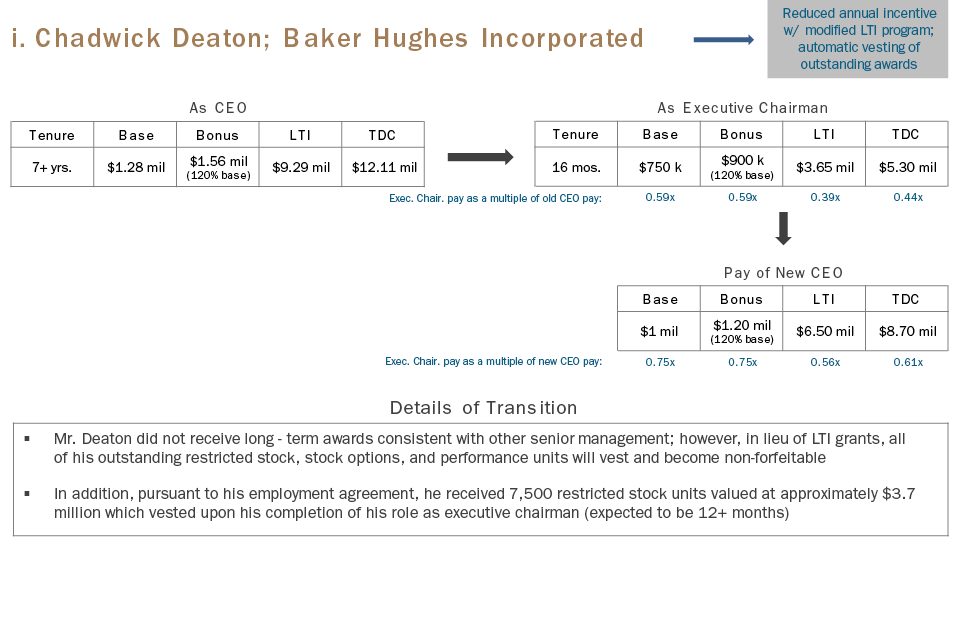

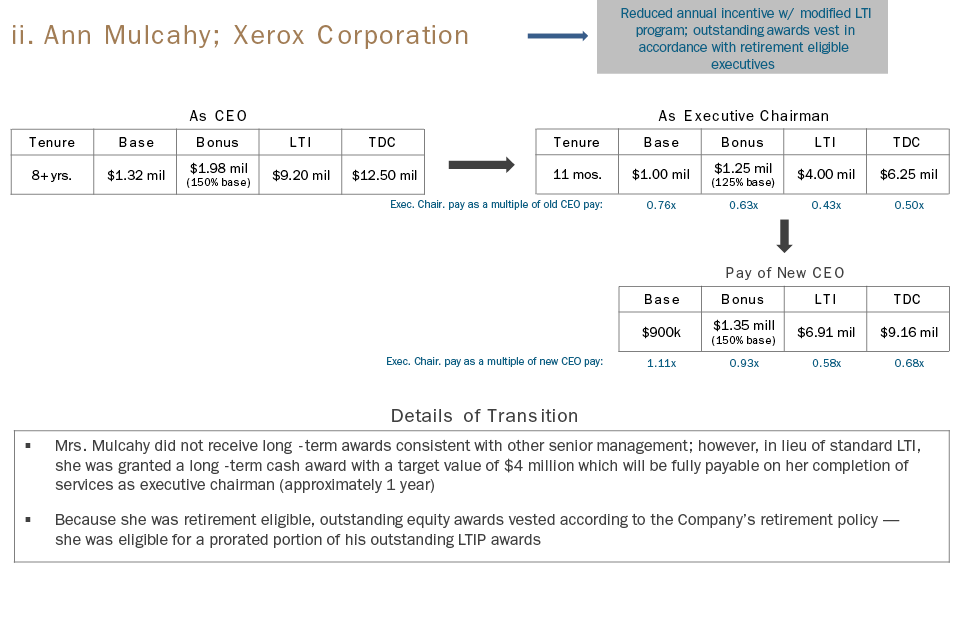

Case Studies

The transition from a private company to a public company is an exciting time for most organizations. For employees, moving from private to public status provides the first opportunity to potentially gain liquidity from equity-based. For venture capital or private equity investors, it typically represents the first opportunity to realize gains from their investment and risk-taking. However, becoming a public company creates new disclosure requirements and opens up compensation programs to scrutiny from a new group of public shareholders and shareholder advisory firms.

Not all newly public companies are the same. In this white paper, we will speak generally about newly public companies, but also address differences that may apply across categories. The categories we most typically see are the following:

- Recent Start-ups: Companies that have been funded primarily by venture capital backers and are in early stages of development

- Often these companies are in the biotech or internet/technology industry and some, in particular in biotech, may be pre-revenue and likely pre-profit when they go public.

- Companies in this category are usually emerging growth companies (revenue less than $1 billion at IPO) under the JOBS act, subject to less stringent disclosure requirements and exempt from Say on Pay votes for up to five years following IPO

- Private Equity Portfolio Companies: More mature businesses that may have been taken private to improve operating performance

- Typically are profitable businesses and trade based on multiples of earnings or EBITDA

- May or may not be “emerging growth companies” under the JOBS act

- Private equity owners may continue to maintain a majority interest following IPO

- Spin-off Companies: Business units of a publicly traded company that become public through a spin-off event

- Spin-off may occur in one stage, an initial IPO and then a spin-off of remaining shares, or a multi-stage sell-down

- In most cases, the spin-offs are mature companies that are viewed as being able to generate more value on their own through greater strategic focus than as part of the parent company

Establishing Public Company Compensation Processes

As a public company, there is an increased requirement for processes governing the company’s compensation decisions. All public companies (other than those controlled by a 50% or greater shareholder) need to have a Compensation Committee of two or more independent directors. The Compensation Committee needs to have a Charter that lays out the responsibilities of the Committee, including its responsibility for overseeing the pay of the CEO and the other executive officers of the company.

In practice, there is a lot of work to set-up a functioning Compensation Committee. Key steps to get a Committee up and running include the following:

- Identify Members: The Board needs to determine which directors have the capabilities and experience to effectively serve on the Compensation Committee;

- Appoint a Chair: The Board needs to identify a Chair for the Committee who can ensure that the Committee operates effectively and meets its responsibilities under the Charter;

- Draft Charter: Company’s counsel needs to draft a Charter outlining the Committee’s responsibilities in compliance with the listing standards of its respective exchange and addresses the expectations of the Board for the Committee;

- Establish Committee Calendar: Human resources needs to work with the Committee Chair to develop a calendar of activities for the year (including the timing and number of Committee meetings) and cross-reference with the Charter to ensure that all responsibilities are addressed;

- Assess Need for External Advisor: The Committee needs to assess whether or not they need an advisor; if they elect to use an advisor, they need to conduct a selection process and assess the independence of the advisor;

- Develop Committee Meeting Process: Establish protocols for the companies interaction with the Committee and preparation for meetings; best practices include the following:

- Provide Committee Chair with a draft agenda for the meeting at least one month in advance of the meeting;

- Review draft materials with the Committee Chair (and Committee advisor) at least 1-2 weeks in advance of the meeting;

- Make materials available to Committee members one week in advance of the meeting;

- Ensure that at least 2 meetings are provided for major decisions; one meeting to review and second meeting to approve; and

- Follow-up with Committee Chair following Executive Session to confirm decisions made in the meeting.

Many companies adopt some of the above practices in advance of going public and this tends to make the transition easier. We find that new Committees have some room to learn as they go; however, the fundamentals of the process should be in place upon going public.

Post-IPO Compensation

In most cases, prior to going public, the compensation program likely was comprised of a relatively modest base salary and annual incentive and significant stock option grants. This approach to compensation is very common for emerging growth companies and private equity-backed companies. Spin-off IPOs may vary from this approach, as they often have relied on the more traditional compensation models of their parent companies. Upon going public, the company may need to rethink its approach to compensation. At the very least, there has to be recognition that employees may have opportunities to recognize significant wealth from past equity grants and the company needs to ensure that the compensation program will be effective in retaining top talent following the IPO. In addition, while the company may have had a relatively small shareholder base to address as a private company, once public, there is a larger group of shareholders and the company needs to make sure that the compensation program of the public company is designed with all shareholders in mind.

Pay Philosophy, Peer Group and Target Pay Levels

For a newly public company, one of the most fundamental compensation decisions is to establish a compensation strategy and pay philosophy. Most companies will want to ensure that the compensation program addresses the following objectives:

- Align executives with shareholders’ interests

- Support achievement of the business strategy

- Pay-for-performance

- Attract and retain required talent

A company’s compensation strategy and design can work to achieve these objectives in a variety of ways and there are tradeoffs among the objectives. For example, compensating executives with equity can serve to align their interests with shareholders; however, executives may place a higher value on cash compensation. Companies will take a variety of approaches based on the relative priority of the different objectives and their views on which compensation design elements best meet the objectives.

As part of the compensation philosophy, while not required, companies will frequently identify a peer group. The peer group is comprised of publicly traded companies and used for pay and/or performance benchmarking. Since one of the primary purposes of the peer group is to assess the competitiveness of pay, a key factor in identifying peers is whether the companies are potential competitors for executive talent. In addition, for external credibility, the peer group should be comprised of companies that are comparable in size (e.g., ~.5x – 2x) your company’s size in terms of revenue and from comparable industries. Ideally, some of the peers will also be newly public companies, though this is less important for more mature companies that are going public.

Most public companies establish a pay philosophy discussing the positioning of target pay levels. The most common pay philosophy statement is along the lines of “our company targets total pay levels at the median of our peer group with variation around median based on individual circumstances.” There is flexibility to have a pay philosophy that targets pay levels above median, but these pay philosophies often attract criticism from shareholders. Alternatively, the company could target below median base salaries and annual incentives and deliver above median long-term incentives. This approach to pay may be more appealing to shareholders, especially with growth companies, with its emphasis on long-term compensation.

Annual Incentive Program

Pre-IPO companies may or may not have a formal annual incentive plan. For some emerging growth companies, there may be a focus on conserving cash and therefore limited cash available for compensation and as a result, the companies may deemphasize annual incentive compensation. In addition, early stage companies in some industries (e.g., biotech, internet) may not have strong income statement performance (e.g., revenue or profitability) and may tie the incentives they pay to the achievement of strategic objectives (e.g., successful clinical trials, product launches, etc.)

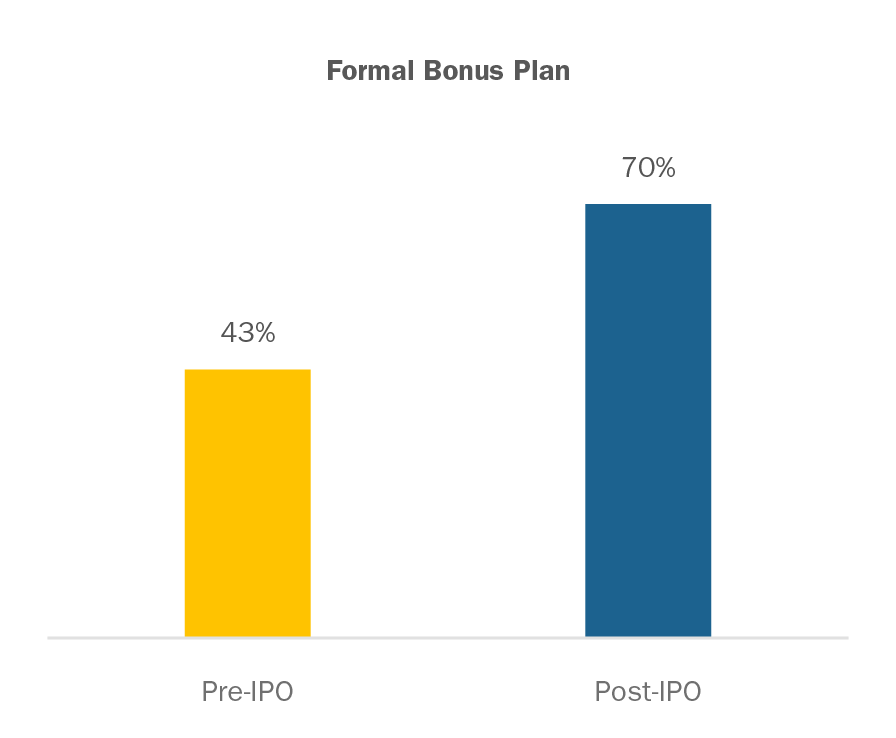

Once companies are public, there are greater expectations from shareholders and shareholder advisory groups that if the company pays an annual incentive, it will be based primarily on the achievement of financial results, with only a small portion based on more qualitative performance criteria. The larger the annual incentive opportunity is as a percentage of total compensation, the greater the expectation that the incentive will be based on financial performance. Shareholders will generally not be happy if a CEO can earn a bonus equal to 50-100 percent of base salary, unless the company has delivered strong financial results. Our analysis of 30 recent IPO’d companies found that 70% have adopted formal bonus plans with quantitative metrics following the IPO.

Note: For both annual and long-term incentives based on the tax code rules (IRC Sec. 162(m), the “performance based compensation” tax exemption for select executive officers), if a company gets an annual and long-term incentive plan approved prior to the IPO and discloses such plan documents in any S-1 filing, the company is exempt from IRC Section 162(m) rules for approximately three years.

Long-term Incentives

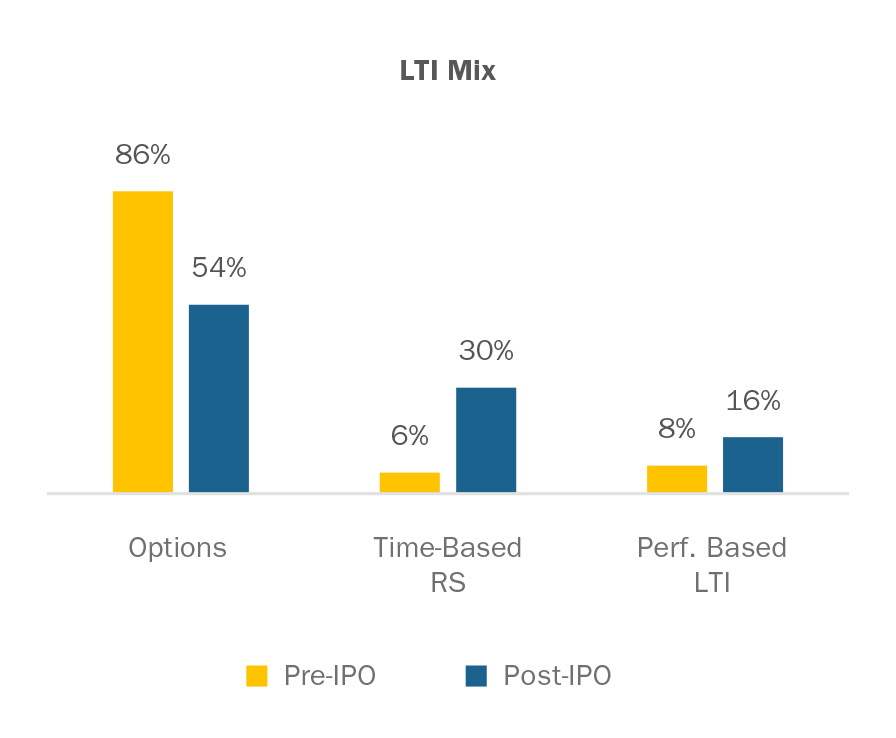

Pre-IPO companies typically use stock options as the main long-term incentive vehicle as they tend to closely align the interest of the venture capital or private equity investors. Rather than making annual grants to executives, pre-IPO companies will generally make large up-front grants to lock in on an early (presumably lower) valuation for purposes of determining the exercise price. In many cases, the equity grants are established as a percentage of the company’s common shares outstanding rather than a targeted dollar value. If an executive has served with the company for a number of years prior to the IPO, then it is possible that all or a majority of the stock options that the executive holds are vested by the IPO. This may be a concern for shareholders for potential shareholders and the company needs to demonstrate it has a game plan for locking in the executives post-IPO.

An important first step for the company as it approaches the IPO is to assess whether its existing reserve of shares set aside for grants to employees and directors will be adequate to cover future grants. It is generally preferable to obtain approval of additional shares for future grant prior to the IPO, as the equity plan needs to be approved by shareholders and it is simpler to gain approval from the VC or private equity shareholders than the new public shareholders. We recommend that the equity reserve and overhang (i.e., share reserve plus outstanding awards relative to total shares outstanding) be benchmarked relative to peer practices to ensure that the reserve will not be viewed as excessive by external shareholders, as eventually the company will have to go to public shareholders for purposes of 162(m) compliance and/or additional shares.

In situations where executives’ equity is largely vested by the time of the IPO, the company may use the IPO as an opportunity to “re-up” equity grants to senior executives to “lock them in” for the next few years following the IPO. However, in order to size any grants made at IPO, the company will likely want to rely on competitive market practices for annual grant values among the peer group. In addition, the company may want to consider shifting to an annual grant frequency, as this is the most common equity granting approach among publicly traded companies.

Public companies have moved toward an annual grant frequency for several reasons, including the following:

- Limits the impact of stock price volatility on option values (e.g., lowers the risk that all stock options end up underwater)

- Facilitates compliance with target compensation positioning (i.e., easy to adjust annual compensation to market competitive levels)

- Results in consistent disclosed compensation values over time and tends to be better received by shareholder advisory groups

Over time, larger newly public companies (particularly those with revenue over $1 billion) may be expected to incorporate a long-term incentive vehicle with explicit performance measures into their long-term incentive designs. Institutional Shareholder Services (ISS) expects that 50% of the long-term incentive opportunity be delivered in a performance-based vehicle and they do not view time-vesting stock options as highly performance-based. In practice, newly public companies may have legitimate reasons to delay adopting a performance-based long-term incentive (e.g., limited stock trading history, challenges in forecasting long-term financial performance).

If you decide to adopt a performance-based long-term incentive, the most common design is a performance-share plan. These plans provide for a target opportunity denominated as a number of shares. Performance is typically assessed over a three-year period, with the number of shares earned ranging from a threshold amount (typically 25%-50% of target) to a maximum amount (150%-200% of target) based on an assessment of performance relative to pre-established performance criteria. Plan designs are mixed among measuring performance relative to financial criteria (e.g., EPS, revenue growth), stock price performance (e.g., total shareholder return relative to peers or the broader market), or a combination of financial and stock price performance. Performance share plans are now the single most prevalent form of long-term incentive for executives at large public companies. In our analysis of the post-IPO practices of 30 recent IPOs, we found that the LTI mix for post-IPO grants shifted away from stock options with weight shifted towards time-based restricted stock and performance-based LTI.

Other Compensation Design Features

Severance provisions should be established as part of a formal severance program (change in control or not change in control) or through severance agreements, or less frequently, as part of an employment agreement. These programs should be implemented after careful consideration of potential costs and benefits to the participants, competitive practices for comparable organizations and if the company desires to maintain a formal program. Gross-ups for any 280(g) CIC tax liabilities are no longer common and should not be included. If not already in place, non-compete and non-solicitation provisions should be put in place for the company, as standalone policies or as part of LTI award agreements.

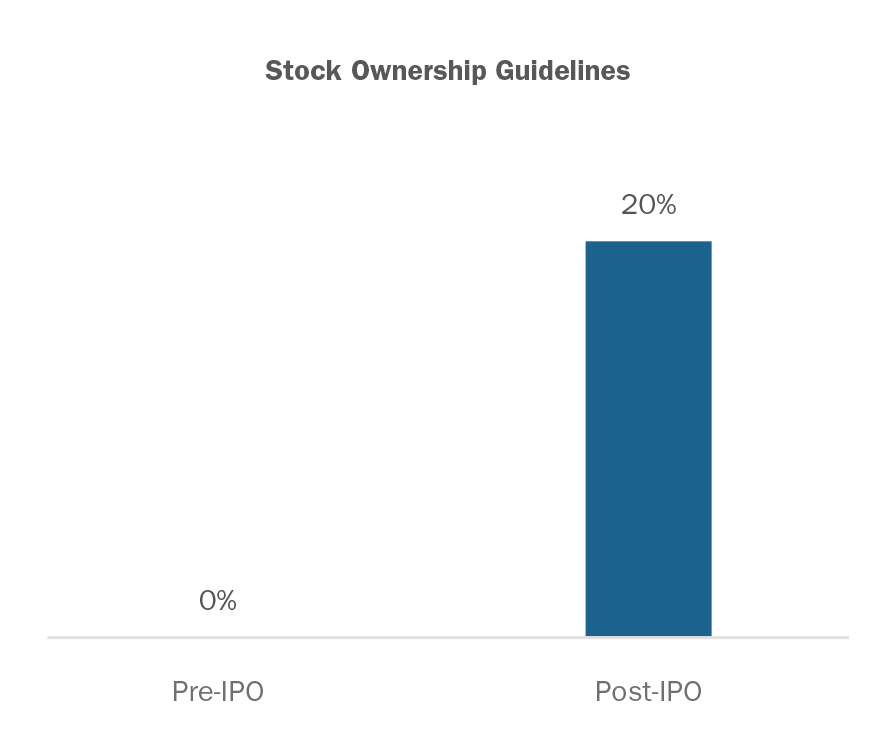

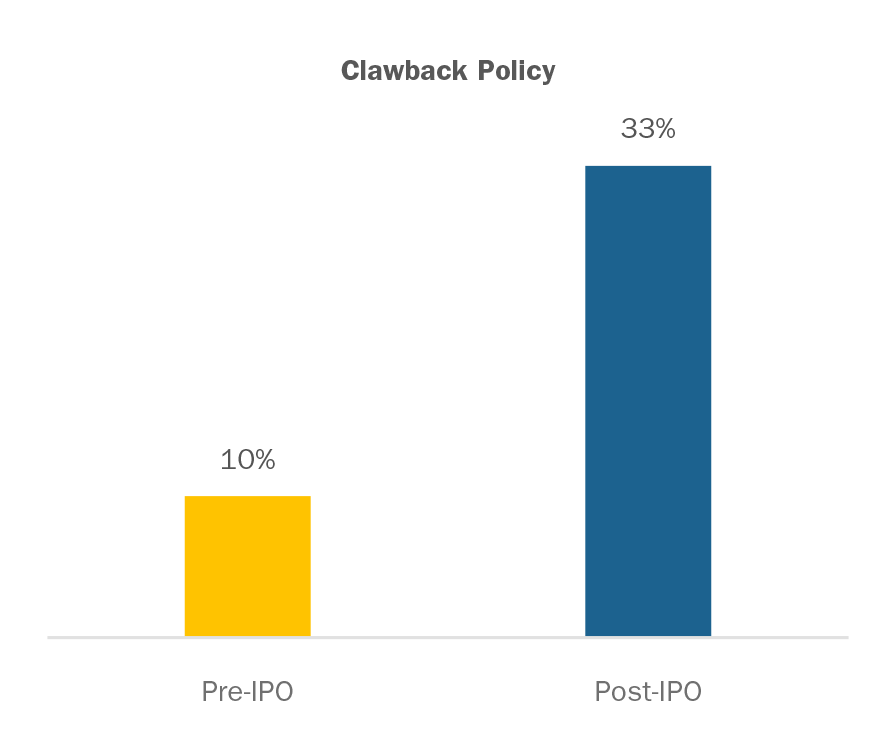

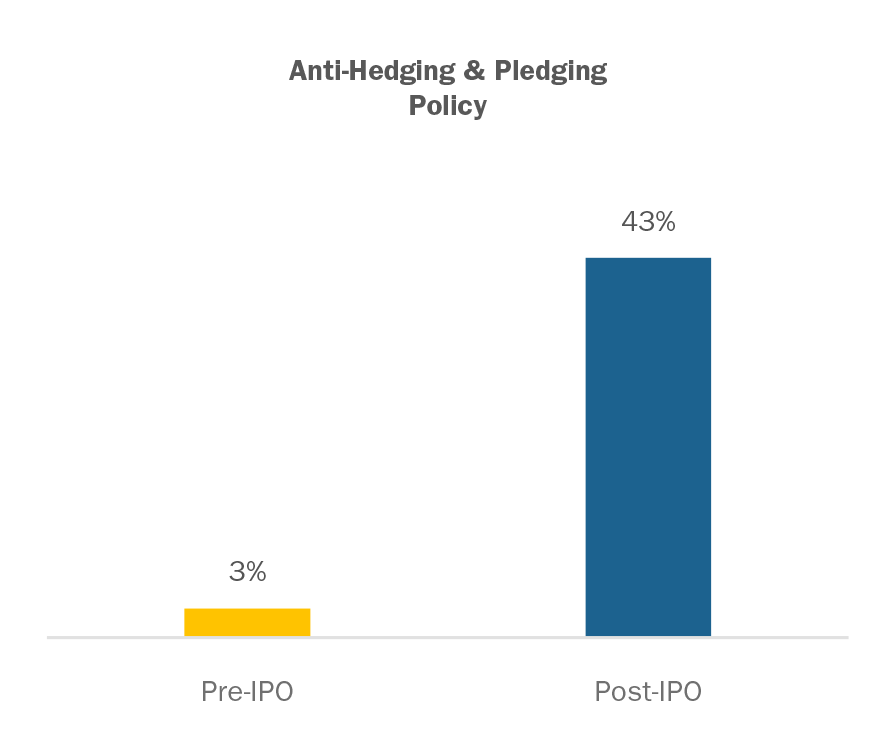

Lastly, other good governance features such as stock ownership guidelines, clawbacks (recoupment policy), and anti-hedging and pledging are considered good practice and are also generally in the best interests shareholders (see data on post-IPO adoption below). How quickly the company adopts these practices depends on how far the company wants to go to be viewed as shareholder friendly.

Conclusions

The IPO is an exciting time for executives and private company shareholders. From a compensation perspective, it is also an exciting time as the company transitions from a model built around an eventual liquidity event to a compensation program that is expected to be maintained over time as a public company. As a public company, the compensation program will be under additional scrutiny and the Compensation Committee will be accountable to a much larger shareholder base. By developing strong compensation governance practices and understanding competitive practices for pay program, Compensation Committees can move forward with confidence that their approach to compensation will meet the strategic needs of the company and stand-up to external scrutiny.

Overall Findings

- Performance: 2015 performance (based on Revenue growth, Pre-tax Income growth, EPS growth and 1-year Total Shareholder Return or TSR) was weaker than 2014 performance.

- CEO Pay: Median CEO pay was up 13% from 2014, driven by significant increases in the grant date value of long-term incentives (LTI) which are typically granted during the beginning of the fiscal year.

- Annual Incentive Payout: At median, annual incentive payouts (as a percentage of target) were lower in 2015 than the prior year. Additionally, there was more variability in payout around target compared to 2014 demonstrating a directional alignment between pay and performance.

- LTI Payout: Performance share plans paid out at target for the 2013-2015 performance period despite strong median 3-year cumulative TSR performance of 56%.

- Disclosure: Companies generally did not make wholesale changes to their proxy statements. Some enhanced their disclosure through the use of charts and graphs to make the proxy statement a communications document for shareholders.

2015 PERFORMANCE

2015 was a year that included an increase in the value of the U.S. dollar, volatility in foreign currency exchange rates and a slowdown in economic growth overseas (particularly in China). These factors contributed to 2015 performance being weaker than 2014 performance. CAP reviewed Revenue growth, Pre-tax Income growth, EPS growth and TSR performance for the Early Filers and the S&P 500. For the measures reviewed, 2015 performance was generally flat (0 – 3% growth) compared to the strong performance of 2014.

|

Financial Metric |

2014 Median 1-year Performance |

2015 Median 1-year Performance |

||

|

S&P 500 |

Early Filers |

S&P 500 |

Early Filers |

|

|

Revenue Growth |

5.6% |

5.7% |

0.8% |

2.4% |

|

Pre-Tax Income Growth |

8.6% |

6.4% |

0.2% |

1.2% |

|

EPS Growth |

10.6% |

10.4% |

2.6% |

3.2% |

|

TSR (1) |

16.3% |

14.1% |

2.3% |

0.3% |

(1) TSR for the S&P 500 is as of September 30, 2014 and September 30, 2015. TSR for Early Filers is as of each company’s fiscal year end.

CEO TOTAL DIRECT COMPENSATION

Among Early Filers with CEOs in their role for at least two years (n=42), 2015 actual total direct compensation increased 13% over 2014 pay levels. 2015 annual incentive payouts were down 3% reflecting weaker financial performance compared to the prior year. LTI grants in 2015, however, were significantly higher than 2014. This finding is likely reflective of the timing of LTI grants (typically in the first quarter of the fiscal year) and companies likely providing larger grants in 2015 because of the strong performance in 2014. Consistent with the expected salary increases, 2015 base salary was 3% higher than 2014.

|

Compensation Element (n=42) |

2014 Median ($000) |

2015 Median ($000) |

% Increase |

|

Base Salary |

$1,000 |

$1,031 |

3.1% |

|

Actual Annual Incentive |

$1,791 |

$1,731 |

-3.4% |

|

Total Cash |

$2,836 |

$2,663 |

-6.1% |

|

Long-Term Incentive (LTI) |

$5,468 |

$6,896 |

26.1% |

|

Total Direct Compensation |

$8,290 |

$9,399 |

13.4% |

INCENTIVE COMPENSATION

Annual Incentive Plan Payout

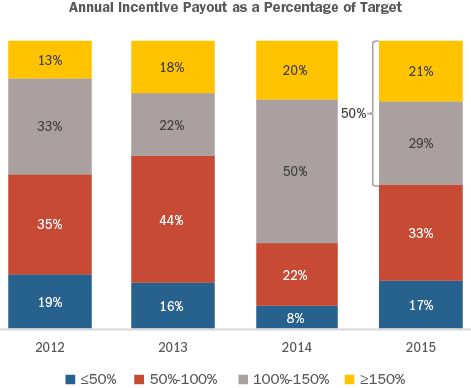

As mentioned above, actual annual incentive payouts in 2015 were lower than 2014. At median, 2015 payouts were 101% of target vs. 2014 payouts which were 111% of target. At the 25th percentile, 2015 payouts were much lower (76%) than 2014 (99%) but were more in line with 2013 and 2012 payouts which is indicative of a return to more normalized distribution of payouts in 2015.

|

Summary Statistics |

Annual Incentive Payout as a % of Target |

|||

|

2012 |

2013 |

2014 |

2015 |

|

|

75th Percentile |

130% |

127% |

135% |

133% |

|

Median |

100% |

95% |

111% |

101% |

|

25th Percentile |

72% |

75% |

99% |

76% |

As expected, performance was noticeably stronger for companies with an annual incentive payout that was at or above target. Conversely, performance for companies with a payout below target was weaker in 2015. These results are similar to 2014 performance, although TSR was stronger for companies with below target payout in 2014 (+7%) compared to 2015 (-11%).

|

Financial Metric |

2014 Median 1-year Performance |

2015 Median 1-year Performance (1) |

||

|

Below target payout (n=15) |

At or above target payout (n=35) |

Below target payout (n=24) |

At or above target payout (n=24) |

|

|

Revenue Growth |

3.6% |

6.3% |

-4.0% |

7.0% |

|

Pre-Tax Income Growth |

-2.9% |

12.7% |

-7.2% |

11.7% |

|

EPS Growth |

-3.4% |

13.5% |

-2.9% |

13.9% |

|

TSR (2) |

7.2% |

16.0% |

-10.7% |

12.6% |

(1) Excludes 2 companies that had spin-offs during 2015.

(2) TSR for Early Filers is as of each company’s fiscal year end.

Overall, 50% of companies provided a payout at or above target in 2015 (consistent with 2013 and 2012) which is much lower than 2014 (70% of companies); as a result, there was more variability in payouts relative to target in 2015 than in 2014. Additionally, the number of companies providing a payout between 100 – 150% of target in 2015 is approximately half of what it was in 2014. Interestingly, nearly the same number of companies provided a payout of 150% and above in both 2014 and 2015. Finally, the number of companies not providing an annual incentive payout in 2015 increased (4 companies in 2015 vs. 1 company in 2014).

Long-Term Incentive Plan Payout

Three-year (2013 – 2015) performance was strong among Early Filers and the S&P 500. Cumulative Revenue growth was 11% (or 4% per year) for both Early Filers and the S&P 500. Cumulative EPS growth was very strong (21%) for the S&P 500 and more modest (11%) for the Early Filers. Overall, companies in both groups had significant stock price appreciation over the three-year period; 3-year cumulative TSR was 48% for the S&P 500 and 56% for the Early Filers.

|

Financial Metric |

Median 3-year Cumulative Performance |

|

|

S&P 500 |

All Early Filers (1) (n=42) |

|

|

Revenue Growth |

10.9% |

11.0% |

|

Pre-Tax Income Growth |

15.6% |

12.1% |

|

EPS Growth |

21.3% |

10.9% |

|

TSR (2) |

48.0% |

55.7% |

(1) Reflects only those companies with a performance share plan.

(2) TSR for the S&P 500 is as of September 30, 2015. TSR for Early Filers is as of each company’s fiscal year end.

Despite strong TSR performance over the three-year period, and even with 60% of companies using Relative TSR as a performance metric, median LTI payout was around target (98%). Median LTI payout for companies that use Relative TSR was slightly below target (95%); however, a majority of these companies (60%) use TSR in conjunction with other financial metrics.

|

Summary Statistics |

LTI Payout as a % of Target |

|

|

All Early Filers (n=42) |

Early Filers with TSR as a Metric (n=26) |

|

|

75th Percentile |

128% |

119% |

|

Median |

98% |

95% |

|

25th Percentile |

54% |

54% |

PROXY STATEMENT DISCLOSURE CHANGES

Since Say on Pay was adopted in 2011, companies have incorporated many new features to make their proxy statement a communications document for shareholders by including a proxy summary, an executive summary in the CD&A and highlighting good governance practices, just to name a few. While Early Filers generally did not make wholesale changes to their proxy statement in 2016, some companies enhanced their disclosure with additional charts and graphs. Some examples include:

- Deere & Co, which has annual incentive performance goals that can vary depending upon the company’s sales volume, added a graph to explain the performance goals, actual results and how each related to the actual sales volume achieved;

- Jabil Circuit, Jacobs Engineering Group and TE Connectivity added a list of corporate governance best practices (i.e., “what we do and what we do not do”);

- Starbucks added a picture describing their shareholder outreach process and topics discussed with shareholders.

We would expect that companies will have more significant changes to the proxy statement as more rules under Dodd-Frank (e.g., pay ratio and pay vs. performance) are finalized and implemented.

CONCLUSION

2015 was not as strong of a performance year as 2014. Given weaker 2015 performance, annual incentive payouts declined from 2014 levels resulting in a directional alignment between pay and performance. 2016 is already shaping up to be an interesting year given recent declines in stock price, currency fluctuations and overall uncertainty given the U.S. Presidential election. Many companies will be making their annual equity grants at depressed stock prices, so we may potentially see a year over year decline in LTI grant values particularly for those companies that grant awards based on a fixed number of shares. From an executive compensation perspective, we expect that the SEC will come out with final rules for the clawback, hedging and pay vs. performance in October 2016 which could have an impact on 2017 and 2018 disclosure.

We believe Mr. Fink raises an important point on linking incentives to business strategy. A clearly communicated business strategy would help to avoid pitfalls that we see frequently today. These include incentives that are designed primarily to respond to pressure from proxy advisory firms, often driving a “one size – fits all” approach or encouraging short-term thinking.

“We are asking that every CEO lay out for shareholders each year a strategic framework for long-term value creation. Additionally, because boards have a critical role to play in strategic planning, we believe CEOs should explicitly affirm that their boards have reviewed those plans. BlackRock’s corporate governance team, in their engagement with companies, will be looking for this framework and board review.”

Larry Fink, BlackRock CEO

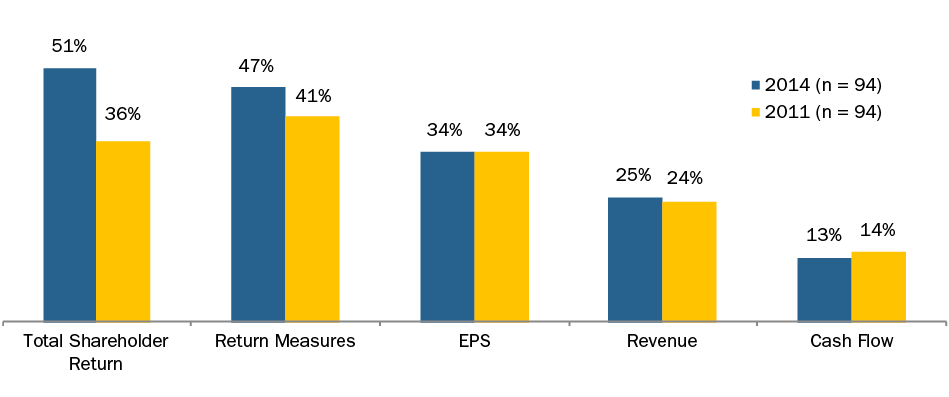

As highlighted by our articles Are You Rewarding Short-Termism? in The Corporate Board and Balancing pay for performance with shareholder alignment in the Ethical Boardroom, it is important that compensation, in particular long-term incentive compensation, links directly to the company’s strategy. We agree that providing shareholders with a voice on compensation programs through Say on Pay has been beneficial, but we have observed a chilling effect on creative compensation programs. Today most public companies are very reluctant to be an outlier on compensation. If we look at CAP’s sample of 100 large market cap companies, 51% use Total Shareholder Return (TSR) and 34% use EPS as metrics in their long-term incentive plans. Are these universal metrics appropriate in almost any situation? We question that premise. Why do so many companies have similar metrics when they have unique business strategies, operate in diverse industries and are positioned at different points in their lifecycle?

The good news is that we have observed modest increases in the use of return metrics, from 41% in 2011 to 47% in 2014 (e.g., return on assets, return on capital and return on equity). In several cases, activist investors have intervened to champion the adoption of return metrics. Traditional institutional investors with concerns over the effectiveness of corporate business strategies have also been vocal in encouraging companies to focus on returns. Both camps frequently push companies to move to adopt balanced metrics that encourage profitability in combination with growth as opposed to growth alone.

The chart below provides a snapshot of how long-term incentive plan metrics have evolved over time. Use of TSR has grown most since 2011, from 36% to 51% and this is after dramatic increases prior to 2011. We believe this is the direct outcome of the influence of proxy advisory firms, who have pushed hard on companies to incorporate relative TSR in their programs. The good news is that since 2011, the number of companies relying on a single metric has declined, with over 1/3 of companies using 3 or more metrics which may indicate they are tailoring plans more to their specific situation.

|

# of Metrics |

2011 |

2014 |

|

1 |

33% |

26% |

|

2 |

40% |

37% |

|

3 or More |

27% |

37% |

While EPS and TSR may make sense for many companies, companies should consider various factors when selecting measures, including:

- Is relative TSR the best answer for your company? We see it as an outcome-oriented metric that lacks a clear linkage to strategic priorities and is not well suited to driving behaviors that create shareholder value.

- Does over-reliance on TSR encourage risk-taking behaviors? Companies may make decisions that drive TSR in the short-term (e.g., share buybacks or higher dividends), rather than identifying better uses of capital that can lead to sustained long-term growth.

- Does an EPS metric create an incentive to buy back shares rather than re-investing for growth? Financial experts have mixed views on the utility of share buybacks. The jury is still out.

- Are the current time horizons for TSR performance optimal? Almost all plans measure TSR over 3 years. Why is a 3-year time frame the default for most companies? Since TSR is usually defined as a relative metric, eliminating the need to set goals in advance, should companies be evaluating longer timeframes that align with their business cycles?

- If relative TSR is your company’s metric, where are you in the cycle? Companies and boards need to ask and analyze whether relative TSR goals will pay out for sustained long-term stock price appreciation or for volatility in relative stock price performance. Companies and boards need to understand whether the stock is only recovering from earlier losses that occurred prior to the start of the performance period.

We don’t believe that either EPS or TSR are inherently poor metrics. In many cases, it makes sense for companies to incorporate these metrics into their overall incentive framework. However, it is critical to determine if these metrics are right for a particular company at a -particular time in its life cycle. Keep in mind that long-term incentives are the largest component of pay for many executives. As companies and boards design long-term incentives, they should consider the following questions:

- Does the compensation program support our strategy and do the metrics and goals align with our long-term business plan?

- Can we communicate clearly and succinctly how the program ties to our strategic framework for both shareholders and program participants?

- What behaviors, good or bad, could the design encourage? For example:

- Does it send clear signals throughout the organization on the strategic priorities?

- Is short-term upside emphasized at the expense of long-term sustained value?

- Do we encourage growth at the expense of returns that exceed our cost of capital?

- Does the program encourage excessive or inappropriate risk-taking?

- For metrics other than TSR, will achievement of goals lead to company and shareholder value creation?

- Are there alternative metrics, including strategic metrics (e.g., increase in market share, diversification of revenue, etc.) that might be better indicators of successful execution of the strategy?

Overall, we think Mr. Fink’s commentary on the importance of defining and communicating a company’s strategic framework for value creation serve shareholders well. His comments point to a fundamental principle of compensation design: incentive compensation should be used to reward the company’s success in achieving its strategy and creating long-term value for shareholders. The performance measures used to determine incentive compensation need to track progress on the strategy over the near term and over the long-term. We believe we will see a migration in this direction as long-term incentives evolve, companies continue to dialogue with their shareholders and perhaps as they enhance disclosure around their strategic framework as Mr. Fink suggests.