Contact

Bertha MasudaPartner Emeritus [email protected] 310-541-6233 Bonnie Schindler

Principal [email protected] 847-636-8919

This report summarizes the Compensation Advisory Partners analysis of survey data collected in May 2019 in collaboration with Family Business and Private Company Director magazines.

Private companies face unique challenges relative to their publicly traded peers when compensating top officers and directors. Private companies lack publicly traded stock, which is a key component of top officer and director pay packages at public companies. Private companies face an additional and formidable challenge with regard to setting director pay: Little to no market pay data exists for board service at private companies. Because of the lack of competitive data, private companies often resort to using board pay levels at public peers, if any are available. Private company board pay programs have been based on a combination of the cash portion of public company director pay and the best judgment of decision-makers at the private companies.

To address this lack of competitive market data, Compensation Advisory Partners (CAP), and Private Company Director and Family Business magazines (both of which are published by MLR Media) worked together to survey private companies about their director pay programs. The response was enthusiastic, with more than 600 companies submitting data during the May 2019 survey period. This article provides a high-level summary of the survey data and describes how private companies can approach the design of effective and competitive board compensation programs.

About the Survey Participants

The private companies that responded to the survey represent a broad array of demographic categories. This broad representation results in a robust and unique data set detailing board of director compensation levels and practices.

Company Size

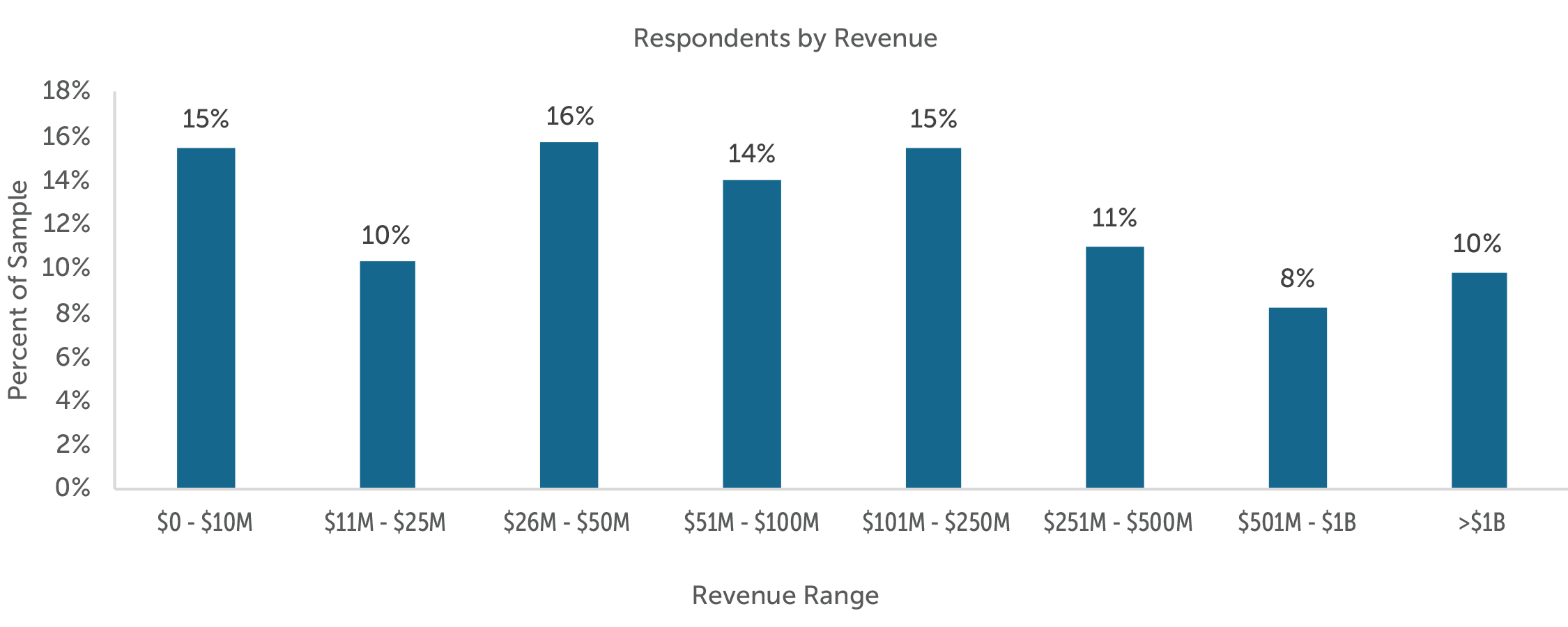

The survey asked about company size because that typically has an impact on board pay levels. Survey respondents have median revenue of $90 million and average revenue of $631 million. The companies in the survey span many revenue sizes as shown in Exhibit 1.

Exhibit 1

Survey participants were also asked about their number of employees and shareholders. The median number of employees for survey participants is 250, while the average is 1,570. The median number of shareholders is seven, with an average of 131.

Industries

The companies that responded to the survey represent a broad range of industries. The largest industries represented in the survey are manufacturing (31%); finance and insurance (9%); retail trade (8%); wholesale trade (7%); professional, scientific, and technical services (7%); construction (7%); real estate, and rental and leasing (5%); and health care and social assistance (5%).

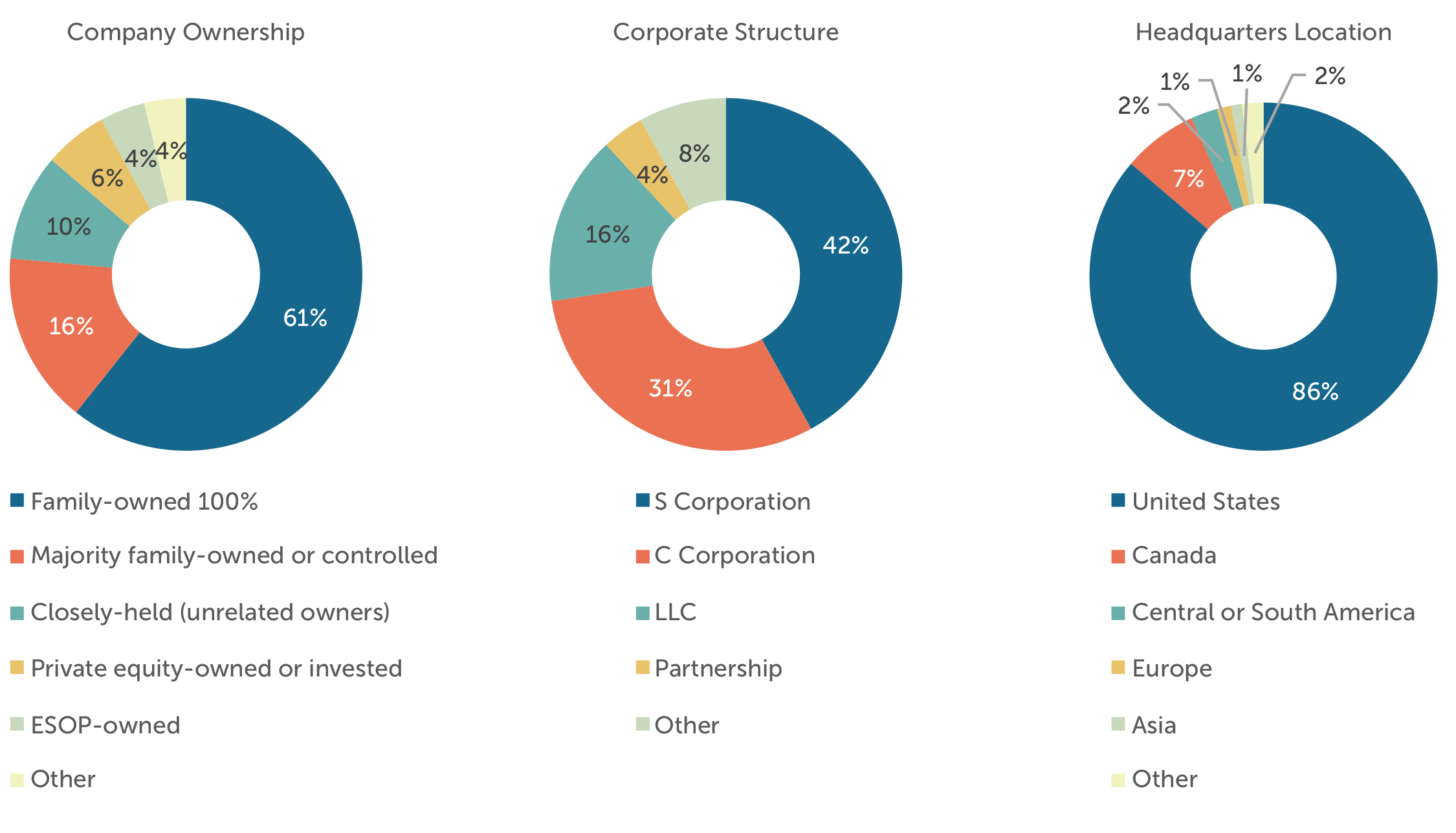

Company Ownership

With regard to company ownership, the largest portion of the sample by far is made up of family-owned businesses. Other ownership groups represented in the sample are companies that are closely held by unrelated owners, private equity-owned or -invested, and employee-owned. (See Exhibit 2.) The “other” ownership category in Exhibit 2 includes mutual companies, tax-exempt entities, and cooperatives.

Corporate Structure

The survey also asked respondents to provide information about their corporate structures. The most prevalent corporate structures are S corporations and C corporations. Smaller numbers of respondents reported that they are limited liability corporations (LLC) and partnerships. (See Exhibit 2.) The “other” category in Exhibit 2 includes mutual companies, sole proprietors, B corporations, cooperatives and trusts.

Location

The vast majority of survey respondents are headquartered in the United States, but the survey drew responses from companies headquartered all over the world. (See Exhibit 2.)

Exhibit 2

Private Company Board Compensation Basics

According to the survey, 87 percent of private companies provide some form of compensation to eligible directors. In public companies, those eligible for compensation are typically outside directors, or those who have no ties to the company through employment. (At times, representatives of private-equity investors do receive cash compensation.) In contrast, 45 percent of private companies compensate board members who are shareholders, family members or executives (“inside” directors). Another 7.5 percent of respondents have “other” compensation arrangements for inside directors. This likely means a hybrid approach that involves some level of compensation for such inside directors, but not to the same degree as outside, independent directors. The high number of private companies that compensate shareholders, family members and executives likely reflects the high percentage of family companies responding to the survey.

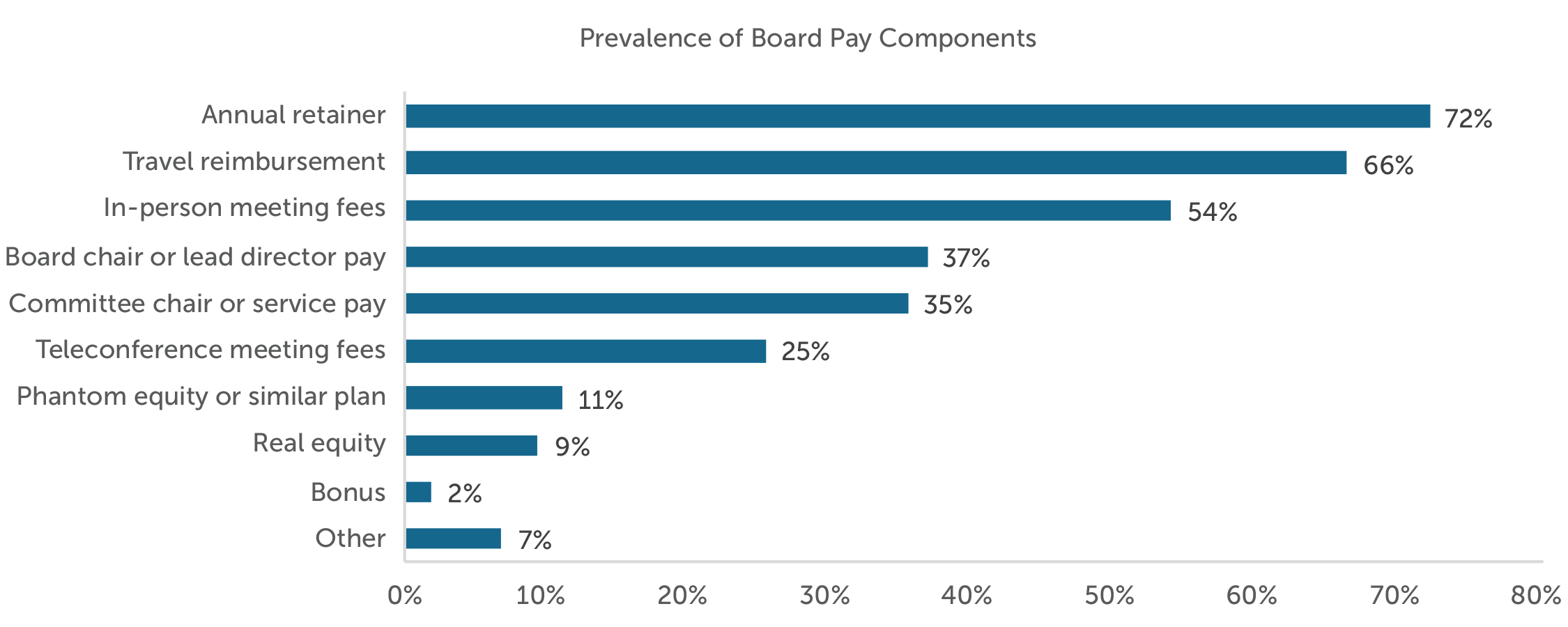

Private-company board compensation programs have two common cash components: An annual retainer and per-meeting fees. An annual retainer, which is an amount paid to each eligible director on an annual or quarterly basis for board service, is offered by 72 percent of private companies surveyed. Per-meeting fees are smaller amounts paid to eligible directors for attendance at each board meeting, and they are offered by 54 percent of the companies surveyed. (See Exhibit 3.)

Exhibit 3

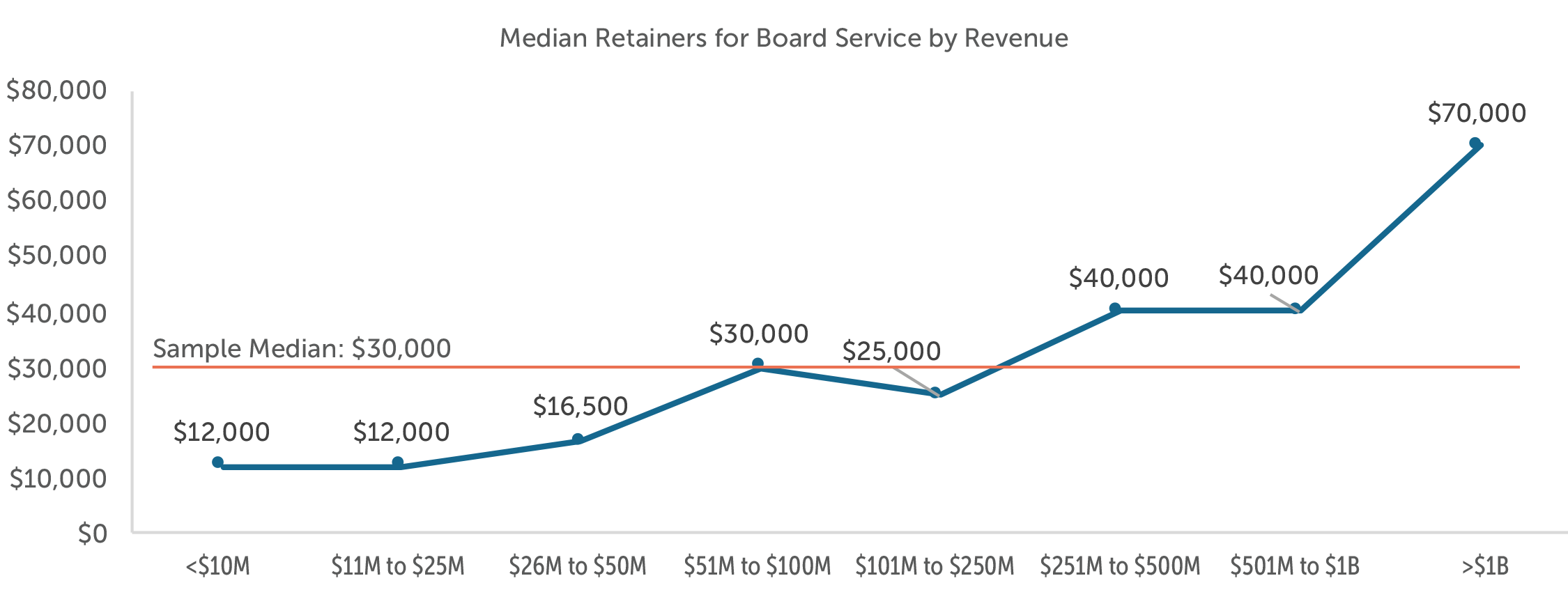

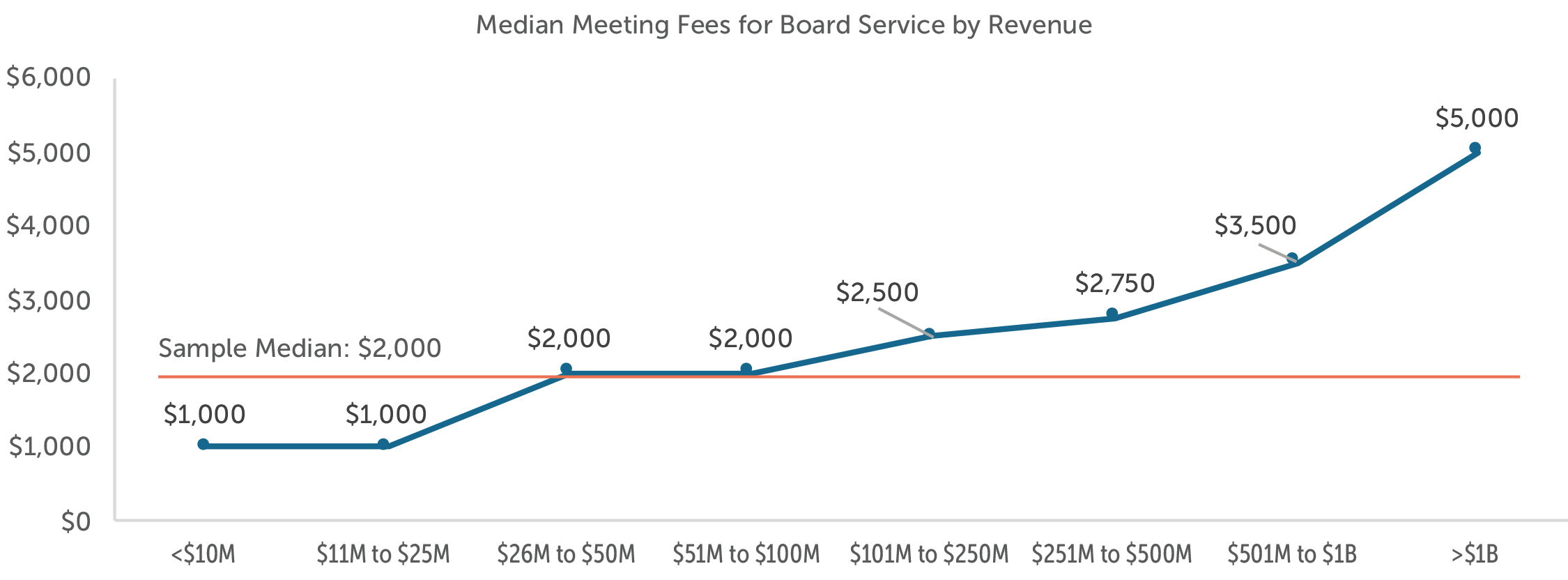

According to the survey, the median annual retainer is $30,000, and the median per-meeting fee is $2,000. Annual retainers and meeting fees increase with company size. (See Exhibits 4 and 5.) Some companies also pay eligible directors a lesser amount for participation in telephonic meetings, with the median payment being $1,000.

Private companies continue to use both an annual retainer and meeting fees, while the trend for director cash compensation at public companies is to pay a higher annual retainer only (i.e., no meeting fees). Public companies have adopted this approach because directorship requires time and effort beyond meetings, so retainers better reflect the requirements of the overall role. In addition, advancements in technology have made meeting participation easier and have blurred the lines for what constitutes a meeting, and public company directors are expected to attend at least 75 percent of board meetings. Incentivizing meeting attendance is, therefore, less of an issue for public companies. Finally, retainers are easier to administer than meeting fees, which require attendance tracking.

Exhibit 4

Exhibit 5

Retainers and per-meeting fees are also used to compensate individuals who take on different roles above and beyond basic board service. According to the survey, 37 percent of private companies offer incremental retainers and/or per-meeting fees for the board chairperson or lead director. In addition, 35 percent of private companies offer incremental retainers and/or per-meeting fees for committee service. In contrast with retainers and meeting fees for basic board service, the retainers and fees for differentiated board roles do not track the company’s size in terms of revenue.

Private companies recognize the value that board members bring to the table; however, only about 20 percent of the private companies surveyed provide long-term incentives to their board members in the form of phantom equity, cash multi-year incentives or actual equity grants, such as stock options or full-value shares. This low prevalence is not surprising, as private companies do not have publicly traded stock. This contrasts with public-company practice, where the vast majority grant equity to their directors. Publicly traded firms provide at least half of a director’s total compensation in the form of equity, typically full-value shares.

Table 1 summarizes the board compensation elements reported in the survey. (Additional data is included in the full survey report, which is provided exclusively to survey participants.)

Table 1

|

Maximum |

Median |

Minimum |

|

| Board Member Base Cash Compensation | |||

| Annual Retainer | $400,000 | $30,000 | $1,000 |

| Meeting Fee | $100,000 | $2,000 | $200 |

| Board Chair Additional Cash Compensation | |||

| Annual Retainer | $450,000 | $20,000 | $1,500 |

| Meeting Fee | $40,000 | $1,700 | $250 |

| Lead Director Additional Cash Compensation | |||

| Annual Retainer | $150,000 | $17,500 | $1,000 |

| Meeting Fee | $15,000 | $1,125 | $250 |

| Committee Chair Additional Cash Compensation | |||

| Annual Retainer | $50,000 | $6,000 | $500 |

| Meeting Fee | $12,500 | $1,000 | $100 |

| Committee Member Additional Cash Compensation | |||

| Annual Retainer | $30,000 | $5,000 | $750 |

| Meeting Fee | $6,000 | $1,000 | $150 |

| Long-Term Incentive (Restricted Stock, Options, Cash) | |||

| Incentive Value | $1,000,000 | $31,250 | $1,000 |

A final prevalent practice for private companies is to reimburse directors for their travel expenses. While this iteration of the survey did not ask about benefits and perquisites, some companies referenced them in their “other” responses. Future iterations of the survey may quantify such compensation elements.

Designing a Private Company Director Compensation Program

Private companies that wish to evaluate the design of their director pay programs should first determine what are the primary objectives of the program. Most board pay programs, whether at private or publicly traded companies, will strive to compensate directors for their time, and for the value received by the company for the director’s contributions. Other common objectives of board pay programs are to:

- Compete with other companies, including public companies, for board talent,

- Attract individuals with needed skills, knowledge and interpersonal networks to the board to supplement the executive team and shareholders,

- Reward directors for contributing to the company’s success, and/or

- Align director interests with shareholder interests.

Companies that are trying to compete for talent or attract special skills should strive to provide a competitive board compensation program, although director pay does not need to be as high as at a public company. Private company boards have a lower level of risk, disclosure and regulation than their publicly traded counterparts.

Once the objectives of the compensation program are defined, the next steps are to conduct internal and external reviews:

Internal review – This step involves looking at the company’s situation and the board dynamics. Issues to consider during the internal review are the complexity of issues facing the company; the likelihood of mergers, acquisitions and/or divestitures; whether the company plans to pursue a value-realizing event; any potential leadership changes or a generational transition in a family business; the company’s executive compensation philosophy and programs; the shareholders’ desire to share equity or not; whether the board’s role is fiduciary or advisory; directors’ expectations and other boards on which the directors serve; the board’s expected time and meeting commitments; non-compensatory benefits of serving on the board; and which board roles and/or committees are more involved and time-consuming. In general, boards and board roles with greater complexity, risk and challenges merit higher compensation.

External review – The external review involves considering how the company compares to its peers and collecting board compensation information for similar companies and/or boards. Sources of compensation information may include informal information from executives and directors about what other companies offer, and more formal information such as public peer company proxy data (generally excluding the equity data) and published survey data, such as the CAP-MLR Media survey. (Companies that participate in the survey have access to specialized data cuts by revenue size, industry and other parameters.) The goal of the external review is to understand competitive compensation practices and ranges, and to inform the company’s decision-making.

Once the internal and external reviews are completed, company shareholders can make decisions about the director compensation program. The shareholders will need to decide what type of pay model to adopt: retainers only, meeting fees only, or a combination of the two. As mentioned previously, publicly traded companies are moving toward a “retainers only” approach for cash compensation. However, the private-company survey indicates that more than 50 percent of private companies use per-meeting fees to compensate directors. A “retainers only” pay model makes sense for companies that wish to pay for overall board roles rather than time spent at individual meetings. Indicators that favor a “retainers only” pay model include material director time required outside of meetings, frequent interaction between board members outside of meetings that could create ambiguity about whether a formal meeting is taking place, a more predictable board workload and a desire for administrative simplicity. Under this model, retainers will need to be set at a level to compensate for all board work. Retainers also can be used to differentiate compensation for board roles. For instance, a basic retainer can be provided to all directors for board service, and incremental retainers can be provided to committee chairs and the board chair to recognize the additional time, effort, skills and knowledge required for those roles.

At the opposite end of the spectrum, some companies may choose a “meeting fees only” pay model. This pay model makes sense if most of the board work is tied to the meetings themselves. Per-meeting fees can be set to take into account typical meeting length, and preparation and follow-up time. Indicators for this pay model include an unpredictable number of meetings, comfort with the administrative efforts required to track and compensate meeting attendance, and most work requirements corresponding to board and committee meetings. Under this pay model, committee work can be compensated through meeting fees that are the same as board meetings or less if committee meetings require less time. In addition, roles such as chairman or lead director could be recognized with a higher per-meeting fee.

For companies that fall somewhere in the middle, a combination of retainers and meeting fees might make sense. Some companies with the potential for a flurry of meetings can stipulate that the basic retainer covers a certain number of meetings. If meetings are required above the number covered by the retainer, then meeting fees will be paid to directors.

In addition, the shareholders will need to decide whether to offer any sort of long-term incentive, such as phantom or real equity, for the directors. Companies that wish to reward directors for contributing to the company’s success and to align director interests with shareholder interests may want to consider providing directors with phantom or real equity stakes, or a multi-year performance bonus. However, according to the CAP-MLR Media survey, most private companies do not do this. However, the practice is common for start-up companies that are cash-constrained, and for private-equity owned companies. In both of those situations, stock options are a common vehicle.

Before implementing a new director pay program, companies should consider the prior year’s board schedule and workload, and calculate what the company’s board compensation expenses would have been last year using the proposed compensation program. This step is particularly important for companies that offer meeting fees. Modeling payouts under a new pay program will help validate the proposed program and flag any potential issues. The company should look at the modeled expenses of the new program relative to past spending on board of director compensation, and determine whether the new program’s costs are reasonable.

Conclusion

While private companies have historically had challenges with regard to competitive board compensation data, the CAP-MLR Media survey helps private companies address this issue. The survey shows that private companies have unique practices from public companies with regard to board of director compensation. Private companies are more likely to compensate a large group of directors, including those who would be considered “insiders” at public companies, and are more likely to use meeting fees. Only a small minority of private companies use long-term incentives, such as phantom and real equity, in their director pay programs. Companies can design an effective and competitive board compensation program by understanding the company’s and board’s unique situation, and by taking external market data into consideration.

Appendix A

Board Composition and Governance

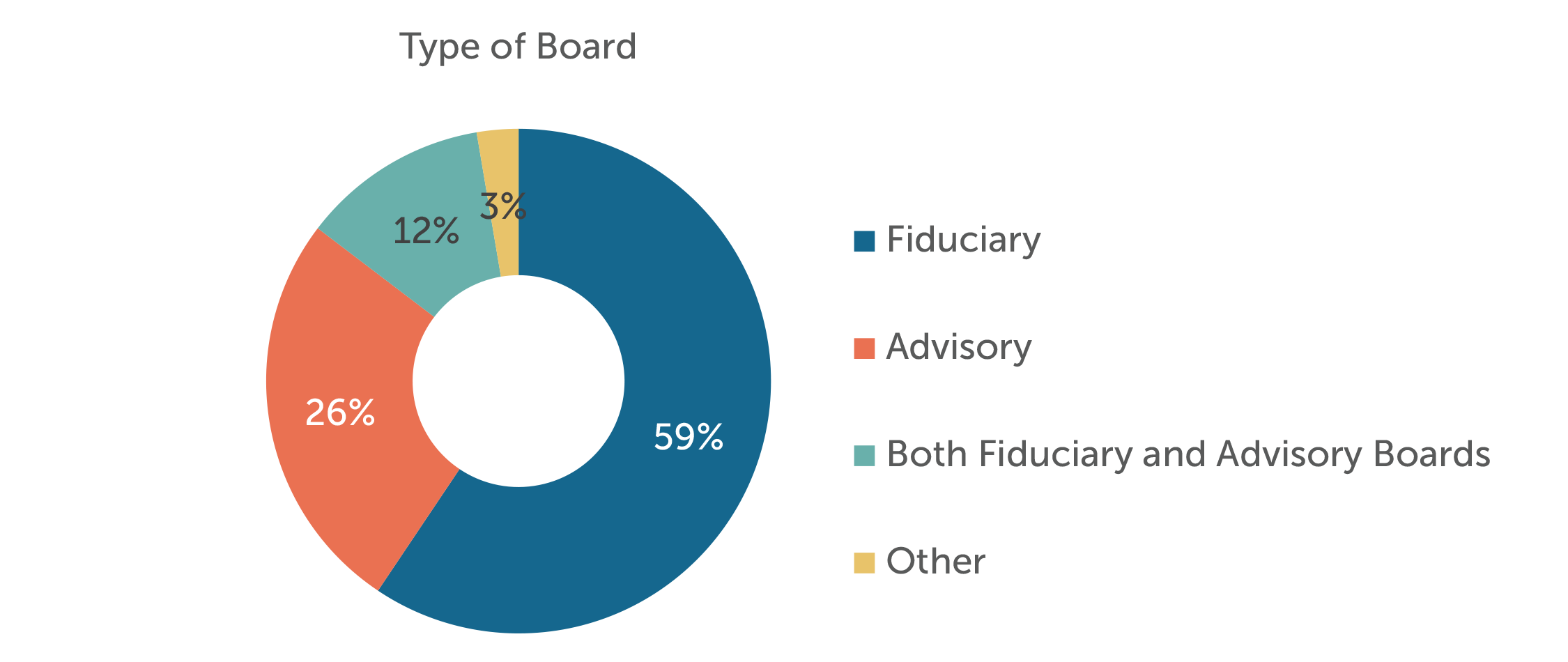

The CAP-MLR Media survey asked a number of questions about the board composition and governance. Almost 60 percent of the private companies surveyed have fiduciary boards. Another 26 percent of companies have advisory boards only, and 12 percent report having both fiduciary and advisory boards. (See Exhibit 6.)

Exhibit 6

According to the companies surveyed, the typical board has five to eight directors, with seven being the median. Inside directors outnumber outside, or independent, directors, with a median of four inside directors and three outside directors.

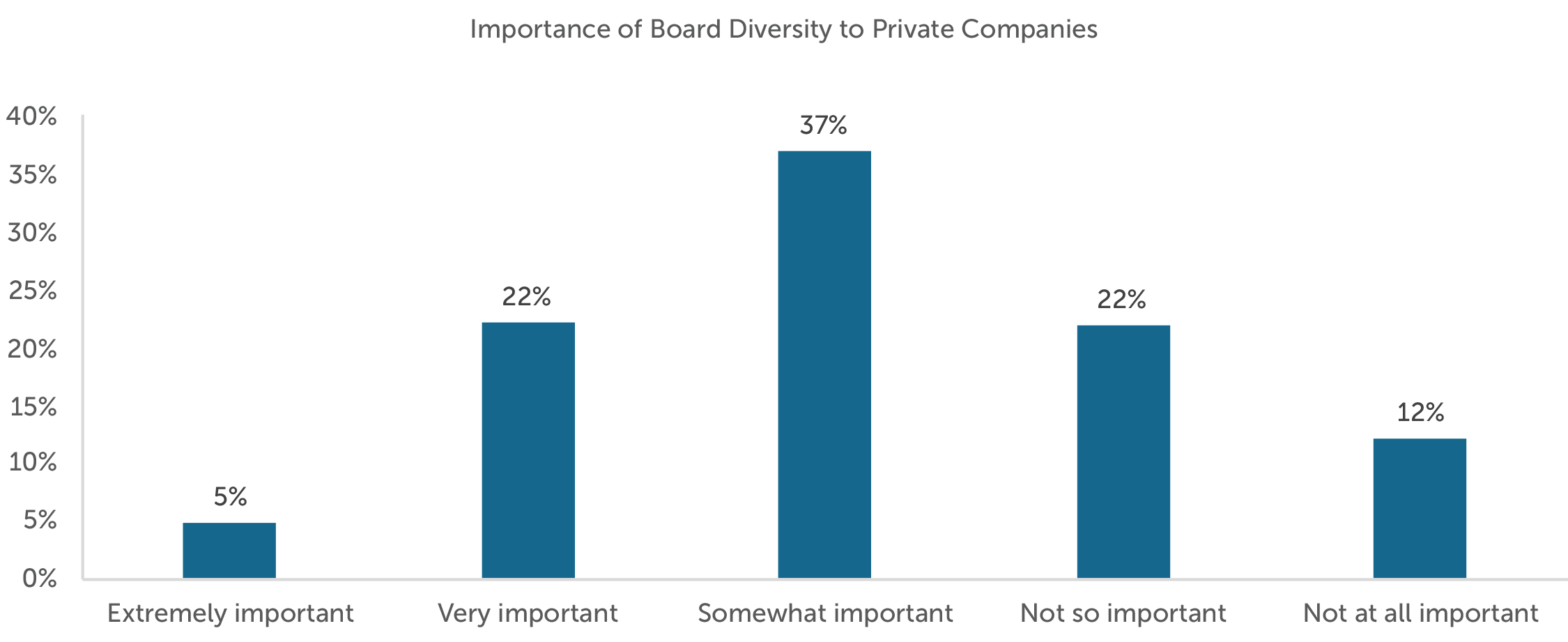

With regard to diversity, each private-company board typically has one female director and no minority directors. Diversity is becoming a bigger issue for public-company directors. Since private companies – especially those preparing for a value-realizing event – tend to follow public-company practices, CAP and MLR Media expect that diversity will become a more important issue for private-company boards going forward. The survey asked respondents about the importance of diversity to private-company boards, with most responding that diversity is moderately important. (See Exhibit 7.) Tracking this question over time will show whether public-company issues are making their way to private companies.

Exhibit 7

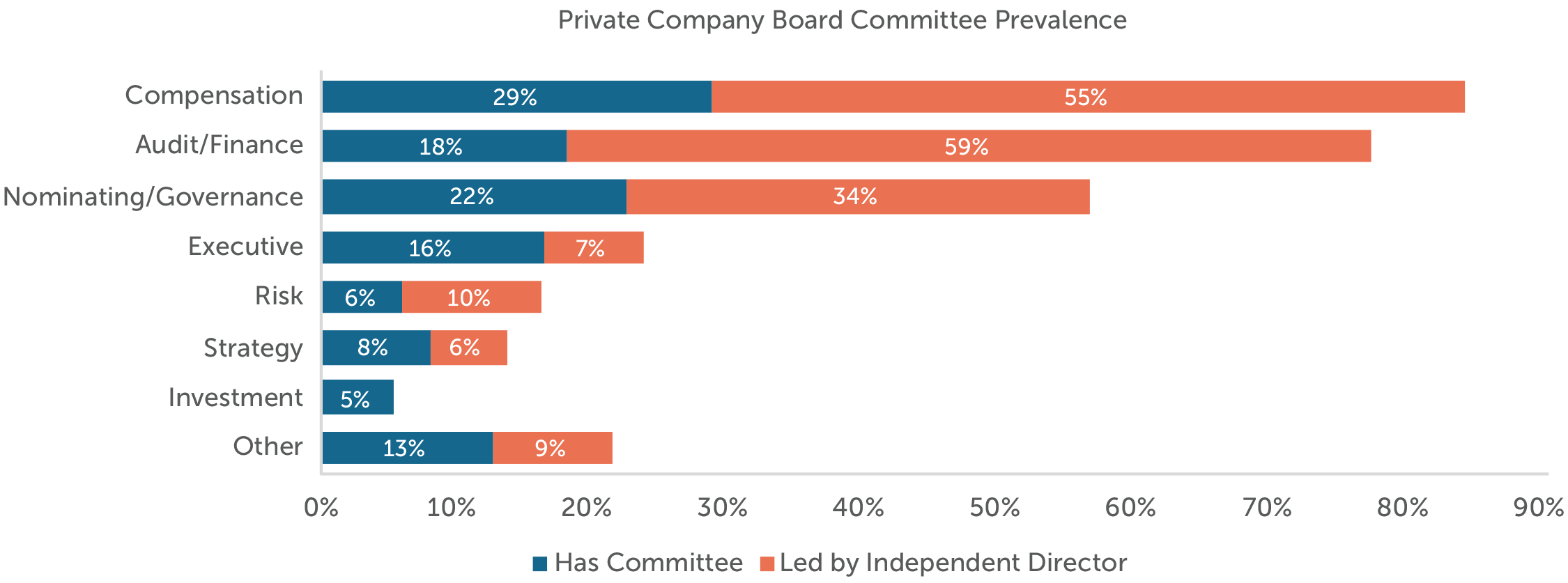

Slightly more than half of the survey participants have formal board committees. For companies that have committees, the committee structure of private-company boards follows that of public-company peers, with audit/finance, compensation and nominating/governance committees being prevalent. Most private-company boards are led by independent directors, with the exception of executive, strategy and other committees. (See Exhibit 8.)

Exhibit 8

Private-company boards typically meet four times per year, as do the committees. Respondents estimate that private-company board members spend 50 hours per year at median on board service and 20 hours per year at median on committee service.

Appendix B

Survey Methodology

MLR Media sent the survey to contacts in its Private Company Director and Family Business subscriber databases. Compensation Advisory Partners, a leading boutique executive compensation consulting firm, analyzed the unattributed data responses and produced the survey reports with the assistance of MLR Media.

For purposes of analyzing the compensation data elements, only companies that provide the compensation element were included. Some companies that do not offer a particular compensation element provided “zero” as the answer for that pay element. Zeros were omitted in the analysis.

The definitions of several terms used in the survey follow:

Advisory Board – A more informal board that provides guidance and advice to the company’s management team and shareholders, but the board has no legal obligations.

Fiduciary Board – A formal board with voting rights and legal obligations to a company. Fiduciary boards oversee the chief executive officer and management.

Independent or Outside Director – An individual on a company’s board who has no ties to the company through employment or family status, and who has no ownership other than compensatory stock provided for board service.

Inside Director – An individual on a company’s board who works at the company or who has ownership of the company, including through family status.

Median – The data point at which half of the responses are higher, and half of the responses are lower.

For questions or more information, please contact:

Bertha Masuda

Partner

Compensation Advisory Partners

[email protected]

310-541-6233

Bonnie Schindler

Principal

Compensation Advisory Partners

[email protected]

847-636-8919

David Shaw

Editor and Publishing Director

Private Company Board

[email protected]

301-963-6162