We believe Mr. Fink raises an important point on linking incentives to business strategy. A clearly communicated business strategy would help to avoid pitfalls that we see frequently today. These include incentives that are designed primarily to respond to pressure from proxy advisory firms, often driving a “one size – fits all” approach or encouraging short-term thinking.

“We are asking that every CEO lay out for shareholders each year a strategic framework for long-term value creation. Additionally, because boards have a critical role to play in strategic planning, we believe CEOs should explicitly affirm that their boards have reviewed those plans. BlackRock’s corporate governance team, in their engagement with companies, will be looking for this framework and board review.”

Larry Fink, BlackRock CEO

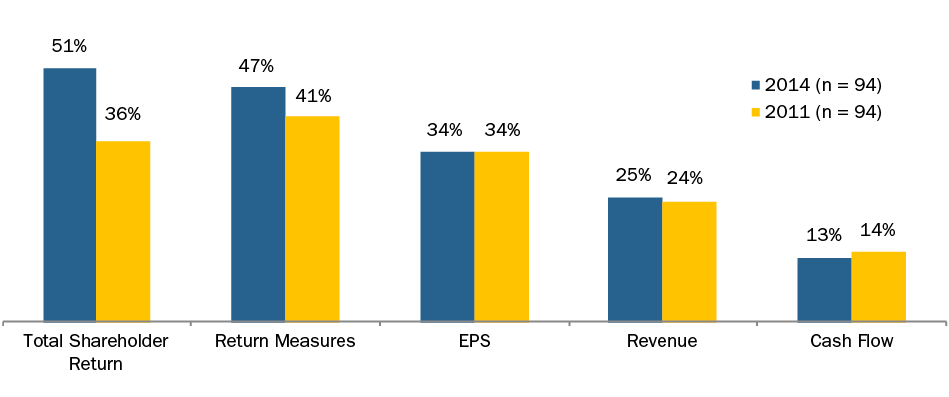

As highlighted by our articles Are You Rewarding Short-Termism? in The Corporate Board and Balancing pay for performance with shareholder alignment in the Ethical Boardroom, it is important that compensation, in particular long-term incentive compensation, links directly to the company’s strategy. We agree that providing shareholders with a voice on compensation programs through Say on Pay has been beneficial, but we have observed a chilling effect on creative compensation programs. Today most public companies are very reluctant to be an outlier on compensation. If we look at CAP’s sample of 100 large market cap companies, 51% use Total Shareholder Return (TSR) and 34% use EPS as metrics in their long-term incentive plans. Are these universal metrics appropriate in almost any situation? We question that premise. Why do so many companies have similar metrics when they have unique business strategies, operate in diverse industries and are positioned at different points in their lifecycle?

The good news is that we have observed modest increases in the use of return metrics, from 41% in 2011 to 47% in 2014 (e.g., return on assets, return on capital and return on equity). In several cases, activist investors have intervened to champion the adoption of return metrics. Traditional institutional investors with concerns over the effectiveness of corporate business strategies have also been vocal in encouraging companies to focus on returns. Both camps frequently push companies to move to adopt balanced metrics that encourage profitability in combination with growth as opposed to growth alone.

The chart below provides a snapshot of how long-term incentive plan metrics have evolved over time. Use of TSR has grown most since 2011, from 36% to 51% and this is after dramatic increases prior to 2011. We believe this is the direct outcome of the influence of proxy advisory firms, who have pushed hard on companies to incorporate relative TSR in their programs. The good news is that since 2011, the number of companies relying on a single metric has declined, with over 1/3 of companies using 3 or more metrics which may indicate they are tailoring plans more to their specific situation.

|

# of Metrics |

2011 |

2014 |

|

1 |

33% |

26% |

|

2 |

40% |

37% |

|

3 or More |

27% |

37% |

While EPS and TSR may make sense for many companies, companies should consider various factors when selecting measures, including:

- Is relative TSR the best answer for your company? We see it as an outcome-oriented metric that lacks a clear linkage to strategic priorities and is not well suited to driving behaviors that create shareholder value.

- Does over-reliance on TSR encourage risk-taking behaviors? Companies may make decisions that drive TSR in the short-term (e.g., share buybacks or higher dividends), rather than identifying better uses of capital that can lead to sustained long-term growth.

- Does an EPS metric create an incentive to buy back shares rather than re-investing for growth? Financial experts have mixed views on the utility of share buybacks. The jury is still out.

- Are the current time horizons for TSR performance optimal? Almost all plans measure TSR over 3 years. Why is a 3-year time frame the default for most companies? Since TSR is usually defined as a relative metric, eliminating the need to set goals in advance, should companies be evaluating longer timeframes that align with their business cycles?

- If relative TSR is your company’s metric, where are you in the cycle? Companies and boards need to ask and analyze whether relative TSR goals will pay out for sustained long-term stock price appreciation or for volatility in relative stock price performance. Companies and boards need to understand whether the stock is only recovering from earlier losses that occurred prior to the start of the performance period.

We don’t believe that either EPS or TSR are inherently poor metrics. In many cases, it makes sense for companies to incorporate these metrics into their overall incentive framework. However, it is critical to determine if these metrics are right for a particular company at a -particular time in its life cycle. Keep in mind that long-term incentives are the largest component of pay for many executives. As companies and boards design long-term incentives, they should consider the following questions:

- Does the compensation program support our strategy and do the metrics and goals align with our long-term business plan?

- Can we communicate clearly and succinctly how the program ties to our strategic framework for both shareholders and program participants?

- What behaviors, good or bad, could the design encourage? For example:

- Does it send clear signals throughout the organization on the strategic priorities?

- Is short-term upside emphasized at the expense of long-term sustained value?

- Do we encourage growth at the expense of returns that exceed our cost of capital?

- Does the program encourage excessive or inappropriate risk-taking?

- For metrics other than TSR, will achievement of goals lead to company and shareholder value creation?

- Are there alternative metrics, including strategic metrics (e.g., increase in market share, diversification of revenue, etc.) that might be better indicators of successful execution of the strategy?

Overall, we think Mr. Fink’s commentary on the importance of defining and communicating a company’s strategic framework for value creation serve shareholders well. His comments point to a fundamental principle of compensation design: incentive compensation should be used to reward the company’s success in achieving its strategy and creating long-term value for shareholders. The performance measures used to determine incentive compensation need to track progress on the strategy over the near term and over the long-term. We believe we will see a migration in this direction as long-term incentives evolve, companies continue to dialogue with their shareholders and perhaps as they enhance disclosure around their strategic framework as Mr. Fink suggests.

In our experience, “activist investors” were more vocal and influential in boardrooms during 2015 than during other recent years. As a result, Compensation Advisory Partners (“CAP”) analyzed circumstances at nine companies that had proxy contests in 20151 where in each case, one area of activist focus was executive compensation. We found that executive compensation issues were often supportive and complimentary to other, larger internal issues at the target companies. While these activists may have targeted executive compensation, this was not the main driver in engaging with the company. Activist complaints tend be more focused on strategic/financial issues and they use compensation as a point of discussion to identify where their views differ. For example, if return on capital is not a utilized metric in incentive plans and the company has completed several low return acquisitions, the activist may use this as support that strategy is flawed and that compensation reinforces that flaw.

“Activist investors” are individuals (i.e. hedge fund managers) or groups (i.e. alternative investment companies) who purchase a stake in a target company’s outstanding equity shares with the end-goal of influencing company decision making by acquiring seats on the Board of Directors. Once on the Board, activists will try to effect changes (i.e., by divesting or acquiring a business segment, cutting expenses, increasing distributions to shareholders, etc.) that ultimately increase the company’s value and the value of the activist’s investment.

What We Found

Compared to prior years, 2015 saw an increase in proxy contests. Among companies in the Russell 3000 Index, there were 20 proxy contests initiated by activist investors during 2015. This compares to 14 proxy contests in 2014 and 16 in 2013.

Of the 20 proxy contests initiated by activist investors in 2015, nine (45 percent) specifically took issue with the executive compensation program at the target company. In each case, “issues” with executive compensation were a part of the supporting statements for the dissident slate of directors. This is a stark contrast to 2014 and 2013, where 4 (29 percent) and 1 (6 percent) proxy contests took issue with executive compensation, respectively.

Specific compensation practices highlighted in 2015 include:

|

Executive Compensation Issue |

Number of Companies (n=9) |

Percentage of Companies |

|

Pay for Performance Misalignment |

7 |

78% |

|

High CEO Compensation |

4 |

44% |

|

Choice of / Adjustments to Performance Metrics |

4 |

44% |

|

Weak Corporate Governance Structure |

3 |

33% |

|

High / Increase to Board of Director Compensation |

3 |

33% |

|

Awards of Special Grants to Executives |

2 |

22% |

|

Outsized Peers |

1 |

11% |

Ultimately, we found that activist investors frequently use executive compensation and pay for performance disconnect as levers to bolster their argument for receiving seats on the target company’s Board of Directors.

Target Companies

Of the nine activist campaigns which specifically took issue with executive compensation practices, the companies that were being targeted generally had lagging TSR performance, both in absolute terms and relative to competitors. Further, low Say on Pay results in 2014 also provided activists with an additional reason for targeting certain companies.

As the below table demonstrates, where activists were successful in securing Board seats, the most recent Say on Pay support was generally low and either the company’s 1-year TSR, 3-year TSR, or both were relatively low.

Successful Activist Campaigns

Of the nine proxy contests that specifically targeted aspects of executive compensation, four ultimately resulted in the activist investor gaining Board seats at the target company. The four companies, which are noted in the chart below, include: Myers Industries, Imation Corp., The Children’s Place2 and Shutterfly, Inc.

The main common denominator, from a compensation perspective, among the successful activist campaigns was a perceived disconnect between executive pay and financial performance at the target company. More specifically, at Myers, Imation and The Children’s Place, the activists were able to show that, despite poor TSR (in both absolute and relative terms), the executives at these companies were still being rewarded either through salary increases, above target annual incentive payouts or equity grants.

|

Company Name |

Say on Pay Results |

Total Shareholder Return |

|||

|

2013 |

2014 |

2015 (Year of Proxy Contest) |

1 Year * |

3 Year CAGR * |

|

|

Activist Gained Board Seat (n=4) |

|||||

|

Myers Industries Inc. |

75% |

75% |

60% |

-17.8% |

12.6% |

|

Imation Corp. |

95% |

50% |

34% |

-17.8% |

-12.9% |

|

The Children's Place, Inc. |

17% |

61% |

94% |

13.8% |

6.3% |

|

Shutterfly, Inc. |

55% |

50% |

22% |

-18.3% |

22.4% |

|

Activist Did Not Gain Board Seat (n=5) |

|||||

|

Hill International, Inc. |

n/a (triennial) |

54% |

n/a (triennial) |

-0.3% |

-9.3% |

|

Ethan Allen Interiors Inc. |

86% |

92% |

80% |

-14.1% |

5.1% |

|

E. I. du Pont de Nemours and Company |

95% |

98% |

96% |

14.4% |

17.3% |

|

Biglari Holdings Inc. |

33% |

31% |

50% |

-21.7% |

2.8% |

|

Select Comfort Corporation |

98% |

93% |

96% |

26.9% |

6.7% |

* As of Fiscal Year End

Further, with regard to Shutterfly’s executive compensation program, activists made the case that executives were being rewarded for performance against metrics that were not “shareholder friendly” (i.e. metrics focusing on top line growth as opposed to earnings growth). In response to the activist criticism, Shutterfly’s Compensation Committee established several changes to their 2015 and 2016 executive compensation program performance targets to “further reflect shareholders views”. However, the lead activist investor (Marathon Partners) ultimately deemed these changes inadequate and requested further, more fundamental, adjustments to the entirety of the compensation program, namely, to begin prioritizing profit over scale.

It is not surprising that activist investors are most successful at winning Board seats at their target companies when they can tie executive compensation to the poor financial performance of the company. If shareholders are not realizing a desired return on their investment in any given company, it is reasonable to expect that they would show more support for an activist investor hoping to gain access to the target’s Board if it could potentially lead to financial improvement. When executive compensation can be tied to poor financial results, it simply provides activists, and shareholders alike, with another reason as to why a shift in leadership could be desirable or change in strategy could be advisable (e.g. CEO change).

ISS also tends to influence the outcome of these proxy contests. ISS supported at least one of the nominees on the dissident slate of directors at each of the four companies that lost at least one Board seat to the activist investor.

Ultimately, of the four companies who lost Board seats to activist investors, three companies (Imation Corp., Myers Industry and Shutterfly) have made changes to their executive leadership teams as these CEOs have stepped down. Further, while DuPont was able to win its proxy contest and keep dissident nominees off of its Board, five months after the Annual Meeting, the CEO announced her retirement.

Conclusion

We are seeing increased activity where activist investors are accumulating stakes in companies with the intention of agitating for change. Their hope is to make changes that will enhance the company’s value. While our analysis reflected proxy contests specifically focusing on executive pay (e.g. pay for performance misalignment), there are a number of circumstances where companies settle with the activist investors, avoiding a contentious public battle, and allow the activist a seat or multiple seats on the Board. Some examples include Baxter International settling with Third Point LLC, Freeport McMoRan settling with Icahn Enterprises and Citrix Systems settling with Elliott Management.

In order to be well positioned, Boards and Compensation Committees should be proactive:

- Ensure the Company and Board have a clear strategic focus and stick to it

- Make sure the metrics used in incentive plans align with the company’s strategic vision

- Confirm the Board has a game plan for shareholder and activist engagement

- Encourage the Company and Board to use external advisors to provide guidance

- Highlight company performance against goals

- Emphasize pay for performance relationship through the validation of relative performance and pay positioning

- Proactively seek feedback from shareholders throughout the year

- Assess program features which may not have a lot of value to executives but are viewed as problematic pay practices (i.e., eliminate excise tax gross-up, eliminate / reduce perquisites, move from single to double trigger equity vesting in the event of a change in control)

It is critical for the Board to work with management to ensure pay practices are defensible and supportable in light of company performance and good governance standards.

Appendix

Summary of Activist Campaigns

|

Company |

Activist |

Executive Compensation Issue Highlighted By Activist |

Contest Result |

|

Hill International, Inc. Program and project management company |

Bulldog Investors, LLC ISS supported both dissident director nominees |

|

No dissident nominees elected to the Board |

|

Ethan Allen Interiors International interior design and manufacturing company |

Sandell Asset Management Corp ISS supported 3 of 6 dissident director nominees |

|

No dissident nominees elected to the Board |

|

E.I. Du Pont International science and technology company |

Trian Fund Management ISS supported 2 of 4 dissident director nominees |

|

No dissident nominees elected to the Board CEO stepped down 5 months after the conclusion of the contest |

|

Biglari Holdings Owns and operates Steak N’ Shake |

Groveland Capital ISS did not support dissident director nominees |

|

No dissident nominees elected to the Board |

|

Myers Industries International manufacturing and distribution company |

GAMCO Asset Management ISS supported 1 of 3 dissident director nominees |

|

Three dissident nominees elected to the Board CEO stepped down |

|

Imation Corp. Data storage and information security company |

Clinton Group ISS supported all dissident director nominees |

|

Three dissident nominees elected to the Board CEO stepped down |

|

Select Comfort Corporation Designer, manufacturer, retailer and services of a Sleep Number beds |

Blue Clay Capital ISS did not support dissident director nominees |

|

Activist dropped proxy contest before it went to shareholder vote |

|

The Children’s Place (settled proxy fights prior to Annual Meeting) Children’s specialty apparel retailer |

Macellum Advisors GP and Barington Capital Group ISS supported 1 of 2 dissident director nominees |

|

Settled prior to contest – activist received one Board seat |

|

Shutterfly, Inc. Manufacturer and retailer of photo-based products |

Marathon Partners ISS supported 2 of 3 dissident director nominees |

|

Two dissident nominees elected to the Board CEO stepped down |

Note: The comments in the above chart are paraphrased or direct quotes from activist investors’ proxy contest materials/filings and do not reflect the view of CAP.

What We Found

Each of the 23 large banking organizations has adopted an annual Say on Pay vote, and among these companies average annual support from 2011-13 approximated 90%.

During this time period, only one company, Citigroup in 2012, did not receive majority shareholder support for its Say on Pay resolution. However, a number of additional large banking organizations (3 others in 2012; Northern Trust, Huntington Bancshares and BNY Mellon) received at or below 75% shareholder support. In each of these cases, we observed significant pay program changes in the subsequent year that were in line with changes seen among companies across industries, not just financial services firms that are affected by regulatory oversight. One company in 2013, Comerica, received below 75% shareholder support and as such we expect a similar response to efforts around shareholder outreach and potential program changes this year.

Proxy advisory firms (i.e., ISS and Glass Lewis) voting recommendations also have been impacting Say on Pay results. Our research shows that an ISS vote recommendation impacts Say on Pay vote results by approximately 30 percentage points.

Say on Pay Vote Results and Implications

Comparisons of results over the last 3 years generally show a consistent pattern with the majority of banks studied receiving 90+% shareholder support. Further, when comparing 2013 shareholder support levels to the S&P 500 to-date, results among the broader industry yields slightly higher support at median (95% vs. 93%).

A company only “fails” a Say on Pay vote if a majority of shareholders do not vote in support of the Say on Pay resolution. However, an “acceptable” shareholder support threshold has emerged around 75%. ISS identified 70% as a minimum acceptable level of support, while Glass Lewis prefers 75%. Further, even with results above 70% or 75%, if results are significantly below prior year results, companies will reevaluate their compensation programs. It is important to note that companies and Boards may be subject to reputational risk with “low” pass rates (i.e., approximately 75% or below).

One company in 2013 – Comerica – reviewed received less than 75% shareholder support. Comerica’s low support level (61%) was likely attributed to two factors: 1) weak 1- and 3-year TSR and 2) ISS recommending shareholders vote “Against” the Say on Pay resolution. ISS’ “Against” recommendations are often driven by high pay relative to performance and/or poor pay practices.

Four companies in 2012 received 75% or lower shareholder support for their Say on Pay resolution – Citigroup (45%), Northern Trust (75%), Huntington Bancshares (61%), and BNY Mellon (58%). Several factors may have led to the low support levels among these large banks, including, low TSR, high pay levels for the CEO or problematic pay practices (i.e., high discretionary payouts associated with poor performance). TSR among these four companies was negative for the one, three and five year periods ending in 2011.

Following the low Say on Pay support level, all made significant changes to their pay programs and conducted enhanced shareholder outreach efforts. In the subsequent year, average support increased by 33 percentage points. In 2013, all four received an ISS “For” Say on Pay vote recommendation (only 1 of 4 did in 2012).

|

Company receiving at or below 75% support on Say on Pay in 2012 |

% Support Received in 2012 /2013 Say on Pay Vote |

Modifications Made to Compensation Program (from 2013 proxy statement disclosure) |

|

Citigroup |

2012 – 45% (ISS – Against) 2013 – 92% (ISS – FOR) |

|

|

Northern Trust Corp |

2012 – 75% (ISS – FOR) 2013 – 87% (ISS – FOR) |

|

|

Huntington Bancshares |

2012 – 61% (ISS – Against) 2013- 95% (ISS – FOR) |

|

|

BNY Mellon |

2012 – 58% (ISS – Against) 2013 – 97% (ISS – FOR) |

|

We have observed a link between Say on Pay vote results and company performance, as primarily measured by TSR. Not surprisingly, companies that enjoy high levels of shareholder support for their Say on Pay resolutions tend to have performed better in the prior year and over the latest three year period.

TSR vs. Say on Pay Vote Results

|

% in Favor |

Avg. 3-Yr TSR @ 12/31/12 |

Avg. 1-Yr TSR @ 12/31/12 |

|

Prior to 2013 Annual Meetings |

Prior to 2013 Annual Meetings |

|

|

95 – 100% |

16.3% |

38.2% |

|

90 – 94% |

5.2% |

42.8% |

|

70 – 89% |

2.5% |

27.6% |

|

50 – 69% |

2.1% |

19.7% |

|

Below 50% |

n.m. |

n.m. |

Another significant factor affecting Say on Pay vote results has been the vote recommendations of proxy advisory firms, with lower voting outcomes when companies do not receive support from the proxy advisory firms on their Say on Pay proposals. The factors generally used by these firms include level of CEO pay, program design and the use of non-performance based pay. These factors can drive an “Against” vote especially when in combination with poor TSR results. In 2013, only Comerica received an “Against” vote on Say on Pay from ISS, and they received 61% support compared to 93% support in 2012. In 2012, 3 companies received an “Against” vote recommendation from ISS, and the average support decreased by 34 percentage points. From 2011-13, ISS recommended shareholders vote Against the Say on Pay resolution at 8 of the companies reviewed. Each time the result was less than 80% support.

Given the growing importance placed on shareholder outreach regarding Say on Pay and executive pay programs, some of the companies (i.e., Morgan Stanley and Goldman Sachs) use supplemental filings as an additional outreach tool. In some cases, the large banks file supplementary soliciting materials pushing back on the voting recommendations of ISS or Glass Lewis. While the voting recommendations do not change, companies continue to push back on the proxy advisory firms when they believe they have strong programs.

Conclusion

Financial services firms will need to continue to strike the right balance between pay-for-performance and alignment among varying stakeholder perspectives. This is increasingly challenging for these companies as interests will conflict between shareholders, employees and the Federal Reserve. We expect to continue to see changes as companies balance these multiple constituencies.

Despite significant changes from large banks over the last 3 years (e.g. decreased upside on long-term performance plans, decreased emphasis on stock options or increased opportunity to make ex-post adjustments on deferred incentive awards), Say on Pay results have been strong from 2011-2013. We will continue to monitor how these risk-mitigating features are implemented by these banks as part of the Federal Reserve’s input and their effect on Say on Pay voting results.

- 1 Companies reviewed include: American Express, Bank of America, BNY Mellon, Citigroup, Capital One Financial, Discover Financial Services, Goldman Sachs, JP Morgan Chase, Morgan Stanley, Northern Trust, PNC, State Street, SunTrust Bank, US Bancorp, Wells Fargo, BB&T, Comerica, Fifth Third, Huntington Bancshares, KeyCorp, M&T Bank, Regions and Zions Bancorp.

Say on Pay Update

2012 marks the second year of mandatory Say on Pay voting. In 2011, the SEC issued final rules implementing Section 951 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”). Dodd-Frank provides shareholders of US public companies with the right to cast three types of advisory votes related to executive compensation:

- A vote to approve the compensation of the Named Executive Officers (NEOs), effective for shareholder meetings occurring on or after January 21, 2011;

- A vote on the frequency with which shareholders should be entitled to cast Say on Pay votes (every one, two or three years), effective for shareholder meetings occurring on or after January 21, 2011; and

- A vote on golden parachute arrangements for NEOs related to a sale, consolidation or merger, effective April 25, 2011.

CAP Comment: While these votes are non-binding, we see evidence that companies carefully evaluate their vote results, taking some action if there is low shareholder support for the company’s executive compensation program. In 2011, a consensus developed that a low pass rate was a concern.

Say on Pay Vote Results Among the S+P 500

So far this season, Say on Pay resolutions received majority shareholder support at all but seven S&P 500 companies.1 The seven companies where a majority of shareholders did not support the executive compensation program were International Game Technology, Citigroup, Cooper Industries PLC, Mylan, NRG Energy, Pitney Bowes and Simon Property Group.

Comparison of year-to-date results for 2012 to 2011 results shows a consistent pattern. We found that the median vote in support of a Say on Pay resolution is 93.7% s in 2012. This is almost identical to the 93.2% median support level that we observed last year.

2011 and 2012 Say on Pay Vote Results

|

% in Favor |

# of Companies in 2012 |

% of Companies in 2012 |

% of Companies in 2011 |

|

90% – 100% |

200 |

69% |

63% |

|

80% – 90% |

42 |

14% |

17% |

|

70% – 80% |

17 |

6% |

10% |

|

50% – 70% |

26 |

9% |

9% |

|

0% – 50% |

7 |

2% |

2% |

CAP Comment: While a company does not “fail” its Say on Pay vote unless a majority of shareholders vote against the compensation program, most companies have received 90+% shareholder support and an “acceptable” shareholder support threshold has emerged around 70% – 80%. ISS identified 70% as a minimum acceptable level of support, while Glass Lewis prefers 75%. Among institutions, CalSTRS and Black Rock identified 75% and 80%, respectively.

Notably, all of the S&P 500 companies that failed Say on Pay in 2011 that have completed their 2012 Say on Pay votes, have received passing grades from shareholders. Some of these companies have made significant changes to pay programs. In addition, management teams at these companies have devoted considerable effort to shareholder outreach and engagement to better understand the issues that may be creating concerns.

|

Company |

% Support Received in 2012 Say on Pay Vote |

Modifications Made to Compensation Program |

|

Hewlett-Packard |

77% |

|

|

Jacobs Engineering |

96% |

|

|

Masco Corp. |

95% |

|

|

Stanley Black & Decker |

93% |

|

CAP Comment: SEC disclosure rules require additional disclosure in the CD&A regarding whether, and if so how, companies have considered the results of the most recent Say on Pay vote.

Several factors impact Say on Pay Voting results. We have observed a clear link between voting outcomes and company performance as measured by Total Shareholder Return (“TSR”). Not surprisingly, companies that enjoy high levels of shareholder support tend to perform better. Companies with lower performance tend to receive lower shareholder support.

TSR vs. Say on Pay Vote Results

|

% in Favor |

Average 1-Yr TSR @ 12/31/11 Prior to 2012 Annual Meetings |

Average 1-Yr TSR @ 12/31/10 Prior to 2011 Annual Meetings |

|

90% – 100% |

3.4% |

24.5% |

|

80% – 90% |

-5.3% |

24.1% |

|

70% – 80% |

-7.6% |

17.3% |

|

50% – 70% |

-5.8% |

8.0% |

|

0% – 50% |

-5.9% |

9.6% |

The recommendations of the proxy advisory services also have an impact. For example, when ISS recommends an “Against” vote on Say on Pay, the voting outcome is normally low. To date in 2012, we found that companies receiving a “For” recommendation from ISS had average shareholder support of 93%. In contrast, companies receiving an “Against” recommendation from ISS had average shareholder support of only 60%.

Among companies where ISS recommended “Against” the Say on Pay proposal, 93% received less than 80% support.

|

Companies Receiving “Against” Vote Recommendation |

||

|

% in Favor |

# of Companies |

% of Companies |

|

90% – 100% |

0 |

0% |

|

80% – 90% |

3 |

7% |

|

< 80% |

38 |

93% |

Given the growing influence of the proxy advisory firms, more and more companies are pushing back. Many companies have been proactive during this proxy season, with more than 50 firms filing supplementary soliciting materials. Prominent examples include Qualcom and Disney. Companies provide additional soliciting material to rebut the vote recommendations of the proxy advisory firms. While the supplemental materials do not impact the recommendation of the proxy advisory firms, they are positive in terms of investor outreach. Arguments over the appropriateness of peer groups selected by the proxy advisory firms are relatively common. In addition, a number of companies have adopted the proxy summary concept to direct attention to key messages, highlight the proposals that shareholders will be voting on and supplement the pay orientated disclosure provided in the CD&A.

Say on Pay Frequency Vote Results

An annual vote frequency emerged as the clear shareholder preference in 2011. Among S&P 500 companies reporting vote results, a majority of shareholders supported an annual frequency at 94% of companies. This differs from vote recommendations, with only 70% of the companies recommending an annual vote.

|

Board Recommendation for Vote Frequency |

# of Companies |

|

Frequency Receiving Majority Shareholder Support |

% of Companies |

|

Annual |

70% |

|

Annual |

94% |

|

Biennial |

3% |

|

Biennial |

0% |

|

Triennial |

23% |

|

Triennial |

5% |

|

No Recommendation |

4% |

|

None (only plurality) |

1% |

The strong support for annual votes is not a surprise. 39 institutional investors, representing more than $830 billion in assets, issued a public call for companies and investors to support annual advisory votes on executive compensation in 2011 proxy statements. Similarly, a number of major mutual funds, as well as ISS and Glass Lewis, have indicated support for annual Say on Pay votes.

CAP Comment: Over time, we expect the prevalence of annual Say on Pay voting to increase.

CAP Comment: Following the frequency vote, the SEC rules mandate disclosure through an 8-K of how often the company will hold future Say on Pay votes. Issuers must also provide proxy-based disclosure of the current frequency of Say on Pay votes and when the next scheduled Say on Pay vote will occur.

CAP Comment: For companies that conduct Say on Pay vote frequency in line with the preference of a majority of shareholders, shareholder frequency proposals can be excluded from the proxy for six years.

Conclusion

Last year many questioned what level of shareholder support should be viewed as “acceptable.” Based on experience to date, the acceptable “threshold” will be around 80% support, a higher hurdle than simply a pass / fail test. This is somewhat higher than the minimums identified by ISS and Glass Lewis, and should be sufficient to avoid undue scrutiny of the compensation program.

Going forward, a Say on Pay vote will be an annual event at most companies. Our experience indicates that Sayon Pay voting has been a catalyst for change, and certain themes have emerged:

- Companies with stronger performance generally receive higher levels of shareholder support;

- Negative vote recommendations from the shareholder advisory firms will likely reduce the vote below the “acceptable” level and companies will need to campaign to obtain a positive voting outcome;

- Many companies have increased dialogue with their largest investors by engaging early;

- Say on Pay proposals include supporting statements;

- Use of executive summaries in the Compensation Discussion and Analysis (CD&A) of the proxy statement is commonplace; and

- Use of a proxy summary or potentially filing supplemental material to rebut negative voting recommendations should be considered.

1 Outside of the S&P 500, an additional 22 companies did not receive majority shareholder support for their NEO compensation program as of 5/25/2012: Actuant Corporation, Argo Group International, Cenveo, Charles River Laboratories, Chemed Corporation, Community Health Systems, Comstock Resources, First California Financial, FirstMerit Corp., Gentiva Health Services, Hercules Offshore, Infinera Corporation, KB Home, Knight Capital Group, Manitowoc Company, OM Group, Palomar Medical Tech., Phoenix Companies, Sterling Bancorp, The Ryland Group, Tower Group, and Viad Corp.

- Going forward, a Say on Pay vote will be an annual event at most companies

- A simple majority should not be considered a passing grade

- Companies with stronger performance generally received higher levels of shareholder support

- Say on Pay voting has already been a catalyst for change

As background, on January 25, 2011, the SEC issued final rules implementing Section 951 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”), which generally provides shareholders of US public companies with the right to cast three types of advisory votes related to executive compensation:

- A vote to approve the compensation of the Named Executive Officers (NEOs), effective for shareholder meetings occurring on or after January 21, 2011;

- A vote on the frequency with which shareholders should be entitled to cast Say on Pay votes (every one, two or three years), effective for shareholder meetings occurring on or after January 21, 2011; and

- A vote on golden parachute arrangements for NEOs related to a sale, consolidation or merger, effective April 25, 2011.

Say on Pay Frequency Vote Results (2011 Proxy Season)

An annual vote frequency has emerged as the clear shareholder preference. Among 93% of S&P 500 companies reporting vote results, a majority of shareholders supported annual Say on Pay vote frequency. This differs from vote recommendations, where only 68% of the companies had recommended an annual vote.

Company Recommendation (n=455)

| Vote Frequency | # of Companies | % of Companies |

| Annual | 310 | 68% |

| Bienniel | 13 | 3% |

| Triennial | 111 | 24% |

| No Recommendation | 21 | 5% |

Vote Results: Received Majority Shareholder Support (n=438)

| Vote Frequency | # of Companies | % of Companies |

| Annual | 409 | 93% |

| Bienniel | 1 | 0% |

| Triennial | 21 | 5% |

| None (only plurality)1 | 7 | 2% |

The strong support for annual votes is not a surprise. 39 institutional investors, representing more than $830 billion in assets, issued a public call for companies and investors to support annual advisory votes on executive compensation in 2011 proxy statements. Similarly, a number of major mutual funds have also indicated support for annual Say on Pay votes, and ISS’ policy recommends that shareholders support annual votes (Glass Lewis has indicated a similar preference).2

CAP Comment: Following the frequency vote, the SEC rules mandate disclosure of how often the company will hold future Say on Pay votes, generally through an 8-K. Issuers must also provide proxy-based disclosure of the current frequency of Say on Pay votes and when the next scheduled Say on Pay vote will occur.

CAP Comment: When companies conduct their Say on Pay vote in line with the frequency preferred by a majority of shareholders, they may exclude shareholder frequency proposals from the proxy for six years.

Say on Pay Vote Results (2011 Proxy Season)

Say on Pay resolutions received majority shareholder support at all but eight S&P 500 companies, with average support of 89% (most companies received greater than 80% support for their NEO pay program).3

| %inFavor | #of Companies | %of Companies | Average1-Yr TSR @12/31/10 | A “threshold” for acceptable passage rates seems to have emerged; to-date, results indicate this threshold is around 80% shareholder support. |

| 90%-100% | 274 | 62% | 25.2% | |

| 80%-90% | 73 | 17% | 24.3% | |

| 70%-80% | 43 | 10% | 16.5% | |

| 50%-70% | 40 | 9% | 7.4% | |

| 0%-50% | 8 | 2% | 9.6% |

As shown above, companies with stronger TSR on a 1-year basis generally received a higher level of support from shareholders on their executive pay programs.

CAP Comment: While a company does not “fail” its Say on Pay vote unless a majority of shareholders vote against the compensation program, many companies have received 90+% shareholder support and an “acceptable” shareholder support threshold has emerged around 80%. Below this level of support, we have found that there often is a notable level of shareholder discontent that should be carefully reviewed.

CAP Comment: While these votes are non-binding, we expect that most companies will carefully evaluate their vote results, taking some action if there is low shareholder support (not just in the limited cases where a majority of shareholders did not support the company’s executive compensation program).

CAP Comment: The final SEC rules require additional disclosure in the CD&A regarding whether, and if so how, companies have considered the results of the most recent Say on Pay vote.

CAP Comment: As a result of the Dodd-Frank legislation, the SEC will eventually adopt rules requiring proxy-based disclosure of the pay-for-performance relationship at each U.S. public company (rules currently schedule to be adopted during 2012).

The eight companies where a majority of shareholders did not support the executive compensation program, and the Say on Pay vote results for these companies, are:

| Company | 1-Yr TSR | % Votes in Favor |

| Hewlett-Packard | -17.7% | 48.2% |

| Freeport-McMoran Copper & Gold | 52.6% | 45.5% |

| Jacobs Engineering | 21.9% | 44.8% |

| Masco Corp. | -6.1% | 44.6% |

| Nabors Industries | 7.2% | 42.5% |

| Janus Capital Group | -3.2% | 40.1% |

| Constellation Energy Group | -10.3% | 38.0% |

| Stanley Black and Decker | 32.7% | 38.0% |

Impact of Proxy Advisor Recommendations

On average, shareholder support for Say on Pay votes was considerably lower when ISS recommended an “Against” vote to shareholders.4,5

|

|

|||||||||||||||||||||

CAP Comment: Where ISS recommended an “Against” vote for Say on Pay, 90% of companies received less than the 80% percent shareholder support threshold discussed above.

As shown below, companies that received an “Against” vote recommendation from ISS generally had lower TSR.

| ISS Vote Recommendation | # Companies that Passed | # Companies that Failed | Total | Average 1-Yr TSR @ 12/31/10 |

| For | 377 | 0 | 377 | 24.3% |

| Against | 53 | 8 | 61 | 10.3% |

| Total | 430 | 8 | 438 | 22.5% |

CAP Comment: Of the 438 companies reporting vote results, to-date, ISS recommended an “Against” vote for Say on Pay at 61 S&P 500 companies (14%). Only 8 of the 61 companies (13%) did not receive majority support for their Named Executive Officer compensation program.

Responding to Proxy Advisor Recommendations

Some notable companies took additional steps related to executive compensation during this proxy season, filing supplementary soliciting materials and/or making last minute modifications to their CEO pay program. Select examples include: General Electric, Disney, ExxonMobil, Johnson & Johnson, Hewlett-Packard, Lockheed Martin, and Northern Trust. While these filings were generally in reaction to negative vote recommendations from shareholder advisory services such as ISS, ExxonMobil went a step further by filing supplementary materials (essentially an executive pay brochure) on the same day as the proxy. ExxonMobil still received a negative vote recommendation from ISS, and later filed additional soliciting material rebutting ISS’ vote recommendation.

Conclusion

During the 2011 proxy season, a clear shareholder preference for annual Say on Pay votes emerged. In terms of the actual Say on Pay vote, an 80% threshold emerged as an “acceptable” level of shareholder support, a significantly higher hurdle than simple a pass / fail test.

Say on Pay has already been a catalyst for change. Companies are more willing to address controversial pay practices than they were a year earlier. Disclosure of executive compensation in proxy statements has evolved, and the influence of proxy/shareholder advisory services (such as ISS) has increased.

Looking forward, companies will need to carefully evaluate their Say on Pay vote result from the 2011 proxy season, and determine how to best incorporate any findings into planning for 2012.

1 None of the three frequency options (annual, biennial, or triennial) received majority support (greater than 50%).

2 For additional detail, see 12/5/10 CAPFlash: “ISS 2011 Policy Updates – Here Comes Say on Pay.”

3 Outside of the S&P 500, an additional 29 companies did not receive majority shareholder support for their NEO compensation program.

4 ISS refers to Institutional Shareholder Services, an influential proxy advisory service. Source of vote recommendations was ISS Voting Analytics.

5 Sample = 434 companies that filed vote results to-date.

Say on Pay Update

On January 25, 2011, the SEC issued final rules implementing Section 951 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”), which generally provides shareholders of US public companies with the right to cast three types of advisory votes related to executive compensation:

- A vote to approve the compensation of the Named Executive Officers (NEOs), effective for shareholder meetings occurring on or after January 21, 2011;

- A vote on the frequency with which shareholders should be entitled to cast Say on Pay votes (every one, two or three years), effective for shareholder meetings occurring on or after January 21, 2011; and

- A vote on golden parachute arrangements for NEOs related to a sale, consolidation or merger, effective April 25th, 2011.

To date, 419 of the S&P 500 companies included Say on Pay resolutions in either a preliminary or definitive proxy statement. Vote results from annual meetings are available for 290 of these companies.

CAP Comment: While these votes are non-binding, we expect that most companies will carefully evaluate their vote results, taking some action if there is low shareholder support (not just in the limited cases where a majority of shareholders did not support the company’s executive compensation program).

Say on Pay Frequency Vote Results

An annual vote frequency is emerging as the clear shareholder preference. Among 94% of S&P 500 companies reporting vote results, a majority of shareholders supported annual Say on Pay vote frequency. This differs from vote recommendations, where only 67% of the companies had recommended an annual vote.

| Company Recommendation (n=419) | ||

| Vote Frequency | # of Companies | % of Companies |

| Annual | 281 | 67% |

| Biennial | 13 | 3% |

| Triennial | 108 | 26% |

| No Recommendation | 17 | 4% |

| Vote Results: Received Majority Shareholder Support (n=290) | ||

| Vote Frequency | # of Companies | % of Companies |

| Annual | 272 | 94% |

| Biennial | 1 | 0% |

| Triennial | 12 | 4% |

| None (only plurality)* | 5 | 2% |

The strong support for annual votes is not a surprise. 39 institutional investors, representing more than $830 billion in assets, issued a public call for companies and investors to support annual advisory votes on executive compensation in 2011 proxy statements. Similarly, a number of major mutual funds have also indicated support for the annual Say on Pay votes, and ISS’ policy recommends that shareholders support annual votes (Glass Lewis has indicated a similar preference)[1].

CAP Comment: As the 2011 proxy season continues, we expect the prevalence of annual vote frequency recommendations to increase.

CAP Comment: Following the frequency vote, the SEC rules mandate disclosure through an 8-K of how often the company will hold future Say on Pay votes[2]. Issuers must also provide proxy-based disclosure of the current frequency of Say on Pay votes and when the next scheduled Say on Pay vote will occur.

CAP Comment: When companies conduct their Say on Pay vote in line with the frequency preferred by a majority of shareholders, they may exclude shareholder frequency proposals from the proxy for six years.

Say on Pay Vote Results

Say on Pay resolutions received majority shareholder support at all but five S&P 500 companies, with support ranging from 55% to 100%[3]. The five companies where a majority of shareholders did not support the executive compensation program were Hewlett-Packard, Jacobs Engineering, Janus Capital Group, Masco Corp. and Stanley Black & Decker.

| % in Favor | # of Companies | % of Companies |

| 90% – 100% | 192 | 66% |

| 80% – 90% | 43 | 15% |

| 70% – 80% | 26 | 9% |

| 50% – 70% | 24 | 8% |

| 0% – 50% | 5 | 2% |

CAP Comment: While a company does not “fail” its Say on Pay vote unless a majority of shareholders vote against the compensation program, an “acceptable” shareholder support threshold is likely to emerge. To-date, results indicate this threshold will be around 80% shareholder support.

CAP Comment: The final SEC rules require additional disclosure in the CD&A regarding whether, and if so how, companies have considered the results of the most recent Say on Pay vote.

Some notable companies have been proactive during this proxy season, filing supplementary soliciting materials. Select examples include: General Electric, Disney, ExxonMobil, Johnson & Johnson, Hewlett-Packard, and Northern Trust. While these filings were generally in reaction to negative vote recommendations from shareholder advisory services such as ISS, ExxonMobil went a step further by filing supplementary materials (essentially an executive pay brochure) on the same day as the proxy. ExxonMobil still received a negative vote recommendation from ISS, and later filed additional soliciting material rebutting ISS’ vote recommendation.

New Fidelity Compensation-Related Voting Guidelines

Fidelity recently released revised proxy voting guidelines that are effective immediately[4]. Our discussion below focuses on guidelines for Say on Pay proposals and new share requests[5].

Say on Pay Proposals

Fidelity will generally vote for proposals to approve executive compensation unless such compensation is misaligned with shareholder interests or otherwise problematic[6]. In determining any misalignment, Fidelity will take into account, among other factors, whether:

- A company has an independent Compensation Committee

- The Compensation Committee engaged independent compensation consultants

- The Compensation Committee waived equity vesting restrictions

- The company adopted or extended a golden parachute without shareholder approval[7]

Fidelity will also:

- Support annual advisory votes on executive compensation

- Generally vote against proposals to support golden parachutesix

Equity Plan Votes – New Share Requests

The guideline for determining votes related to new share requests is now based on a company’s three-year average burn rate, instead of the dilutive effect of the proposed plan (the basis for the previous guideline)[8]. The guidelines state that Fidelity will generally vote against approval of additional shares if a company’s three-year average burn rate exceeds certain caps.

| Companies | 3-Yr. Avg. Burn Rate |

| Large Capitalization (A company included in the Russell 1000 Index) |

1.5% |

| Small Capitalization (A company not included in the Russell 1000 Index that is not a Micro-Capitalization Company) |

2.5% |

| Micro Capitalization (A company with market capitalization below US $300 million) |

3.5% |

CAP Comment: Similar to the prior dilution caps, if a burn rate exceeds the caps Fidelity will consider circumstances specific to the company or plans that lead it to conclude the burn rate is acceptable; details on mitigating factors not yet available.

CAP Comment: While Fidelity will be reviewing historic burn rate, it is not clear if they will consider prospective burn rate in terms of how many years the shares are expected to last. A duration of greater than five years is considered problematic by ISS. Glass Lewis has a similar policy, but uses a three-to-four year threshold.

CAP Comment: The guidelines do not make allowances for companies in industry groups that have historically had higher burn rates, such as technology. In contrast, ISS does vary burn rate caps by industry.

CAP Comment: Unlike ISS, Fidelity will not use a multiplier for full-value awards in its burn rate calculation. Since the calculation does not differentiate stock option awards and full-value stock awards, it could encourage greater use of full-value stock awards and less use of stock options.

Additional equity plan voting guidelines include:

- Vote against equity plans where:

- Stock option exercise price is less than fair value on the grant date, unless the discount is 15% or less and is expressly granted in lieu of salary or cash bonus

- The plan’s terms allow repricing of underwater stock options

- The Board or Compensation Committee has repriced outstanding options in the past two years without shareholder approval

- Vote against equity plans that include an evergreen provision[9]

- Vote against equity plans that provide for acceleration of equity award vesting without an actual change-in-control occurring

- Require a restriction period of no less than three years for time-based share awards and a performance period of no less than one year for performance-based awards[10]

Conclusion

A clear shareholder preference for an annual Say on Pay vote frequency has emerged. In terms of the actual Say on Pay vote, it will be interesting to see what level of shareholder support becomes viewed as “acceptable,” likely a higher hurdle than simply a pass / fail test. Based on current results, the acceptable “threshold” will be near 80% support, but that may change as the proxy season continues. Differences among industries may also emerge.

Where Fidelity’s support is desired for Say on Pay votes or new share requests, it will be important to take their policies into account when: making compensation-related decisions, putting together the Compensation Discussion and Analysis, and preparing shareholder proposals (Say on Pay, new long-term incentive plans and/or share requests, etc.).

Please contact us at (212) 921-9350 if you have any questions about the issues discussed above or would like to discuss your own executive compensation issues. You can access our website at www.capartners.com for more information on executive compensation.

[1] For additional detail, see 12/5/10 CAPFlash: “ISS 2011 Policy Updates – Here Comes Say on Pay.”

[2] Required no later than 150 calendar days after the date of the annual meeting in which the vote took place, but in any event no later than 60 calendar days prior to the deadline for submission of Rule 14a-8 shareholder proposals for the subsequent annual meeting.

[3] Outside of the S&P 500, an additional 18 companies did not receive majority shareholder support for their NEO compensation program (as of 5/20/11): Ameron International, Beazer Homes, Cincinnati Bell, Cogent Communications, Curtiss-Wright, Dex One Corporation, Helix Energy Solutions, Hercules Offshore, Intersil Corp., M.D.C. Holdings, Navigant Consulting, NutriSystem, NVR, Inc., Penn Virginia Corporation, PICO Holdings, Shuffle Master, Stewart Information Services Corporation and Umpqua Holdings Corporation.

[4] Available at: http://personal.fidelity.com/myfidelity/InsideFidelity/InvestExpertise/governance.shtml.tvsr.

[5] The guidelines also cover additional compensation-related topics, such as: bonus plan proposals (162m), equity exchanges/repricings, and employee stock purchase plans.

[6] Fidelity funds sub-advised by Geode Capital Management LLC, which discloses its own set of proxy voting guidelines, will generally vote for proposals to approve executive compensation unless it believes the company has engaged in poor compensation practices (similar to Fidelity’s general guidelines) or provided poor compensation disclosure (different from Fidelity’s general guidelines).

[7] Fidelity defines a “golden parachute” as: “employment contracts, agreements, or policies that include an excise tax gross-up provision; single trigger for cash incentives; or may result in a lump sum payment of cash and acceleration of equity that may total more than three times annual compensation (salary and bonus) in the event of a termination following a change-in-control.”

[8]Fidelity funds sub-advised by Geode Capital Management LLC, which discloses its own set of proxy voting guidelines, will continue to focus on the dilutive effect of the plan; dilution may not be greater than 10% (15% for companies with a smaller market capitalization). If the plan fails this test, the dilution effect may be evaluated relative to any unusual factor involving the company.

[9] A feature which provides for an automatic increase in the shares available for grant under an equity plan on a regular basis.

[10] Shorter periods are permitted for up to 5% of a plan’s shares for Large-Capitalization companies (10% for Small- or Micro-Capitalization companies).

In addition, the SEC has provided an updated timeline for implementation of other key aspects of the Dodd-Frank legislation related to executive compensation, likely providing companies with additional time to comply with some of the potentially challenging aspects of the legislation.

Highlights of the Final Rules on Say on Pay and Say on Golden Parachutes

Under the Final Rules, the Effective Date for compliance with Say on Pay and the Say on Pay Frequency vote is listed as 60 days following publication in the Federal Register; however, companies that have not yet filed their 2011 proxy statements should comply with the Final Rules.

Advisory Vote on Say on Pay

As in the proposed rules, the final rules require companies to have a Say on Pay Vote in any proxy for an annual meeting after January 21, 2011 and to have additional votes at least once every three years. A key change in the final rules is that smaller issuers (i.e., public companies with less than $75 million in public equity float) have been provided with a two-year exemption from the Say on Pay and Say on Pay frequency votes. Consistent with the Proposed Rules, companies operating under TARP do not need to conduct the Say on Pay frequency vote until they have repaid TARP funds.

The Proposed Rules indicated that in future CD&A disclosure, companies would need to discuss how their compensation policies and decisions have been influenced by past Say on Pay votes. In the Final Rules, this has been clarified to specify that the mandatory disclosure is only for the most recent Say on Pay vote and that disclosure on earlier Say on Pay votes is only necessary to the extent material.

Aside from the above changes, most of the other changes from the Proposed Rules to the Final Rules are technical clarifications (e.g., clarify that the requirement is to have a vote once every three calendar years vs. by the third anniversary of the most recent Say on Pay vote). In addition, the SEC confirmed in the Final Rules that the Say on Pay Proposal and the Say on Pay Frequency Proposal do not trigger a preliminary proxy filing.

Vote on Frequency of Say on Pay Votes

The Final rules on the frequency of Say on Pay votes confirm that shareholders will have to be provided with four choices on frequency:

- Every year

- Every two years

- Every three years

- Abstain

Under the Proposed Rules, companies were required to disclose the frequency with which the company expects to conduct future Say on Pay votes and how it relates to the results of the shareholder vote in the 10-Q or 10-K covering the period in which the shareholder advisory vote occurred. The Final Rules have made a modification to provide companies with more time. Instead of disclosure in a 10-Q or 10-K, they will be required to disclose the frequency of future Say on Pay votes in a new required 8-K disclosure (as an amendment to the prior 8-K filings disclosing the preliminary and final results of the shareholder votes on frequency). The new 8-K will be due no later than 150 calendar days after the date of the vote and no later than 60 days before its next annual proxy meeting filing is due.

In the Proposed Rules, separate shareholder proposals on Say on Pay or Say on Pay frequency could be excluded from the proxy statement provided that the company’s policy was consistent with plurality of votes cast in the most recent vote. The Final Rules strengthened the standard to allow separate Say on Pay or Say on Pay Frequency proposals to be excluded only if the company adopts a Say on Pay frequency consistent with the majority of shareholders. As a result, in cases where no majority emerges in the Say on Pay Frequency vote, separate proposals on Say on Pay and Say on Pay Frequency will not be able to be excluded.

Finally, consistent with the Proposed Rules, companies participating in TARP (which are required to conduct a Say on Pay vote annually) will not be required to conduct a vote on the frequency of the Say on Pay vote until the shareholder meeting immediately following the repayment of TARP funds.

Highlights of the Guidance on Say on Parachutes

The SEC’s Final Rules for new enhanced disclosure of golden parachute payments and an advisory vote on parachute payments closely comply with the Proposed Rules. One key change in the Final Rules is that the effective date is established for merger filings on or after April 25, 2011. It should also be noted that there is no small company exception for the disclosure of golden parachute payments and advisory vote on parachute payments.

Disclosure of Golden Parachute Payments

Consistent with the Proposed Rules, the Final Rules will require tabular disclosure of the following elements related to Golden Parachute payments for each Named Executive Officer:

- Cash severance payments

- Dollar value of accelerated stock awards, in-the-money value of options accelerated, and payments to cancel stock or options

- Pension and deferred compensation enhancements

- Perks and benefits

- Tax reimbursement and gross-up payments

- Other

- Total

A change from the Proposed Rules is that in the Final Rules, for elements that are based on the transaction stock price, the value will be based on the consideration per share in the transaction (where applicable) or the average closing day price for the 5 days immediately following the announcement of the transaction.

Say on Golden Parachute Payments

Consistent with the Proposed Rules, the Final Rules require a separate non-binding shareholder advisory vote on golden parachute compensation, to the extent not previously subject to a prior general Say on Pay vote. In order to ensure that parachute payments are subject to the general Say on Pay vote, companies will have to disclose golden parachute compensation in their proxy statements with the new tabular disclosure and enhanced narrative disclosure of golden parachute payments. In addition, if any changes are made to the golden parachute payments following the most recent vote, the company will have to hold a subsequent vote on golden parachutes. It should be noted that in the Final Rules, the SEC has specified that an additional vote will not be required if the changes to golden parachute payments decrease the value of the parachute payments.

SEC Timing Updates

In order to fully implement Dodd-Frank, the SEC needs to develop rules governing several aspects of the legislation impacting executive compensation. Based on a recent status update from the SEC, the anticipated timing of when rules will be issued has been pushed back in many cases. The table below provides a summary of the current status.

| Proposed Rules | Adopt Final Rules | |

| Compensation Committee and Advisor Independence | January-March, 2011 | April – July, 2011 |

| Disclosure of pay-for-performance, pay ratios, and hedging by employees and directors |

August – December, 2011 | TBD |

| Clawbacks | August – December, 2011 |

TBD |

Based on the updated schedule, it is not clear that many of these items will be implemented in time for the 2012 proxy statements for calendar fiscal year end companies.

Conclusion

The Final Rules are largely consistent with the Proposed Rules. Most companies are already well on their way in the process of putting together their Say on Pay proposals and Say on Pay frequency recommendations and the Final Rules should not have much of an impact on their decision making.

The Final Rules covering increased disclosure of Golden Parachute Payments and Say on Golden Parachutes are largely consistent with the Proposed Rules. We expect that most companies will not adopt the enhanced disclosure of Golden Parachute Payments, as they are likely to have to conduct an additional shareholder vote on Golden Parachute Payments at the time of a transaction that triggers payments in any case.

The delay in the SEC’s schedule will likely be welcomed by companies, so long as it results in a delay for implementation beyond the 2012 proxy season for the new pay-for-performance and pay ratio disclosure. Given the potential challenges in implementing the these aspects of Dodd-Frank, we expect that it would be very difficult for calendar year companies to comply in their 2012 proxy statements, unless final rules were provided before the end of 2011.

Please contact us at (212) 921-9350 if you have any questions about the issues discussed above or would like to discuss your own executive compensation issues. You can access our website at www.capartners.com for more information on executive compensation.