On December 18, 2018, the SEC adopted new rules that will require disclosure of a company’s hedging policy. The hedging policy was initially proposed by the SEC on February 9, 2015 under Section 955 of the Dodd-Frank Wall Street Reform and Consumer Protection Act. It requires companies to disclose in the proxy (or information statements relating to the election of directors), any practices or policies regarding the ability of employees or directors to engage in certain hedging transactions with respect to company equity.

The rules become effective beginning with proxy statements filed for the first fiscal year beginning on or after July 1, 2019 and apply to all publicly traded U.S. companies (other than foreign private issuers and listed closed-end funds). Smaller reporting companies and emerging growth companies will have an additional year to comply.

The final rules are consistent with much of the original proposal from four years ago, with key changes noted below:

- Companies are required to describe any practices or policies they have adopted regarding the ability of its employees, officers or directors to purchase securities or other financial instruments, or engage in transactions, that hedge or offset any decrease in the market value of equity securities granted as compensation, or held directly or indirectly by the employee or director

- Companies can satisfy the disclosure requirements by either providing a fair and accurate summary of the hedging practices or policies that apply, including the categories of persons they affect and any categories of hedging transactions that are specifically permitted or specifically disallowed, or, alternatively, by disclosing the practices or policies in full

- If the company does not have any such practices or policies, the company must disclose this fact or state that hedging transactions are generally permitted

These requirements are different from the proposed rules which only required a company to disclose whether they permitted employees and directors to hedge.

For most companies, the impact of the rules may likely require only slight modification to existing disclosure, given that many public companies already disclose hedging policies on a voluntary basis.

Click on this link to see the final SEC rule and this link for the press release.

In anticipation of the SEC’s upcoming “Roundtable on the Proxy Process,” the SEC has withdrawn letters issued in 2004 to Egan-Jones Proxy Services and Institutional Shareholder Services, Inc. (ISS) that many argue were responsible for entrenching the influence of shareholder advisory firms. The SEC’s roundtable is expected to be held in November 2018, and more recommendations to the Commission regarding proxy advisory firms from investment advisors and corporate issuers may result.

On Thursday, September 13th, the SEC’s Division of Investment Management released this statement: “(it) has been considering (among other topics) whether prior staff guidance about investment advisers’ responsibilities in voting client proxies and retaining proxy advisory firms should be modified, rescinded or supplemented.” The statement went on to assert that “staff guidance is nonbinding and does not create enforceable legal rights or obligations.” Under this rationale and with the upcoming roundtable in mind, the letters were withdrawn to encourage and facilitate debate on the most appropriate role for the proxy advisory firms.

How did we get here?

In 2003, the SEC issued rules which required mutual funds and investment advisors to design and implement policies and procedures intended to ensure that proxies are voted in the best interests of their clients, i.e. to avoid a conflict of interest influencing decisions made on their behalf. In 2004, Commission staff issued the now withdrawn letters which allowed the outsourcing of fiduciary obligation of investment advisors to independent proxy advisory firms. This allowed advisors to rely on proxy advisory firm recommendations to fulfill their fiduciary responsibility to clients. Since then, we have witnessed the significant increase in power and influence of companies like ISS and Glass Lewis, the leading proxy advisory firms. For example, today an ISS “Against” recommendation on a Say on Pay proposal will typically reduce shareholder support by about 30%.

Proxy advisory firms play an important role in developing acceptable governance practices for companies and boards. Yet they are often criticized for applying a rigid, “one size fits all” model to companies across all industries that often disregard market conditions. While there are instances where recommendations against compensation programs and the directors responsible for them are warranted, this cookie cutter approach has led to some unfair recommendations. Companies are then left scrambling to respond, trying to draw attention to faulty analysis and salvage the shareholder vote. The frustrations produced in these instances are amplified further by the apparent conflict of interest that arises when the proxy advisory firm responsible for the “against” vote recommendation charges fees for consulting services intended to avoid similar outcomes in the future.

Impact of the Withdrawal?

While the withdrawal of these letters does little other than provide a clean slate for an open discussion in the fall, it feels like a solid punch landed for those in the corporate community lobbying for greater oversight of the proxy advisory firms. House Financial Services Committee Chairman Jeb Hensarling, R-Texas, welcomed the move this week saying, “The proxy advisory firm duopoly is in serious need of reform and SEC attention. The market power of proxy advisory firms demands greater accountability for these firms’ actions and the information that they provide institutional investors.”

In response, both ISS and Glass Lewis issued public statements that they have never relied upon these no-action letters and the withdrawal has no impact on the services they are providing or how investors use their advice.

We anxiously await the discussion at the SEC’s roundtable in November. Perhaps the withdrawal of these letters will lead to a renewed and meaningful discussion on an appropriate level of oversight, transparency, and accountability of proxy advisory firms that ultimately strengthens corporate governance.

On August 21, 2018, the IRS issued long-awaited guidance on the amendment of Section 162(m) made in the Tax Cuts and Jobs Act (TCJA).

This initial guidance is limited in scope and intended to respond to comments requesting clarification on the amended rules for identifying covered employees and the operation of the grandfather rule applicable to written binding contracts in effect before November 2, 2017. The initial guidance contains commentary, as well as numerous examples, on:

- The definition of publicly held corporations covered by Section 162(m);

- The definition of covered employees;

- The definition of applicable employee remuneration;

- The grandfather rule for compensation arrangements made under a written binding contract; and

- Material modification of written binding contracts.

Highlights

The most important highlights include:

- The definition of publicly held corporations covered by Section 162(m) is broadened.

- The definition of covered employees is modified to better align with current proxy disclosure rules, although differences continue to exist primarily because the “end-of-year” requirement is eliminated for purposes of Section 162(m).

- The definition of covered employees is expanded to include chief financial officers, former covered employees and payments to a covered employee’s heirs and estate.

- The tax deductibility of compensation is preserved if the compensation is paid under a written binding contract in effect on November 2, 2017 and not materially modified after that date.

- The ability to use negative discretion to reduce compensation under such an arrangement is likely sufficient to limit tax deductibility, since the contract is not binding. We expect companies to test this concept in the courts over time.

- A material modification increases compensation, or provides additional compensation, on substantially the same elements or conditions.

- Additional payments equal to or less than reasonable cost of living adjustments do not result in a material modification.

Amendments to the Definition of Publicly Held Corporation

The TCJA amendment broadened the definition of publicly held corporations covered by Section 162(m). Rather than limiting the scope to companies issuing common equity securities, the new definition includes “any corporation:

- Which is an issuer the Securities of which are required to be registered under section 12 of the Securities Exchange Act of 1934 (the 1934 Act), or

- That is required to file reports under section 15(d) of the 1934 Act.”

The new definition expands coverage to companies issuing various equity securities and publicly traded debt, as well as companies that may be otherwise exempt from filing a proxy statement. For example, the executive officers of a public company that delists its securities, thus eliminating the requirement to file a proxy statement and disclose executive compensation, would be covered employees for tax purposes and subject to the amendment’s limits on tax deductibility.

Amendments to the Definition of Covered Employee

Under the TCJA, the definition of covered employees is modified to better align with current proxy disclosure rules. Under the new definition, a covered employee means “any employee if:

- Such employee is the principal executive officer (PEO) or principal financial officer (PFO) of the taxpayer at any time during the taxable year, or was an individual acting in such a capacity,

- The total compensation of such employee for the taxable year is required to be reported to shareholders under the 1934 Act by reason of such employee being among the three highest compensated officers for the taxable year other than any individual described in (a), or

- Such employee was a covered employee of the taxpayer (or any predecessor) for any preceding taxable year beginning after December 31, 2016.”

Importantly, the initial guidance clarifies that a covered employee is not limited to only those serving in their role at the end of the year. By eliminating the end-of-year requirement, disconnects between the individuals reported in the proxy statement and actual covered employees may occur. The IRS notes that SEC rules do not constitute the sole basis for interpreting Section 162(m).

By including covered employees for any preceding taxable year beginning after December 31, 2016, the initial guidance clarifies that the pre-amendment rules for identifying covered employees will apply for taxable years beginning during 2017. These employees will be wrapped in under the amendment, with tax deductibility strictly limited beginning in taxable years beginning in 2018 and beyond.

Amendment to the Definition of Applicable Employee Remuneration

Applicable employee remuneration was defined, under Section 162(m), as the total amount allowed to be deducted for the tax year. Prior to the amendment to Section 162(m), applicable employee remuneration excluded commission-based and qualified performance-based compensation. The amendments to Section 162(m) removed these exclusions from the definition. The Act also added a rule that limits the deductibility of applicable employee remuneration even if the compensation is paid to a beneficiary in the event of the death of a covered employee.

Application of the Grandfather Rule

The amendment to Section 162(m) allows for the tax deductibility of compensation to be preserved (in other words “grandfathered”) if the compensation is paid under a written binding contract in effect on November 2, 2017 and not materially modified after that date. The initial guidance preserves the pre-amendment definitions of “written binding contract” and “material modification” as first detailed in the original 1993 grandfather rules included when Section 162(m) was added to the Internal Revenue Code.

Written Binding Contract

The initial guidance defines a written binding contract as a contract that requires the company under applicable law (for example, under state law) to pay compensation if the employee performs services or satisfies the vesting conditions attached to the compensation. If a contract contains elements that are binding and other elements that are discretionary, the amounts that are binding will continue to be deductible under the grandfather rule, absent a material modification, and the discretionary amounts will be subject to the amendment's limits on tax deductibility and not grandfathered.

Grandfathering is not available to contracts that are renewed after November 2, 2017. Instead, these are treated as new contracts. If a company has the right to cancel or terminate a contract without the executive’s consent after November 2, 2017, the loss of grandfathering occurs as of that date and the amendment’s limits on tax deductibility apply at that point and going forward. One common scenario plays out when a contract contains a notice period. For example, if a company can give notice of non-renewal after a defined initial term ends, or annually thereafter, the contract is treated as a new contract when the notice period ends or upon renewal, if earlier.

There are important caveats to this rule to keep in mind. If a contract can only be cancelled or terminated by ending the employment of the executive, the contract does not lose grandfathered status. Similarly, if the executive has the unilateral right to cancel the contract after a certain date but chooses not to do so, the contract does not lose grandfathered status after this date.

Consensus has developed that the ability of the board or compensation committee to exercise negative discretion and adjust payments down to zero makes a compensation plan or arrangement non-binding. This results in a loss of grandfathering and limits on tax deductibility under the amendment to Section 162(m).

We expect this position to be tested by issuers in tax court and/or state court. For example, if performance metrics and targets are clearly articulated in a contract or award agreement and the company has no history of actually applying negative discretion, a case could be made that the executive has a valid claim to receive that compensation. We will monitor developments on this point, since negative discretion is built into the majority of executive incentive plans.

Finally, if a compensation plan or arrangement is binding, the amount that is required to be paid as of November 2, 2017, will be grandfathered with no loss of tax deductibility, provided the executive was employed on that date by the corporate sponsor or the employee had a written binding contract as of that date. Supplemental executive retirement plan (SERP) benefits are a good example of this. If an executive has a binding right to receive SERP benefits, the accrued benefit as of November 2, 2017 will continue to be deductible when paid in the future, while amounts accrued for service after that date will be subject to the amendment’s limits on tax deductibility.

Material Modification

The IRS defines a material modification as an amendment that increases the amount of compensation payable to the executive, or provides additional compensation, on substantially the same elements or conditions. If a material modification occurs, amounts received prior to the date of the modification are grandfathered and amounts received after that are not grandfathered, but rather subject to the amendment’s limits on tax deductibility.

Another aspect identified by the IRS as a material modification to a written binding contract includes the acceleration of the timing of a payment unless the payment is discounted to reasonably account for receiving the compensation early. The IRS notes that modifying a contract to defer a payment does not constitute a material modification as long as the excess amount payable is based on a reasonable rate of interest or the rate of return of a predetermined investment.

The adoption of a supplemental contract that increases compensation or provides for an additional payment is a material modification, when the facts and circumstances demonstrate that the “compensation is paid on the basis of substantially the same elements or conditions as the compensation that is otherwise paid pursuant to the written binding contract.”

On the other hand, companies may increase compensation to offset the impact of cost-of-living without loss of grandfathering. The guidance clarifies that an additional payment that is less than or equal to a reasonable cost- of-living increase (for example, a modest salary increase) would not be a material modification.

Effective Date

According to the guidance, the amendment to Section 162(m) applies to taxable years beginning on or after January 1, 2018. The regulators anticipate that the guidance will be incorporated in future regulations and will apply to taxable years ending on or after September 10, 2018. The IRS also notes that any future guidance or regulations that address issues covered in the guidance that would broaden the definition of covered employee or limit the definition of written binding contract would apply prospectively only.

IRS Request for Comments

Treasury and the IRS expect to issue additional guidance on Section 162(m) and is requesting comments on other aspects of the amendments to Section 162(m) that should be addressed. These include a number of highly technical points, such as:

- The definition of “publicly held corporation” applicable to foreign private issuers,

- The definition of “covered employee” to an employee who was a covered employee of a predecessor of the publicly held corporation,

- The application of Section 162(m) to corporations immediately after an initial public offering or a similar business transaction, and

- The application of the SEC executive compensation disclosure rules for determining the three most highly compensated executive officers for a taxable year that does not end on the same date as the last completed fiscal year.

Written comments are being requested through November 9, 2018.

Conclusion

The IRS has provided initial guidance on key questions from practitioner after the TCJA passed. Plenty of examples as to how the new rules would be applied going forward are provided. However, the guidance is complex. Companies should evaluate how the rules apply by consulting internal and external subject matter expert that understand compensation, as well as the tax and legal perspectives. We will keep clients informed as consensus develops on various aspects of the guidance and as the IRS issues further guidance on Section 162(m).

Nearly three months after President Trump signed the Tax Cuts and Jobs Act (“Tax Reform”) into law, company management, Compensation Committees, and outside advisors have been evaluating the impact the notable changes to Internal Revenue Code Section 162(m) (“Section 162(m)”) will have on executive compensation.

Tax Reform now eliminates the loophole of exceptions of performance-based pay and expands the list of “covered employees.” With these changes, companies face the challenge of understanding what impact this will have on their executive compensation programs, often specifically designed to qualify for the performance-based tax deduction, and the loss of tax deductibility.

Section 162(m) was first passed into law in 1993, with the intent to rein in executive compensation by eliminating the tax deductibility of executive compensation above $1 million for “covered employees”, effectively named executive officers (NEOs), unless the compensation was performance-based. The purpose of the tax law was to “punish” firms paying excessive executive compensation; however unforeseen was the performance-based loophole that has led to the unintended consequence of increased executive compensation post-1993.

Flash forward to 2018; 25 years later, Tax Reform now eliminates the loophole of exceptions of performance-based pay and expands the list of “covered employees.” With these changes, companies face the challenge of understanding what impact this will have on their executive compensation programs, often specifically designed to qualify for the performance-based tax deduction, and the loss of tax deductibility.

This article explores CAP’s perspective on the implications of these significant changes on compensation programs in 2018 and beyond.

Highlights of the Changes to Section 162(m)

Change: The new rule expands coverage to include any person serving as the Chief Executive Officer (CEO) and Chief Financial Officer (CFO) during the tax year, as well as the three highest paid executive officers other than the CEO and CFO (commonly referred to as NEOs). If a “covered employee” is paid $1 million a year in base salary, that is all the company will be able to deduct and annual performance-based bonuses, stock options, performance-based equity and deferred compensation will no longer be deductible.

Previously, a covered employee was an employee who, on the last day of the company’s fiscal year, was the CEO and the highest four paid executive officers. The CFO was excluded due to a change in the SEC’s definition of an NEO in 2006. Under the Tax Reform, CFO’s will be considered a covered employee as SEC and Section 162(m) rules now align.

CAP Perspective on Incentive Plan Design: We do not expect wholesale changes to compensation arrangements for executives.

The table below highlights the potential impact on the three major elements of pay for executives.

|

Pay Element |

Impact on Plan Design |

|

Salary |

|

|

Annual Incentive |

|

|

Long-Term Incentive (LTI) |

|

CAP Perspective on Administrative Requirements: Going forward, companies no longer need to follow certain administrative requirements around incentive plans and may need to revisit severance payment timing as certain practices were adopted based on the old tax code.

Additionally, once an executive is a covered employee, they will always be considered a covered employee, even if they appear in the proxy for just one year. Thus, compensation of covered employees for all future years of employment will be impacted, potentially creating an ever-growing group of covered employees subject to the $1 million cap.

The table below highlights the potential impact on these three key areas.

|

Administrative Requirements |

Impact on Plan Design |

|

Incentive Plans |

|

|

Severance Payments |

|

|

List of Covered Employees |

|

Change: Tax Reform included some transition relief. The elimination of the performance-based exception applies to taxable years beginning after December 31, 2017. However, the changes do not apply to compensation provided pursuant to a written binding contract in effect as of November 2, 2017, and are not “modified in any material respect” as of November 2, 2017.

CAP Perspective: Under the “transition rule,” deductibility is preserved for compensation provided under a written binding contract in effect as of November 2, 2017, as long as there is not a subsequent material modification. At this time, it is not clear how the transition rule will be interpreted and implemented. While we await further clarification, companies will have to evaluate if they plan to claim a tax deduction under the transition rule based on the limited guidance provided to date, and the specific facts related to the grants / award agreements. During this waiting period, companies should carefully consider any changes to existing arrangements, including outstanding long-term incentive grants, as they could disqualify those arrangements from being grandfathered under the transition rule.

Change: Prior to Tax Reform, under Section 162(m) the definition for “outside directors” was different than the stock exchange rules of “independent directors.” The difference is that a former officer could never be considered an outside director but can be independent.

CAP Perspective: The Compensation Committee can now include independent directors who are not “outside directors”. We are not seeing companies make changes at this time, as they still need to approve (outstanding) payouts that are grandfathered under annual incentive or performance-based plans. However, we still expect the Compensation Committee to be comprised of “outside directors” given the independence factors. Companies may want to amend Compensation Committee charters to remove any references to Section 162(m) outside director or procedural requirements.

Planning for 2018 and Beyond

Beginning in 2018 companies will lose the tax deduction on compensation over $1 million for covered employees; however, the reduced corporate tax rate will provide an offset to the lost deduction. As companies evaluate the effect of the lost tax deduction and full impact of Tax Reform on their compensation programs, we would recommend companies to work with outside advisors to determine the impact the changes will have their compensation program design, particularly grandfathered performance-based compensation arrangements.

Companies should await further guidance from the IRS, proxy advisory firms and stock exchanges before making substantial changes to their compensation programs. Any change should ensure the appropriate behaviors and results are being rewarded, performance targets are reflective of the long-term strategy, and incentive plan design supports current business needs, while considering good governance practices.

Compensation Advisory Partners (CAP) reviewed executive compensation pay levels and trends at 50 companies (Early Filers) that filed their most recent proxy statement between November 2017 and January 2018 (fiscal year ends from July 2017 to October 2017; 35 companies have September 30 fiscal year ends). Industry sectors reviewed include: Consumer Discretionary, Consumer Staples, Financials, Health Care, Industrials, Information Technology and Materials. Among these 50 companies, median Revenue was $7.5B, median Market Capitalization (based on each company’s fiscal year-end) was $13.0B and 1-year Total Shareholder Return, or TSR (based on each company’s fiscal year-end) was 19.3%.

Overall Findings

Performance: 2017 performance (based on Revenue growth, EBIT growth, EPS growth and 1-year TSR) was strong. Revenue and EBIT grew by approximately 6%, EPS was up 4% and TSR was up nearly 20% vs. prior year.

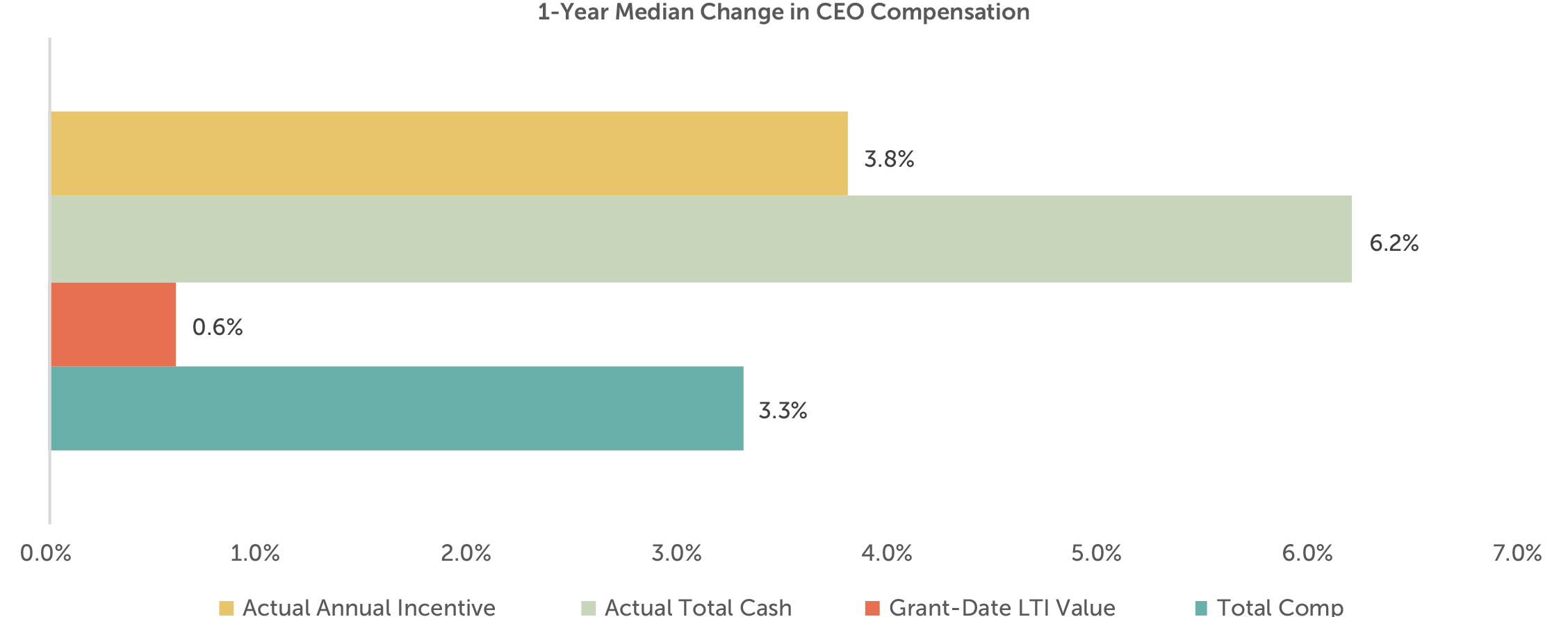

CEO Pay: Median CEO pay increased slightly by 3.3% mainly driven by actual annual incentive payouts. The grant date value of long-term incentives (LTI) was generally flat.

Annual Incentive Payout: Overall, the median 2017 annual incentive payout was 115% of target, reflective of strong financial performance.

2017 Performance

CAP reviewed Revenue growth, EBIT growth, EPS growth and TSR performance for the Early Filer and the S&P 500 companies. Overall, 2017 median performance for Early Filers was strong. Revenue and EBIT grew approximately 6%, EPS grew around 4% and TSR was up nearly 20%. TSR among the Early Filers showed double-digit growth for the second year in a row; this growth is due to strong financial performance as well as market expectations around tax reform in light of the current political climate.

| Financial Metric (1) | 2016 Median 1-year Performance | 2017 Median 1-year Performance | ||

| S&P 500 | Early Filers | S&P 500 | Early Filers | |

| Revenue Growth | 2.1% | 2.0% | 6.3% | 5.7% |

| EBIT Growth | 2.2% | 7.6% | 6.6% | 6.0% |

| EPS Growth | 4.2% | 5.2% | 9.9% | 3.9% |

| TSR | 3.3% | 18.4% | 17.0% | 19.3% |

(1) TSR and Financial performance for the S&P 500 is as of September 30, 2016 and September 30, 2017. Financial performance and TSR for Early Filers is as of each company’s fiscal year end.

CEO Total Direct Compensation

Among Early Filers with CEOs in their role for at least two years (n=39), median total direct compensation increased 3.3%. This increase was mainly due to higher actual annual incentive payouts in 2017; the grant-date value of LTI was generally flat year over year. Actual annual incentive payout was up nearly 4% reflective of strong financial performance while LTI, the largest component of CEO pay, was up only 1%. Median base salary for CEOs in our sample was unchanged from 2016.

Annual Incentive Plan Payout

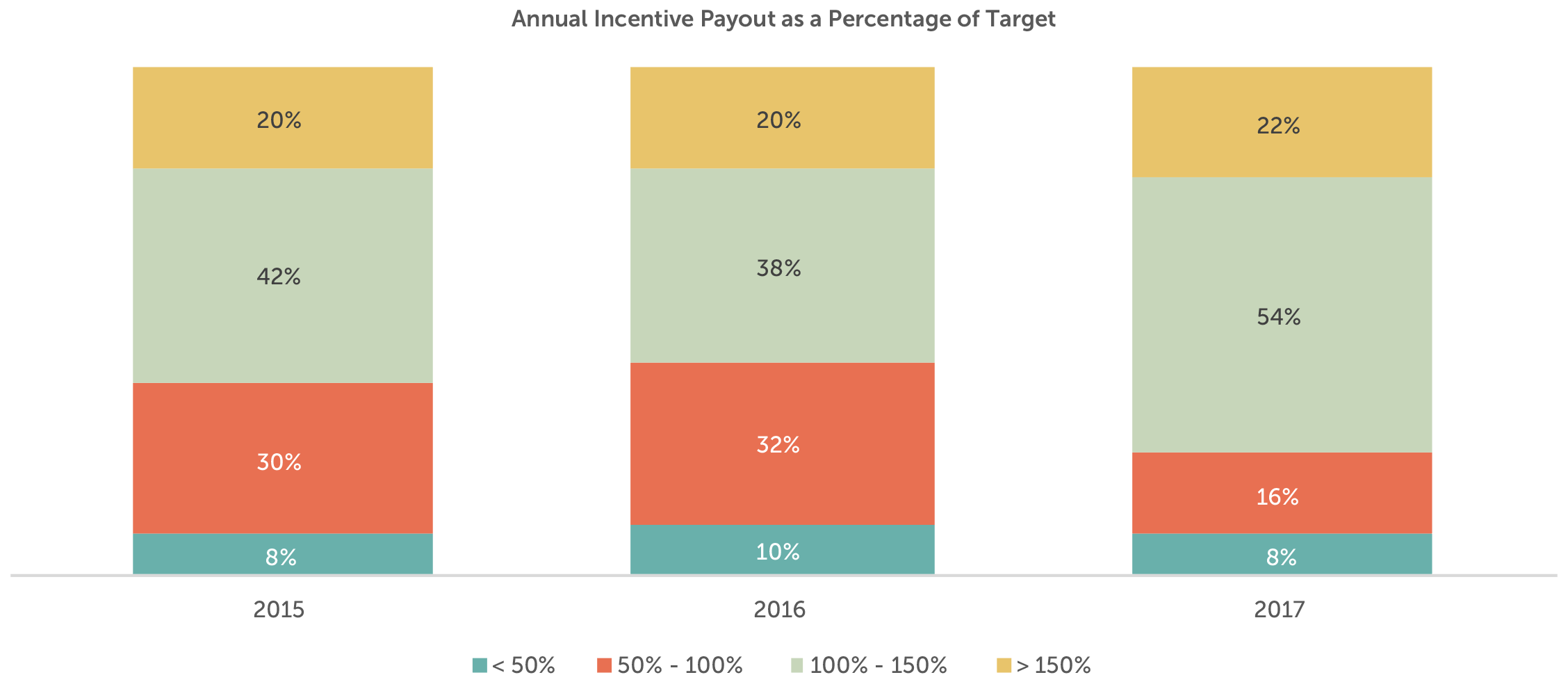

The median actual annual incentive payout in 2017 was 115% of target, higher than the median payout in 2016 of 106% of target. In fact, the 25th percentile bonus payout in 2017 was at target, noticeably higher than last year (86% of target).

| Summary Statistics | Annual Incentive Payout as a % of Target | ||

| 2015 | 2016 | 2017 | |

| 75th Percentile | 134% | 141% | 147% |

| Median | 106% | 106% | 115% |

| 25th Percentile | 97% | 86% | 100% |

Performance for companies with at or above target annual incentive payouts was substantially stronger than that of companies with below target payouts. Companies with payouts at or above target had strong EPS (10.9%) and TSR (23.2%) growth and solid Revenue (6.3%) and EBIT (7.2%) growth. Performance for companies with below target payouts was flat or declining from prior year.

| Financial Metric (1) | 2016 Median 1-year Performance | 2017 Median 1-year Performance | ||

| Below target payout (n=21) | At/above target payout (n=29) | Below target payout (n=12) | At/above target payout (n=38) | |

| Revenue Growth | (0.7%) | 3.0% | 2.1% | 6.3% |

| EBIT Growth | (2.8%) | 15.9% | 1.0% | 7.2% |

| EPS Growth | (3.9%) | 16.9% | (4.3%) | 10.9% |

| TSR | 16.9% | 19.6% | (3.9%) | 23.2% |

(1) Financial performance and TSR is as of each company’s fiscal year end.

76% of companies in 2017 provided a payout at or above target which is considerably higher than 2016 and 2015 (58% and 62%, respectively). In 2017, significantly more companies provided a payout between 100 – 150% of target than below target. This distribution is more evenly split in prior years. The distribution of payouts in 2017 aligns with stronger overall performance than 2016 and 2015.

Incentive Plan Design

Among Early Filers, 75% of companies use 2 – 3 financial metrics in the annual incentive plan and nearly 83% use 1 – 2 measures in the LTI plan. Metrics in the annual incentive plan typically focus on growth and profitability, while LTI plans are more likely to reward executives based on profits, return measures or stock price performance. A growing number of companies are beginning to use non-financial strategic goals, primarily diversity and inclusion and creating a more engaged workforce, in the annual incentive plan design. With the recent amendment to 162(m) due to the Tax Cuts and Jobs Act, we anticipate more companies will use strategic measures and individual objectives to reward executives in the future.

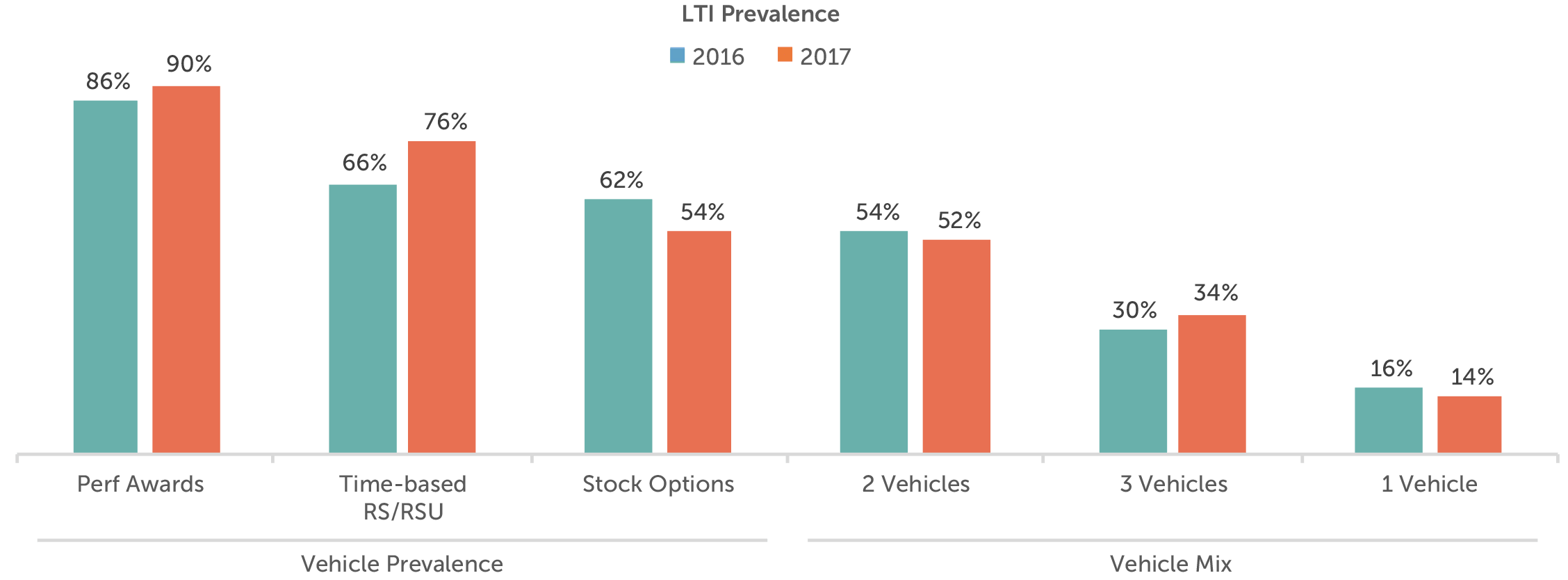

As performance-based compensation continues to be championed by both shareholders and proxy advisory firms, the use of performance-based LTI continues to be very prevalent. Performance plan usage remains high, at 90% of Early Filers. Option use declined among the Early Filers (54% down from 62%) and shifted to use of restricted stock.

TSR continues to be the most prevalent LTI metric, with approximately 60% of companies using a performance-based plan with this metric. Of the companies that use TSR, 25% use it as a modifier, 50% use it as a stand-alone metric in conjunction with a financial measure and 25% use it as the sole measure. The prevalence of TSR as the sole measure has decreased somewhat over the last several years as companies use a balanced approach to reward executives for long-term financial and stock price results. We anticipate its usage as a sole measure to plateau or continue to decline particularly given ISS’ recent shift towards the use of other financial measures in its quantitative pay for performance assessment (ISS and Glass Lewis Policy for the 2018 Proxy Season).

Governance Practices

Over the last decade, many companies adopted good governance practices. Increased scrutiny from shareholders and proxy advisory firms has quickened the pace with which companies incorporated clawback, or recoupment, policies as well as hedging and pledging policies. It is no surprise that more than 90% of companies in our sample have a clawback policy in place. 85% of companies also have implemented hedging and pledging policies for their executives.

Nearly all companies (96%) in our sample have stock ownership guidelines in place; these guidelines encourage executives to hold a meaningful equity stake and align with shareholder interests. The guideline is most commonly expressed as a multiple of salary, with a median CEO multiple of 5x base salary and other NEOs with a multiple of 3x base salary. About one-third of companies also require executives to hold stock (typically 50 – 100% of net shares received) until stock ownership guidelines are met. It is less common for companies to require executives to hold shares for a period of time (e.g., 1 year) in lieu of stock ownership guidelines. Good governance practices continue to be a focus of shareholders, and companies are routinely implementing and updating policies as appropriate in the current regulatory environment.

Conclusion

2017 was a year of strong financial performance for the Early Filers, which resulted in above target annual incentive payouts for approximately 75% of companies. CEO actual total cash compensation increased by 6%, and when combined with generally flat LTI award values, total pay increased by 3%.

2018 will be the first performance year after the passage of tax reform. We do not expect companies to unwind their use of performance-based pay and good governance practices, yet we foresee greater use of individual and strategic performance measures, along with increased use of discretionary pay decisions, in moderation.

For questions or more information, please contact:

Lauren Peek Principal

[email protected] 212-921-9374

Joanna Czyzewski Associate

[email protected] 646-486-9746

Melissa Burek Partner

[email protected] 212-921-9354

Effective January 1, 2018, California joined a handful of other cities and states to pass a law barring employers from seeking previous salary information from prospective employees or relying on previous salary information when making an offer. Assembly Bill 138 (“AB 138”) specifically prohibits employers from requesting previous salary information about prospective employees during any point in the pre-employment process, including during application, interview, and job offer and salary negotiations.

This prohibition includes utilizing outside agents to procure said salary information. Exceptions are made for government employees whose salary is already public record. Additionally, AB 138 requires California employers to provide pay scale information to prospective employees upon “reasonable request.”

The passage of AB 138 follows the start of a larger trend toward legislation intended to support pay equality and transparency. AB 138, and similarly designed legislation, aims to prevent continuous, inadvertent pay discrimination by obligating companies to pay salaries based upon skill, experience and current company pay ranges. The legislation also aims to create greater pay transparency, granting prospective employees valuable salary information to utilize during the negotiation process.

California’s Assembly Bill 138 does not prohibit a candidate from voluntarily, and without prompting, providing previous salary information. However, organizations may not rely on this exception and must be diligent in complying with the law.

As pay equality legislation becomes law and we begin to see challenges work their way through the court system, we will see clarifying opinions and rulings to provide additional guidance to employers. At present time, little information is available regarding what may constitute a “reasonable request” or what organizations must provide as a response to such request when they do not have established pay scales or ranges for the position.

Due to the broadening popularity of pay equality legislation, organizations with multi-state operations are encouraged to consider making uniform salary policy changes. We are also seeing an increase in requests for salary benchmarking studies and the development of salary range structures in order to have a consistent and defensible process for salary administration. We encourage companies to work with their legal counsel to review and amend existing pre-employment documentation, such as applications, and to educate their managers who interview and recruit prospective employees to ensure compliance with the law.