On April 21, 2016, the National Credit Union Administration (NCUA) issued joint proposed rules governing incentive compensation arrangements for the following agencies: Office of the Comptroller of the Currency (OCC), Board of Governors of the Federal Reserve System (Board), Federal Deposit Insurance Corp. (FDIC), Federal Housing Finance Agency (FHFA), NCUA, and the U.S. Securities and Exchange Commission (SEC). The joint proposed rule is a revision to the proposed rule the agencies released five years ago on April 14, 2011 and is intended to implement section 956 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act).

The new proposed rules are 279 pages long and have moved from the principles based guidance of the 2011 proposed rules to a more prescriptive approach that lays out specific incentive compensation practices that covered institutions are expected to comply with and explicitly prohibits certain practices. The agencies are soliciting comments between now and July 22, 2016. Covered financial companies are expected to comply with the proposed rule in the first calendar quarter that begins 540 days (18 months) after the final rule is published in the Federal Register. It will not apply to any incentive-based compensation plan with a performance period that begins before the compliance date.

Given the length of the proposal document, we will focus on summarizing the key provisions and provide some initial thoughts on its implications. It should be noted that much of what is in the new proposal builds on practices that many banks have already adopted as they have responded to regulatory input over the past five years. We will provide more comprehensive feedback as we develop a comment letter on the proposed rule.

Requirements and Prohibitions Applicable to All Covered Institutions

The new proposed rule is similar to the 2011 proposed rule in that it maintains the restrictions against establishing or maintaining incentive-based compensation arrangements that encourage inappropriate risk taking and by providing covered persons with excessive compensation, fees or benefits that could lead to material financial loss to the covered institution. A covered institution is one with at least $1 billion in assets.

The following provisions are consistent with the 2011 proposed rule:

- Excessive Compensation: Compensation, fees and benefits will be viewed as excessive when amounts paid are unreasonable or disproportionate to the services provided by a covered person, considering all factors, including:

- Combined value of all compensation, fees and benefits to a covered person;

- The compensation history of the covered person and other individuals with comparable expertise at the covered institution;

- The financial condition of the covered institution;

- Compensation at comparable institutions (specific criteria described in the proposal);

- For post-employment benefits, the potential cost and benefit to the covered institution;

- Any connection between the covered person and any fraudulent act or omission, breach of trust or fiduciary duty, or insider abuse with regard to the covered institution.

- Risk Balancing: An incentive-based compensation arrangement will be considered to encourage inappropriate risks that could lead to material financial loss to the covered institution, unless the arrangement:

- Appropriately balances risk and reward;

- Is compatible with effective risk management and controls; and

- Is supported by effective governance.

Key Addition: What is new in the proposed rule is that an incentive-based compensation arrangement would not be considered to appropriately balance risk and reward unless it:

- Includes financial and non-financial measures of performance;

- Is designed to let non-financial measures of performance override financial measures of performance, when appropriate; and

- Is subject to adjustment to reflect actual losses, inappropriate risks taken, compliance deficiencies, or other measures or aspects of financial and non-financial performance.

Board Oversight: Also, similar to the 2011 proposed rule, the new proposed rule requires that the Board of Directors:

- Conduct oversight of the covered institution’s incentive –based compensation program;

- Approve incentive-based compensation arrangements for senior executive officers, including amounts of awards, and at the time of vesting, payouts under such arrangements; and

- Approve material exceptions or adjustments to incentive-based compensation policies or arrangements for senior executive officers.

Covered Institution Categories

The proposed rules segment covered institutions into three main categories:

- Level 1: Greater than $250 billion assets

- Level 2: Greater than $50 billion assets, less than $250 billion assets

- Level 3: Greater than $1 billion assets less than $50 billion assets

The requirements of the proposed rule vary by type of institution with the more prescriptive aspects of the rule having the most impact on Level 1 and Level 2 covered institutions which due to their size and complexity are viewed as the most likely organizations to contribute to systemic risk. It should be noted that the Agencies have reserved the authority to require certain Level 3 institutions with assets between $10 billion and $50 billion to comply with the more rigorous requirements applicable to Level 1 and Level 2 organizations if they find that the complexity of operations or compensation practices are comparable to those of a Level 1 or Level 2 covered institution.

Risk Management and Controls

The risk management and controls required under the proposed rules are more extensive than prior guidance. Level 1 and Level 2 institutions would be required to have a risk management framework in place for their incentive based compensation programs that is independent of any lines of business and includes an independent compliance program to provide controls, testing, monitoring and training of the institution’s policies and procedures. In addition it would require covered institutions to:

- Provide individuals in control functions with appropriate authority to influence the risk-taking business areas they monitor and ensure that covered persons in control functions would be compensated independently from the areas they monitor; and

- Provide for independent monitoring of whether plans are appropriately risk balanced, events that relate to forfeiture or downward adjustments and compliance with the institution’s policies and procedures

While not as explicit in the 2011 rules this is another area where most large institutions have developed well defined risk management functions that independently oversee/monitor incentive compensation programs and participate in evaluating individual and plan compliance.

Governance

The proposed rule formally requires Level 1 and Level 2 institutions to establish an independent compensation committee (comprised of directors who are not members of management) to assist the Board of Directors in carrying out its responsibilities. It would be expected to obtain input from the institution’s audit and risk committees related to the effectiveness of the institution’s overall program and related processes. Management will be required to submit a written assessment of the effectiveness of the program, compliance and processes that are consistent with the risk profile of the covered institution. Separately, the compensation committee would also be required to annually obtain a similar written assessment from the audit or risk management function.

Level 1 and Level 2 institutions have generally integrated their processes for reviewing compensation programs and individual decision making with the risk (and audit) committee at least annually. Additionally compensation committees receive reports on a periodic basis from internal risk management. The rules provide a more detailed set of processes and documentation for these activities.

Disclosure and Record Keeping Requirements

The proposed rule requires all Level 1 and Level 2 covered institutions to create annually, and retain for seven years, documents that cover the following:

- Senior executives and significant risk-takers (listed by legal entity, job function, organizational hierarchy and line of business)

- Incentive-based compensation arrangements for senior executives and significant risk-takers, including percentage of incentive-based compensation deferred and the form of award

- Any forfeiture, downward adjustments or clawback reviews and decisions for senior executives and significant risk-takers

- Any material changes to the covered institution’s incentive-based compensation arrangements or policies

This record keeping requirement replaces an annual reporting requirement in the 2011 proposal. Based on our experience, in their interactions with regulators, most covered institutions have been required to develop and maintain extensive record keeping around their incentive compensation arrangements so the main new requirements are the specific content of the record keeping and the seven year retention period.

Covered Persons

The proposed rule describes specific employees that will be subject to the proposed rule labeled as senior executive officers and significant risk-takers. These categories are roughly equivalent to Category 1 and Category 2 employees under the 2011 proposed rules; however they have been expanded somewhat and the rules for defining significant risk-takers are somewhat more prescriptive.

- Senior Executive Officers:

- The following positions: President, Chief Executive Officer, Executive Chairman, Chief Operating Officer, Chief Financial Officer, Chief Investment Officer, Chief Legal Officer, Chief Lending Officer, Chief Risk Officer, Chief Compliance Officer, Chief Audit Executive, Chief Credit Officer, Chief Accounting Executive, or head of a major business line or control function

- Anyone performing the equivalent function to the above titles

- Significant Risk-Taker: There are two main tests to determine whether someone is a significant risk taker. If either test is met, the employee is a significant risk-taker

- Relative Compensation Test: For a Level 1 institution, are they among the 5 percent highest compensated covered persons; for a Level 2 institution are they among the 2 percent highest compensated covered persons

- Exposure Test: Does the covered person have the authority to commit more than 0.5% of the capital of the covered institution

- One-Third Threshold: A covered person will only be considered a significant risk-taker if 1/3 or more of their total compensation is incentive-based compensation

We suspect that many covered institutions will find that their current list of Category 2 employees has significant overlap with who will ultimately be considered significant risk-takers. However, organizations that have spent the past few years developing rigorous criteria for identifying Category 2 employees may find it frustrating to have to comply with a new set of criteria, particularly since the new criteria appear to be more sweeping and less tailored to the nature of specific institutions’ lines of business.

Deferral, Forfeiture, Downward Adjustment and Clawback Requirements

Deferral

The 2011 proposed guidance mandated covered institutions with more than $50 billion assets to require executive officers to defer at least 50% of incentive-based compensation for at least three years. The new rule expands the deferral requirement in several ways:

- Deferral Percentages: Amounts deferred have been modified to apply to senior executives and significant risk-takers with required deferral percentages by institution and employee designation. The table below summarizes the requirements by type of institution, type of incentive and class of executive:

|

Level / Incentive Type |

Senior Executive |

Significant Risk-Taker |

|

Level 1 – Short-term |

60% for at least four years |

50% for at least four years |

|

Level 1 – Long-term |

60% for at least two years |

50% for at least two years |

|

Level 2 – Short-term |

50% for at least three years |

40% for at least three years |

|

Level 2 – Long-term |

50% for at least one year |

40% for at least one year |

- Deferral Period: Deferrals cannot vest any faster than a pro rata basis over the full deferral period (i.e., for a Level 1 Senior Executive, the deferral of a short-term incentive cannot vest any faster that 25% per year over the four anniversaries of the award date; for a long term award deferral commences at the end of the performance period)

- Form of Deferral: Under the proposed rules, incentive based compensation will be deferred in cash and equity like instruments. While the rules do not propose specific percentages for each form they expect a degree of balance between the two. The rules are specific as to how much incentive based compensation can be deferred in the form of stock options.

- Stock Options: Under the proposed rules, stock options cannot represent more than 15% of the total incentive compensation used to meet the minimum required deferred compensation awarded for that period

- Acceleration of Deferrals: Level 1 and Level 2 covered institutions are prohibited from accelerating deferrals in any circumstances other than the death or disability of the covered person (i.e., no ability to accelerate upon other termination scenarios as is common today)

The more challenging aspects of the new requirements will be the mandatory deferral of both cash and equity in proportionate amounts, long-term performance plan payouts and the prohibition of the acceleration of deferrals. Companies may reconsider the amount of deferred compensation delivered in long-term performance plans if the new rules remain in place, as it will potentially diminish the value associated with plans due to the longer vesting period and increase the complexity of compensation programs. Many of these plans among Level 1 institutions have only recently been adopted and are well-received by long term investors. In addition, it is a fairly common practice to accelerate payouts of deferred compensation upon a termination of employment following a change in control or other termination scenarios (e.g., involuntary termination without cause or retirement). We suspect there will be additional commentary on this provision and that many institutions will begin to reexamine their practices as a result of the new rule.

Forfeiture and Downward Adjustment

Under the new proposed rules, the guidance has defined two new terms for practices that have been developed over the past few years as covered institutions have worked to comply with the 2011 proposed guidance:

- Forfeiture: A reduction of the amount of deferred incentive-based compensation that has been awarded but not yet vested.

- Downward Adjustment: A reduction of the incentive-based compensation not yet awarded to a covered person for a performance period that has already begun

Under the proposed rules all deferred incentive-based compensation will be subject to forfeiture and all not yet awarded incentive-based compensation will be subject to downward adjustment under the following circumstances:

- Poor financial performance attributable to a significant deviation from the covered institution’s risk parameters set forth in the covered institution’s policies and procedures;

- Inappropriate risk-taking, regardless of the impact on financial performance;

- Material risk management or control failures;

- Non-compliance with statutory, regulatory or supervisory standards resulting in enforcement or legal action brought by a federal or state regulator or agency, or a requirement that the covered institution report a restatement of a financial statement to correct a material error; and

- Other aspects of conduct or poor performance as defined by the covered institution

Under the proposal, the covered institution can exercise discretion in determining how much, if any, of an award will be impacted by the forfeiture or downward adjustment. However, in the proposal, there are specific factors that should be considered in making the determination, including the intent of the covered person, the covered person’s responsibility or awareness of the circumstances around the triggering event, actions that could have been taken to prevent the triggering event, the financial and reputational impact of the event, the cause of the events and any other relevant information related to the event, including past behavior of the covered person.

Based on our experiences with covered institutions, we expect this portion of the rule to be straightforward to comply with as most organizations have developed rigorous processes to cover forfeiture and downward adjustments over the past few years.

Clawback

The 2011 proposed guidance did not require clawbacks. Under the new rule, there will be a clawback provision covering any incentive compensation (cash and equity) for seven years from the time that the award vests. This would mean that some forms of deferred compensation could potentially be subject to clawback for more than ten years from the date that they were originally awarded. The clawback will apply to a current or former senior executive officer or significant risk-taker. While the time-frame for the new provision is long in duration, the triggering events for a clawback are described more narrowly than the events that would trigger a review for forfeiture or downward adjustment. Specifically, the triggering events for a clawback are defined as:

1. Misconduct that resulted in significant financial or reputational harm to the covered institution;

2. Fraud;

3. Intentional misrepresentation of information used to determine the senior executive officer’s or significant risk-taker’s incentive-based compensation.

This is one of the most significant changes included in the new proposal and is likely to result in significant comment. While it will be hard to argue with the triggering events, the time-frame for the clawback provision may create challenges in implementation and may create anxiety among covered employees.

Additional Prohibitions

While the bulk of the proposed rule is spent discussing the institutions covered, the individuals subject to the deferral requirements, the form of the deferral, forfeiture, downward adjustment and clawback requirements; there are some additional aspects of the rule that will be of interest to institutions and may have significant impact on compensation design.

Hedging

The proposed rule will prohibit covered institutions from purchasing hedging instruments on behalf of covered persons. As a practical matter, many financial institutions go further than this as they prohibit executives from engaging in hedging activities on their own behalf.

Maximum Incentive-Based Compensation Opportunity (also referred to as leverage)

Over the course of the last five years since the original guidance was provided, regulators have raised concerns with covered institutions over the degree of leverage in short-term and long-term incentive compensation arrangements. While many companies had incentive compensation arrangements with upside leverage of 200% of the target incentive opportunity when the 2011 rules were issued, most now have upside leverage of either 150% of target or 125% of target for their formulaic incentive-based compensation arrangements. The new proposed rule explicitly limits the upside leverage allowed for Level 1 and Level 2 institutions:

- Senior Executives: 125% of the target incentive opportunity

- Significant Risk-Takers: 150% of the target incentive opportunity

The professed intent is not to create a ceiling on incentive compensation but to constrain a plan feature that may contribute to inappropriate risk taking. However it will likely be viewed by institutions as weakening their ability to align pay with performance on the downside and the upside and as an uncompetitive feature when compared to other non-covered financial service firms or other companies.

Relative Performance Measures

Similar to the proposal on upside leverage in incentive plans, regulators have raised concerns over the use of relative performance measurement. While the proposed rule is described as a prohibition on relative performance, it is really just a prohibition on using relative performance measurement as the sole performance criteria in an incentive compensation plan. The majority of large financial institutions using relative performance measurement combine measures of absolute and relative performance in their plans. It is not clear what proportion of performance measures can be relative.

We expect that many organizations may continue to use the relative performance measure as a modifier or as some portion of a plan where the primary determinant of performance is based on the institution’s absolute performance.

Volume-Driven Incentive-Based Compensation

The proposed rules prohibit incentive compensation for Level 1 and Level 2 senior executive officers and significant risk-takers based on volume based performance measures without regard to the quality of the products sold or compliance with sound risk management. This restriction is more likely to have implications for incentive-compensation plans for significant risk-takers than for senior executive officers. In practice, most institutions have added assessments of compliance with risk management and credit quality to individual evaluations for incentive-based compensation so this may be more of a formality in terms of going forward compliance.

Conclusions

The new proposed rules are the culmination of five plus years of regulatory review of incentive-based compensation practices and follow a period of considerable interaction with covered institutions. A good portion of what is proposed is a codification of the discussions and exchanges that have occurred between financial institutions and their regulators. Some of the major new pieces of the rules, e.g., potentially larger group of covered individuals, increases to the required deferral percentages and vesting periods, required deferrals of long-term incentive compensation, the prohibition of acceleration of deferrals, and the lengthy and broader clawback requirement were likely not anticipated. We expect that the agencies will receive significant feedback on these points over the comment period. That said, we expect that much of the proposed rule particularly as it relates to governance and risk management, policies and procedures will be retained in the final rules, as they are generally consistent with guidelines that the large institutions have worked to implement over the past five years.

Compensation Advisory Partners LLC (“CAP”) appreciates the opportunity to comment on proposed rules for clawbacks. As a leading executive compensation consulting firm, we support sound corporate governance.

Today, the SEC approved the final rules related to pay ratio. Companies will be required to disclose their CEO’s pay as a multiple of the pay of their median employee in their 2017 proxy (released in 2018 for calendar year filers). The SEC issued proposed rules in September 2013 and received over 280,000 comments related to the topic. For further details and thoughts please see our earlier CAPFlashes on the topic (Sept 20, 2013 and April 1, 2015) and look for more details in future CAPflashes.

Click here to read SEC’s press release on the topic.

On July 1, 2015, the SEC proposed rules directing the stock exchanges to expand listing standards to require companies to adopt clawback policies. These clawback policies would require executive officers to pay back incentive compensation that was awarded in error under an accounting restatement. According to SEC Chair Mary Jo White, the express purpose of the rules are ‘increased accountability and greater focus on the quality of financial reporting, which will benefit investors and markets.” With these proposed rules, the SEC has now addressed all of the executive compensation governance reforms included in the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

Where Do We Go From Here?

- Most major companies have already implemented clawback policies

- SEC proposal on clawbacks does not align with current market practice

- Includes current and former executive officers

- Triggered exclusively by an accounting restatement resulting from an error

- Triggered regardless of whether executive has committed fraud or misconduct related to the accounting restatement

- Includes a 3-year look-back period

- Generally precludes board discretion

- Accompanied by onerous disclosure rules

- Assess your company’s current clawback policy against the proposed rules

- Brief senior management and the board on the scope of the proposed rules

- Await further developments after the public comment period ends and final rules are issued

Broad Scope

The SEC’s proposal amends the Securities Exchange Act of 1934 (the “Exchange Act”) by adding new Exchange Act Rule 10-D1. Other amendments would apply to filings by foreign private issuers and certain investment companies. As a result, the clawback rules will apply to virtually all listed issuers of equity securities, debt and preferred securities, including emerging growth companies, smaller reporting companies, foreign private issuers and controlled companies.

New Rule 10-D1

As proposed, an issuer would be subject to delisting if it fails to (1) adopt a clawback policy that complies with the new requirements, (2) disclose the policy and (3) comply with the policy to recover compensation under an accounting restatement. Under the proposal, clawback of incentive compensation would be required from current and former executive officers who received excess incentives during the three fiscal years prior to the date on which a company is required to prepare an accounting restatement to correct a material error. The clawback provision applies on a “no fault” basis, regardless of whether misconduct occurred and regardless of whether an individual had any responsibility for the error.

The amount subject to clawback would be the amount that exceeds the amount that the executive officer would have received if the incentive compensation had been determined using restated financial statements. The proposed rules direct companies to use reasonable estimates of the effect that an accounting restatement would have on stock price and total shareholder return to determine amounts subject to recovery.

Limits on Board Discretion

Under the proposal, the situations where a Board could elect not to pursue recovery are limited. The SEC specified situations where the direct expense related to enforcing recovery would exceed the amount recovered. However, even in these situations, the Board would have to go through the process of determining the amount subject to clawback and make an attempt at recovery before deciding not pursue enforcement of the recovery. In addition, foreign private issuers could elect not to comply when clawback would violate home country law.

Trigger for Recovery

New Rule 10-D1 would trigger a clawback in the event that the issuer prepares a restatement of previously issued financial statements to correct an error that was material. Note that the requirement to restate financial statements is enough to trigger the clawback provisions, allowing the SEC to avoid the potentially thorny question of what constitutes a material error. Under GAAP, an error may include mathematical mistakes, mistakes in the application of GAAP principles, or oversights or misuse of facts when the financial statements were prepared. The proposal indicates several types of changes to financial statement that are not error corrections and would not trigger clawback, including

- Retrospective application of a change in accounting principle;

- Retrospective revision to reportable segment information due to a change in the structure of the issuer’s organization;

- Retrospective reclassification due to a discontinued operation;

- Retrospective application of change in reporting entity, such as from a reorganization;

- Retrospective adjustment to provisional amounts in connection with a prior business combination; and

- Retrospective revision for stock splits.

3-Year Look-Back Period

The proposed clawback will apply to excess incentives during a 3-year period prior to the date on which the issuer is required to prepare an accounting restatement. The proposal defines this date as the earlier of:

- The date the issuer’s board of directors, a committee of the board of directors, or the officer or officers of the issuer authorized to take such action if board action is not required, concludes , or reasonably should have concluded , that the issuer’s previously issued financial statements contain a material error; or

- The date a court, regulator or other legally authorized body directs the issuer to restate its previously issued financial statements to correct a material error.

The SEC notes that the first proposed date would generally coincide with the filing of Form 8-K, but Form 8-K is not necessary for recovery. Further, the obligation to clawback does not depend on whether or when restated financial statements are filed.

Application to Executive Officers

The proposed clawback rules apply to current or former executive officers who received incentive compensation. Under the proposal, executive officer is defined as the issuer’s president, principal financial officer, principal accounting officer (or controller), any vice president to the issuer in charge of a principal business unit, division or function (such as sales, administration or finance), any other officer who performs a policy-making function, or any other person who performs a similar policy-making functions for the issuer.

This proposed definition of executive officer is modeled on the definition used in Section 16, so it will apply to a reasonably large group of senior executives. The proposal also specifies that individuals who served as an executive officer at any time during the performance period for incentive compensation subject to recovery will be subject to clawback. This would include incentive compensation authorized before the individual becomes an executive officer and inducement awards granted in new hire situations.

Compensation Subject to Clawback

The SEC proposal contains a very broad definition of “incentive-based compensation” subject to clawback. As proposed, this would be defined as “any compensation that is granted, earned or vested based wholly or in part upon the attainment of any financial reporting measure.” The rules would also specify that “financial reporting measures” are measures determined and presented in accordance with the accounting principles used to prepare the issuer’s financial statements, any measures derived wholly or in part from such financial information and stock price and total shareholder return.

This definition wraps in accounting-based measures, as well as non-GAAP measures. Notably the SEC proposal includes stock price and total shareholder return. Although these are not accounting-based measures, the SEC included them because these measures are affected by accounting information and subject to current disclosure (i.e., stock performance graph and disclosure of high and low stock prices for each quarter within the two most recent fiscal year and any subsequent interim periods). Importantly, stock options and restricted stock that vest solely based on continued service are not subject to clawback.

The SEC acknowledges the complexities associated with trying to determine the amount of excess compensation related to the relationship between an accounting error and stock price. The SEC recognizes that complex analyses may be required. As a solution, the SEC suggests that issuers be permitted to make reasonable estimates and requires disclosure of these estimates.

The proposal includes examples of compensation that would be subject to clawback, as well as compensation that would be excluded:

|

Compensation Subject to Clawback |

Compensation Excluded from Clawback |

|

Non-equity incentive plan awards that are earned based wholly or in part on satisfying a financial reporting measure performance goal |

Salaries |

|

Bonuses paid from a bonus pool, the size of which is determined based wholly or in part on satisfying a financial reporting measure performance goal |

Bonuses paid solely at the discretion of the Compensation Committee or Board, not paid from a pool determined wholly or in part on satisfying a financial reporting measure goal |

|

Restricted stock, RSUs, performance shares, stock options and SARS that are granted or become vested wholly or in part on satisfying a financial reporting measure performance goals |

Bonuses paid on subjective standards (e.g., leadership) and/or completion of a specified employment period |

|

Proceeds received upon the sale of shares acquired through an incentive plan that were granted of vested based wholly or in part on satisfying a financial reporting measure performance goal |

Non-equity incentive plan awards earned solely upon satisfying one or more strategic measures (e.g., consummating a merger or divestiture) or operational measures (e.g., opening a specified number of stores, completion of a project, increase in market share) |

|

Equity awards for which the grant is not contingent upon achieving any financial reporting measure performance goal and vesting is contingent solely upon completion of a specified employment period and/or attaining one or more non-financial reporting measures |

Proposed Disclosure Requirements

Proposed new Rule 10D-1 would require disclosure of the issuer’s policy related to clawback of erroneously awarded compensation. The clawback policy would need to be filed as an exhibit to Form 10-K for listed U.S. issuers.

The proposal contains additional disclosure requirements that are extensive when a restatement was completed or an outstanding balance of excess incentive-based compensation relating to a prior restatement. In these instances, the proposed disclosure would include:

- For each restatement, the date on which the listed issuer was required to prepare an accounting restatement, the aggregate amount of excess incentives and the aggregate amount that remains outstanding as the end of the most recent completed fiscal year;

- The estimates used to determine the excess incentive compensation related to a stock price or total shareholder return measure;

- The name of each person subject to clawback for whom the listed issuer decided not to pursue recovery, the amount forgone and a description of the reason the issuer decided not to pursue recovery; and

- The name and amount due from each person from who, at the end of the last completed fiscal year, excess incentive-based compensation had been outstanding for 180 days or longer.

The proposed disclosure would be included as a separate item, not part of the CD&A. However, companies would have the option of providing the information in the CD&A to provide all information related to the clawback policy in one place.

The proposed rules also include amendments to Summary Compensation Table disclosure. Amounts previously reported would be reduced by the amount recovered by clawback with a footnote explanation. Finally, the required disclosure would be provided as interactive using XBRL block-text tagging.

Other Important Provisions

The proposed rules are incorporated in a 198 page filing. They are very detailed and complex. This article necessarily serves as a summary of the most important points that we see as being of general interest. But there are other details that shed light on the SEC’s thinking, as follows:

- Incentive-based compensation recovery will apply to pre-tax amounts.

- Clawback may occur simultaneously under new Rule 10D-1 and SOX Section 304. If an individual reimburses the Company under Section 304, a credit will be recorded for purposes of new Rule 10D-1.

- Lack of compliance with a clawback policy threatens a company with delisting, depending on the stock exchange’s assessment of whether the company was making a good faith effort to clawback compensation.

- Companies may not indemnify executive officers or former executive officers against the loss of erroneously awarded compensation.

- If an executive purchases third-party insurance, companies would be prohibited from paying the premiums for this insurance.

Timing of New Rules

The SEC’s proposal calls for prompt implementation. The current comment period extends for 60 days. After final rules are adopted, the SEC is calling for the stock exchanges to file their proposed amended listing standards within 90 days. Following the effective date of the stock exchange listing standards, each listed company would be required to adopt a clawback policy within 60 days. Clawback would apply to all excess incentive-based compensation received for any fiscal year ending on or after the effective date of new Rule 10D-1. Similarly, disclosure requirements would become effective immediately on or after the date on which the stock exchange listing standards become effective.

The SEC recently updated its regulatory agenda, impacting select compensation-related rulemaking that resulted from the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”). As part of the update, the deadline to issue final CEO Pay Ratio rules, final Hedging Disclosure rules, and proposed Compensation Clawback rules was pushed back to April 2016 (from October 2015).

- Implication (Pay Ratio): if final rules are adopted in April 2016, companies with a December 31 fiscal year end are not expected to be required to comply with pay ratio rules/disclosure until publication of 2018 proxy statements

- Implication (Hedging Disclosure): if final rules are adopted in April 2016, companies with a December 31 fiscal year end are not expected to be required to comply with disclosure rules until publication of 2017 proxy statements. However, if the rule is released early, by the end of 2015, disclosure requirements could still be effective for 2016 proxy statements

- Implication (Compensation Clawback): No information regarding effective date(s) is currently available

These timeline changes reflect a new deadline, not the date rulemaking will be published, proposed or adopted.

We will provide additional updates as this issue continues to evolve.

On Wednesday April 29, the SEC held an open meeting and approved by a vote of 3-2 a staff proposal to amend Section 14(i) of the Securities Exchange Act of 1934 to expand disclosure requirements for executive compensation. The proposed amendment was added by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. The proposed rules will require clear disclosure of the relationship between executive compensation actually paid and company financial performance.

The SEC’s objectives – enhanced disclosure, more transparency, alignment of pay and performance – are praiseworthy, but some of the new rules are complex. CAP predicts that compliance will prove to be burdensome for most companies.

Highlights of the Proposed Rules

Publication of a New Table: The proposed rules add a new table to the current disclosure on executive compensation. This new table will include:

- Executive compensation actually paid for the principal executive officer and the average amount actually paid to the remaining named executive officers. For purposes of the table, compensation actually paid is total compensation as disclosed in the summary compensation table with adjustments to the amounts included for pensions and equity awards.

- The total executive compensation reported in the summary compensation table for the principal executive officer and an average of the reported amounts for the remaining named executive officers.

- The company’s total shareholder return (TSR) on an annual basis as presented in the existing stock performance graph. The definition of TSR is provided for the stock performance graph in Item 201(e) of Regulation S-K.

- The TSR of the companies in a peer group or index, using either the peer group identified by the company in its stock performance graph or in its compensation discussion and analysis.

CAP predicts that graphic representations, similar to the Stock Performance Graph, will be a popular approach.

Additional Disclosure: In addition to the new table, companies will be required to provide a clear explanation for the relationship between compensation actually paid and the company’s TSR performance. An explanation of the company’s TSR performance and the TSR performance of the peer group or index is also required. Companies will have the flexibility to provide this explanation as a narrative, in a graph or by using both.

Adjustments to Calculate Compensation Actually Paid: Companies will need to make two adjustments to total compensation reported in the summary compensation table to calculate compensation actually paid. The adjustments relate to equity award values and pension values. Companies will be required to disclose the adjustments to the compensation reported in the summary compensation table in a footnote.

First, the reported grant date value of equity will be subtracted from reported total compensation and the fair value of equity vesting in that year and re-valued on the date of vesting will be added to calculate compensation actually paid. Companies will need to disclose the vesting date valuation assumptions if they differ materially from the assumptions used for financial statements as of the grant date.

In the second adjustment, the reported change in pension value will be subtracted from reported total compensation and the change in pension value attributable to the actuarially determined service cost for services rendered by the executive during the applicable year will be added.

Time Period Covered: The disclosure will be required for the last five fiscal years, provided a company was subject to disclosure rules during this period.

Interactive Data Format Required: Companies will be required to tag the disclosure in an interactive data format using eXtensible Business Reporting Language, or XBRL.

Covered Companies: The proposed rules apply to all reporting companies, except that foreign private issuers, registered investment companies and emerging growth companies are exempt.

Transition Period: The proposed rules provide a phase-in for all companies. In the first year, companies will be required to provide the information for three years. The fourth and fifth years of disclosure will be added in each subsequent year’s annual proxy filing that requires this disclosure.

Rules for Smaller Reporting Companies: These companies are required to provide disclosure for only the last three fiscal years, rather than for five fiscal years. Smaller reporting companies will not be required to include peer group TSR, since they do not disclose either a stock performance graph or a compensation discussion and analysis. In addition, smaller reporting companies will not be required to make adjustments to pension amounts because they are subject to scaled compensation disclosure requirements that do not include disclosure of pension plans. The requirement to tag disclosure in an interactive data format will also be phased-in for smaller reporting companies, so that they will not be required to comply with the tagging requirement until the third annual filing in which the pay-versus-performance disclosure is provided. Initially, smaller reporting companies will provide the information for two years, adding an additional year in the next annual proxy or information statement.

Process: The proposed rules will be published on the SEC’s website and in the Federal Register. The comment period for the proposed rules will last for 60 days after publication in the Federal Register.

Adjustment to equity award values adds complexity and creates disconnects. By revaluing equity on the date of vesting, timing differences between the TSR calculation and the date(s) of vesting will occur. In addition, compensation actually paid will include tranches of different awards that happen to vest in a particular year so Board decision-making on pay and performance in the year of grant will be unclear.

CAP’s Initial Assessment of the Proposed Rules

We applaud the SEC’s attempt to improve disclosure and we agree that pay and performance alignment is critical to good governance and effective executive compensation programs. We also agree that some standardization is necessary. Our research indicates that approximately 15% to 20% of S&P 250 companies provide supplemental disclosure of either realized or realizable pay. Currently, there is no standard definition for either formulation of total compensation. Supplemental pay disclosure is frequently compared to TSR performance, but a consistent approach that can be compared across companies does not exist. The proposed rules impose a standard approach, but at what cost?

We are concerned that the proposed rules are too prescriptive and overly complex. Implementation will burden many companies. The proposed definition of compensation actually paid stands out as our biggest concern. The SEC proposal requires companies to re-value equity awards that vest in each year as of the date of vesting. This approach instantly creates timing differences between the stock prices used in the TSR calculation and the stock prices on the date(s) of equity award vesting. Vesting dates occur throughout the year, but occur most frequently in February – April for calendar year companies. As a result, the proposed approach allows for a re-valuation of equity awards at a more current stock price, but that stock price will likely not correlate with the fiscal year end stock price used in the TSR calculation. This is an obvious disconnect.

In addition, the re-valuation of equity awards for most companies will be composed of tranches of different awards that were granted in different years — likely spanning a three to five year period — that happen to vest in a single year. This approach contributes to confusion around the Board’s thinking on pay and performance alignment, rather than increasing clarity. Instead of focusing on the date of vesting, a better approach would be to re-value equity awards granted in a single year using a year-end stock price consistent with the TSR calculations.

Finally, to the extent that a company uses stock options, updating the assumptions used in option pricing models, such as Black-Scholes, to reflect the date of vesting will be time-consuming at best. This means that stock options will not only be re-valued at a new stock price, but that other assumptions, such as expected life, volatility, dividend yield and risk-free rates, must also be updated.

Two other aspects of the proposed rules contribute greatly to the compliance burden. First, the requirement to include compensation of the average of the remaining named executive officers in the new table in addition to the compensation of the CEO will be very complicated for companies to work through. Publication of this average based on equity grants made over a three to five year span to at least four executives for five years potentially requires dozens of calculations. The SEC should have limited the new disclosure to the CEO since that would greatly reduce the compliance burden and arguably allow for a simpler and more targeted explanation of the Board’s thinking. After all, the CEO normally sets the tone for the entire organization!

The second aspect of the proposed rules that increase the compliance burden is the decision to publish five years of information, rather than three years. Arguably longer time frames are positive when assessing TSR performance, but the summary compensation table shows three years of compensation. Most supplemental disclosure of realized and realizable pay out there today incorporates only three years of compensation and performance data. Even though the SEC provides transition relief, building out the new table to cover five years will be burdensome.

Adjustment to change in pension value is appropriate since it eliminates the impact of changes in assumptions for mortality and discount rates.

We will refine our initial assessment and provide more finely tuned comments back to the SEC during the public comment period. We would not be surprised if the SEC backs off on the date of vesting re-valuation of equity in favor of date of grant re-evaluation. Many will recall that when the proxy disclosure rules were initially proposed, equity award values reflected the amounts recognized for financial reporting purposes. After much public discussion and pushback, the SEC amended the disclosure rules in 2009 to incorporate the grant date fair value of equity awards.

More to come on these points in the next few months! We hope that the SEC achieves consensus on effective pay and performance disclosure before the 2016 proxy season begins.

The 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”) directed the SEC to enact rules that require disclosure in the annual proxy statement of the ratio of CEO compensation to that of the median employee, including the absolute value for each input that goes into the ratio calculation. More than four years later, final pay ratio rules are yet to be released by the SEC (proposed rules were released in September 2013). In fact, the SEC recently pushed back its deadline to adopt final pay ratio rules from October 2014 to October 2015. According to some stakeholders, this is actually a good thing.

- The Center on Executive Compensation has stated that: “The Commission’s Proposed Rule will impose significant and wholly unnecessary costs on U.S.-listed companies and U.S. investors. The pay ratio requirement itself is mistaken: it will provide no useful information to investors and to the extent the information is used by investors at all, it is likely to be misleading and thus will be harmful to them.”

- The House Financial Services Chairman submitted a letter to SEC Chair Mary Jo White arguing that adopting the proposed pay ratio rule would be unduly costly and detract from more important SEC priorities

Separate from Dodd-Frank requirements, are there other pay ratios that Compensation Committees should track and discuss? Yes.

This CAPflash focuses on two such pay ratio calculations: CEO versus second highest paid Named Executive Officer (“NEO”) and CEO versus average of Other NEOs (i.e., CFO and next 3 highest paid executive officers). Below we provide and discuss market practice among S&P 500 companies, as well as relevant proxy advisor policies. Why do these two ratios matter? If these ratios get too high, they may indicate either potential succession planning issues or excessive CEO compensation.

What does our research show?

To evaluate market norms, Compensation Advisory Partners (“CAP”) conducted an analysis of senior executive pay ratios among S&P 500 companies during the most recent three fiscal years (as of February 28, 2015).1

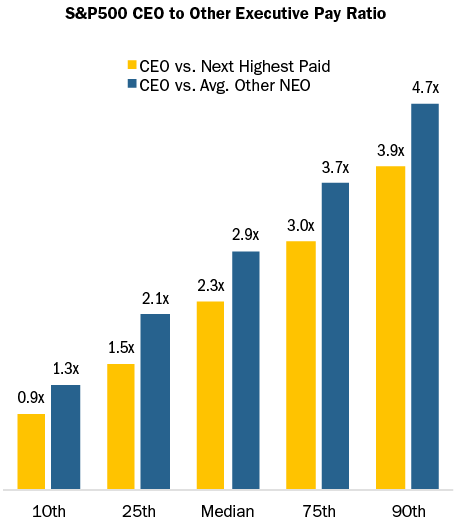

- At median, CEO pay was 2.3x the second highest paid NEO; i.e., for every $1.00 paid to the second highest paid NEO, the CEO was paid approximately $2.30

- At median, CEO pay was 2.9x average Other NEO pay; i.e., for every $1.00 paid to an average NEO, the CEO was paid approximately $2.90

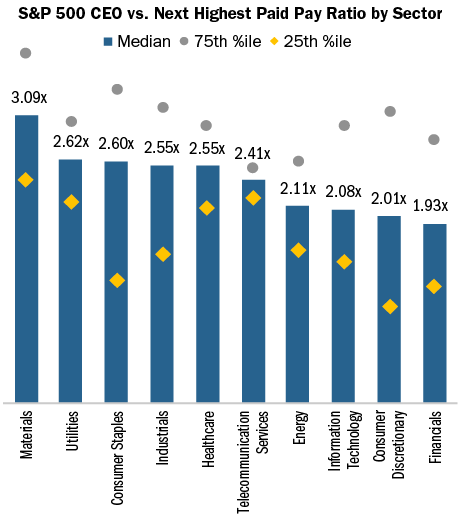

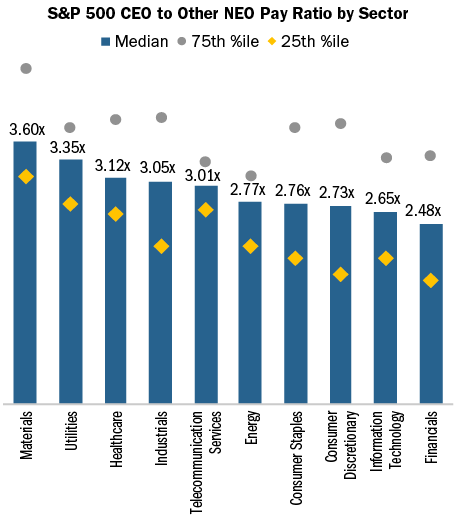

CAP also analyzed the S&P 500 senior executive pay ratios by industry.

- For the CEO vs. second highest paid NEO ratio, the materials sector had the highest ratio of 3.09x at median, while financials had the lowest ratio of 1.93x at median

- For the CEO vs. average Other NEO ratio, the Materials sector had the highest ratio of 3.60x at median, while financials had the lowest ratio of 2.48x at median

How do ISS and Glass Lewis use pay ratios?

Both proxy advisory firms include senior executive pay ratios in their annual proxy reports.

- ISS includes the ratio of CEO pay versus the second highest paid active NEO, as well as the ratio of CEO pay versus the average of the other active NEOs. “Pay” includes all elements from the Summary Compensation Table; however, the grant-date value of stock options is updated to reflect ISS’ methodology which differs from accounting rules

- Glass Lewis includes the ratio of CEO pay versus the average of other NEOs during each of the past three years. “Pay” includes select elements from the Summary Compensation Table: Salary, Bonus, Non-Equity Incentive Plan, Stock Awards, and Option Awards

ISS also uses pay ratio as one of the inputs to the Compensation score it assigns companies in its QuickScore 3.0 tool, which is meant to influence investment decisions through an assessment of governance risk factors. The ratio of CEO pay versus the second highest paid active NEO is included in QuickScore 3.0.

When do proxy advisors perceive there to be a possible issue?

To our knowledge, these ratios have not been used by ISS or Glass Lewis to justify an Against Say on Pay vote recommendation. However, large pay discrepancies can reinforce other negative factors. In general, comments from ISS and Glass Lewis are likely when the ratio exceeds 4x. Ratios exceed 4x at 5-10% of S&P companies, depending on which ratio is used (see ISS and Glass Lewis definitions above). Ratios rising to 5-6x, or greater, will receive more strongly worded commentary.

Conclusion

We believe that there is limited utility in the pay ratio disclosure that will be required by the SEC under Dodd-Frank. In contrast, it is a worthwhile exercise to track and discuss these senior executive pay ratios with the Compensation Committee. The ratio(s) can be discussed as part of succession planning and best-in-class talent management. The ratio(s) can also be another input in the executive officer benchmarking process; i.e., when setting or adjusting target pay levels.

1 Total compensation as disclosed in the Summary Compensation Table was used for this analysis.