CAP reviewed chief executive officer (CEO) pay levels among 50 companies with fiscal years ending between August and October 2023 (defined as the Early Filers). 2023 financial performance was generally flat, which resulted in median bonus payouts of around target. Median CEO total direct compensation was up +7%, largely delivered in the form of long-term incentive awards. This report covers 2023 financial performance, CEO actual pay levels and annual incentive payouts for the Early Filers.

Key Findings

Performance: 2023 median financial performance – as measured by revenue, earnings before interest and taxes (EBIT), and earnings per share (EPS) – was generally flat. This is in stark contrast to 2021 and 2022 where companies experienced tremendous growth after weaker 2020 performance (impacted by COVID). In 2023, median revenue grew slightly (+3.7%), and EBIT and EPS were flat (+0.2% and +0.3%, respectively). One-year total shareholder return, or TSR, was up double digits year-over-year (+11.6%) as stock prices rebounded from 2022.

CEO Pay: Median CEO total direct compensation increased +7% year over year, driven by an +11% increase in the grant-date value of long-term incentives (LTI). Median bonus payout was down year over year (-11%), reflective of more modest performance.

Annual Incentive Payout: Overall, 2023 median bonus payouts for CEOs were at target (i.e., 102% of target). Payout for the CEO was generally in line with the corporate funding factor (i.e., the percentage at which the annual incentive funds based on company performance), although companies who made a discretionary adjustment (up or down) were more likely to do so when funding was below target.

2023 Performance

Financial performance in 2023 was generally flat compared to 2022. Median revenue was up +3.7%, and EBIT and EPS were flat (up +0.2% and +0.3%, respectively). In contrast, performance in 2022 was strong, with median growth of +9 to +12% for revenue, EBIT and EPS.

TSR growth was strong in 2023 and, at median, ahead of 1-year financial performance. Median TSR was up +11.6% year over year. The stock market has been volatile post-pandemic and further impacted by macroeconomic issues such as inflation, higher interest rates, supply chain difficulties, and geopolitical instability. One-year financial and TSR performance for the Early Filers slightly underperformed the S&P 500, which experienced modest growth in 2023.

|

Financial Metric (1) |

2022 Median 1-year Performance |

2023 Median 1-year Performance |

||

|

S&P 500 |

Early Filers |

S&P 500 |

Early Filers |

|

|

Revenue Growth |

11.1% |

11.9% |

5.7% |

3.7% |

|

EBIT Growth |

8.8% |

9.6% |

4.8% |

0.2% |

|

EPS Growth |

8.9% |

8.9% |

2.5% |

0.3% |

|

TSR |

(13.8%) |

(14.6%) |

15.0% |

11.6% |

(1) Reflects companies in the S&P 500 as of December 2023. For the S&P 500, financial performance and TSR are as of September 30, 2023 and September 30, 2022. For Early Filers, financial performance and TSR are as of each company’s fiscal year end.

CEO Actual Total Direct Compensation

CEO pay continued to rise in 2023. Median total direct compensation – base salary plus actual bonus payout plus grant-date value of LTI – for the CEO was up +7%. This increase was largely delivered in the form of LTI (+11%). Long-term incentive awards are generally approved in the first quarter (i.e., September 2022 – January 2023 for Early Filers), and significant increases in award value are typically provided to recognize strong company and/or individual performance from the prior year.

For the second year in a row, median bonus payout was down year over year (-11%), reflective of the flat financial growth (although 2022 financial performance was strong, bonus payout was down from record highs in 2021). Median base salary was up (+3%) in 2023.

Note: Reflects same incumbent CEOs. Excludes companies that did not pay a bonus in the prior year (and, therefore, 1-year growth for these companies is not meaningful).

When considering the tenure of the CEO, those with less than three years of service received larger salary and LTI increases (than those who have been in their role for more than three years) to position pay more competitively with market. Interestingly, those who have less tenure also saw steeper declines in the bonus payout year over year, driven by above target-payouts in 2022 and well-below-target payouts in 2023. Approximately half of these companies have a transformation plan in place to improve performance in the coming years, which combined with actual payouts, suggested more volatile performance outcomes during this transition time. One-year change in pay for CEOs who have been in the role for more than three years aligned with overall findings for the Early Filers.

Annual Incentive Plan Payout

The median annual incentive payout was around target (102%) in 2023 and reflective of flat financial performance. This is down from 2022, with 75th and 25th percentiles also lower than prior year.

|

Summary Statistics |

Annual Incentive Payout as a % of Target |

||

|

2021 |

2022 |

2023 |

|

|

75th Percentile |

177% |

147% |

130% |

|

Median |

149% |

119% |

102% |

|

25th Percentile |

122% |

86% |

64% |

Approximately 50% of companies in our sample had an annual incentive payout that was at or above target in 2023 (median payout of 129% of target). These higher performing companies saw modest growth at median for revenue, EBIT and EPS growth, and had strong TSR performance. For companies with below target performance (median payout of 61% of target), median revenue growth was down slightly (-2.6%) while EBIT and EPS performance was down double digits (-15.6% and -11.4%, respectively). Median TSR increased for both groups. TSR was up significantly (+17.8%) for at or above target performers and up slightly (+2.3%) for below target performers.

|

Financial Metric (1) |

2022 Median |

2023 Median |

||

|

Below target payout (n=14) |

At/above target payout (n=31) |

Below target payout (n=22) |

At/above target payout (n=24) |

|

|

Revenue Growth |

6.4% |

14.3% |

(2.6%) |

9.8% |

|

EBIT Growth |

(5.7%) |

18.0% |

(15.6%) |

9.6% |

|

EPS Growth |

(4.4%) |

10.3% |

(11.4%) |

6.4% |

|

TSR Growth |

(24.0%) |

(6.8%) |

2.3% |

17.8% |

|

Annual incentive payout |

74% of target |

129% of target |

61% of target |

129% of target |

(1) 1-year financial performance and TSR is as of each company’s fiscal year end.

In 2023, annual incentive payouts had a normal distribution with companies nearly evenly split in receiving payout either above or below target. This is a change from the prior two years when a majority of companies paid out at or above target. The distribution of payouts coupled with the median incentive payout around target suggests the difficulty in setting goals amid unpredictable macroeconomic factors.

Note: N = 46. Reflects corporate funding factor and excludes companies with a discretionary bonus plan.

Approximately one-third of Early Filers incorporate individual performance in the annual incentive payout for the CEO. This means that the CEO’s payout as a percentage of target may be higher or lower than that of the corporate funding factor (i.e., the percentage at which the annual incentive funds based on company performance). 70% of companies in our sample provided a payout to the CEO that was +/-5 percentage points from the corporate funding factor in 2023.

Nearly 15% of companies reduced the CEO’s payout from the corporate funding factor in 2023, which is up from 2022 (4% of companies) and 2021 (7% of companies). However, the average reduction in payout was lower in 2023 than in prior years. On average, companies that lowered the CEO payout in 2023 reduced it by 30 percentage points compared to 39 points in 2022 and 102 points in 2021. The number of companies that increased the CEO’s payout by more than 5 points above the corporate funding factor was up slightly from last year (17% in 2023 vs. 11% in 2022) but down from 2021 (when it was 33%). However, the increase in payout was more modest, with companies raising the CEO’s payout by, on average, 15 points in 2023 compared to 20 points in 2022 and 34 points in 2021.

Looking Ahead

2023 financial performance was generally flat compared to 2022. We continued to see an increase in total direct compensation for CEOs, although bonus payouts were down moderately year over year. These increases in total direct compensation were largely delivered through LTI and reflective of strong financial performance in 2022 or providing more competitive pay for newer CEOs. We anticipate that companies will provide modest increases in LTI in 2024 given 2023 outcomes although CEOs newer in their roles will likely continue to receive more significant increases. Given the continuing macroeconomic factors (U.S. presidential election, geopolitical unrest, continued supply chain disruptions), 2024 performance expectations are still largely unknown.

Early Filers’ Company Sample

CAP’s study reflects 50 companies with fiscal years ending between August and October 2023. Industry sectors reviewed include: Communication Services, Consumer Discretionary, Consumer Staples, Financials, Health Care, Industrials, Information Technology and Materials. Revenues for these companies ranged from $1.4 billion – $383 billion (median revenues of $11.9 billion); median fiscal-year-end market capitalization was $16.4 billion.

Kristine Stanners, Rebecca Friday and Grace Tan provided research assistance for this report.

The challenging stock market conditions of the last two years may have companies questioning their continued use of stock options. Our analysis of stock options granted in 2022 among S&P 500 companies finds that the majority of stock options (54% of all option grants) granted are underwater (i.e., the current stock price is below the option exercise price) and on average, the stock options are 23% underwater. That means that for the average executive holding stock options granted in 2022, the stock price would have to increase by more than 30% for the stock option to have any intrinsic value.

Recent Stock Option Struggles

CAP analyzed CEO equity grants among S&P 500 companies to understand the degree to which stock options were out-of-the-money, given the challenging stock price environment. It should be noted that many companies have moved away from granting stock options. In fact, among the S&P 500, only 43% of CEOs received stock options. This reflects a broad market shift where options have been replaced by performance share units and restricted stock units.

|

S&P 500 |

% |

|

Companies Granting Stock Options |

43% |

|

Stock Option Grants Currently Underwater |

54% |

|

Average % Change from Exercise Price |

-23% |

As of November 30, 2023, 54% of these awards are underwater which means they currently have no value. Among these underwater awards, the current share price is 23% below the exercise price, on average. While it is still early in the vesting schedule for these awards, share price depreciation at such levels may leave employees wondering if their options will have realizable value as it will take significant stock price appreciation to get back to break-even.

In looking more closely at the sample, we find that there is a broad range of how far out-of-the-money stock options are across companies. For example, 11% of the stock options are more than 50% out-of-the-money, meaning that the stock price would have to more than double for them to begin to have intrinsic value. A full third of the options granted are more than 30% underwater.

|

Percent Change From Exercise Price |

Underwater Grants |

% of Underwater |

|

0% to -10% |

29 |

25% |

|

-10% to -20% |

32 |

28% |

|

-20% to -30% |

16 |

14% |

|

-30% to -40% |

19 |

17% |

|

-40% to -50% |

5 |

4% |

|

-50%+ |

13 |

11% |

|

Total |

114 |

– |

When we look at the underwater stock options by industry, we find that there are differences in the percentage of underwater options and the degree to which they are underwater across industry sectors. For example, all five Communications Services companies had underwater options that were on average 33% underwater. Underwater options were much less of an issue in the Information Technology sector, where companies have recently been rallying and recovering from share price depression.

|

Industry Sector |

Annual Option Grants |

% of Grants Underwater |

Average % Underwater |

|

|

Underwater |

Total |

|||

|

Communication Services |

5 |

5 |

100% |

-33% |

|

Consumer Discretionary |

10 |

20 |

50% |

-25% |

|

Consumer Staples |

15 |

22 |

68% |

-22% |

|

Energy |

0 |

4 |

0% |

– |

|

Financials |

12 |

25 |

48% |

-22% |

|

Health Care |

33 |

46 |

72% |

-28% |

|

Industrials |

18 |

46 |

39% |

-24% |

|

Information Technology |

7 |

21 |

33% |

-23% |

|

Materials |

10 |

15 |

67% |

-18% |

|

Real Estate |

1 |

4 |

25% |

– |

|

Utilities |

3 |

5 |

60% |

-25% |

|

Total |

114 |

213 |

54% |

-23% |

Handling Underwater Stock Option Concerns

Underwater stock options can create retention issues throughout organizations. In times of economic uncertainty and poor stock market conditions, employees rightfully may worry that underwater stock options will never achieve the upside that was once promised. Executives may feel that their outstanding underwater stock option awards are worthless, which may leave them feeling demotivated to remain at the company for the long haul. Similarly, younger employees who are holding stock options that are deeply underwater may look for more attractive opportunities at high-growth potential organizations. Moving on to a new company may become more appealing, especially if the offer includes a sign-on award at a new employer which may represent a fresh start from an equity compensation perspective. In general, employees may not consider the long-term potential of their stock options and instead focus on the current lack of value.

To mitigate these potential retention concerns, employers need to provide clear messaging to employees about the long-term potential provided by stock options, and potentially consider redesigning their equity grant practices. Among the S&P 500 sample, the most common (84%) exercise term for stock option grants is 10 years. This decade-long time horizon should provide plenty of opportunity for the share price to recover, and potentially grow far beyond the exercise price. On the flip side, currently depressed share prices also mean that the next annual stock option awards will be granted at a lower exercise price and therefore should have more upside potential over the new term.

If employees have been put off by multiple cycles of underwater options, another alternative to consider is redesigning and rebalancing the equity compensation mix. Among the S&P 500 sample, stock options represent 19% of the average equity compensation package. Excluding CEOs who do not receive options, the average CEO receives 38% of equity compensation in stock option awards. Most S&P 500 companies use multiple equity vehicles and place more weight on full-value share awards in their long-term incentive plans, which is a market best practice and shields executive compensation packages from excessive macroeconomic risk. While stock options continue to make sense at growth-stage companies, the associated retention and recruitment risks in times of share price depression may cause mature companies to fall behind in the war for talent.

Conclusion

Periods of economic uncertainty raise many compensation issues as companies look to properly incentivize and retain key talent despite depressed stock prices. While stock options remain appropriate for incentivizing employees at growth-stage companies, mature organizations must strike the right balance of equity compensation to navigate the retention and recruitment risks during these periods. With extreme stock market volatility expected to continue in the coming years, companies may benefit from emphasizing equity compensation based on multi-year financial goals and relative stock price performance rather than boom-or-bust stock option grants. Whether or not an equity program redesign is under consideration, clear communication about the future potential of equity awards, including underwater options, remains vital.

Compensation Advisory Partners (CAP) is conducting a market pulse survey to get a sense of banks’ compensation expectations for the balance of 2023 and initial thinking for 2024. Questions will cover salary increases, 2023 projected bonus funding and retention awards. We estimate the survey will only take 5 minutes to complete and are asking for submissions no later than Friday, June 30. We will distribute results on an aggregate basis to all participants at no cost. Individual results will be kept confidential.

2022 Results

Following an exceptional 2021 for the banking industry, 2022 performance results were mixed with results varying significantly from bank to bank based on business mix. Overall, revenue increased in 2022, driven by high interest rates. At the same time, net Income declined somewhat but remained well-above 2020 levels. In line with these results, CEO compensation increased in 2022 but more modestly than it did in 2021.

|

Summary Data (n=55) |

Change in Total CEO Compensation |

|

|

2021 vs. 2020 |

2022 vs. 2021 |

|

|

75th Percentile |

+30.1% |

+15.9% |

|

Median |

+21.5% |

+7.0% |

|

25th Percentile |

+12.6% |

+0.0% |

2022 bonuses, which payout based on annual performance results, paid out above target, though to a lesser degree than 2021.

|

Summary Data (n=51) |

CEO Bonus as a % of Target |

|

|

2021 |

2022 |

|

|

75th Percentile |

162% |

155% |

|

Median |

143% |

130% |

|

25th Percentile |

128% |

112% |

2023 Results To-Date and Outlook

The first half of 2023 has been a volatile period in the banking industry, marked by the failures of Silicon Valley Bank, Silvergate, Signature, and First Republic in the U.S. and Credit Suisse internationally. In the wake of these bank failures, the macroeconomic uncertainty that lies ahead and potential regulation and the impact it could have on performance has led to depressed stock prices for many banks. The S&P 500 Banking index has decreased 14% since the end of 2022 compared to the broader S&P 500, which has increased 10% over the same period.

Many banks are beginning to consider the impact these dynamics will have on their compensation programs. CAP is conducting a market pulse survey to get a sense of banks’ compensation expectations for the balance of 2023 and initial thinking for 2024.

Please use the link below to participate in the survey. The survey should only take 5 minutes to complete and the deadline to participate is Friday, June 30. We will distribute results on an aggregate basis to all participants at no cost. Individual results will be kept confidential.

Click here to participate in the survey.

If you have any questions, please contact Kelly Malafis ([email protected]), Eric Hosken ([email protected]), Mike Bonner ([email protected]), or Shaun Bisman ([email protected])

Kelly Malafis and Michael Bonner discuss compensation practices and trends in the banking and financial services industry.

CAP’s report examines compensation outcomes for Chief Financial Officers (CFOs) relative to Chief Executive Officers (CEOs). This analysis summarizes 2021 compensation actions among 130 companies with median revenue of $14 billion. Additional information on criteria used to develop the sample is included in the Appendix.

Study Highlights

Base Salary

More CFOs received increases in 2021 compared to 2020, with the median increase generally in line with 2020

- Approximately 7% more CFOs received base salary increases this past year. Overall, 62% of companies made salary increases for CFOs in 2021 and 42% made increases for CEOs

- Among executives who received salary increases, the median increase was 4.0% for both CEOs and CFOs. This increase was generally in line with the prior year’s increases (4.1% and 4.3% for CEOs and CFOs, respectively)

- Among the total sample, the median increase for CFOs was 2.5%, similar to last year’s 2.7% increase. Since 58% of CEOs did not receive an increase, the median increase for CEOs is 0%.

Bonuses

Strong 2021 financial performance, compared to performance challenges in 2020, supported higher bonuses in 2021

- Among our sample, approximately 75% of CFOs had higher bonus payouts in 2021. Median change in actual bonus payouts increased significantly – up 34% for both CEOs and CFOs

- The bonus payouts were mostly aligned with company performance during 2021. Companies whose operating income fell in 2021 paid bonuses approximately 12% lower than 2020 for CFOs (17% lower for CEOs). Companies who improved operating income paid bonuses approximately 43% higher for CFOs (36% for CEOs).

- Median target bonus opportunities remained unchanged for both CEOs (150% of salary) and CFOs (100% of salary), with the median CEO target bonus level unchanged for the last 8 years

Long-Term Incentive (LTI)

LTI awards were also up in 2021, reflective of stronger company and stock price performance

- LTI awards increased 12% for CEOs and 11% for CFOs, up from CEO and CFO increases last year (5.3% and 8.7%, respectively)

Total Compensation

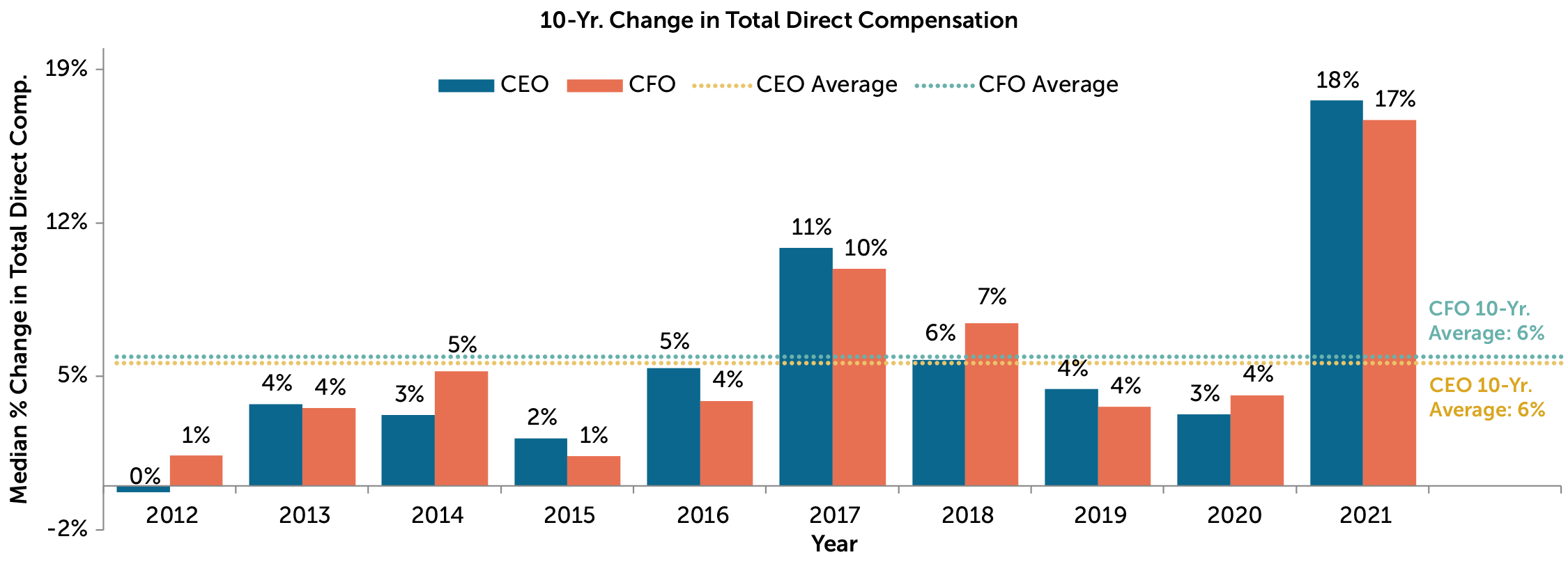

2021 saw the largest year over year increases at median in the last 10 years; the last time we saw increases in the 15% – 20% range was after the financial crisis in 2008/2009

- Median 2021 increases in actual total direct compensation (i.e., cash plus equity) for CEOs and CFOs were 18% and 17%, respectively, substantially higher compared to 2020 (3% and 4%, respectively) driven by large increases in variable incentives (annual incentive payouts and long-term incentive awards)

- As in prior years, CFO total compensation continues to approximate one-third of CEO total pay

Pay Mix

The use of stock options slightly decreased in 2021 over 2020 as companies continue to emphasize performance-and time-based stock

- The emphasis on variable over fixed pay, and performance-based equity over time-based equity continues

- Use of stock options shifted down slightly (3-4%) compared to last year, and prevalence of performance- and time-based stock is consistent with 2020

- As we predicted last year, the slightly greater emphasis on time-based equity continued from 2020 into 2021

Study Results

Salaries

In 2021, prevalence of salary increases stayed consistent for CEOs (42% received increases in 2021 compared to 44% in 2020) and rose for CFOs (62% received increases in 2021 compared to 55% in 2020). At many companies, salary increases planned for 2020 may have been delayed to 2021 due to the COVID-19 pandemic. As indicated in the charts below, median 2021 salary increases were 2.5% for CFOs (or 4% for those receiving an increase) and 0% for CEOs (or 4% for those receiving an increase).

2021 Salary Increases

Changes in Actual Pay Levels

The actual total cash compensation for 2021 increased among our sample, driven by significant increases in bonus payouts. On a total compensation basis (including long-term incentive awards), the median rate of increase continued to trend much higher for both CEOs and CFOs (18% for CEOs and 17% for CFOs).

|

Median Percentage Change in Pay Components |

||||||

|

|

2018 – 2019 |

2019 – 2020 |

2020 – 2021 |

|||

|

Pay Components |

CEO |

CFO |

CEO |

CFO |

CEO |

CFO |

|

Salary |

2.5% |

3.0% |

0.0% |

2.7% |

0.0% |

2.5% |

|

Actual Bonus |

-2.2% |

-3.2% |

0.0% |

0.0% |

33.5% |

34.1% |

|

Long-Term Incentives |

6.1% |

8.3% |

5.3% |

8.7% |

11.8% |

11.0% |

|

Actual Total Direct Compensation |

4.4% |

3.6% |

3.3% |

4.1% |

17.6% |

16.7% |

As indicated above, though salary increases are consistent over year, there was a significant increase in bonus payouts and long-term incentive award values in 2021 compared to prior years.

Bonus payouts were generally aligned with performance outcomes for most companies. For companies with lower operating income in 2021, bonus payouts were down 12% at median for CFOs and 17% for CEOs, compared to +43% for CFOs and +36% for CEOs at companies with operating income growth.

Median Total Compensation Increase by Industry1

Median total compensation increases varied by industry. In 2021, industrials, consumer discretionary, IT and financials sectors had the biggest increases. Consistent with the overall study, these increases are higher than in prior years given stronger performance and higher payouts in 2021.

Target Pay Mix

The pay program structure for CEOs and CFOs over the last 10 years has remained largely unchanged. CEOs continue to receive less in the form of salary and more in variable pay opportunities, especially LTI, than CFOs.

Target Bonuses

Median target bonus opportunities as a percentage of salary remained consistent at the median and 25th percentiles, and fell at the 75th percentile. We expect target bonus will continue to remain at similar levels.

Long-Term Incentive (LTI) Vehicle Prevalence and Mix

The majority of companies (approximately 60%) deliver LTI using two different vehicles. Approximately 30% of companies in the sample use stock options, time-based stock awards, and performance plan awards.

The portion of LTI awards granted in performance plans decreased slightly in 2020 at the expense of higher time-based awards but bounced back in 2021. Stock option usage decreased in 2021. The minor increase in time-based awards was expected in 2020 due to the COVID-19 pandemic, and performance shares rebounded in 2021 when goal setting became more manageable.

10-Year Changes in Total Direct Compensation

For its 10th year producing its annual CFO report, CAP reviewed historical changes in compensation from 2012 through 2021. CFO pay has generally tracked with CEO pay, though CEO pay has had higher highs and lower lows, as is expected for the top role. There is only one year – 2012 – that CEO pay fell compared to the prior year, but increases at median were less than 5% for most of the last 10 years for both CEOs and CFOs. 2021 saw by far the largest increases in total compensation, reflective of strong 2021 performance and compounded by below-average increases in 2020.

Conclusion

Financial performance improved dramatically in 2021 compared to the prior year. Revenue grew 18% at median and operating income increased 33%. Such exceptional financial performance explains the drastic incentive increases and indicates an overall alignment of pay outcomes and company financial performance.

Since many companies made equity grants early in 2021, prior to the impact of economic contraction into 2022, we do not expect to see increases of this magnitude next year.

APPENDIX

Sample Screening Methodology

Based on the screening criteria below, we arrived at a sample of 130 public companies with median 2021 revenue of $14B.

|

Revenue |

At least $5 billion in revenue for fiscal year 2021 |

|

Fiscal year-end |

Fiscal year-end between 9/1/2021 and 1/1/2022 |

|

Proxy Statement Filing Date |

Proxy statement filed before 3/31/2022 |

|

Tenure |

No change in CEO and CFO incumbents in the past three years |

|

Industry |

All industries have been considered for this analysis |

1 Excludes industries which had a sample less than five companies. Total compensation equals the sum of base salary, actual bonuses, and LTI awards granted in 2021.

Compensation Advisory Partners (CAP) conducted a study of executive compensation trends in the banking industry. The study includes 18 U.S. banks with greater than $50 billion in assets across three groups: Money Center banks (n=4), Custody banks (n=3), and Super Regional banks (n=11). This report summarizes the findings of CAP's study, including the relationship between pay and performance in 2021, executive compensation trends, and outlook for the industry in 2022.

Key Themes

- 2021 Pay and Performance Outcomes

Chief executive officer (CEO) compensation increased 21% at median, primarily through higher incentives. Increases in CEO pay were in line with strong 2021 earnings, which were buoyed by releases of loan loss provisions taken in 2020. - Incentive Plan Design Trends

All banks in this study considered Diversity, Equity and Inclusion (DE&I) progress as part of the annual incentive decision in 2021, typically evaluated on a qualitative basis. - Special Retention Awards

The use special one-time long-term incentive awards increased among large financial services companies, including the banks in our study, in 2021. These awards, in some cases, received pushback from shareholders and proxy advisory firms that resulted in lower Say-on-Pay outcomes. - Looking Ahead

The performance outlook for 2022 is less certain. Results may vary significantly based on business mix and balance sheet makeup.

2021 Pay and Performance Outcomes – Significant Pay Increases for Strong Results

The banks in CAP’s study had strong bottom line results in 2021. Earnings per share (EPS) and Return on Equity (ROE) improved significantly versus 2020 as the credit environment improved, and banks reversed pandemic-related loan loss provisions from 2020. Over the same period, Pre-Provision Net Revenue (PPNR), which does not include the impact of loan loss provisions, was down at median, though several banks in our study grew PPNR versus 2020 primarily through increases in fee income. 1-year Total Shareholder Return (TSR) was strong over this period. 2021 TSR for the banks in CAP’s study was +38 percent, at median, while the S&P 500 returned +29 percent.

The chart below summarizes median performance results for the banks in CAP’s study:

|

Metric |

Median Percent Change |

|

|

Year Ended |

Year Ended |

|

|

Earnings per Share |

-29.5% |

+96.2% |

|

Pre-Provision Net Revenue |

-0.2% |

-5.2% |

|

Return on Equity (Basis Point Change) |

-371 bps |

+527 bps |

|

1-Year Total Shareholder Return |

-11.4% |

+37.6% |

|

3-Year Total Shareholder Return (Cumulative) |

-3.9% |

+58.7% |

Source: S&P Capital IQ Financial Database.

In 2021, total direct compensation (i.e., the sum of base salary, annual cash bonus, and awarded long-term incentives), increased 21 percent, 18 percent, and 22 percent at median for the money center, custody, and super regional banks, respectively. Banks primarily delivered increases through incentive compensation. 2021 cash bonuses were up 36 percent at median as 2021 results surpassed target performance goals and improved significantly versus 2020 due primarily to the quicker than expected economic recovery and resulting releases of loan loss provisions. Several banks in CAP’s study even disclosed making negative adjustments to incentive plan payouts to recognize the benefit of the releases of loan loss provisions. This stands in stark contrast to 2020 where companies generally failed to meet targets set prior to the start of the pandemic and funded bonuses below target and below 2019 bonuses. Long-term incentives also increased significantly at median (i.e., +21 percent), compared to 2020 when banks increased long-term incentives more modestly (i.e., +5 percent at median).

Compensation and benefits expense increased on an absolute basis in both 2020 and 2021. However, as a percentage of revenue and net income, compensation and benefits expense increased in 2020 and decreased in 2021. This likely demonstrates that while 2020 was a challenging performance year, banks maintained a level of compensation necessary to retain key talent. In 2021, banks increased incentives to reward for improved earnings and recognize the intensely competitive talent market, but did so at a reasonable level relative to revenue and earnings growth.

Incentive Plan Design Trends – Focus on DE&I

Most banks in our study did not make changes to annual or long-term incentive plan metrics or structure in 2021. One area that continues to evolve is how banks tie incentives to Environmental, Social, and Governance (ESG) considerations. As companies and shareholders spend more time focusing on ESG strategies, companies are increasingly incorporating ESG metrics into incentive plans to support these strategies. To-date banks have primarily focused on DE&I in incentive plans. All of the banks in our study disclose considering DE&I achievements as part of the incentive decision-making process. Most banks include DE&I in the individual or strategic component of the annual incentive plan and evaluate results on a qualitative basis. Specific metrics include diversity in hiring, use of diverse suppliers, and employee engagement. Several banks in our study also disclose considering other ESG factors (e.g., aligning investing activities to climate commitments) as part of the annual incentive determination.

Special Equity Awards

We noted an increased use of special one-time equity awards among banks in 2021 and 2022 to-date. Such awards are typically reserved for special situations, such as supporting retention and incentivizing significant growth or business transformation. These awards, particularly those that provide executives with the opportunity to earn significant value, are often subject to longer-term vesting periods (i.e., five or more years) and payout based on the achievement of shareholder value creation goals. Shareholders and proxy advisory firms often push back on these types of awards, demonstrated by the decline in Say-on-Pay support in 2022 for many of the banks that granted special equity awards in 2021.

One notable example in our study is JPMorgan. The bank granted awards worth $53 million and $28 million to the CEO and President & COO, respectively, to support retention of these key leaders. The awards consisted of stock appreciation rights that vest after five years. Likely due to the significant value of these awards, both major proxy advisory firms, Institutional Shareholder Services (ISS) and Glass Lewis, recommended that shareholders vote against JPMorgan’s Say-on-Pay proposal and JPMorgan failed Say-on-Pay, receiving only 31% support from shareholders.

Looking Ahead to the Second Half of 2022

2021 was a strong earnings year for banks and executive compensation levels reflected that. The outlook for 2022 is less certain and performance results may vary significantly based on business mix and balance sheet makeup. Provision releases, which had a significant positive impact on bank earnings in 2021, will likely not be available to banks in 2022. Additionally, the rising interest rate environment, inflation, and macroeconomic uncertainty are expected to impact bank performance in 2022.

The Federal Reserve has increased interest rates significantly in 2022 and anticipates additional rate hikes in the second half of the year. Rising interest rates are expected to drive higher net interest income but decrease demand for loans. The degree to which the rate environment benefits 2022 earnings will vary by bank based on the sensitivity of the balance sheet to increases in interest rates and the cost of funds.

The volume and value of mergers and acquisitions (M&A) transactions are expected to decline in 2022 due to economic uncertainty, inflation, and rising interest rates. This will adversely impact fee income for investment banking businesses.

In light of these dynamics, the first half of 2022 told a different performance story than 2021. PPNR is slightly up at median, likely due to increased interest rates, and EPS is down at median without the benefit of provision releases. Total shareholder return through the second quarter for the banks in our study is down approximately 20% at median, commensurate with the S&P 500. At the same time, the current talent market is intensely competitive, particularly in key areas for banks such as digital and commercial banking. As we approach the end of 2022, banks will need to balance aligning pay with 2022 performance results and shareholder returns, which may be down versus 2021, with the need to attract and retain critical talent.

For questions or more information, please contact:

Eric Hosken

Partner

[email protected]

212-921-9363

Mike Bonner

Principal

[email protected]

646-486-9744

Stefanie Kushner

Associate

[email protected]

646-532-5931

Theo Allen and Felipe Cambeiro provided research assistance for this report.

Banks in CAP’s Study (n=18)

Money Center Banks

- Bank of America Corporation

- Citigroup, Inc.

- JPMorgan Chase & Co.

- Wells Fargo & Company

Custody Banks

- The Bank of New York Mellon Corporation

- Northern Trust Corporation

- State Street Corporation

Super Regional Banks

- Citizens Financial Group, Inc.

- Comerica, Inc.

- Fifth Third Bancorp

- Huntington Bancshares, Inc.

- KeyCorp

- M&T Bank Corporation

- The PNC Financial Services Group, Inc.

- Regions Financial Corporation

- Truist Financial Corporation

- U.S. Bancorp

- Zions Bancorporation

CAP periodically publishes a study on compensation for Chief Financial Officers (CFOs) relative to Chief Executive Officers (CEOs). Our analysis for fiscal 2020 compensation is based on a sample of 135 companies with median revenue of $12 billion. Additional information on criteria used to develop the sample is included in the Appendix.

Study Highlights

|

Pay Component |

Highlights |

|

Base Salary |

|

|

Bonuses |

|

|

Long-Term Incentive (LTI) |

|

|

Total Compensation |

|

|

Pay Mix |

|

Study Results

Salaries

In 2020, the salary increase prevalence declined by about 10% from historical practice. We believe the COVID-19 pandemic was the main factor for the decrease. However, salary increases were still quite prevalent for CEOs and CFOs, at 44% and 55% of the sample, respectively. As indicated in the charts below, median 2020 salary increases were 2.7% for CFOs (or 4.3% for those receiving an increase) and 0% for CEOs (or 4.1% for those receiving an increase).

2020 Salary Increases

Changes in Actual Pay Levels

The actual total cash compensation for 2020 was generally flat among our sample with only CFOs seeing a minor salary increase in salary levels. On a total compensation basis (including long-term incentive awards), the median rate of increase continued to trend lower for CEOs and was generally flat for CFOs (3.3% for CEOs and 4.1% for CFOs).

|

Median Percentage Change in Pay Components |

||||||

|

Pay Components |

2017 – 2018 |

2018 – 2019 |

2019 – 2020 |

|||

|

CEO |

CFO |

CEO |

CFO |

CEO |

CFO |

|

|

Salary |

2.0% |

3.5% |

2.5% |

3.0% |

0.0% |

2.7% |

|

Actual Bonus |

4.8% |

4.5% |

-2.2% |

-3.2% |

0.0% |

0.0% |

|

Long-Term Incentives |

6.5% |

8.7% |

6.1% |

8.3% |

5.3% |

8.7% |

|

Actual Total Direct Compensation |

5.8% |

7.4% |

4.4% |

3.6% |

3.3% |

4.1% |

As indicated above, the sample had approximately the same number of companies with bonus increases (64 CFOs and 60 CEOs) and decreases (65 CFOs and 60 CEOs). A small number of companies had the same exact payout for two straight years (6 CFOs and 15 CEOs).

Bonus payouts were generally aligned with performance outcomes for most companies. For example, of the companies with a bonus decrease, over 60% had a decrease in operating income during 2020 and over 80% of companies with a bonus increase had higher operating income during the year. Bonus payouts were also aligned to revenue and TSR performance for the year.

Median Total Compensation Increase by Industry1

Median total compensation increases varied by industry. In 2020, Consumer goods (Staples and Discretionary) industries and IT companies generally experienced higher compensation increases compared to other industries.

Target Pay Mix

The pay program structure for CEOs and CFOs has remained largely unchanged since 2011. CEOs continue to receive less in the form of salary and more in variable pay opportunities, especially LTI, than CFOs.

Target Bonuses

Target bonus opportunities as a percentage of salary remained unchanged for the CEOs in the sample. For CFOs, the 25th percentile increased to 90% of salary from 80% last year. We expect target bonuses will continue to remain largely unchanged.

Long-Term Incentive (LTI) Vehicle Prevalence and Mix

The use of two different vehicles to deliver LTI remains the most prevalent approach, used by almost 60% of companies. Approximately 30% of companies in the sample use all three equity vehicles (stock options, time-based stock awards, and performance plan awards).

The portion of LTI awards granted in Performance plans decreased slightly in 2020 at the expense of higher time-based awards. The stock option portion remained unchanged. Even though most of the awards in the analysis were granted before the onset of the COVID-19 pandemic (due to disclosure rules), the minor increase in time-based awards was expected.

Conclusion

Financial performance in 2020 fell compared to prior years. Revenue declined 1% at median and operating income increased 1% – below 2019 increases of 3% and 5%, respectively. In a typical year, performance at these levels would have likely resulted in more meaningful compensation decreases. The COVID-19 pandemic was a shock to the system with many companies evaluating the impacts of the pandemic at the end of the year and adjusting performance results for annual incentive calculations, since annual incentives are typically paid to a broader employee population than are long-term incentives. The total cash compensation outcomes for 2020 (i.e., flat bonus payouts on weakened absolute financial performance) continue to reinforce the alignment of pay outcomes with a broader view of company performance.

Since many companies made equity grants early in 2020, prior to the impact of the pandemic on the stock market, we may not see the pandemic’s impact on LTI levels until the 2021 grants are disclosed.

Appendix

Sample Screening Methodology

Based on the screening criteria below, we arrived at a sample of 135 public companies with median 2020 revenue of $12B.

|

Revenue |

At least $5 billion in revenue for fiscal year 2020 |

|

Fiscal year-end |

Fiscal year-end between 9/1/2020 and 1/1/2021 |

|

Proxy Statement Filing Date |

Proxy statement filed before 3/31/2021 |

|

Tenure |

No change in CEO and CFO incumbents in the past three years |

|

Industry |

All industries have been considered for this analysis |

1 Excludes industries which had a sample of fewer than five companies. Total compensation equals the sum of base salary, actual bonuses, and LTI awards granted in 2020.