Institutional Shareholder Services (ISS) released on October 1st the results of its annual Global Benchmark Policy survey and its new climate survey. The surveys are part of ISS’ annual policy development process. ISS will release the final policy updates by the end of the year, to be adopted for shareholder meetings during the 2022 proxy season. This CAP alert examines key findings from the 2021 Global Benchmark Policy Survey that foreshadow shareholder expectations in 2022. Overall, the survey results align with recent trends of increased shareholder interest in environmental, social, and governance (ESG) issues.

Overview of the Survey

The global benchmark policy survey covers a wide array of issues including executive compensation, board meeting practices, and governance provisions. The survey received 409 responses, of which 39% were from investors and investor-affiliated organizations, 60% from companies or corporate-affiliated organizations (“non-investors”), and the remaining 1% from non-profit and academic organizations.

Key Findings

ESG Performance Metrics in Executive Compensation

The significant majority of respondents view the inclusion of ESG metrics as an appropriate way to incentivize executives. Investors and non-investors differ, however, on the necessity of measurable ESG metrics. Most investors maintain that ESG metrics in compensation programs must be specific and measurable, and their associated targets communicated transparently. Among non-investors, the most popular position is that even ESG-related metrics that are non-financially measurable can effectively incentivize positive outcomes that may be important to the company. Investors and non-investors favoring the inclusion of ESG metrics generally agreed that both short-term and long-term incentives can be appropriate depending on the circumstances.

Racial Equity Audits

New in 2021, several companies received shareholder proposals to conduct an independent audit for racial bias both internally within the company and externally through its business practices. Investors are split between those who support an independent racial equity audit for most companies, regardless of the corporate programs the company might have in place to address racial equity and those who favor commissioning an audit on a case-by-case basis. Most non-investors agree with the latter position. Among those respondents, the prevailing factor that would require a company to commission an audit is involvement in significant racial and/or ethnic diversity-related controversies followed by the company’s lack of initiatives at enhancing workforce diversity and inclusion. For investors, the prevailing factor that would require an audit is also the company’s involvement in significant diversity-related controversy, but the second most popular factor is the company’s lack of detailed workforce diversity statistics such as EEO-1 type data.

Long-Term Perspective on Performance

CEO pay quantum has received increased attention over the past decade. One of ISS’ three quantitative pay-for-performance tests evaluates one-year CEO pay quantum in the multiple of the median test. The survey asked respondents whether they would find a long-term perspective (such as a three-year horizon) helpful. The majority of both investors and non-investors view the long-term perspective to be relevant and helpful.

Mid-Cycle Long-Term Incentive Plan (LTIP) Changes

For the 2021 proxy season, ISS viewed mid-cycle changes to long-term incentive awards as a problematic response to the pandemic, given that many investors consider that long-term incentives should not be adjusted based on short-term market disruptions. The survey asked whether mid-cycle changes to long-term incentive programs for companies incurring long-term negative impacts should be considered problematic. Investors were divided on the topic. 53% responded against the adjustment of long-term incentives based on short-term market disruptions while 40% believed adjustments may be reasonable.

Looking Ahead

Responses from the survey indicates that investors favor more extensive disclosures on ESG issues and measuring compensation against long-term performance. Survey responses typically provide insight into future ISS policy direction. ISS will release its draft policies for public comment later this month, before finalizing them in December for meetings starting on February 1, 2022.

For full detail related to ISS Annual Global Survey results, please visit the complete published report.

Say on Pay arrived in 2011, born out of the SEC’s rule-making efforts to reform corporate governance under Dodd-Frank after the financial crisis. This non-binding advisory vote, which is an annual event at most companies, allows shareholders to cast votes for or against Named Executive Officer (NEO) compensation. While earning simple majority support is technically a passing result, most companies strive for and achieve significantly higher levels of support. Investor support of compensation programs is influenced by many factors, which primarily include magnitude of pay, pay practices, and stock price performance.

In 2020, COVID-19 significantly disrupted the global economy, causing many companies to re-evaluate their compensation programs. Proxy statements filed in 2021, which will discuss compensation during the COVID pandemic year, will depart from previous norms. In anticipation of these filings, CAP has reviewed Say on Pay voting results at Russell 3000 companies in 2020, and since inception, to gauge the current landscape with an eye on what may occur with 2021 Say on Pay results.

Say on Pay Overview

Russell 3000 Historic Results

2020 marked the 10th year of Say on Pay voting. To date, voting results have generally been very consistent over time. Median support among Russell 3000 companies has been approximately 95% in each of the past 10 years. Most companies receive support from over 90% of shareholders, with an average of 74% of companies receiving support in the 90-100% range. Consistent vote outcomes are seen at the top and the bottom end of the range. The percentage of companies falling in each range shown below has been consistent throughout the 10-year history of Say on Pay voting.

|

All Companies |

2020 |

2011 – 2020 |

|

|

Average |

Range |

||

|

Median Level of Support |

94.9% |

95.2% |

94.7% – 95.6% |

|

>90% Support |

74.0% |

73.8% |

70.0% – 76.8% |

Only 2.2% of companies failed to receive majority support for Say on Pay votes in 2020. The number of companies that have failed the Say on Pay vote has also been very consistent over the 10-year period, with an average of 2.0% of companies failing over the past 10 years. For companies that failed in 2020, the median level of support was approximately 38%, mirroring historical results.

|

All Companies – Failed Say on Pay Vote |

2020 |

2011 – 2020 |

|

|

Average |

Range |

||

|

% of Companies Failing |

2.2% |

2.0% |

1.4% – 2.4% |

|

Median Level of Support |

38.2% |

39.2% |

33.1% – 42.7% |

Proxy Advisor Impact

Proxy advisors have a substantial impact on the Say on Pay vote for companies. The most influential proxy advisory firm is Institutional Shareholder Services (“ISS”) which grades companies on a pay-for-performance scale to determine if, in their view, CEO pay and company performance are well-aligned. ISS will then issue a recommendation “For” or “Against” the NEO compensation program, ISS’ vote recommendation often has a substantial impact on the vote result, as outlined below.

The two main inputs that ISS looks at are CEO compensation and Total Shareholder Return compared to an ISS-defined peer group based on company size and industry. Companies will then receive a “Low”, “Medium” or “High” concern level that determines whether ISS performs a qualitative evaluation of the compensation program. The overall concern level drives ISS’ ultimate recommendation For or Against the Say on Pay resolution. Historically, approximately 95% of companies with a Low concern receive support from ISS, compared to about two-thirds of companies rated Medium concern and roughly half of the High concern companies. Often, shareholders will reference the ISS recommendation (i.e., For or Against) when casting their vote on Say on Pay; however, many institutional investors have their own proprietary tests to evaluate compensation programs at companies.

ISS has consistently recommended Against Say on Pay for approximately 12% of companies per year, over the last decade. Among companies that have failed Say on Pay, the vast majority, 96% on average, have received an Against recommendation from ISS. In 2020, roughly 20% of companies that received an ISS Against recommendation ultimately failed the vote and for all companies with an Against recommendation from ISS, the median level of support was only 67%.

|

ISS Against Recommendation Impact |

2020 |

2011 – 2020 |

|

|

Average |

Range |

||

|

% of Companies with ISS Against Recommendation |

10.4% |

11.6% |

10.0% – 13.5% |

|

% of Companies with ISS Against Recommendation Failing Say on Pay |

19.5% |

16.3% |

10.6% – 21.5% |

|

Median Level of Support |

67.0% |

67.4% |

65.1% – 70.4% |

As shown below, the percentage of companies with an ISS Against recommendation, at each support level range, has been generally consistent since the Say on Pay vote was established.

Expectations for 2021

Institutional Shareholder and Proxy Advisor Commentary

2021 proxy statement disclosures will reflect the impact of COVID-19 on company performance which influenced both executive compensation in 2020 and the development of 2021 incentive programs. While the degree of impact will vary by industry and company, many more companies than usual will disclose adjustments to their compensation programs than in past years. During 2020, shareholders and proxy advisors provided some general guidance on how they will be assessing and evaluating these unique circumstances.

Institutional shareholders and proxy advisors have both stated that they recognize that 2020 was a more challenging year than most due to the impact of COVID-19. Because of this, they will review companies on a case-by-case basis, evaluating the facts and circumstances that went into any adjustments that were made. Guidance has generally encouraged proactive, enhanced disclosure that clearly explains the situation and rationale for COVID-related changes as opposed to generic descriptions of a challenging year, which may be viewed as insufficient.

How shareholders and proxy advisors interpret and assess the COVID-related disclosures and adjustments will ultimately influence Say on Pay votes and recommendations. While ISS and Glass Lewis did not make wholesale changes to their pay-for-performance evaluations for 2021, ISS did call out key disclosure items that would help investors evaluate COVID-related changes. This indicates that there may be more discretion and flexibility applied for companies with more robust disclosure. Even with greater flexibility in the qualitative evaluations, pay-for-performance misalignment will continue to be the main driver for Against recommendations from ISS in the broader market.

CAP Expectations

Since pay-for-performance is expected to remain the primary driver for proxy advisor recommendations, Say on Pay results will continue to depend on the magnitude of pay, pay practices and stock price performance. For companies that may have a pay and performance misalignment, we expect reduced shareholder support if a company has not provided sufficient rationale for the following actions:

- Annual and long-term incentive plan adjustments

- Major employee actions (e.g., layoffs)

- Performance that is dramatically below investor expectations

- Low relative financial performance

- Above-target discretionary adjustments to payouts that previously missed threshold performance

- Awarding one-time special cash/equity grants

Shareholder outreach will be more important in 2021 as companies can use these discussions to supplement their required disclosures. Proactive outreach may help to prevent a significant impact on the Say on Pay result even if proxy advisors recommend Against a company’s compensation program. There will also likely be more disclosure on go-forward incentive programs, as the impact of COVID-19 lingers into 2021.

Say on Pay results in 2021 will likely depart from prior norms. Even if the percentages of Against recommendations and companies passing remains relatively consistent with historic levels, we expect to see a downward shift in the median level of support and in the percentage of companies receiving at least 90% support. For companies that do receive an Against recommendation from proxy advisors, the level of support may decline compared to historic norms if disclosures do not sufficiently justify the actions taken.

Conclusion

2021 Say on Pay results will likely test the “steady state” seen over the previous 10 years. While the full picture will not be clear until later this year, CAP has begun to look at companies with fiscal years ended in late 2020 to get an early read. We will continue to monitor Say on Pay results throughout the year to see how the COVID-19 pandemic shapes these results.

Kelly discusses discretion in compensation plans and the future of ESG strategies at NACD’s popular compensation forum. The virtual panel discussion and Q&A bring together compensation experts and compensation committee members to examine executive compensation trends.

In late 2018, Institutional Shareholder Services (ISS) and Glass Lewis & Co (Glass Lewis) each issued proxy voting guidelines for 2019. While policy changes announced by both firms were minimal, both ISS and Glass Lewis announced policy updates aimed at increasing female representation on boards of directors. This summary highlights some changes to ISS and Glass Lewis’ policies for 2019 and is not intended to be all encompassing.

ISS Policy Updates

ISS did not make substantial changes to its policy for 2019. In fact, ISS postponed implementing a vote recommendation on excessive director pay that was to be introduced in 2019. After receiving investor feedback, ISS revised its methodology for identifying excessive director pay and will begin making vote recommendations in 2020. Under the new policy, ISS will recommend a vote “Against” Board members responsible for setting director pay if individual director pay is above the top two to three percent of a company’s index and sector for two or more consecutive years (e.g., 2019 and 2020). ISS will consider mitigating factors, such as compression in pay within the index and sector, disclosure of a rationale for a director’s pay positioning, and a larger equity grant at time of joining the board, in its vote recommendation.

In addition to the vote recommendation on director pay in 2020, ISS will recommend an “Against” vote for the Nominating Committee Chair if the Board does not have female representation. This will apply to companies in the Russell 3000 and S&P 1500 indices for meetings that occur after February 1, 2020.

Another policy change anticipated for 2019 was ISS replacing the metrics in the pay-for-performance assessment. However, ISS did not make any changes to their assessment from 2018. ISS considered using Economic Value Added (EVA) in lieu of the current GAAP measures (Return on Invested Capital, Return on Equity, Return on Assets, Earnings Before Interest, Taxes, Depreciation and Amortization growth and/or Cash Flow (from operations) growth). Instead, ISS will disclose a company’s EVA performance as additional information within the research report and not in the Financial Performance Assessment (FPA). This is similar to the approach ISS used in 2017 for the FPA. ISS introduced the FPA as additional information in the research report in 2017 and, ultimately, incorporated it into the pay-for-performance assessment a year later. ISS may use a similar approach with EVA.

In addition to these policy updates, ISS provided clarification on its views on the use of TSR as an incentive metric, front-loaded awards and impact from regulatory updates, as well as updated its list of problematic pay practices as summarized in the below chart. For information on all ISS policy updates, please visit https://www.issgovernance.com/policy-gateway/latest-policies/

| Other Select ISS Policy Updates |

| Front-loaded Awards

Will likely recommend “Against” a company’s say on pay (SOP) vote for large multi-year awards that are intended to cover more than four years. |

| Updated Problematic Pay Practices

Added the definition of “Good Reason” whereby an executive could receive a windfall in the event of a corporate failure (such as bankruptcy or delisting). ISS will not consider the definition to be problematic if it is in connection with a constructive termination (e.g., material reduction in compensation, title or role, etc.). |

| Incentive Metrics

Clarified that it does not advocate the use of any incentive metric over another (specifically TSR). ISS stated that the Board and Compensation Committee are best suited to determine the appropriate measures to incent executives to create long-term value for shareholders. |

| Updates due to Regulatory Changes

Updated its policy to reflect recent regulatory changes: Elimination of 162(m) Tax Deductibility Exemptions: Will view pay programs negatively if a company shifts performance-based pay into fixed or discretionary forms of compensation. Smaller Reporting Companies: Will continue to review the completeness of the disclosure. ISS will likely recommend “Against” an SOP vote if it is difficult to assess the compensation philosophy and practices. |

Glass Lewis Policy Updates

Similar to ISS, Glass Lewis did not make changes to its pay-for-performance assessment for 2019. The firm did, however, clarify that its letter rating system (i.e., A, B, C, D and F) is not equivalent to the typical school grading system. In the policy update, Glass Lewis notes that receiving a “C” means that pay is aligned with performance. An “A” or a “B” indicates that the pay percentile is less than the performance percentile, and a “D” or an “F” means that the pay percentile is higher than the performance percentile.

Glass Lewis noted three voting policy updates related to compensation and diversity:

- If the Board does not have any female members, Glass Lewis will recommend a vote “Against” the Nominating Committee Chair and may extend the recommendation to other committee members, depending on factors including company size, state headquarters, and a company’s governance profile. Glass Lewis will take into consideration mitigating factors, such as a disclosed timetable for addressing female representation or an agreement with restrictions from a significant investor. The vote recommendation on Board diversity is in effect for 2019.

- Glass Lewis will generally recommend a vote “For” shareholder proposals that request additional information regarding employee diversity or the process for promoting diversity within the workforce.

- Glass Lewis will consider the addition of an excise tax gross-up, particularly if there is a prior commitment for no gross-up, as a factor that may influence a negative vote recommendation against the Compensation Committee.

In addition to these policy updates, Glass Lewis also noted that it will review the terms of a company’s recoupment or clawback policy. The mere presence of a policy that meets the legal minimum requirement will no longer suffice. Glass Lewis states that, at minimum, the recoupment should be triggered for a financial restatement. The lack of a comprehensive clawback policy may inform Glass Lewis’ overall opinion of a company’s compensation program.

Additionally, Glass Lewis provided insight on its views on front-loaded awards and contractual payments and arrangements, both summarized in the chart below. For all information related to Glass Lewis’ 2019 voting policies visit http://www.glasslewis.com/guidelines/

| Other Select Glass Lewis Policy Updates |

| Front-loaded Awards

Will review a company’s rationale for a front-loaded grant and will expect a commitment to not grant additional awards during the defined period of the award. |

| Contractual Payments and Arrangements

Will consider the amount of a “make whole” award as well as the process for determining the award size. Glass Lewis notes that the disclosure should include a meaningful rationale. To evaluate severance and sign-on awards, Glass Lewis will review the size of the payment in relation to the amount of target compensation, amounts paid to other executives (including an executive’s predecessor) and the design of the payment. |

The new disclosure of the CEO pay ratio in 2018 was met with a surprisingly muted response from the press and shareholders. Companies had been concerned that the CEO pay ratio would be used as a way to shame companies with high levels of CEO pay relative to the median worker, yet for the most part criticism of CEO pay was mild.

Near the end of 2018 however, institutional shareholders began to express greater interest in the CEO pay ratio from two directions:

- A group of 48 institutional investors recently sent a letter to many large companies requesting more robust disclosure about their workforces.

- The Office of the New York State Comptroller (NYSC) recently issued a press release stating that they have submitted shareholder proposals to several companies to incorporate considerations about the broader workforce into their CEO pay decision making and pay philosophy.

Shareholder Letter from 48 Institutional Investors

The group of institutional investors believe supplemental information will provide reference points for understanding the company’s workforce and will help investors put the pay ratio into context. Their perspective is that human capital is a critical asset of the company and that investors will benefit from a better understanding of a company’s approach to human capital management. The 48 companies are for the most part made up of unions and pension funds (e.g., CalPERS, NYSC, AFL-CIO) so their view may not be representative of other institutions (e.g. index funds, hedge funds, etc.). Supplemental disclosures cited as useful by these investors are largely focused on workforce demographics (i.e. use of seasonal workers, geographic locations, etc.), median employee detail (i.e. job function, education levels, etc.) and the company’s overall compensation philosophy. The letter acknowledges that some of this information has already been voluntarily disclosed by companies and some may be available elsewhere.

New York State Comptroller Proposal

Based on the NYSC’s press release, companies responding and reaching agreement with the NYSC in 2018 are CVS Health, Macy’s, Microsoft, Salesforce.com, The TJX companies; companies reaching agreement in 2017 are BB&T, Discovery Communications and Regeneron Pharmaceuticals. The NYSC withdrew the proposals after the companies agreed to reexamine their CEO and executive pay and adopt policies that take into account the compensation of the rest of their workforces. The proxy disclosure for two of these companies, CVS Health and Discovery Communications, provided more robust disclosure around CEO pay ratio than what is typically seen, such as enhancements to employee base pay/benefits and pay considerations for their global workforce. It is unclear if there are other pending shareholder proposals from the NYSC on this topic.

Current CEO Pay Disclosure Practice

Very few companies currently provide the kind of supplemental disclosures requested by the institutional investors. With approximately 90% of the S&P 500 having disclosed 2018 CEO pay ratios at this point, Compensation Advisory Partners researched the prevalence of the requested information. Among the S&P 500, only about 25% of companies disclosed any specific geographic information on their employee population as part of the pay ratio disclosure. This was primarily discussed as the number of U.S. employees versus non-U.S. employees or in the context of the de minimis exemption, where companies can exclude up to 5% of the non-U.S. employee workforce. Further, the type of workers employed by the companies (i.e. seasonal, part-time, temporary, etc.) was typically disclosed with minimal detail on the relative size of the employee populations. Only 1% disclosed a headcount of part-time employees and a minority of companies provided context around their workforce demographics.

Median employee detail was included in a minority of disclosures, with 14% providing any detail at all. The most common disclosure (85%) provided was the geographic location of the median employee’s employment. Employment/pay type (full/part time, salaried/hourly) was also prevalent; approximately two-thirds and one-third of these disclosures included this information, respectively. Half of the companies providing median employee detail gave information on the role of the median employee, often related to job title, job function, or place of employment (e.g. factory). Incentive compensation eligibility, education level, and compensation mix were rarely provided, with less than 5% of companies sharing such detail.

Detail on Median Employee

| Type of Description | Prevalence of Disclosure |

| Median Employee | 62 of 446 (14%) |

| Geographic Location of Employment | 53 of 62 (85%) |

| Employment Type (full/part time) | 41 of 62 (66%) |

| Pay Type (salaried/hourly) | 23 of 62 (37%) |

| Role (job title or type of work) | 30 of 62 (48%) |

| Bonus Eligibility (eligible/non-eligible) | 3 of 62 (5%) |

| Equity Eligibility (eligible/non-eligible) | 1 of 62 (2%) |

| Compensation Mix | 2 of 62 (3%) |

Looking Forward

We do not expect that many companies will significantly expand their disclosures around workforce demographics in 2019 proxy statements. We think that what these shareholders are requesting would require fundamental change to the CEO pay ratio disclosure and is substantially different from the original intent of the CEO pay ratio. For the most part, we expect the information disclosed to remain consistent with what companies provided in 2018, with any changes in disclosure being modest (e.g. how many companies will exercise the option of reusing the same median employee, will they provide a comparison of the 2019 pay ratio to the 2018 pay ratio).

Looking beyond 2019, companies should recognize that there is an appetite among some of the larger institutional investors for greater information on the makeup of a company’s human capital. We suspect that the requests in these shareholder letters, combined with some of the requests in shareholder proposals around gender pay equity, may serve as a basis for new legislation from the Democratic majority in the House of Representatives requiring disclosure of workforce demographics and pay equity statistics. While any proposed legislation is unlikely to become law before 2021, we expect that shareholder requests for additional information may evolve from a letter into actual shareholder proposals similar to those submitted by the NYSC.

Compensation Advisory Partners LLC (“CAP”) appreciates the opportunity to comment on the draft 2019 proxy voting policies related to compensation.

CAP is an independent consulting firm that helps clients make informed decisions about executive and non-employee director compensation and related corporate governance matters. We believe compensation should be used as a management tool to support business strategy. Our consultants serve as independent advisors to Boards and senior management at many leading companies and share ISS’ interest in advancing sound corporate governance.

Beginning with fiscal years ending on or after December 31, 2017, companies are required to disclose the ratio that compares the compensation of the CEO to the compensation of the median employee (pay ratio). This disclosure was part of the Dodd-Frank Wall Street Reform and Consumer Protection Act signed into law in 2010.

Compensation Advisory Partners LLC (CAP) researched early pay ratio disclosures. As of March 9, 2018, we obtained pay ratios from 150 companies with a median revenue of $2.1B from a cross-section of industries.

Pay Ratio

The median pay ratio disclosed by these companies is 87x. The lowest ratio is 1x (Apollo Global Management, Dorchester Minerals and The Carlyle Group) and the highest ratio is 1465x (Fresh Del Monte Produce Inc.).

| Summary Statistics | Median Employee Pay | Median CEO Pay | Pay Ratio |

| 75th percentile | $88,612 | $10.5M | 172x |

| Median | $58,256 | $5.6M | 87x |

| 25th percentile | $43,966 | $2.5M | 36x |

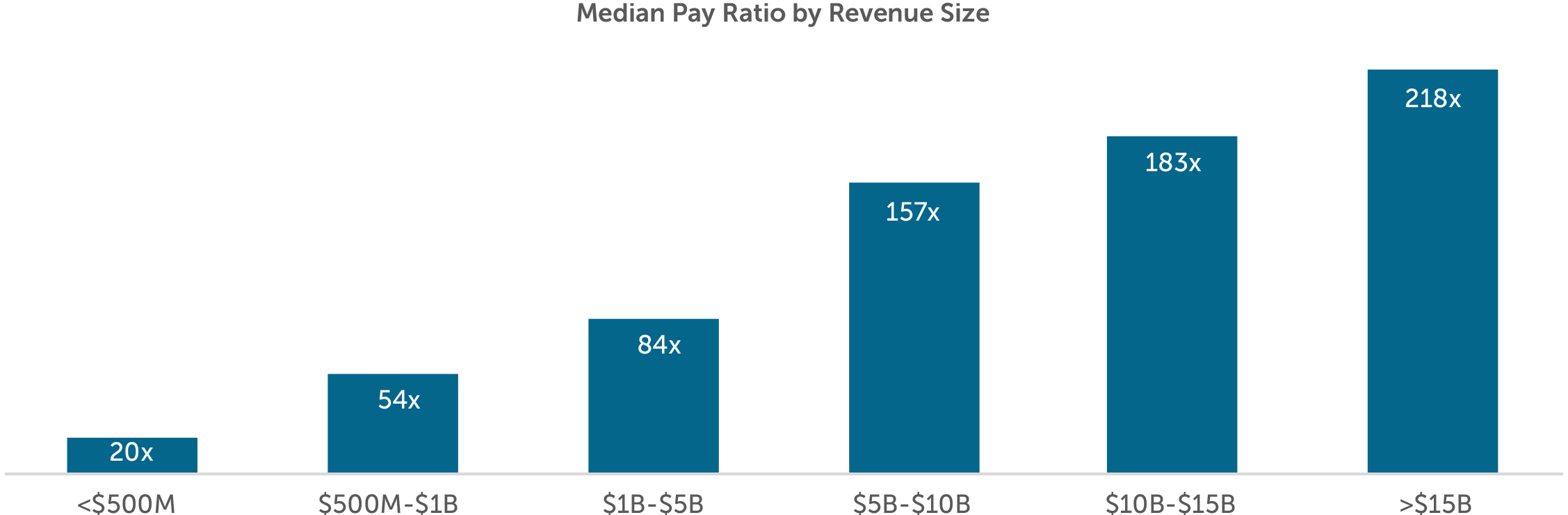

As expected, the pay ratio correlates with company size, with larger companies disclosing higher ratios. CEO pay varies greatly depending on the size and complexity of the organization. Employee pay has less variability since it reflects the job function and does not vary significantly based on the size of the organization. The median ratio in our sample of 150 companies ranges from 20x for companies with revenue less than $500M to 218x for companies with revenue greater than $15B.

Few companies, 15, disclose a supplemental pay ratio with only a handful of companies (three) disclosing more than one additional ratio. These companies with supplemental ratios are typically adjusting the CEO’s pay which may exclude anomalies such as a one-time special bonus or equity award. Interestingly, three companies disclosed a higher supplemental pay ratio likely to provide context for a large year over year increase in the 2019 proxy statement.

Location of Disclosure

Nearly 70% of companies disclose the pay ratio after the Potential Payments upon Termination or Change in Control section of the proxy statement. Approximately 25% of companies disclose the pay ratio just before or after the Summary Compensation Table and a small minority, 5%, disclose it in the Compensation Discussion and Analysis (CD&A).

Pay ratio is typically not disclosed in the CD&A, signaling to shareholders that the pay ratio is not used to determine CEO pay levels. Additionally, around 25% of companies include language in the disclosure that the ratio should not be used to compare pay levels to other companies within the industry, region of the country or revenue size.

Measurement Date

The SEC’s final rules give companies the flexibility to use any date within the last quarter of the fiscal year to identify the median employee. Companies most commonly used the last day of the fiscal year or a date within the last month of Q4. It is also common for companies to use a day within the first month of Q4 to identify the median employee.

| Measurement Month | Prevalence | Measurement Date | Prevalence | |

| First Month of Q4 | 29% | Last day of Q4 | 44% | |

| Second Month of Q4 | 8% | First day of Q4 | 17% | |

| Third Month of Q4 | 57% | Other | 33% | |

| Not Disclosed | 6% | Not Disclosed | 6% |

Exclusions from Median Employee Determination

Approximately one-third of companies excluded a portion of their workforce when determining the median employee. The most common rationale is the de minimis exemption (approximately 55%) whereby a company can exclude up to 5% of its non-U.S. employee workforce. Companies also commonly cited an acquisition or corporate not responsible for setting pay (e.g., independent contractors) as rationales for excluding certain employee groups.

Conclusion

As more companies continue to file their proxy statements in the coming weeks, we will likely see larger pay ratios, particularly as companies with a significant part-time workforce begin to disclose their ratios. We do not anticipate an increasing trend in the number of companies filing supplemental pay ratios though it will be interesting to see the rationale for those that do. We expect to continue to see companies placing the pay ratio outside of the CD&A with most disclosing it after the Potential Payments upon Termination or Change in Control section.