Compensation Advisory Partners (CAP) assessed human capital actions taken by companies in the Real Estate sector in response to the COVID-19 pandemic. Key findings include:

- The Real Estate sector was nominally impacted by the COVID-19 pandemic.

- 24% of the Real Estate companies in the S&P Composite 1500 Index reported human capital actions in response to the pandemic. In contrast, 41 percent of companies in the S&P 1500 reported actions.

- Pay reductions for executives and board members are the most prevalent human capital actions in the Real Estate sector.

- Median salary reductions were 50 percent for chief executive officers (CEOs), while median salary reductions for other executives were 21 percent.

- For boards of directors, pay was cut by a median of 33 percent.

- In addition to pay reductions for executives and boards, the most prevalent human capital actions in the Real Estate sector were furloughs, workforce reductions and employee pay reductions.

The PDF of the report provides additional data for the Real Estate sector.

The human capital actions that CAP is tracking include pay cuts; changes to annual and long-term incentives; furloughs; workforce reductions; suspended 401K matches; enhanced health and welfare benefits; additional pay for frontline workers; pay continuity; and workforce expansions. CAP will continue to monitor corporate public announcements of COVID-19 actions.

Compensation Advisory Partners (CAP) assessed human capital actions taken by companies in the Information Technology sector in response to the COVID-19 pandemic. Key findings include:

- The Information Technology (IT) sector and its Software & Services, Technology Hardware & Equipment, and Semiconductors and Semiconductor Equipment industries were nominally impacted by the COVID-19 pandemic.

- 28% of the Information Technology companies in the S&P Composite 1500 Index reported human capital actions in response to the pandemic. In contrast, 41 percent of companies in the S&P 1500 reported actions.

- Of the industries in the Information Technology sector, Software and Services (33%) and Technology Hardware and Equipment (32%) were impacted similarly, with about a third of companies reporting actions. In the Semiconductors and Semiconductor Equipment industry, only 15% of companies reported actions.

- Pay reductions for executives and board members are the most prevalent human capital actions in the Information Technology sector.

- Median salary reductions were 30 percent for chief executive officers (CEOs), while median salary reductions for other executives were 20 percent.

- For boards of directors, pay was cut by a median of 28 percent. The range of board pay cuts approximates the range for CEO pay cuts.

- In addition to pay reductions for executives and boards, the most prevalent human capital actions in the Information Technology sector were furloughs, employee pay cuts, and workforce reductions.

The PDF of the report provides additional data for the Information Technology sector.

The human capital actions that CAP is tracking include pay cuts; changes to annual and long-term incentives; furloughs; workforce reductions; suspended 401K matches; enhanced health and welfare benefits; additional pay for frontline workers; pay continuity; and workforce expansions. CAP will continue to monitor corporate public announcements of COVID-19 actions.

Compensation Advisory Partners (CAP) assessed human capital actions taken by companies in the Financials sector in response to the COVID-19 pandemic. Key findings include:

- The Financials sector was moderately impacted by the COVID-19 pandemic, with 27% of companies in the S&P Composite 1500 Index taking human capital actions.

- Banks, which often have retail operations, reported the most actions (35%) – many of which were positive for employees, such as expanded time off and healthcare benefits, and one-time bonuses and additional pay for on-site workers

- The five most prevalent human capital actions by Financial Sector are expanded benefits programs, one-time bonuses for non-executives, additional payments for on-site employees (non-executives), reducing CEO base salary, and guaranteed pay continuity for non-executives

- Executive salaries were reduced, particularly in Diversified Financials and Insurance:

- Median salary reductions were 30 percent for chief executive officers (CEOs), while median salary reductions for other executives were 20 percent.

- For boards of directors, pay was cut by a median of 28 percent.

The PDF of the report provides additional data for the Financials sector.

The human capital actions that CAP is tracking include pay cuts; changes to annual and long-term incentives; furloughs; workforce reductions; suspended 401K matches; enhanced health and welfare benefits; additional pay for frontline workers; pay continuity; and workforce expansions. CAP will continue to monitor corporate public announcements of COVID-19 actions.

Compensation Advisory Partners (CAP) assessed human capital actions taken by companies in the Communication Services sector in response to the COVID-19 pandemic. Key findings include:

- The Communication Services sector and its Telecommunication Services and Media & Entertainment industries were hit significantly by the COVId-19 pandemic.

- 54% of the Communication Services companies in the S&P Composite 1500 Index reported human capital actions in response to the pandemic. In contrast, 41 percent of companies in the S&P 1500 reported actions.

- Of the industries in the Communication Services sector, Media & Entertainment was particularly hard hit, with 59 percent of companies reporting human capital actions. In the Telecommunication Services industry, 38 percent of companies took human capital actions in response to COVID-19.

- Pay reductions for executives and board members are the most prevalent human capital actions in the Communication Services sector.

- Median salary reductions were 50 percent for chief executive officers (CEOs), while median salary reductions for other executives were 20 percent.

- For boards of directors, pay was cut by a median of 25 percent.

- In addition to pay reductions for executives and boards, the most prevalent human capital actions in the Communication Services sector were furloughs, workforce reductions and suspended raises and/or bonuses.

The PDF of the report provides additional data for the Communication Services sector.

The human capital actions that CAP is tracking include pay cuts; changes to annual and long-term incentives; furloughs; workforce reductions; suspended 401K matches; enhanced health and welfare benefits; additional pay for frontline workers; pay continuity; and workforce expansions. CAP will continue to monitor corporate public announcements of COVID-19 actions.

Compensation Advisory Partners (CAP) assessed human capital actions taken by companies in the Industrials sector in response to the COVID-19 pandemic. Key findings include:

- The Industrials sector and its Capital Goods, Commercial and Professional Services, and Transportation industries were hit hard by COVID-19, as reflected by the percentage of companies taking actions in response to the pandemic.

- Half of the Industrials companies in the S&P Composite 1500 Index reported human capital actions in response to the pandemic. In contrast, 39 percent of companies in the S&P 1500 reported actions.

- Of the industries in the Industrials sector, Transportation was particularly hard hit, with 69 percent of companies reporting human capital actions. In the Commercial and Professional Services industry, 51 percent of companies took human capital actions in response to COVID-19, while 45 percent of companies in the Capital Goods sector took actions.

- Pay reductions for executives and board members are the most prevalent human capital actions in the Industrials sector.

- Median salary reductions were 38 percent for chief executive officers (CEOs), while median salary reductions for other executives were 20 percent.

- For boards of directors, pay was cut by a median of 30 percent. The range of director pay cuts is similar to the range of CEO salary cuts.

- In addition to pay reductions for executives and boards, the most prevalent human capital actions in the Industrials sector were furloughs, pay reductions for employees, and workforce reductions.

The PDF of the report provides additional data for the Industrials sector.

The human capital actions that CAP is tracking include pay cuts; changes to annual and long-term incentives; furloughs; workforce reductions; suspended 401K matches; enhanced health and welfare benefits; additional pay for frontline workers; pay continuity; and workforce expansions. CAP will continue to monitor corporate public announcements of COVID-19 actions.

When OPEC meetings in Vienna ended last week without a deal to extend production cuts to counter the drop in demand brought about by the Coronavirus outbreak, Saudi Arabia and Russia initiated a production battle, flooding the market with more oil regardless of the price. As a result, the energy industry is in a tailspin with WTI crude prices at $22.

The impact of this price drop has had an immediate impact. Producers have already announced spending cuts which quickly trigger layoffs and furloughs among the oilfield services and drilling companies. Some companies have already announced these moves and it is inevitable at many others.

CAP has conducted a “pulse” survey within the oilfield services and drilling sectors to get a sense of the impact this is having on executive compensation. 19 companies participated in our survey this week and the findings are summarized below.

Key Takeaways

- While less than 10% have implemented base salary cuts, nearly half of the companies we spoke with are currently considering them and the reductions will be deeper than those made several years ago at the start of the downturn.

- Nearly one-third of companies have not yet established annual incentive goals for 2020.

- Another one-third indicated that discussions to adjust goals approved in the last few weeks have already begun.

- 16% indicated that bonus payouts for 2020 have already been capped or suspended altogether. The vast majority indicated bonus target reductions have not been considered.

- As the first quarter of 2020 comes to a close, 47% of companies already indicate they expect the Compensation Committee will exercise discretion on bonus payouts at the end of the year.

- 21% of companies have not yet made LTI grants with some citing market volatility.

- 79% of companies have already issued grants with 73% of those indicating that grant date award values were equal to or very close to prior year award values. 27% have modest reductions in grant date value mostly attributable to lower stock prices.

- Almost 60% of companies stated that cash-settled long-term awards were (or will be) used. The average allocation of cash awards is roughly 50% of the total value granted.

Base Salary

2020 was not going to be a year for prevalent salary increases in the sector, but within a matter of a weeks it now seems inevitable that executive salary cuts will be widespread. As talk of layoffs and furloughs turns into reality, the optics are not good (internally and externally) if executives are not also impacted. While only a handful of companies have already implemented salary cuts, the topic has come up and is under consideration at nearly half of the companies we spoke with.

Our early read is that the cuts already implemented and under consideration are deeper than those we saw 4-5 years ago. At that time, reductions of 5-7.5% were common. Cuts of 15-20% have already occurred at a couple of companies with a few others indicating 10%-20% cuts are likely.

Annual Incentive / Bonus Program

One of the toughest responsibilities of the Compensation Committee is to establish meaningful performance goals in the midst of great uncertainty. Based on our survey, approximately 32% of companies have not yet established performance goals for 2020.

Of those with approved goals, 31% indicated they already anticipate an adjustment to the performance levels approved just in the last few weeks.

During the extended downturn, we have seen many companies widen the range of performance from threshold to maximum. With these wide performance ranges, the payout levels are typically lowered. For instance, when threshold performance is lowered to 60% or 70% of target the payout might start at 25% instead of the normal 50% of target. Likewise, maximum performance is often stretched further or the payout may be capped at a lower multiple (i.e. 150% vs. the standard 200% leverage).

A few companies indicated that within the last couple of weeks they have already suspended or capped 2020 bonus payouts. While only 16% of companies indicated such actions, it is not an insignificant development at this early stage.

One trend that we think will increase dramatically in 2020 will be the use of discretion by the Compensation Committee. In fact, with Coronavirus adding to the disruption caused by low oil prices, we believe discretion will be widely used across many industries this year. 47% of the companies in our survey already expect the Compensation Committee to exercise discretion over payouts at the end of the year. A little more than one-third (38%) of those expecting discretion indicated the application would only be negative (to lower payouts).

Competing views on the use of discretion are sure to emerge. ISS and Glass Lewis consider positive discretion to be problematic although that view may evolve this year given that global economy is under unprecedented stress. Some will argue that as stakeholders are hurt, executive bonuses should be reduced or even curtailed. On the other hand, executives will work tirelessly and often pick up additional responsibilities in times like these to stabilize and survive and some believe they should be rewarded for doing so.

It will be important for all to document the impact of the oil price decline coupled with the impact of the Coronavirus. These events are so significant that it may be necessary for compensation committees to evaluate an executive team’s performance on executing the adjusted strategic plan.

Whether discretion is applied or more qualitative type goals are used to assess performance, companies should be prepared to provide clear and enhanced disclosure of the decision-making process and the impact of the operating environment.

Long-Term Incentive Program

Stock prices within the sector were already low and many companies had already spent a great deal of time deliberating over grant sizes and values for 2019/2020 cycle awards. To make matters much worse, stock prices have fallen precipitously in the last few days – more than 50% in most cases. For those who have not yet made grants it will likely be impossible at this point to come close to awarding values from last year due to the severely reduced stock prices, burn rate implications, and share availability.

That said, most of the companies responding (74%) have already issued grants. 73% of those companies issued 2020 awards that have a grant date value equal to last year’s award. 27% indicated that award values are less than prior year primarily due to share availability and lower stock prices as opposed to intentional reductions in award value.

Nearly 60% of the sector issued (or intends to issue) cash-settled awards. The average company has allocated 50% of the total award value to cash-settled instruments. The most prevalent practice is to issue restricted stock awards with performance-based awards that pay out in cash. The use of cash alleviates some of the pressure on long-term plans by reducing share usage.

As we move forward, companies will be forced to consider various techniques. These could include dilution caps, using a 30- or 60-day average stock price to determine grants, restricted cash awards at and below the director level of the organization (and possibly higher), establishing stock price hurdles that act as performance conditions for vesting to occur or switching to a fixed share approach, among other practices.

Conclusion

While companies across the globe are in crisis mode, it will be important for compensation committees to strike a balance between stakeholder interests and the interests of their executives. A tremendous amount of wealth has been erased in a week. While retention is a key issue it should not be overplayed at this moment. The focus is to manage through the crisis. Achieve alignment by motivating the team to engage in the achievement of the strategic plan by incorporating milestone measures into the annual incentive plan and make financial performance goals achievable – at least at the threshold level. Use discretion where appropriate to balance outcomes at the end of the year. We are at the front end of an unprecedented year for the oil & gas industry while at the same time the entire world braces for recession due to Coronavirus. However, the recovery, when it comes, will bring opportunity.

Each year CAP analyzes non-employee director compensation programs among the 100 largest companies. These companies can provide early insights into trends for compensation practices. This report reflects a summary of pay levels and pay practice trends based on 2019 proxy disclosure.

CAP Findings

Board Compensation.

pay levels remained generally flat

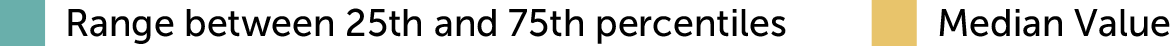

- Total Fees. Board compensation continues to be in a steady state with low single-digit annual increases. Median is now $305K, up from $300K last year. This is the lowest year over year increase we have seen recently.

- Pay Structure. Companies rely mainly on annual retainers (cash and equity) to compensate directors. Pay programs for large companies are simple and tend to rely less on meeting fees or committee member retainers. We support this approach as it simplifies administration and eliminates the need to define what counts as a meeting, though this simplified approach may not be appropriate in all situations.

- Meeting Fees. Consistent with prior years, only 12 percent of companies studied provide meeting fees. Companies could consider having a mechanism for paying meeting fees if the number of meetings in a single year far exceeds the norm (“hybrid approach”). Also consistent with prior years, 5 percent of companies studied used this “hybrid approach” to meeting fees, with the threshold number of meetings ranging between 6 and 10.

- Equity. 98 percent of companies used full-value awards (shares/units) and only 4 percent used stock options (3 of the 4 companies granting stock options used both vehicles). Almost all companies denominated equity awards using a fixed value, versus a fixed number of shares. Using fixed value is generally considered best practice as it manages the “target” value awarded each year.

- Pay Mix. On average, total pay is comprised of 62 percent equity and 38 percent cash, which is consistent with findings in other recent years.

- Process. One-third of companies disclosed increases to board cash and/or equity retainers versus prior year.

Committee Member1 Compensation.

prevalence continues to slowly decline

- Overall Prevalence. 45 percent of companies paid committee-specific member fees for Audit Committee service, 28 percent paid member fees for Compensation Committee service, and 26 percent paid member fees for Nominating/Governance Committee service. Companies rely more on board-level compensation to recognize committee member (non-Chair) service, with the general expectation that all independent directors contribute to committee service needs.

- Total Fees. Of the companies that paid committee member compensation, the median was $13K in total, down from $16k in prior year.

Committee Chair2 Compensation.

little/no change

- Overall Prevalence. More than 90 percent of companies studied provided additional compensation to committee Chairs to recognize additional time requirements, responsibilities, and reputational risk.

- Fees. Median additional compensation remained at $25K for Audit Committee Chairs, $20K for Compensation Committee Chairs, and increased to $20K for Nominating/Governance Committee Chairs. In the past, Nominating/Governance Chairs were paid around $15K. Most often, such fees were delivered through an additional cash retainer.

Independent Board Leader Compensation.

little/no change

- Non-Exec Chair. Additional compensation is provided by nearly all companies with this role. Median additional compensation was $225K. As a multiple of total Board Compensation, total Board Chair pay was 1.75x a standard Board member, at median.

- Lead Director. Median additional compensation was $35K, consistent with prior year. Additional compensation is provided by nearly all companies with this role3. The differential in pay versus non-executive Chairs is in line with typical differences in responsibilities.

Pay Limits.

prevalence continues to increase

- 62 percent of companies have an award limit for director compensation, up from 54 percent in the prior year.

- Director pay limits are largely due to advancement of litigation where the issue has been that directors approve their own annual compensation and are therefore deemed to be inherently conflicted.

- Similar to last year, limits range from $250K to $4.75 million, with a median limit of $750K. Companies that denominate the limit in shares tend to have a higher dollar-equivalent limit, with a median of $925K. The median for the companies with value-based limits is $675K.

Limit Range Prevalence <= $500,000 29% $500,001 – $1,000,000 50% $1,000,001 – $2,000,000 16% > $2,000,000 5% - The limits are generally much higher than annual equity grants. Approximately one-third of limits are equivalent to more than 5x the annual equity grants.

Limit Multiple Range Prevalence <= 3x annual equity 37% 3.01x – 5x annual equity 31% 5.01x – 7x annual equity 17% > 7x annual equity 15% - Approximately 60 percent of companies with limits apply it to just equity-based compensation, compared to 70 percent last year. We anticipate the prevalence of limits that apply to both cash and equity-based compensation (i.e., total pay) will continue to increase.

- Some companies exclude initial at-election equity awards and/or additional pay for Board leadership roles from the limit.

- The higher limits above likely are intended to address the possibility of having a non-executive Chair. However, in terms of potential perceived conflict of interest when it comes to setting pay for the non-executive Chair, the incumbent can be recused from discussions and the vote on their pay.

Some Changes CAP Suggests Companies Consider (Looking Ahead).

- Recruiting New Directors. As boards look to refresh and diversify their membership, this may be the time to re-visit initial at-election equity awards for new directors. There has been a considerable “move to the middle” with director pay programs, and at-elections grants can be a way to differentiate your company’s pay program in the recruiting process without a broader, more costly, increase to standard director pay levels.

- Board Leadership Roles. Taking on the role of non-executive Chair, Lead Director or Chair of a major Board committee can come with considerable additional time requirements, responsibilities, and reputational risk, yet additional compensation provided for most of these roles only reflects a market premium on the standard director pay program. Providing greater additional compensation for the role of non-executive Chair, Lead Director of Chair of a major Board committee should be considered, in recognition of the typical time requirements, responsibilities and reputational risk individuals in these roles take on.

- Stock Ownership Requirements. Many boards, especially among the largest companies, require equity-based compensation be deferred until retirement (i.e., termination of board service). While we encourage further aligning director and shareholder interests through equity ownership, another approach is maintaining a standard stock ownership guideline (e.g., multiple of annual cash retainer). A stock ownership guideline may be a competitive advantage when recruiting new directors who may be more focused on current compensation, versus having to hold all equity-based compensation until termination of board service.

Appendix

Total Board Compensation ($000s)4

Additional Compensation for Independent Board Leaders ($000s)

1 Audit, Compensation and/or Nominating and Governance committees.

2 Audit, Compensation and/or Nominating and Governance committees.

3 Excludes controlled companies. Also excludes instances where Lead Director role is assumed by Chair of Nominating and Governance Committee, who receives compensation for the role.

4 Total Board Compensation reflects all cash and equity compensation for Board and committee service, excluding compensation for leadership roles such as committee Chair, Lead/Presiding Director, or non-executive Board Chair.