DOWNLOAD A PDF OF THIS REPORT pdf(0.2MB)

Contact

Bonnie SchindlerPrincipal [email protected] 847-636-8919 Brooke Warhurst

[email protected] 212-921-9350

Having a workforce and leadership team that mirror the society in which the company operates is important for several reasons, beyond being the right thing to do. Companies with employee and leadership diversity have more positive cultures and committed employees, and studies have shown these companies tend to have greater profitability and higher returns. The events of 2020 accelerated efforts in corporate America to make progress in this important area. This study analyzes the representation by women and racially/ethnically diverse individuals in the 50 largest U.S. public companies and reports other disclosed diversity and inclusion (D&I) efforts. Compensation Advisory Partners (CAP) is focusing on the largest U.S. public companies because they are highly visible and receive intense shareholder and public scrutiny. As a result, these companies’ actions become precedents, and the companies become the de facto “trend-setters” for their respective industries.

Key Takeaways

- Among the companies studied, women and people of color fill only a small fraction of director roles, especially leadership roles such as non-executive chair, lead director, and committee chairs.

- While company workforces typically mirror the U.S. population, women and people of color lack proportionate representation in management positions.

- 38 percent of the companies in the sample have received shareholder proposals regarding diversity, pay equity and related corporate governance issues. While the proposals have not yet passed, they are growing in popularity, with support exceeding 35 percent in one case.

- Of companies included in the sample, 70 percent have a board diversity policy, and 42 percent consider diversity and inclusion in executive pay incentive plans.

Our Sample

CAP’s Diversity and Inclusion Report reflects the largest 50 companies in the S&P 500. These companies have revenues ranging from $75 billion to $156 billion and represent a cross-section of eight industry sectors. We focus on larger companies because they can provide early insights into trends for their respective industries. Summary statistics for the 50-company sample are shown below:

Summary Financials of Total Sample (in $mms)

|

Last Twelve Months Revenue |

Market Capitalization as of 12/31/2020 |

|

|

75th Percentile |

$156,418 |

$280,026 |

|

Median |

$98,906 |

$122,811 |

|

25th Percentile |

$74,253 |

$45,263 |

Source: S&P Capital IQ

Board and Employee Representation

Among the 50 companies, 82 percent of boards are led by white men, either as the non-executive chairman of the board or lead independent director. Only six boards are led by women, and three are led by a man of color. However, none of the company boards in the sample are led by a woman of color, a demographic group that has been severely lacking in representation in corporate leadership. While 68 percent of the companies have Black women on their boards, only 34 percent have Black women as committee chairs.

Source: Company Proxy Statements and Public Reports

Source: Company Proxy Statements and Public Reports

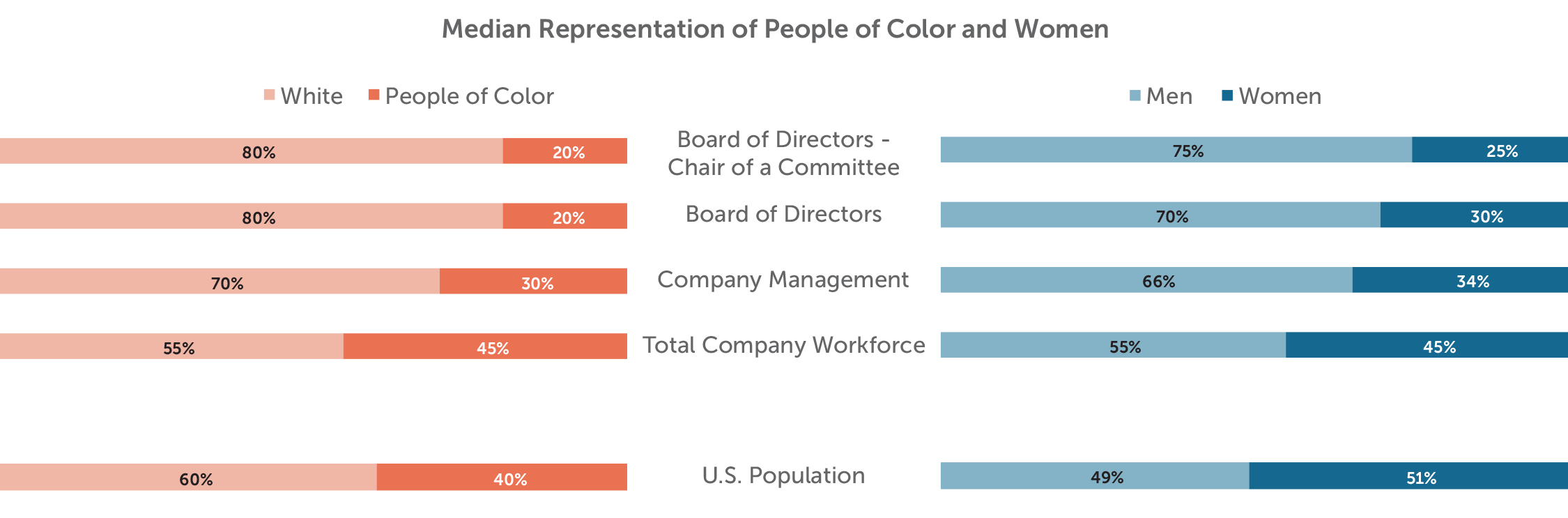

An example of how to interpret the median representation data: Women have median representation of 30 percent on the sample's boards of directors, so on a board with 10 people and median representation, three board members would be women.

When looking at the typical demographics of large company workforces, representation by people of color and women mirrors the U.S. population. When reviewing leadership positions as defined by company public reports however, the demographic skews, showing a lower representation for both women and people of color.

Similarly, women also have a smaller representation in management roles. Among companies in our sample that publicly disclose management demographics, women, on average, represent 34 percent of management roles even though they make up nearly half of the workforce. The findings show a larger representation of women and minorities in non-management roles, which are typically lower paying jobs.

Source: Company Proxy Statements and Public Reports

While many companies disclose workforce demographics (white or people of color), slightly less than half disclose specific statistics on racial representation (Black, Latinx, Asian, etc.). When looking at the companies that disclose specific employee demographic information, Black and Hispanic or Latinx employees have significantly less representation in board and management leadership roles than in the total workforce. Of the companies reviewed, the representation of Black and Hispanic or Latinx people on boards is, at median, 17 percent. The median number of committee chair positions being held by Black and Hispanic or Latinx people is also 17 percent. Among the companies that disclose specific racial data for their workforce, at median Black and Hispanic or Latinx people make up 30 percent of the total workforce, which is consistent with the demographics of the U.S. population. However, Black and Hispanic or Latinx employees represent, at median, 16 percent of management roles disclosed in company public reports.

Shareholder Proposals

Shareholders have been requesting boards to take more ownership of diversity and inclusion (D&I) efforts in the organization. Among companies in our sample, 22 proposals were filed in recent proxies regarding topics related to diversity, pay equity, and race. Most proposals requested that boards release pay equity and/or diversity data, add environmental, social and governance (ESG) goals such as diversity to executive compensation plans, and/or increase diverse representation on boards. While none of these proposals received majority shareholder support, one received more than 35 percent support with a request for U.S. Equal Employment Opportunity Commission EEO-1 Survey disclosure. CAP expects to see more shareholder proposals related to diversity and inclusion in proxies released in 2021.

|

Shareholder Proposals |

Count |

|

Requesting report on gender and/or racial pay equity |

9 |

|

Including employees as Director candidates |

4 |

|

Reporting on feasibility of adding ESG metrics to performance metrics (including diversity) for executive pay plans |

3 |

|

Requesting policy for improving board and top management diversity |

2 |

|

Requesting report on community impacts of business including environmental racism |

2 |

|

Reporting requesting EEO-1 Form disclosure |

1 |

|

Disclosing Director skills, ideological perspectives, and experience and minimum Director qualifications to promote diversity |

1 |

Source: Company Proxy Statements

In the 50-company sample, three companies disclosed in recent proxies that they have adopted the “Rooney Rule” to fill Board positions, requiring their Nominating and Governance Committees and third-party search firms to interview diverse candidates. The Rooney Rule, used in the National Football League, requires teams to interview at least one minority candidate for head coaching, senior operations, and general manager positions. The intent of the rule is to increase diversity in recruiting, which can help to increase diverse representation in leadership roles. CAP anticipates that more companies will begin to use the principles of the Rooney Rule to promote diversity in the recruiting process for both board service and management positions.

Committee Actions

Although companies may not publicly disclose information on employee demographics, most boards in our study (70 percent) include diversity and inclusion responsibility in one or more of their committee charters. These responsibilities are most often included in the Nominating and Governance Committee and Compensation Committee charters. Additionally, several companies are establishing new committees with missions related specifically to corporate social responsibility and human resources. The charters for these committees also have diversity and inclusion roles. As diversity and inclusion becomes a more prevalent topic on boards, we expect to see multiple committees handle these initiatives.

Source: Company Committee Charters and Proxy Statements

One emerging trend is to incorporate D&I goals in executive compensation incentive plans. These goals are more commonly included in the annual incentive plan design versus long-term incentive plans. Use of D&I measures is more common among the companies in our sample than in the broader market; less than 25 percent of S&P 500 companies include these measures in an incentive plan, while 42 percent of companies in our sample disclose D&I as a goal in an incentive plan. These larger companies face more shareholder scrutiny and have a heightened desire to stay ahead of topics that stakeholders care about. Of the companies in our sample that incorporate D&I measures, use is generally equally prevalent between being a weighted measure (typically ranging from 5 percent to 15 percent of the total payout) and being a qualitative assessment incorporated into individual goals. When using D&I as a weighted measure, it is important to set realistic goals that align with a comprehensive strategy of improving diversity.

Source: Company Committee Charters and Proxy Statements

Conclusion

No overnight fix exists to increase representation in a company’s workforce and leadership pipeline. Increasing minority and female representation requires an investment in attracting, developing, and retaining a diverse workforce. Some high-profile companies (including several not included in this study) have publicly committed to recruiting from Historically Black Colleges and Universities and investing in minority communities to improve racial diversity. In addition to these efforts, companies also highlight other endeavors to promote diversity and inclusion, including reporting on diverse supplier spending, support of professional associations for minority and female employees, as well as attrition goals for minority employees. Companies have also recently disclosed other diversity initiatives including company donations and matching charitable contributions to racial justice charities in the wake of recent national protests.

Shareholder scrutiny will continue to put pressure on companies to address gender and racial diversity, particularly at the board and management level. Directors and management should annually review their employee demographics, even if they do not disclose this information publicly, so that they can monitor and set goals to create a more diverse and inclusive workforce and build a diverse pipeline for leadership positions. The two major proxy advisory firms, Institutional Shareholder Services (ISS) and Glass Lewis, issued recent policy updates requiring board representation by women and racially/ethnically diverse individuals at certain public companies to receive positive vote recommendations on certain management proposals. While this will no doubt accelerate diversity efforts at the board level, if companies do not also foster a more inclusive culture, retention may become a key issue. Growing an inclusive culture at the board level may require companies to go beyond the minimum ISS and Glass Lewis representation standards. Given the positive impact of diversity and inclusion on the bottom line, CAP expects shareholder pressure to continue well into the future.

For questions or more information, please contact:

Bonnie Schindler – Principal

[email protected]

847-636-8919

About the data: The data was obtained through public filings such as proxy statements and diversity or governance reports found on company websites.