DOWNLOAD A PDF OF THIS REPORT pdf(0.4MB)

Contact

Melissa BurekFounding Partner [email protected] 212-921-9354 Eric Hosken

Partner [email protected] 212-921-9363 Bonnie Schindler

Principal [email protected] 847-636-8919 E. Whitney Cook

[email protected] 212-921-9350

Companies make special equity awards to executives and key talent as unique business situations arise, but the COVID-19 pandemic triggered a larger number of such awards than during a typical year. Compensation Advisory Partners (CAP) reviewed special, one-time long-term incentive (LTI) awards granted by 49 S&P 1500 companies during the pandemic. The special awards made during COVID-19 were granted for several main reasons: to retain talent, to reward past performance and replace incentive value lost because of COVID-19, and to incentivize future performance. While COVID-19 was a unique situation, the lessons learned from this sample of 49 companies may be instructive for special grants in the future.

Amidst the economic disruption and unprecedented circumstances created by the COVID-19 pandemic, many companies found themselves balancing the need to cut costs and conserve cash with retaining the talented leaders required to navigate the crisis. A number of companies addressed these opposing needs by granting one-time, special equity awards to executives. While companies make special equity grants for many reasons in “normal” economic times, COVID-19 resulted in a large number of companies taking this action during a compressed period. Compensation Advisory Partners (CAP) assessed special, one-time long-term incentive (LTI) awards granted by the first 49 S&P 1500 companies to make such awards during the pandemic. While COVID-19 presented a truly unique situation, analysis of this sample of companies and their special awards may be instructive for companies considering special grants in the future.

Companies Making Special Equity Awards

CAP reviewed special equity awards made by 49 S&P 1500 companies during 2020 and the first half of 2021. Fifteen of the companies represent the S&P 500; 18 represent the S&P MidCap 400; and the remaining 16 companies represent the S&P Small Cap 600. The companies range in size from $35 million in revenue to nearly $100 billion. The companies that used special one-time equity awards show significant representation from the Consumer Discretionary, Industrials, and Information Technology sectors.

Special Equity Award Objectives

Special, one-time equity awards are a tool that companies have historically used as unique business situations arise. While COVID-19 was unprecedented, the objectives for special equity grants made during the pandemic mirrored traditional reasons, but with a COVID-twist.

Special Equity Award Objectives

|

Traditional Special Award Objectives |

COVID-19 Twist |

|

|

Retain talent, especially in competitive industries and/or during times of change |

→ |

Retain talent and stabilize the management team during COVID-19’s economic turmoil |

|

Drive future performance |

→ |

Provide incentives to return the company to pre-COVID levels of performance |

|

Reward outstanding past performance |

→ |

Reward past performance and replace a portion of equity value erased by COVID-19 |

|

Recognize leadership |

→ |

Recognize leadership for those in charge of the COVID-19 response |

|

Other: Recruit new hires and “buy out” the value of lost incentives at the prior employer |

||

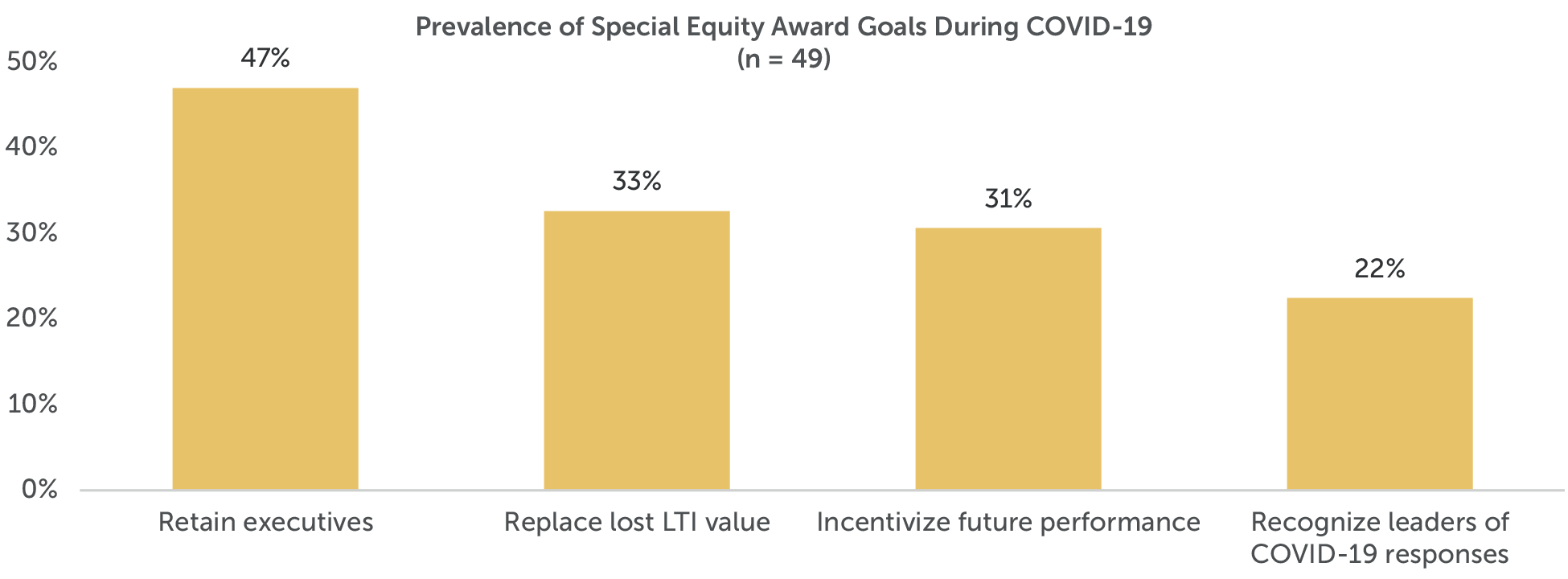

During COVID-19, the most common rationale for special awards was retention of top executives and other key employees. Replacing lost LTI value and recognizing past financial and stock price accomplishments erased by COVID-19 was the second most common goal of special awards. Incentivizing future performance and recognizing those who led COVID responses were other key reasons. Many companies’ awards were made to achieve several of the goals. CAP used its best judgment to classify the awards into the categories shown below based on company disclosure language and the types of vehicles used.

Note: Some companies expressed more than one rationale for special equity awards, so the prevalence sums to greater than 100%.

Restricted stock or restricted stock units (RSUs) were by far the most common vehicles used, followed by performance share units (PSUs) and stock options.

Note: Some companies used more than one vehicle for special equity awards, so the prevalence sums to greater than 100%.

Companies most often granted special equity awards to the named executive officers (NEOs) and other executives. Certain companies limited awards to specific executives who made more significant contributions during the pandemic. Five companies noted that special awards were made beyond the executive group to a portion of the broader employee population.

The following sections discuss the special equity award objectives and prevalent practices associated with each.

Retain Talent

Many companies were in a reactive mode when COVID-19 hit in 2020 and, to a lesser degree, in early 2021. Companies needed to stabilize their executive teams during this period of uncertainty, and special awards addressed the difficulty of replacing valuable executives when a material risk of an executive’s departure would cause meaningful harm to the company. Of the 49 companies in the sample, 23 granted special awards with a stated purpose of retaining key talent.

The most prevalent retention vehicle is restricted stock or restricted stock units (RSUs). Of the 23 companied that made retention grants, 17 companies included restricted stock or RSUs as an equity vehicle. Other vehicles used include PSUs (six companies) and stock options (four companies). Two companies included a cash vehicle as part of the retention grants.

Vesting for the retention grants ranged from one year to six years, with two- and three-year vesting being most common.

Examples

- DiamondRock Hospitality Company – Granted special retention awards for certain executives, including the NEOs, in consideration of increased competition for lodging industry talent, the management team’s contributions to the company’s success prior to the onset of the pandemic as well as its prompt and comprehensive response to the crisis, and value to the company of leadership continuity through a market downturn. The special retention awards are in the form of RSUs, which increase alignment between executives and stockholders and preserve cash liquidity for the company. The RSUs vest over three to five years.

- Comtech Telecommunications Corp. – Made loyalty stock option grants to employees and NEOs with 10 years or more of service. The option grants, which vest ratably over five years, are intended to motivate employees during a period of uncertainty and after a terminated acquisition.

Replace Lost LTI Value

Sixteen companies granted equity intended to replace outstanding awards that had lost their retentive value and/or that had been canceled because of COVID-19’s impact on the economy. When COVID hit, many companies had multi-year performance awards outstanding with goals based on normal business operations and stock market performance. COVID rendered many business plans useless, and stock prices toppled in many industries. COVID wiped out the value in many LTI plans and provided management teams with myriad business challenges and operating difficulties. As a result, some companies elected to make special equity grants.

The vehicles used varied. Ten companies used restricted stock, four used stock options, four used PSUs and one used stock appreciation rights. Four of the companies used more than one vehicle.

To determine the targeted value for the replacement awards, approaches varied, and not all companies disclosed their methodologies. Several companies aimed to approximate a certain percentage of the targeted long-term incentive value or the lost incentive value. Approaches reported include:

- Grant the same number of shares as the number cancelled

- Grant value equals 50 percent to 100 percent of the annual target grant value

- Targeted value equals 50 percent to 100 percent of the decline in value because of COVID-19

One company reported providing a lower grant value to the CEO, while another company reported providing greater replacement value to employees than executives.

Examples

- Medtronic Plc. – Made special, one-time grants of unvested stock options to NEOs to align pay with the performance delivered to stockholders as the business recovers from the pandemic. The stock options have ten-year terms and vest over four years in equal increments beginning one year after the date of grant. Award values range from $620,000 to $2.5 million.

- Nordson Corporation – Determined not to revise the goals for the 2020 PSUs and instead awarded stock option grants to each of the NEOs in recognition of continued economic uncertainty and a desire to incentivize executives toward optimal shareholder outcomes. The stock options have two-year cliff vesting. The company also granted special, one-time RSU awards to certain members of management. The RSUs have two-year vesting and a gateway performance measure of 8% return on invested capital that must be maintained over the two-year period for the awards to vest.

Incentivize Future Performance

Fifteen companies granted special equity awards to incentivize future performance and align management with the goal of achieving financial stability and/or returning to pre-COVID levels of performance. The most common vehicle used to incentivize future performance is PSUs tied to specific financial goals. Ten companies used PSUs. Other vehicles used include stock options (four companies, with one using premium-priced stock options), and performance cash (one company). Unum Group, an insurance company, focused on both retention and incentivizing performance. The company used restricted stock with six-year cliff vesting and earlier vesting if certain performance hurdles are achieved. Three companies made part of their awards in restricted stock to include a retention focus with the performance awards.

The vesting and performance periods for these companies range from one year to six years, with three years being the most common duration.

Performance measures vary across the companies and are tailored to each company’s unique COVID challenges. Measures used include stock price, total shareholder return (TSR), earnings per share (EPS), net income, free cash flow, book value growth, return on net assets, and Environmental, Social and Governance (ESG) measures.

Examples

- The Coca-Cola Company – Awarded special “Emerging Stronger” PSU awards to approximately 1,000 employees, including the NEOs, designed to motivate and reward employees to continue to drive company performance and emerge stronger from the pandemic. The ultimate value of the award is contingent upon the achievement of EPS goals that reach pre-COVID-19 levels over a two-year period, as well as a relative TSR modifier.

- Herman Miller, Inc. – Granted premium-priced stock options to the leadership team that vest ratably over a three-year period commencing on the first anniversary of the grant date and are in addition to the company’s customary long-term incentive awards for fiscal year 2021.The premium-priced option awards are intended to further align the leadership team with the goal of increasing shareholder value. These awards enhance the focus on the long-term impact of the critical steps that management is taking to aid in the recovery from the effects of the COVID-19 pandemic on the business and position the company for future growth.

Recognize Leaders of COVID-19 Responses

Eleven companies disclosed special awards to select NEOs and key employees to recognize their leadership through the COVID-19 crisis. These awards predominately took the form of time-based restricted stock, although three of the companies used PSUs. Vesting for recognition awards varies from one year to four years, with the most typical vesting period being three years.

Examples

- Chevron Company – Awarded restricted stock, which cliff-vests in five years, to the Executive Vice President (EVP), Technology, Products and Services. In its proxy, Chevron clearly communicates the unique nature of the special award – its first special LTI grant since 2016 – and the rationale for the award: to recognize the EVP’s leadership in managing the company’s global COVID-19 response in addition to his oversight of the integration of Noble Energy, Inc., and an enterprise-wide business restructuring.

- Quidel Corporation – Made a special restricted stock unit grant to the senior vice president of research and development in recognition of the individual’s role in the development of the company’s COVID-19 diagnostic products.

Proxy Advisor and Investor Scrutiny

Special, one-time awards have the potential to draw scrutiny from proxy advisors and institutional investors. One-third of the companies in this analysis received “Against” recommendations from Institutional Shareholder Services, and two-thirds of those companies with “Against” recommendations failed Say on Pay votes.

Companies granting special equity awards frequently do so because of depressed stock prices. As a result, these companies trigger elevated concern on proxy advisor quantitative pay-for-performance tests that use TSR. An elevated concern on quantitative screens triggers qualitative assessment. Proxy advisors have made it clear that they are open to listening to rationales for pay actions taken to address issues caused by COVID-19. Compensation committees should strive to convey clear, compelling rationales in their proxies as to why special awards were made and how they are in the company’s and shareholders’ best interests.

Looking Ahead

While COVID-19 triggered an unusually large sample of special equity awards over a short duration, such awards will likely be used more selectively in the future. Compensation committees making special equity awards in the future should carefully consider several issues to ensure that the awards are reasonable and support company and shareholder objectives. Key considerations should include:

- The overall quantum of the award

- The company’s pay for performance relative to peers and potential proxy advisor concerns

- The vehicle(s) used in the award and linkage to company performance

- The duration of vesting and/or performance period

- The breadth of the recipients

- The clarity of the proxy communication about the award and its necessity to the company

Special equity awards can be useful compensation tools to achieve specific objectives. Companies can mitigate scrutiny from proxy advisors, institutional investors, shareholders, and employees, if the special equity awards are crafted thoughtfully.

Louisa Heywood and Zaina Jabri provided research assistance for this report.

Additional COVID-19 Resources – Compensation Advisory Partners

- COVID-19 Resource Center. CAP’s COVID-19 Resource Center includes a searchable database of business actions related to COVID-19 that can be filtered on company, revenue, company type, industry, and action. CAP’s COVID-19 Resource Center can be accessed here.

- COVID-Related Executive Pay Actions at December FYE Companies Focus on Annual Incentives. CAP summarizes incentive actions taken by December FYE S&P 1500 companies in response to the COVID-19 pandemic. The report can be accessed here.

- Early Read on ISS’ View on COVID-Related Compensation Changes.CAP reviewed select broad market COVID-19 executive compensation actions and the corresponding ISS report commentary. The report can be accessed here.