Never fall behind on the latest trends in CEO pay ratio with CAP’s CEO Pay Ratio Tracker. The CEO Pay Ratio Tracker uses each company’s most recent pay ratio disclosure.

Data effective: June 1, 2022

Revenue and Market Cap Filters

- Select the desired Revenue and Market Cap scopes using the text boxes

Sector Breakdown Chart

- Chart shows the sector breakdown for companies within the selected Revenue and Market Cap scopes

- Hover over each section to see the percentage and number of companies in each sector

- Click on each section to show pay ratio data for only that sector

- Select multiple sectors by holding down the Ctrl key

- Click the center of the Sector Breakdown chart to reset to all companies

- The number of companies in the selected scope will show in the center of the Sector Breakdown chart

Pay Ratio – Percentiles Chart

- Chart shows pay ratio data for companies in the selected sector and Revenue and Market Cap scopes

- When a sector is selected, bolded bars show data just for that sector and lighter bars show data for all companies within the selected Revenue and Market Cap scopes

For questions or more information, please contact: Ryan Colucci Principal [email protected] 646-486-9745 or Kyle White Senior Analyst [email protected] 646-568-1161.

Click here to read more about new factors impacting the CEO Pay Ratio Disclosure in 2021 and beyond: https://www.capartners.com/cap-thinking/2021-ceo-pay-ratio-disclosure-new-considerations-and-expectations/.

The COVID-19 pandemic dealt an unexpected blow that pushed a number of companies into bankruptcy. The impact of pandemic-related shutdowns was broad: Companies in a diverse range of industries – including retail, oil and gas, consumer goods, restaurants, and entertainment and recreation – filed for Chapter 11 bankruptcy protection in the first half of 2020. While the number of filings has not yet reached the level seen in the 2008 financial crisis, the number of bankruptcies is expected to rise through the remainder of the year.

The 2020 surge in bankruptcies has been accompanied by heightened scrutiny of executive pay in restructuring situations. Bankruptcy filings are often preceded by announcements of executive retention and other short-term performance-based awards. These awards can draw criticism as excessive and even inappropriate given the impact of bankruptcy on shareholders and the broader employee population. However, 2020 is unique. While situations vary by industry, most agree that this flurry of bankruptcy filings is not the result of poor management but rather the inevitable impact of unprecedented and unforeseeable broad shutdowns across the country to contain the pandemic. The companies entering bankruptcy need continuity, stability, and motivated leadership. Carefully designed and communicated retention and performance awards can play an important role in keeping leadership in place and focused on moving the company through the restructuring process.

The Evolution of Prepaid Awards

Corporate bankruptcies cause a significant amount of uncertainty for executives and employees, who can be tempted to leave for more stable work situations with predictable, secure compensation streams. Poor company performance means that annual incentives are unlikely to pay out, and equity holdings lose almost all value. In situations where shareholders need to retain executives through the bankruptcy period, cash retention awards to critical members of management can be effective by providing compensation stability. These programs are often called Key Executive Retention Programs (KERPs).

Executive retention awards in bankruptcy situations today have a unique design: they are paid before the bankruptcy filing and are subject to clawback provisions. Clawback provisions are triggered if the executive terminates employment during a specified time period or is terminated for cause. In addition, some clawbacks are tied to performance goals not being achieved. If triggered, the clawback provisions require executives to pay back the after-tax award value. The fact that the awards are prepaid differentiates them from most other cash incentives and makes them the subject of criticism and misunderstanding.

The Evolution of Prepaid Executive Retention Awards in Bankruptcies

The unique design for executive retention awards emerged from changes to the U.S. bankruptcy code made through the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA). Prior to BAPCPA, a large portion of executive compensation in bankruptcy situations was delivered through retention awards. Executive retention awards were typically paid out in a lump sum or through several payments based on the executive’s continued employment. Executive retention awards also had special status in the bankruptcy proceedings that ensured payment ahead of many other company obligations. As a result of the special status and lack of performance features, executive retention awards were not viewed favorably.

BAPCPA imposed stringent restrictions on awards to “insiders” implemented during the bankruptcy process that are based solely on retention and that lack performance features (“Insiders” are defined as directors, officers, individuals in control of the corporation, and relatives of such individuals). BAPCPA’s restrictions effectively stopped the use of executive retention awards once companies file for bankruptcy. Despite BAPCPA, executive retention awards eventually re-emerged – as prepaid awards subject to clawbacks. By paying the awards before the bankruptcy filing, companies can generally avoid the BAPCPA restrictions and avoid having the award subject to Bankruptcy Court approval.

Prevalent Executive and Employee Pay Practices during Bankruptcy

CAP analyzed the 8-K filings of a number of companies that entered bankruptcy in 2020. Based on this analysis, companies today often use a mix of compensation programs to retain and motivate executives and employees leading up to, and during, the bankruptcy process:

- Pre-filing, prepaid executive retention awards

- Performance-based Key Employee Incentive Plans (KEIPs)

- Employee retention and incentive programs

Pre-Filing, Prepaid Executive Retention Awards

A number of companies that filed for bankruptcy during 2020 announced prepaid retention awards for executives anywhere from days to months before the legal filing. The 8-K filings indicate that the prepaid retention awards are designed by the board with advice from compensation consultants, as well as bankruptcy and other advisors. Typical design parameters for executive retention bonus awards include:

|

Participation: |

CEO, other key executives and officers |

|

Objectives: |

Retain key employees before and during the bankruptcy proceedings |

|

Award Value: |

|

|

Form of Payment and Timing: |

Awards are made in cash, prepaid in a lump sum prior to the bankruptcy filing |

|

Clawback Provisions: |

Executives must repay the awards, net of taxes, if they 1) Terminate employment prior to the earlier of a specified period or the conclusion of the bankruptcy period, or 2) Are terminated by the company for cause |

|

Clawback Period: |

Most often one year |

While less common, some companies, including Chesapeake Energy and Ascena Retail Group, include base-level performance criteria in the clawback provisions to add a performance element to the prepaid retention awards. This improves the overall optics of such awards and helps avoid additional scrutiny during bankruptcy.

|

Select Pre-Filing Retention and Incentive Programs |

||||||

|

Company |

Revenue FY2019 ($000s) |

Industry |

Bankruptcy Date |

Program |

Award Term |

Description |

|

J.C. Penney |

$12,019 |

Retailing |

5/15/2020 |

Retention & Incentive |

0.6Y |

Adopted a prepaid cash compensation program equal to a portion of NEO annual target variable compensation; NEO awards ranged from $1M to $4.5M; clawbacks are tied 80% to continued employment through January 31, 2021, and 20% to milestone-based performance goals |

|

Retention |

1.6Y |

Accelerated the earned 2019 portion of three-year long-term incentive awards ($2.4M for NEOs); clawbacks are tied to continued employment through January 31, 2022 |

||||

|

Hertz Global Holdings |

$9,779 |

Transportation |

5/22/2020 |

Retention |

0.8Y |

Cash retention payments to 340 key employees at the director level and above ($16.2M in aggregate); NEO awards ranged from $190K to $700K; clawbacks tied to continued employment through March 31, 2021 |

|

Chesapeake Energy |

$8,408 |

Energy |

6/28/2020 |

Retention & Incentive |

1.0Y |

Executives: Prepaid 100% of NEO and designated VP target variable compensation ($25M in aggregate for 27 executives) based 50% on continued employment and 50% on the achievement of specified incentive metrics Employees (retention only): Converted annual incentive plan into a 12-month cash retention plan paid quarterly, subject to continued employment |

|

Ascena Retail Group |

$5,493 |

Retailing |

7/23/2020 |

Retention & Incentive |

0.5Y |

Executive and Employee Retention and Performance Awards: Six-month cash award for NEOs (NEO awards ranged from $600K to $1.1M), 3 other executives, and employees who are eligible for the company’s incentive programs based 50% on continued employment through Q4 2020 and 50% on performance; award amounts are based on a percentage of annual and long-term incentive targets Earned Performance-Based LTIP Awards: Accelerated earned 2018 and 2019 performance-based cash awards for all employees ($1.1M for 2 NEOs), subject to continued employment through August 1, 2020 for the 2018 award and August 3, 2021 for the 2019 award |

|

Whiting Petroleum |

$1,572 |

Energy |

4/1/2020 |

Retention |

1.0Y or Chapter 11 Exit |

NEO awards were prepaid and ranged from $1.1M-$6.4M; clawbacks are based on termination of employment before the earlier of March 30, 2021, or Chapter 11 exit; employees receive quarterly cash awards that in aggregate may not exceed that employee’s target annual and long-term incentive compensation |

|

GNC Holdings |

$1,446 |

Food, Beverage and Tobacco |

6/23/2020 |

Retention |

1.0Y |

Cash exit incentive awards for key employees (including executives) based 75% on the Company’s exit from bankruptcy and 25% on the 60th day following an emergence event that occurs on or prior to June 23, 2021. Prepaid NEO awards ranged from $300K to $2.2M |

|

Diamond Offshore Drilling |

$935 |

Energy |

4/26/2020 |

Retention |

1.0Y |

Past Executive Long-Term Cash Incentives: Payment of a portion of past three-year cash incentive awards was accelerated for retention; awards are subject to clawbacks based on termination of employment for one year; NEO payouts ranged from $140,208 to $1.75 million. Other Plans: The Company announced a Key Employee Incentive Plan, a Non-Executive Incentive Plan and a Key Employee Retention Plan, which are all subject to approval by the Bankruptcy Court |

Performance-Based Key Employee Incentive Plans (KEIPs)

After BAPCPA, KEIPs emerged to provide incentives to executives without running afoul of the bankruptcy code. KEIPs, which are approved during the bankruptcy process, are performance-based incentives that pay out in cash based on the achievement of financial and operational goals. The goals can be very short-term in nature, such as quarterly performance periods.

Typical design parameters for KEIPs include:

|

Participation: |

CEO, other key executives and officers (ultimately those designated as “insiders” in the bankruptcy proceeding) |

|

Objectives: |

Incentivize key executives before, but primarily during, the bankruptcy proceedings |

|

Award Value: |

|

|

Form of Payment and Timing: |

|

A current trend is to design and implement the KEIP prior to filing. This is especially true in pre-packaged bankruptcies where the financial reorganization of the company is prepared in advance in cooperation with its creditors. Having these programs in place with payouts contingent on performance improves continuity throughout the entire process, incentivizes the management team to perform, and meets the court’s requirement that any variable compensation to executives be performance based.

One recent example of a company announcing a KEIP before the bankruptcy filing is Diamond Offshore Drilling. The company announced a prepaid retention program for executives, as well as a KEIP, a non-executive incentive plan and an additional retention plan. All plans except for the prepaid executive retention program are subject to Bankruptcy Court approval, according to the 8-K. The KEIP, nonexecutive incentive plan and the additional retention plan replace past incentives – including requiring the forfeiture of past restricted stock unit awards and stock appreciation rights – and current incentives that would have been granted in 2020. The KEIP includes nine participants, including the senior executive team.

Employee Retention and Incentive Programs

Retention and incentive programs for employees are also used during the bankruptcy process. The use of employee programs depends on the company’s business needs and other factors, such as size and industry. Retention and incentive programs for non-executives typically replace the value of annual incentives and sometimes long-term incentives. Employee retention programs are cash-based and pay out at specific intervals, often quarterly given the uncertainties associated with companies in restructuring situations. The duration of employee retention programs often mirrors those for executives.

Severance programs, which provide compensation to individuals at termination, are also used in bankruptcy situations. When communicated broadly during bankruptcy, severance can be considered a retention program as it helps employees have some financial security and focus on their current jobs rather than finding new positions. Severance programs tend to be used more commonly for employees than executives because BAPCPA limits the value that can be delivered to “insiders.” However, a recent example of a severance program for executives came from Hertz Global Holdings, which announced amendments to its executive severance programs prior to its bankruptcy filing in May 2020. The severance programs, which were disclosed in the same 8-K filing as a prepaid key employee retention program, cover senior executives and vice presidents, and the payment multiple was reduced to 1X salary and bonus from 1.5X.

Conclusion

Executive compensation programs implemented in conjunction with a bankruptcy should be carefully designed and reviewed with outside advisors to ensure that the company is complying with bankruptcy code. Companies should carefully review the value of executive awards to ensure that they are reasonable while also in line with competitive practices and past incentive opportunities. Executive award amounts should be considered in the context of employee awards and the company’s overall financial situation to ensure fairness and avoid the appearance of excess. Lastly, companies should carefully communicate the rationale for executive awards and what the company is doing for employees in the 8-K current report or other announcement. Clear communication up front can help head off later public relations and optics headaches.

Compensation Advisory Partners (CAP) assessed human capital actions taken by companies in the Communication Services sector in response to the COVID-19 pandemic. Key findings include:

- The Communication Services sector and its Telecommunication Services and Media & Entertainment industries were hit significantly by the COVId-19 pandemic.

- 54% of the Communication Services companies in the S&P Composite 1500 Index reported human capital actions in response to the pandemic. In contrast, 41 percent of companies in the S&P 1500 reported actions.

- Of the industries in the Communication Services sector, Media & Entertainment was particularly hard hit, with 59 percent of companies reporting human capital actions. In the Telecommunication Services industry, 38 percent of companies took human capital actions in response to COVID-19.

- Pay reductions for executives and board members are the most prevalent human capital actions in the Communication Services sector.

- Median salary reductions were 50 percent for chief executive officers (CEOs), while median salary reductions for other executives were 20 percent.

- For boards of directors, pay was cut by a median of 25 percent.

- In addition to pay reductions for executives and boards, the most prevalent human capital actions in the Communication Services sector were furloughs, workforce reductions and suspended raises and/or bonuses.

The PDF of the report provides additional data for the Communication Services sector.

The human capital actions that CAP is tracking include pay cuts; changes to annual and long-term incentives; furloughs; workforce reductions; suspended 401K matches; enhanced health and welfare benefits; additional pay for frontline workers; pay continuity; and workforce expansions. CAP will continue to monitor corporate public announcements of COVID-19 actions.

CAP partners Bertha Masuda and Susan Schroeder discuss essential components to building robust long term and short term incentive plans as well as what companies overlook when developing incentive plans for their employees

CAP reviews and publishes an annual update on pay levels for Chief Financial Officers (CFOs) and Chief Executive Officers (CEOs). This year’s update is based on a sample of 119 companies with median revenue of $13 billion. Additional information on criteria used to develop the sample of companies is included in the Appendix.

Highlights 2017 vs 2016

| Component | Highlight |

| Base Salary |

|

| Bonuses |

|

| LTI |

|

| Performance Results |

|

| Total Compensation |

|

| Pay Mix |

|

Study Results

Salaries

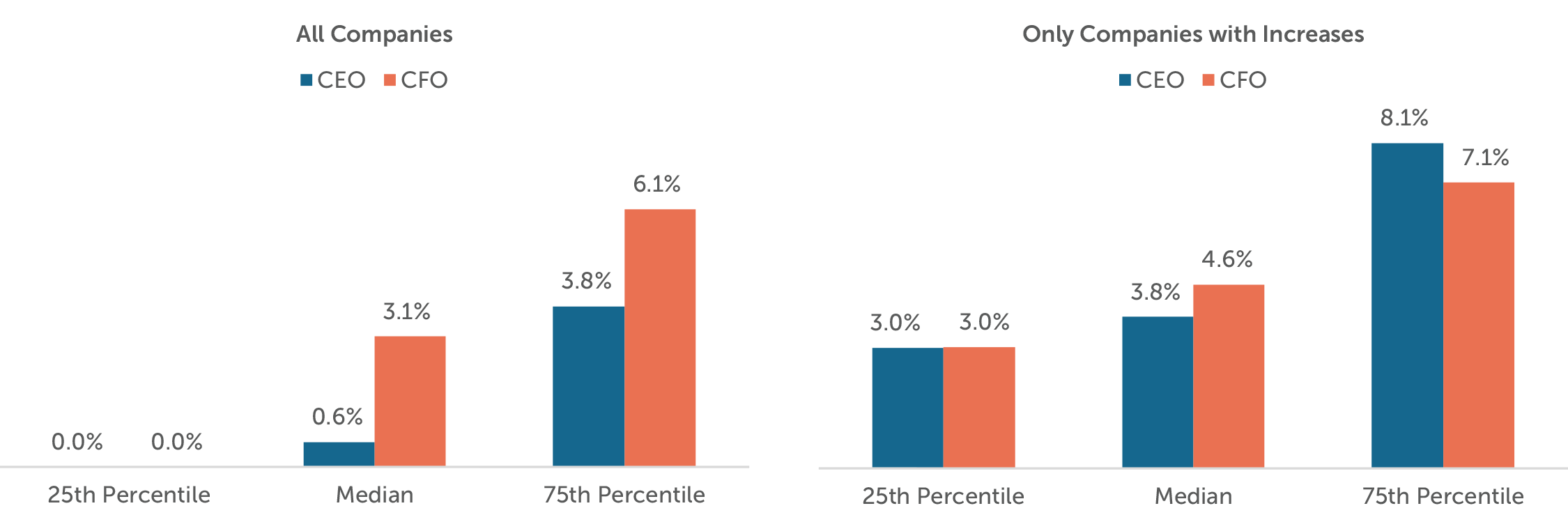

In the past, we have seen a steady growth in the number of CEOs and CFOs receiving salary increases in each year. However, for the 2016-2017 period the salary increase prevalence of 51% for CEOs and 70% for CFOs was very comparable to the increases for 2015-2016. The median 2017 salary increases were 3.1% for CFOs and 0.6% for CEOs.

2017 Salary Increases

Actual Pay Levels

Salary increases were higher for CFOs since only about one-half of CEOs received an increase. Yet, the median increases in actual bonus and long-term incentives were at similar levels for both CFOs and CEOs.

The median rate of increase in actual total direct compensation levels for CEOs and CFOs was 10.9% and 9.9% in 2017, respectively. We found that in 58% of the companies, the CEO received a higher percentage total compensation increase than the CFO.

| Median Percentage Change in Pay Components | ||||

|

Pay Components |

2015 – 2016 | 2016 – 2017 | ||

| CEO | CFO | CEO | CFO | |

| Salary | 0.0% | 3.0% | 0.6% | 3.1% |

| Actual Bonus | 1.5% | 1.1% | 12.0% | 12.7% |

| Long-Term Incentives | 3.8% | 4.1% | 8.1% | 10.3% |

| Actual Total Direct Compensation | 5.4% | 3.9% | 10.9% | 9.9% |

While target bonuses remained relatively the same, actual bonuses had significant increases indicating a strong performance year among the sampled companies. Year-over-year revenue and operating income growth was 7% for both measures which was much higher than 2016 performance of 1% and 4% growth, respectively.

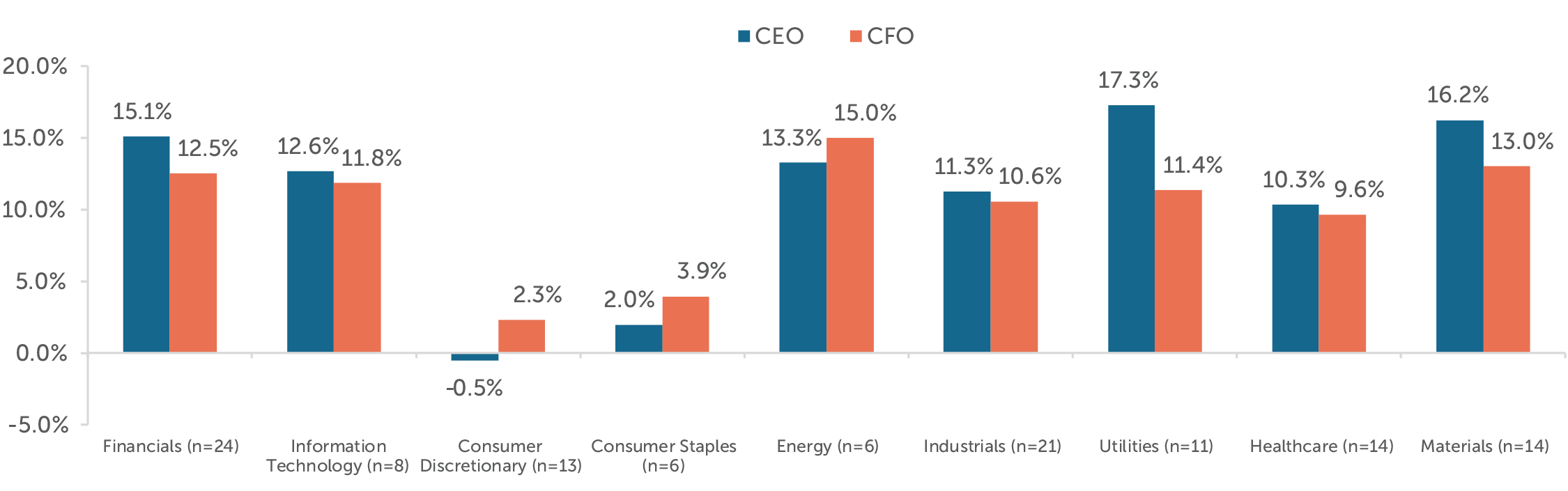

Median Pay Increase by Industry1

Actual Total Direct Compensation2

Median TDC increases by industry were generally aligned with the year-over-year revenue and operating income improvements.

Total compensation increases lagged the total sample for the Consumer Discretionary and Consumer Staples industries. While the companies in Consumer Staples improved total shareholder returns, revenue growth, and operating income growth in 2017, the overall industry performance still lagged the total sample. On the other hand, the companies in Consumer Discretionary generally saw a decrease in operating performance and an improved total shareholder return in 2017, but total compensation was generally flat.

The underperformance of the Consumer Staples companies is partially attributed to the pressure on sales volume as a result of taxes on soda, competition from store brands / smaller upstarts, battle for shelf space, and health conscious consumers.

For Consumer Discretionary companies, the trend is less clear as this industry is more diverse and covers a lot more sub-sectors (for example: media and entertainment, distributors, retail, hotels, automobiles, etc.). When we look at the companies in this industry individually, the compensation changes year-over-year were most often aligned with improved or deteriorated performance.

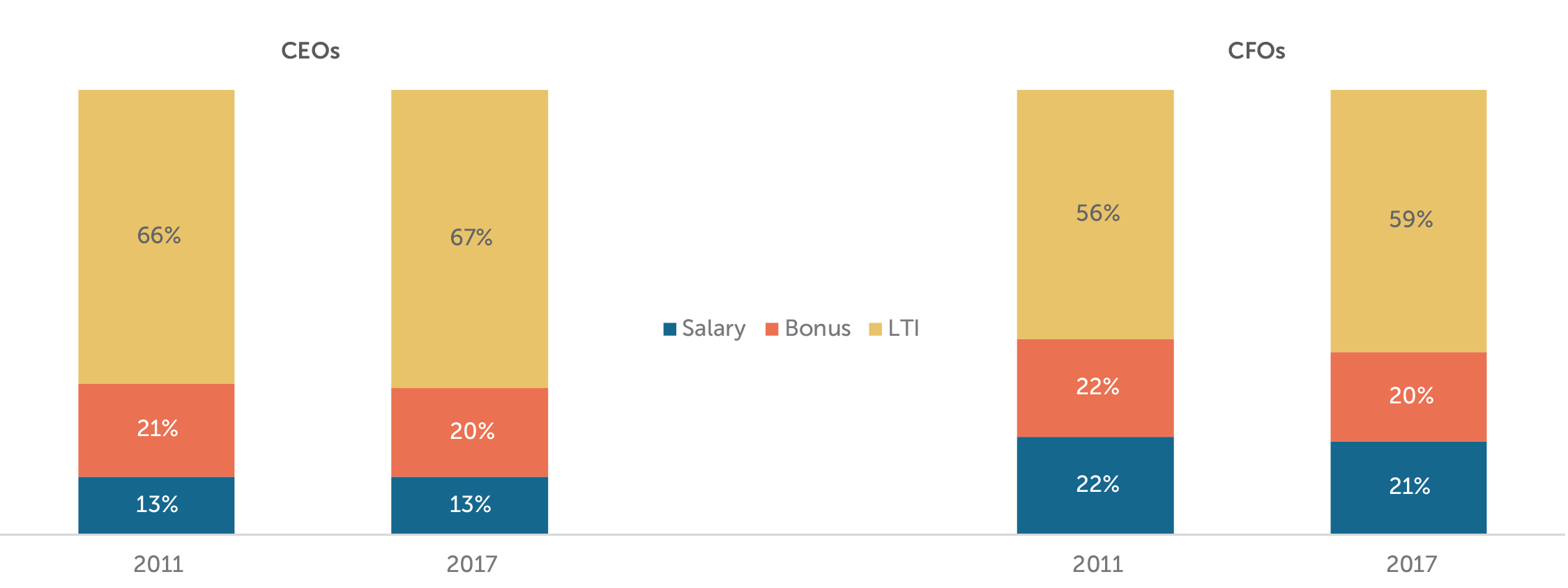

Target Pay Mix

The structure of the overall pay program (salary, bonus, LTI) has remained largely unchanged since 2011. CEOs continue to receive less in the form of salary and more in variable pay opportunities, especially LTI, than CFOs.

Target Bonuses

Target bonuses as a percentage of salary remained unchanged at median and only changed slightly at 25th and 75th percentiles. We do not foresee any major changes in target bonus percentages in the near future.

| Target Bonus as % of Salary | ||||

|

Summary Statistics |

CEO | CFO | ||

| 2016 | 2017 | 2016 | 2017 | |

| 25th Percentile | 138% | 135% | 85% | 85% |

| Median | 150% | 150% | 100% | 100% |

| 75th Percentile | 190% | 200% | 120% | 125% |

Long-Term Incentive (LTI) Vehicle Prevalence and Mix

Prevalence of performance plans continued to increase in 2017. The use of two different vehicles to deliver LTI remains the most prevalent approach and approximately 25% of companies studied use all 3 equity vehicles (stock options, time-based stock awards, and performance plan awards).

Performance plans account for around 60% of LTI awards on average among companies studied. The other portion of LTI is delivered through an almost equal mix of stock options and time-vested restricted stock awards.

| LTI Mix | ||||||

|

LTI Vehicles |

2011 | 2016 | 2017 | |||

| CEO | CFO | CEO | CFO | CEO | CFO | |

| Stock Options | 32% | 32% | 23% | 22% | 19% | 17% |

| Time Vested Restricted Stock | 17% | 22% | 20% | 24% | 18% | 24% |

| Performance Plans | 51% | 46% | 57% | 54% | 63% | 59% |

Conclusion

2017 performance overall, was higher compared to last year. Median revenue growth was 7% (vs 1% in 2016) and operating income growth was 7% (vs 4% in 2016). Total shareholder return in 2017 was comparable to 2016; the full year return was 20% (vs 16% in 2016). Total pay increases were much higher than in 2017, which we believe were directionally aligned with the performance improvements. A strong year of financial performance led to high annual incentive payouts in 2017 and after multiple years of sustained TSR growth companies are increasing LTI opportunities among their top executives.

The pay mix has been relatively consistent since 2011, but where we are seeing the most change is within LTI delivery vehicles. Since 2011 performance-based LTI plans have increased about 13% for both CEOs and CFOs with a similar drop in the prevalence of stock options, and time vested stock being relatively the same. With the focus on aligning pay outcomes with company performance by Boards and investors, we are not surprised to see large increases in total compensation after multiple years of sustained strong performance across industries.

APPENDIX

Sample Screening Methodology

Based on the screening criteria below, we arrived at a sample of 119 public companies with median 2017 revenue of $13B.

| Revenue | At least $5B in revenue for fiscal year 2017 |

| Fiscal year-end | Fiscal year-end between 9/1/2017 and 1/1/2018 |

| Proxy Statement Filing Date | Proxy statement filed before 3/31/2018 |

| Tenure | No change in CEO and CFO incumbents in the past three years |

| Industry | All industries have been considered for this analysis |