On September 21, 2017 the US Securities and Exchange Commission (SEC) issued interpretive guidance on the CEO pay ratio calculation and disclosure. The pay ratio rule was adopted by the SEC on August 5, 2015 under the Dodd-Frank Wall Street Reform and Consumer Protection Act. It requires companies to disclose their CEO’s annual total compensation as a multiple of the annual total compensation of the median employee for the first fiscal year beginning in 2017.

The guidance came in the following three areas:

- As long as the company uses reasonable estimates, assumptions, or methodologies (to identify the median employee or calculating any elements of annual total compensation for employees), the pay ratio itself and related disclosure would not provide the basis for an enforcement action from the SEC

- A company may use internal records (such as tax or payroll records) to identify its median employee

- For determining whether independent contractors are “employees”, companies may apply a widely recognized test under another area of law (e.g., tax or employment laws) that they would otherwise use to determine whether their workers are employees

- Provides guidance and detailed examples on the use of statistical sampling

Revised Compliance and Disclosure Interpretations (C&DIs)

- Adds a new C&DI that issuers can state the ratio is an “estimate”

- Withdraws C&DI that primarily addressed the treatment of independent contractors and leased workers

The latest guidance now provides more flexibility for companies in determining the median employee, specifically as it relates to the use of statistical sampling and clarification of independent contractors. We will track pay ratio disclosure over the coming year and keep you informed of new developments as they occur.

On February 6, 2017 the Acting Chairman of the US Securities and Exchange Commission (SEC) issued a Public Statement on Reconsideration of Pay Ratio Rule Implementation. The pay ratio rule was adopted by the SEC on August 5, 2015 under the Dodd-Frank Wall Street Reform and Consumer Protection Act. It requires companies to disclose their CEO’s annual total compensation as a multiple of the annual total compensation of the median employee for the first fiscal year beginning in 2017.

The statement indicated that “some issuers have begun to encounter unanticipated compliance difficulties that may hinder them in meeting the reporting deadline.” The SEC began a 45-day comment period for issuers to submit detailed comments on challenges they have experienced in preparing for compliance with the rule. Additionally, the staff was directed to determine whether additional guidance or relief is necessary.

Click on this link to see the full text of the Public Statement.

We believe pay ratio disclosure is an example of regulation that will be costly to implement and serves no clear purpose to benefit investors or American companies. We expect that a number of issuers will provide their comments on the challenges, cost and effort related to the preparation of compliance with the rule. This may be a first step in a major overhaul, delay or reversal of the rule.

In addition to the SEC’s Public Statement, it was reported by Bloomberg BNA that House Republicans “plan to introduce legislation to roll back the Dodd-Frank Act in mid-February”. Depending on the timing of any changes to the Dodd-Frank Act or the results of the comment review process, issuers may not have definitive direction before the summer.

We will track these issues over the coming year and keep you informed of new developments as they occur.

The 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”) directed the SEC to enact rules that require disclosure in the annual proxy statement of the ratio of Chief Executive Officer (CEO) compensation to that of the median employee, including the absolute value for each input that goes into the ratio calculation. More than five years later, final pay ratio rules have been released by the SEC. These rules will go into effect requiring companies to provide disclosure of their pay ratios for their first fiscal year beginning on or after Jan. 1, 2017.

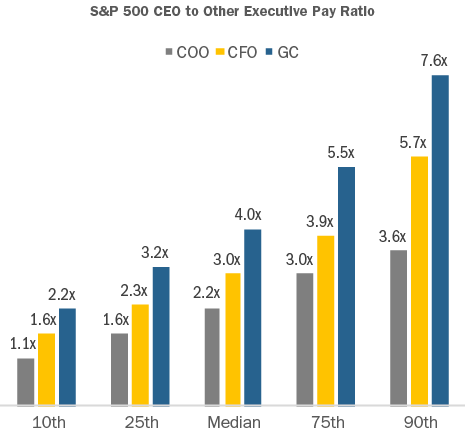

While many companies are preparing for the new pay ratio disclosure requirements from the SEC, ratios of CEO pay to other NEOs are also something companies should pay close attention to. Committees can use these ratios as a starting point to assess issues such as retention, talent development, and succession planning. A high ratio can be an indicator that the CEO is potentially carrying too much of the company, a disconnect exists between the pay practices for the CEO vs. other senior leaders, or that there is no succession plan in place. Having healthy internal equity with appropriate ratios of pay for leadership, and an eye on general market norms, is an important factor in talent acquisition and retention.

This CAPflash focuses on three NEO pay ratio calculations:

- CEO versus Chief Operating Officer (COO);

- CEO versus Chief Financial Officer (CFO); and

- CEO versus General Counsel (GC).

In this study, we provide market practice among S&P 500 companies, as well as the policies of proxy advisory firms, ISS and Glass-Lewis. In our analysis, we use the following target pay elements per proxy disclosure: disclosed base salary, target annual incentive, and target/grant date value of LTI awards.

Please note that the ratios used in this analysis are calculated from proxy disclosure. Therefore, if a COO or GC is not among the top 5 highest paid, as required in proxy disclosure, they are not included in the analysis—CFO pay disclosure is required.

What does our research show?

To evaluate market norms, Compensation Advisory Partners (“CAP”) conducted an analysis of senior executive target pay ratios among S&P 500 companies during the most recent three fiscal years (as of August 22, 2016).

- At median, CEO pay was 2.2x the COO; i.e., for every $1.00 paid to the COO, the CEO was paid approximately $2.20

- At median, CEO pay was 3.0x the CFO; i.e., for every $1.00 paid to the CFO, the CEO was paid approximately $3.00

- At median, CEO pay was 4.0x the GC; i.e., for every $1.00 paid to the GC, the CEO was paid approximately $4.00

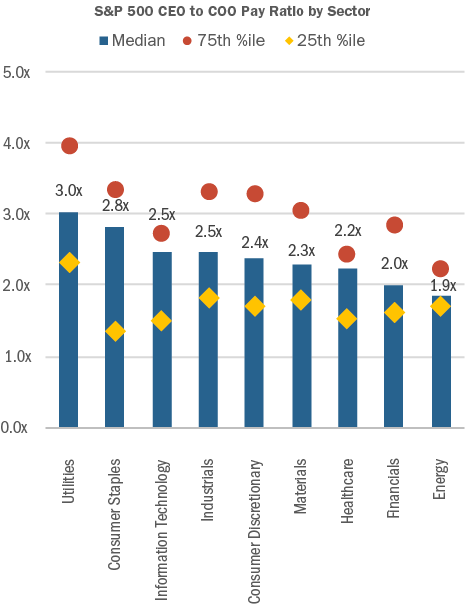

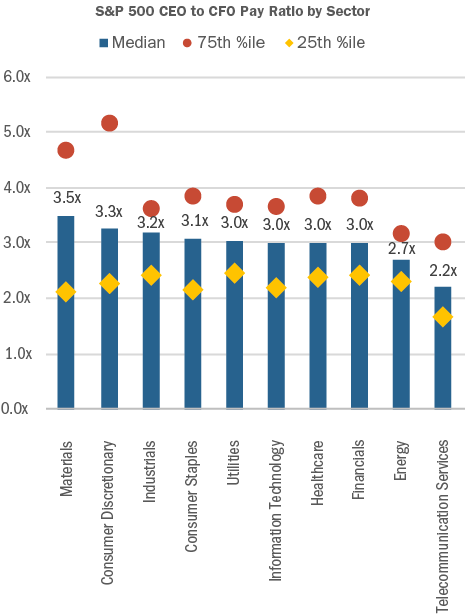

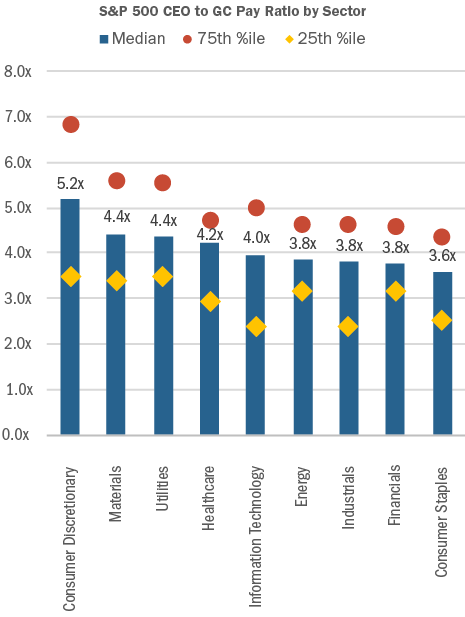

CAP also analyzed the S&P 500 senior executive pay ratios by industry.

- For the CEO vs. COO ratio, the Utilities sector had the highest ratio of 3.0x at median, while Energy had the lowest ratio of 1.9x at median

- For the CEO vs. CFO ratio, the Materials sector had the highest ratio of 3.5x at median, while Telecommunication Services had the lowest ratio of 2.2x, at median

- For the CEO vs. GC ratio, the Consumer Discretionary sector had the highest ratio of 5.2x at median, while Consumer staples had the lowest ratio of 3.6x, at median

Note: Telecommunication Services was not included because the sample was too small.

Note: Telecommunication Services was not included because the sample was too small.

How do ISS and Glass-Lewis use pay ratios?

Both proxy advisory firms include senior executive pay ratios in their annual proxy analyses.

- ISS includes the ratio of CEO pay versus the second highest paid active NEO, as well as the ratio of CEO pay versus the average of the other active NEOs. “Pay” includes all elements from the Summary Compensation Table; however, the grant-date value of stock options is updated to reflect ISS’ methodology which differs from accounting rules

- Glass-Lewis includes the ratio of CEO pay versus the average of other NEOs during each of the past three years. “Pay” includes select elements from the Summary Compensation Table: Salary, Bonus, Non-Equity Incentive Plan, Stock Awards, and Option Awards

ISS also uses pay ratio as one of the inputs to the Compensation score it assigns companies in its QuickScore 3.0 tool, which is meant to influence investment decisions through an assessment of risk factors. The ratio of CEO pay versus the second highest paid active NEO is included in QuickScore 3.0.

When do proxy advisors perceive there to be a possible issue?

To our knowledge, these ratios have not been used by ISS or Glass-Lewis to justify an Against Say on Pay vote recommendation. However, large pay discrepancies can reinforce other negative assessments. In general, comments from ISS and Glass-Lewis are likely when the CEO to NEO ratio exceeds 4x. Ratios exceed 4x at 5-10% of S&P companies, depending on which ratio is used (see ISS and Glass-Lewis definitions above). Ratios rising to 5-6x, or greater, will receive more strongly worded commentary.

Conclusion

Since companies are very different in their organizational and operational structures, we believe that there is limited utility in the CEO pay ratio disclosure that will be required by the SEC under Dodd-Frank. However, looking at the ratios of leadership pay at companies in the same business sector and/or of the same size, can provide important information and insights. It is worthwhile for compensation committees to track this information internally and on a relative basis. Such information can be used as an input in the pay benchmarking process and as a barometer of healthy succession planning, as well as contributing to effective talent acquisition and retention.

Today, the SEC approved the final rules related to pay ratio. Companies will be required to disclose their CEO’s pay as a multiple of the pay of their median employee in their 2017 proxy (released in 2018 for calendar year filers). The SEC issued proposed rules in September 2013 and received over 280,000 comments related to the topic. For further details and thoughts please see our earlier CAPFlashes on the topic (Sept 20, 2013 and April 1, 2015) and look for more details in future CAPflashes.

Click here to read SEC’s press release on the topic.

The SEC recently updated its regulatory agenda, impacting select compensation-related rulemaking that resulted from the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”). As part of the update, the deadline to issue final CEO Pay Ratio rules, final Hedging Disclosure rules, and proposed Compensation Clawback rules was pushed back to April 2016 (from October 2015).

- Implication (Pay Ratio): if final rules are adopted in April 2016, companies with a December 31 fiscal year end are not expected to be required to comply with pay ratio rules/disclosure until publication of 2018 proxy statements

- Implication (Hedging Disclosure): if final rules are adopted in April 2016, companies with a December 31 fiscal year end are not expected to be required to comply with disclosure rules until publication of 2017 proxy statements. However, if the rule is released early, by the end of 2015, disclosure requirements could still be effective for 2016 proxy statements

- Implication (Compensation Clawback): No information regarding effective date(s) is currently available

These timeline changes reflect a new deadline, not the date rulemaking will be published, proposed or adopted.

We will provide additional updates as this issue continues to evolve.

The 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”) directed the SEC to enact rules that require disclosure in the annual proxy statement of the ratio of CEO compensation to that of the median employee, including the absolute value for each input that goes into the ratio calculation. More than four years later, final pay ratio rules are yet to be released by the SEC (proposed rules were released in September 2013). In fact, the SEC recently pushed back its deadline to adopt final pay ratio rules from October 2014 to October 2015. According to some stakeholders, this is actually a good thing.

- The Center on Executive Compensation has stated that: “The Commission’s Proposed Rule will impose significant and wholly unnecessary costs on U.S.-listed companies and U.S. investors. The pay ratio requirement itself is mistaken: it will provide no useful information to investors and to the extent the information is used by investors at all, it is likely to be misleading and thus will be harmful to them.”

- The House Financial Services Chairman submitted a letter to SEC Chair Mary Jo White arguing that adopting the proposed pay ratio rule would be unduly costly and detract from more important SEC priorities

Separate from Dodd-Frank requirements, are there other pay ratios that Compensation Committees should track and discuss? Yes.

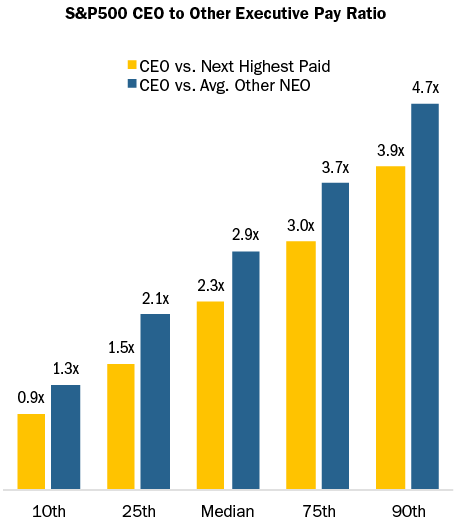

This CAPflash focuses on two such pay ratio calculations: CEO versus second highest paid Named Executive Officer (“NEO”) and CEO versus average of Other NEOs (i.e., CFO and next 3 highest paid executive officers). Below we provide and discuss market practice among S&P 500 companies, as well as relevant proxy advisor policies. Why do these two ratios matter? If these ratios get too high, they may indicate either potential succession planning issues or excessive CEO compensation.

What does our research show?

To evaluate market norms, Compensation Advisory Partners (“CAP”) conducted an analysis of senior executive pay ratios among S&P 500 companies during the most recent three fiscal years (as of February 28, 2015).1

- At median, CEO pay was 2.3x the second highest paid NEO; i.e., for every $1.00 paid to the second highest paid NEO, the CEO was paid approximately $2.30

- At median, CEO pay was 2.9x average Other NEO pay; i.e., for every $1.00 paid to an average NEO, the CEO was paid approximately $2.90

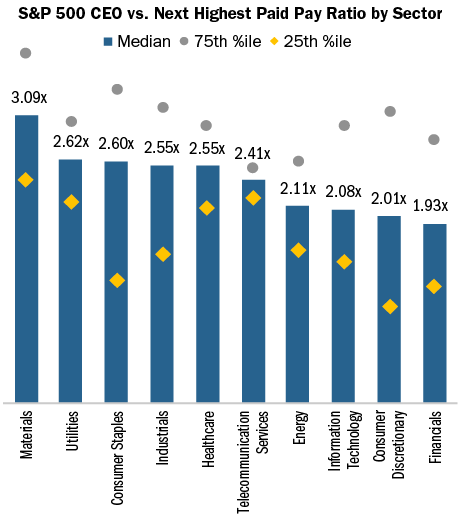

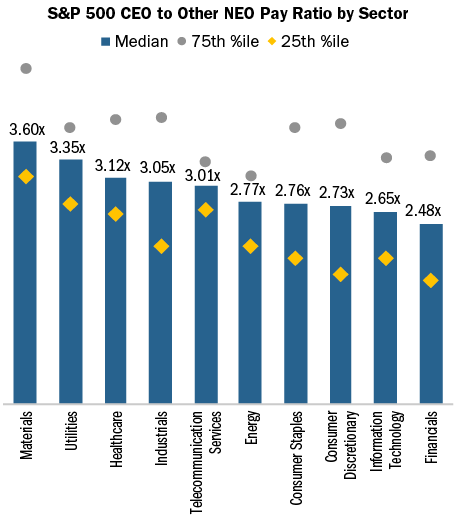

CAP also analyzed the S&P 500 senior executive pay ratios by industry.

- For the CEO vs. second highest paid NEO ratio, the materials sector had the highest ratio of 3.09x at median, while financials had the lowest ratio of 1.93x at median

- For the CEO vs. average Other NEO ratio, the Materials sector had the highest ratio of 3.60x at median, while financials had the lowest ratio of 2.48x at median

How do ISS and Glass Lewis use pay ratios?

Both proxy advisory firms include senior executive pay ratios in their annual proxy reports.

- ISS includes the ratio of CEO pay versus the second highest paid active NEO, as well as the ratio of CEO pay versus the average of the other active NEOs. “Pay” includes all elements from the Summary Compensation Table; however, the grant-date value of stock options is updated to reflect ISS’ methodology which differs from accounting rules

- Glass Lewis includes the ratio of CEO pay versus the average of other NEOs during each of the past three years. “Pay” includes select elements from the Summary Compensation Table: Salary, Bonus, Non-Equity Incentive Plan, Stock Awards, and Option Awards

ISS also uses pay ratio as one of the inputs to the Compensation score it assigns companies in its QuickScore 3.0 tool, which is meant to influence investment decisions through an assessment of governance risk factors. The ratio of CEO pay versus the second highest paid active NEO is included in QuickScore 3.0.

When do proxy advisors perceive there to be a possible issue?

To our knowledge, these ratios have not been used by ISS or Glass Lewis to justify an Against Say on Pay vote recommendation. However, large pay discrepancies can reinforce other negative factors. In general, comments from ISS and Glass Lewis are likely when the ratio exceeds 4x. Ratios exceed 4x at 5-10% of S&P companies, depending on which ratio is used (see ISS and Glass Lewis definitions above). Ratios rising to 5-6x, or greater, will receive more strongly worded commentary.

Conclusion

We believe that there is limited utility in the pay ratio disclosure that will be required by the SEC under Dodd-Frank. In contrast, it is a worthwhile exercise to track and discuss these senior executive pay ratios with the Compensation Committee. The ratio(s) can be discussed as part of succession planning and best-in-class talent management. The ratio(s) can also be another input in the executive officer benchmarking process; i.e., when setting or adjusting target pay levels.

1 Total compensation as disclosed in the Summary Compensation Table was used for this analysis.

The SEC recently updated its regulatory agenda. As part of the update, the deadline to adopt final pay ratio rules was pushed back to October 2015 (from October 2014).

- Implication: companies with a Dec 31 fiscal year end are not expected to be required to comply with pay ratio rules/disclosure until publication of 2017 proxy statements

The deadline for other outstanding compensation-related rulemaking coming out of the Dodd-Frank Act was also delayed to October 2015: standardized pay vs. performance disclosure, hedging policies, and clawbacks requirements.

- Note: Timeline changes reflect a new deadline, not the date at which rulemaking will be published or adopted

We will provide additional updates as this issue continues to evolve.