DOWNLOAD A PDF OF THIS REPORT pdf(0.6MB)

Contact

Daniel LaddinFounding Partner [email protected] 212-921-9359 Matthew Vnuk

Partner [email protected] 212-921-9364

We are pleased to present the 1st annual report on non-employee director (NED) compensation produced by Compensation Advisory Partners LLC (CAP). CAP regularly publishes research and articles focused on executive and director compensation, and related corporate governance issues, designated as a “CAPFlash.” The 2010 CAP Director Compensation Report provides:

- A review of current director pay practices among the largest public U.S. corporations, generally considered trend setting organizations

- Observations regarding trends and outlook

- The Report’s Best in Class Director Compensation Process / Practices, listed below, provide a strong foundation for non-employee director compensation programs at organizations of any size/industry

- This report was authored by Dan Laddin and Matt Vnuk, with research assistance from Shaun Bisman, Meredith St. Lawrence, Deep Patel, Harsha Raghunath, and Devika Ray. Questions and comments should be directed to Dan Laddin or Matt Vnuk at [email protected] or (212) 921-9359, [email protected] or (212) 921-9364

Additional information on Compensation Advisory Partners can be found in the Company Profile section of the Appendix

Table of Contents

Executive Summary

Pay Levels

- Board Member Total Compensation

- Board Cash Retainers

- Board Meeting Fees

- Committee Member Compensation

- Total Board Cash Compensation

- Value of Equity Awards

- Committee Chair Compensation

- Non-Executive Board Leadership (additional compensation)

Pay Practices

- Mix

- Equity Vehicle Type

- Denomination of Equity Awards (fixed value vs. fixed shares)

- Vesting of Equity Awards

- Non-Executive Board Leadership (additional compensation)

Other Program Design Considerations

- Total Company Cost (of Board oversight)

- Board Membership and Meetings

- Committee Membership and Meetings

- Stock Ownership Guidelines (requirements)

- Benefits and Perquisites

Appendix

- Board Member Total Compensation (industry medians)

- Methodology

- Public Fortune 100 Companies

- Company Profile (Compensation Advisory Partners)

Executive Summary

- Best in Class Director Compensation Process / Practices

- Notable Findings / Outlook

- Elements Studied

Executive Summary | Best in Class Director Compensation Process / Practices

Process – Independent Directors Should:

- Establish a process to determine director pay levels and structure in an informed, deliberate and objective way, with consideration given to market data, trends and outlook

- Define target market positioning for total pay

- Target should typically align with executive compensation philosophy

- “Market” should reflect the peer group used for executive compensation benchmarking and/or size-appropriate general industry data; at times, other reference points may also be appropriate

- Use compensation as a tool to align the interests of non-employee directors and long-term shareholders

Practices – Compensation / Governance Committees Should:

- Align pay levels with an organization’s size and complexity; in turn, provide appropriate pay for time and responsibilities

- Review director pay programs focusing on aggregate pay (Total Board Compensation), with consideration given to:

- The ratio of cash compensation to equity compensation

- Additional pay for Board leadership roles

- Structure pay so that equity represents at least half of the total; however, the pay program should:

- Not be highly leveraged

- Be viewed as a “management fee”

- Establish meaningful equity ownership requirements that must be achieved within, at most, 5 years

- Eliminate benefit / perquisite programs unless there is a strong business case for maintaining them

- Provide detailed disclosure of the director compensation philosophy and rationale for the program

Executive Summary | Notable Findings / Outlook

Looking Back – While workload increased over the past couple of years, dramatic economic changes and poor performance increased scrutiny and debate in regard to director pay programs. Therefore, it is not surprising that this year’s study found:

- Conservative increases in pay levels; from 2008 to 2009 Total Board Compensation increased 4 percent, at median

- Year-over-year, no change in median pay mix

- Reduction in the prevalence of meeting fees, which were already minority practice

- Increase in the prevalence of full-value equity awards, with a corresponding decrease in the prevalence of stock options

- Increase in the prevalence of equity awards based on a fixed value, with a corresponding decrease in equity awards based on fixed number of shares

- At least one full-value equity award will not be transferred until retirement at approximately 50% of companies studied

Looking Ahead – Over the next few years, changes in director compensation will take place in terms of both pay levels and program design; specifically:

- Low-to-mid single digit annual increases in Total Board Compensation

- More companies moving to a fixed cash pay structure, with related:

- Decreases in the prevalence of meeting fees, especially Board meeting fees

- Slow / gradual decrease in the prevalence of committee member compensation

- Continued growth in prevalence of full-value equity awards, with corresponding decreases in the prevalence of stock option awards

- Increases in equity awards based on a fixed value, with corresponding reductions in equity awards based on fixed number of shares

- Increased use of, and modifications to, stock ownership guidelines / requirements

- Continued growth in the prevalence of hold until / transfer at retirement equity award provisions

It is important for companies to comprehensively evaluate their director compensation programs regularly, or risk falling behind the curve in regards to desired relative market positioning and best in class program design. While reviews should be conducted regularly, it is usually unnecessary for major design changes to take place more often than every 2 –3 years.

Note: there will be a follow-up CAPFlash made available in early 2011 discussing the top 5 director compensation considerations for the next year.

Executive Summary | Elements Studied

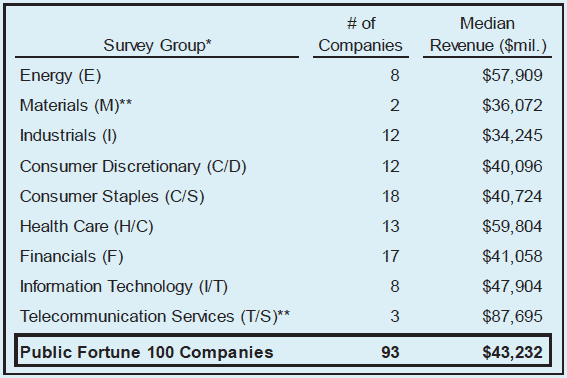

CAP’s consulting staff reviewed current director compensation programs for each of the public Fortune 100 companies.

- The Fortune 100 reflects the largest U.S. corporations based on annual revenue (93 are public companies); see Appendix for a list of the 93 companies in this year’s survey

- “CAP Observations,” included throughout this report, provide commentary on trends and outlook

Elements Studied:

- Annual Cash Retainer

- Total Board Meeting Fees; per meeting fee times the number of meetings

- Committee Member Compensation; all meeting fees and retainers

- Total Board Cash Compensation; sum of cash retainer, total Board meeting fees and average committee member compensation

- Equity Awards (stock retainer); full-value shares/equivalents and stock options

- Total Board Compensation; sum of Total Board Cash Compensation and Equity Awards

- Total Company Cost (of Board oversight); Total Board compensation times number of non-employee directors plus additional/premium pay for committee leadership (Chair) roles and additional/premium pay for independent Board leadership roles (presiding / lead director or non-executive chair)

2010 Study Also Provides Data / Analysis On:

- Equity grant practices, compensation for leadership positions, stock ownership guidelines, perquisites/benefits, and industry pay practices

Note: Total Board Cash Compensation includes committee member compensation (excludes additional/premium meeting fees or retainers paid for chairing a committee) as the trend is towards companies building fees for basic committee service into annual Board fees/retainers. Further, committee member compensation is typically cash-based.

Executive Summary | Elements Studied (Continued)

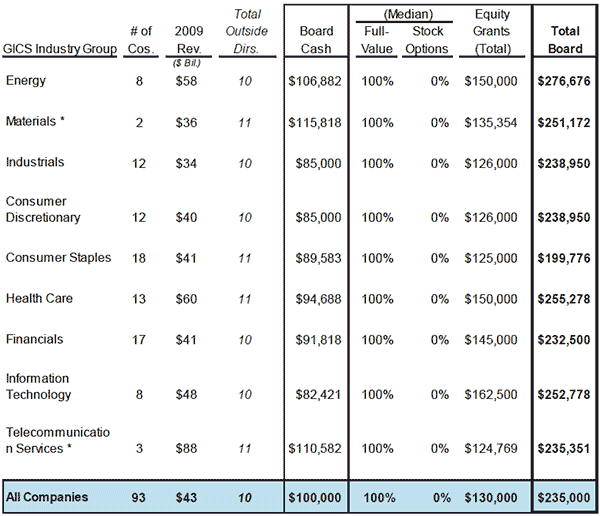

While this analysis of Fortune 100 data focuses on the group of companies as a whole, industry specific practices were also reviewed (click here to see the list).

* Industry groups were determined by GICS code.

** Due to limited number of companies, revenue listed reflects industry average, not median.

Pay Levels

- Board Member Total Compensation

- Board Cash Retainers

- Board Meeting Fees

- Committee Member Compensation

- Total Board Cash Compensation

- Value of Equity Awards

- Committee Chair Compensation

- Non-Executive Board Leadership (additional compensation)

Pay Levels | Board Member Total Compensation

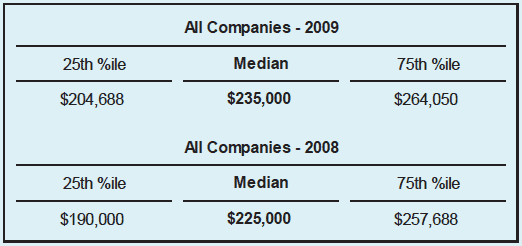

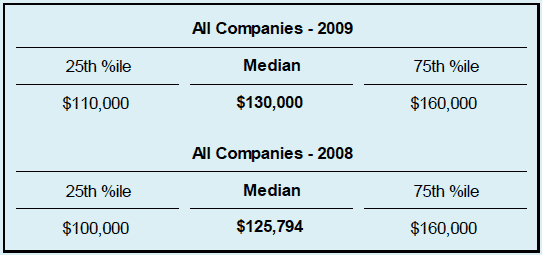

Between 2008 and 2009, basic compensation for service as a Board member (Total Board Compensation) increased approximately 4 percent, from $225,000 to $235,000 (at median).

- Reflects all cash and equity compensation, excluding compensation for additional leadership roles such as committee Chairman, Lead/Presiding director or non-executive Chairman of the Board

- CAP’s director compensation best practices (p.5) state that director compensation should be reviewed focusing on aggregate pay

CAP Observation:

- Director compensation levels increased substantially several years ago following the new demands of Sarbanes-Oxley, but pay has recently leveled off

- As a result of increased director workloads, during each of the next few years, we expect to see low-to-mid single-digit increases in Total Board Compensation

- We also expect to see more companies adopt a fixed cash pay structure

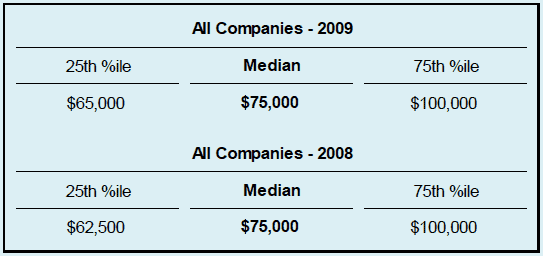

Pay Levels | Board Cash Retainers

The value of annual Board cash retainers remained constant over the past 2 years, at median.

- 98 percent of companies studied provide an annual cash retainer

CAP Observation:

- Once 2010 director pay levels are available, in part due to more companies moving to a fixed cash pay structure, we expect to see a small to moderate increase in the median value of annual cash retainers, as compared to 2009

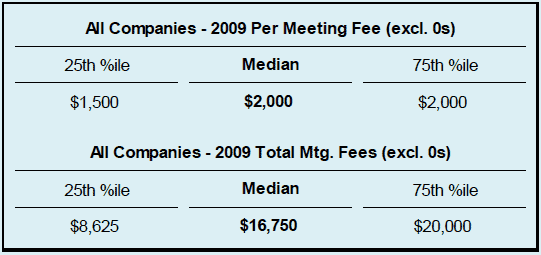

Pay Levels | Board Meeting Fees

Board meeting fees are a minority practice, provided by only 23 percent of companies studied in 2009. Therefore, the median Board meeting fee in 2009 was zero.

- Of the companies studied that provide Board meeting fees, some only do so for special meetings or for meetings in excess of a minimum number

- Only 19 percent of companies studied provided Board meeting / attendance fees for all regular Board meetings

- This is down from 21 percent in 2008

- Among those companies paying meeting fees for all regular Board meetings, the median fee in 2009 was unchanged from 2008

CAP Observation:

- The practice of using Board meeting fees continues to decline in prevalence, partly in reaction to difficulties in defining what constitutes a “meeting” (e.g., ad hoc teleconferences)

- Companies that eliminate meeting fees typically provide an increased Board cash or equity retainer

- We expect to see more companies simplify their director compensation programs and eliminate meeting fees, moving towards a more fixed cash pay structure / “management fee”

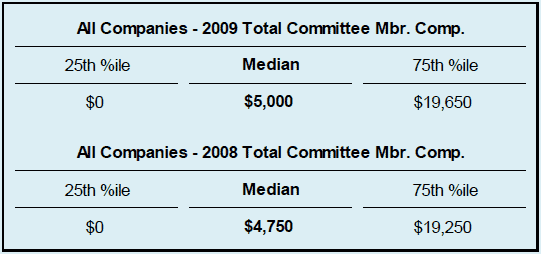

Pay Levels | Committee Member Compensation

From 2008 to 2009, committee member compensation increased slightly, about 5 percent at median; reflects average compensation received by a director for all committee member service (includes 0s).

- Over 35% of companies studied pay no committee-specific fees to members of any of the 3 major committees

- The median committee meeting fee for each of the Audit, Compensation and Nominating / Governance committees is $0

- The median committee member retainer at the Audit Committee is $10,000, but is $0 at the Compensation and Nominating / Governance committees

- Most often, the Audit Committee involves the largest workload; however, over recent years workload has been becoming less differentiated between the 3 major Board committees

CAP Observation:

- Many companies are shifting, or have shifted, committee member fees to the annual Board cash or equity retainer, viewing all Board members as active participants in Board matters / committee-level work

- In 2010, we may see moderate decreases in committee member compensation, primarily due to additional companies shifting committee-specific (member) fees to the annual Board cash or equity retainer

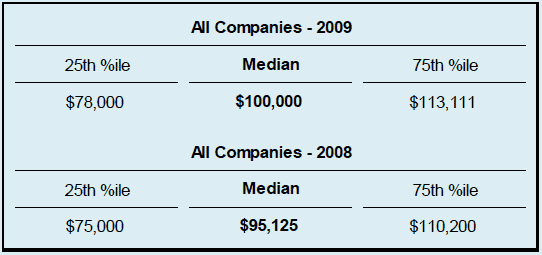

Pay Levels | Total Board Cash Compensation

From 2008 to 2009, Board cash compensation[1] increased approximately 5 percent.[2]

- 98 percent of companies studied provide annual cash compensation to non-employee directors

CAP Observation:

- In 2010, we expect to continue to see moderate increases in Board cash compensation

Pay Levels | Value of Equity Awards

Despite rebounding equity markets, from 2008 to 2009 the median value of equity awards increased only 3 percent, due largely to the majority practice of granting equity awards based on a fixed value.

- Granting equity awards is as near universal practice, with about 95 percent prevalence among companies studied

- Initial at-election equity awards, meant to “ramp up” director equity ownership and alignment with shareholders, as well a recruitment tool, are a minority practice (under 20 percent of companies studied)

- From 2008 to 2009, there was a small decrease in the prevalence of initial at-election equity awards

- During 2009 a small number of companies (ex: Apple and Caterpillar) intentionally reduced or eliminated equity awards

- Apple switched from granting a fixed number of stock options annually to a fixed value award of restricted stock units

- Caterpillar discontinued annual equity awards, but instituted a stock ownership requirement

CAP Observation:

- From 2009 to 2010, we expect to see a:

- Moderate increase in annual equity award values

- Continued decrease in the prevalence of initial at-election equity awards

Pay Levels | Committee Chair Compensation

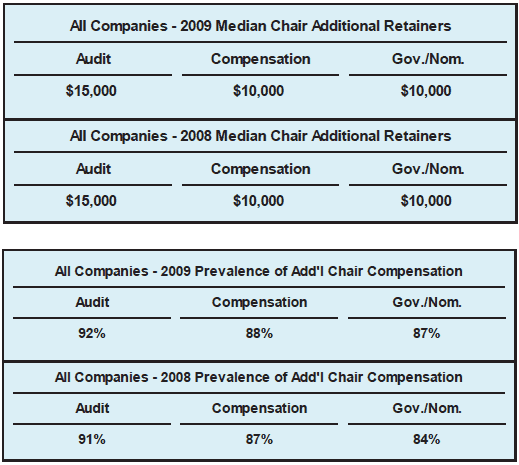

From 2008 to 2009, the median value of additional retainers for committee Chairs (retainer value in-addition to that provided to committee members) remained constant.

- The total value of Chair retainers was also reviewed, and also remained constant from 2008 to 2009

- Chart below excludes zeros

CAP Observation:

- If workload between the major Board committees continues to become less differentiated, there may be less differentiation in additional / premium retainers for the Chairs of the major Board committees

- In 2009, approximately 20 percent of Fortune 100 companies did not differentiate additional / premium pay for the Chairs of the 3 major Board committees, and about another 10 percent of Fortune 100 companies did not differentiate additional / premium pay between the Chairs of the Audit and Compensation committees

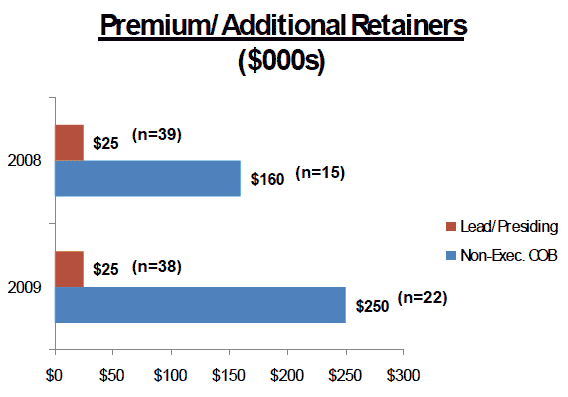

Pay Levels | Non-Executive Board Leadership (additional compensation)

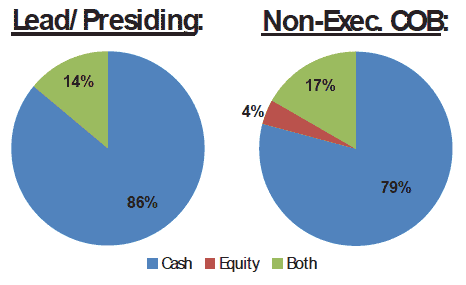

At median, the premium / additional retainer paid to non-executive Chairmen is 10 times that paid to Lead / Presiding directors.

- The median additional retainer for Lead / Presiding directors was consistent from 2008 to 2009 (excludes zeros)

- The median additional retainer paid to non-executive Chairman increased from 2008 to 2009 (excludes zeros); year-over-year, there were also more non-exec. COBs receiving additional pay

- While it is common to pay an additional retainer to independent Board leaders, not all receive an additional retainer

- It is most common to provide additional pay to a non-executive Chairman, and less common to do so for Presiding directors

- Prevalence of additional pay for Board leadership roles increased year-over-year

- Under 5 percent of companies providing additional pay do so for both a Lead / Presiding director and a non-executive Chairman

CAP Observation:

- When determining compensation for a Board leadership position, it is important to consider:

- Does the role merit a premium based on scope of responsibilities, workload, visibility, influence, etc.?

- How do the role / responsibilities relate to that of committee Chairs?

- While not all non-executive Board leaders receive additional pay for the role, prevalence is expected to continue increasing

- The differential in pay between Lead / Presiding directors and a non-executive Chair is in-line with the typically different responsibilities of each position

Pay Practices

- Mix

- Equity Vehicle Type

- Denomination of Equity Awards

(fixed value vs. fixed shares) - Vesting of Equity Awards

- Non-Executive Board Leadership

(additional compensation)

Pay Practices | Mix

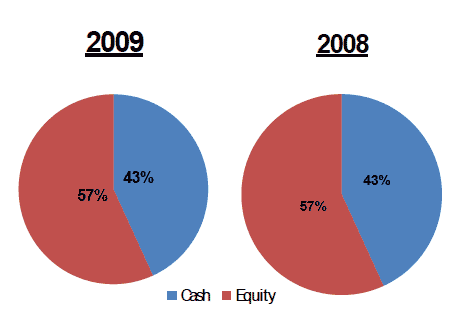

Over the past 2 years, cash versus equity pay mix has remained constant, with equity representing a majority of pay.[3]

- Reflects all cash and equity compensation, excluding compensation for additional leadership roles such as committee Chairman or independent Board leader (Lead / Presiding Director or non-executive Chairman of the Board)

- CAP’s Best in Class Director Compensation Process / Practices (p.5) state that independent directors should structure pay so that equity represents the majority of compensation

Both on average and at median, the weighting of the various elements of Total Board Compensation was nearly consistent between 2008 and 2009.

- Includes cash retainer, Board meeting fees, stock options, full-value equity awards, and committee member compensation

CAP Observation:

- Once 2010 director pay levels are available, we expect to see the portion of pay delivered in equity-based compensation to be similar to 2008 and 2009, with a slight increase possible

- Equity-based compensation aligns director pay with wealth created or lost for shareholders, especially when the equity-based pay is required to be held for an extended period of time

- Additionally, during 2010 we expect that the overall pay mix will remain relatively constant; however, over the next few years, we expect the weighting of stock options and committee member compensation to decrease even further, with a corresponding increase in full-value equity awards and cash retainer

Pay Practices | Equity Vehicle Type

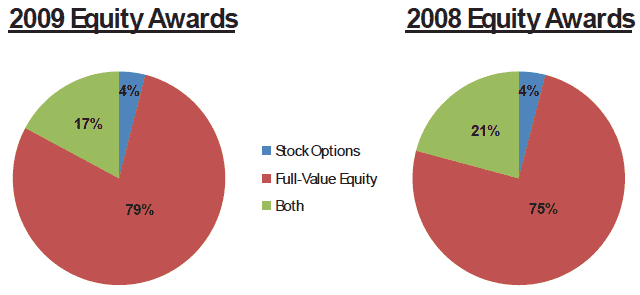

From 2008 to 2009, the prevalence of stock option awards declined (less companies granted both full-value equity awards and stock options), with a corresponding increase in the prevalence of full-value equity awards.

- As compared to full-value awards, stock options are both more leveraged and more likely to be granted based on fixed number of shares (rather than based on a fixed value)

- Stock option values and equity awards based on a fixed number of shares are strongly affected by swings in stock price

- Two companies granted performance-based equity awards to directors in 2009, Intel and Coca-Cola

CAP Observation:

- As companies move more towards viewing director compensation as somewhat of a “management fee,” combined with a strong focus on risk management, we expect to see a continued move toward increased use of full-value equity awards

- However, practices vary by industry and we do not expect the use of stock options to stop completely; i.e., in some industries the prevalence of stock option awards is greater than others and/or that seen in general industry data

- While two companies studied granted performance-based equity awards to directors during 2009, we do not expect this to become a trend

Pay Practices | Denomination of Equity Awards (fixed value vs. fixed shares)

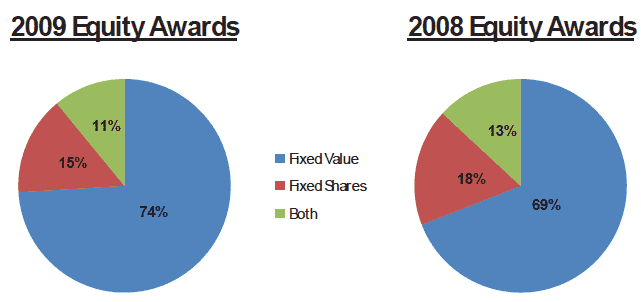

Director equity awards are based on either a fixed value or a fixed number of shares. From 2008 to 2009, the prevalence of fixed value equity awards increased 5 percent, accounting for nearly three quarters of all equity awards.

- When equity awards are based on a fixed value, the number of shares / options granted changes each year, but the grant date value remains constant; however, when equity awards are based on a fixed number of shares, the value of the award changes each year mostly due to changes in stock price, but the number of shares granted remains constant from one year to the next

- Therefore, director compensation is more predictable from one year to the next when equity awards are based on a fixed value

CAP Observation:

- Part of the year-over-year shift is due to the declining prevalence of stock option awards

- Stock options are more likely than full-value equity awards to be based on a fixed number of shares

- Over the past few years, volatile stock prices have helped drive a trend towards fixed value equity awards

- Fixed value equity awards can be viewed as prudent risk management, a predictable way to reach expectations related to director stock ownership, linking long-term director interests with those of shareholders

Pay Practices | Vesting of Equity Awards

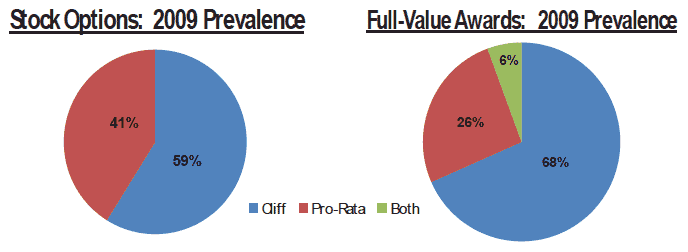

A majority of both stock option and full-value equity awards cliff vest.

- Year-over-year, the percent of stock options with cliff vesting increased, while the percent of full-value equity awards with cliff vesting remained constant

- Both stock options awards and full-value equity awards typically vest after 1 year, at median

- At least one full-value equity award at approximately 50 percent of companies studied will not be transferred to directors until retirement

- Since 2008, the prevalence of this practice has increased

CAP Observation:

- For a number of years, there has been a trend towards declassification of Boards; i.e., one year terms

- Short vesting periods line up with the term of declassified Boards

- Short vesting periods and hold until / transfer at retirement provisions, for director equity awards, are often viewed as best practices

- We expect short vesting periods to remain majority practice, and the prevalence of hold until / transfer at retirement provisions to increase in 2010 and beyond

- Already, the high prevalence of hold until / transfer at retirement provisions is notable

Pay Practices | Non-Executive Board Leadership (additional compensation)

Additional / premium retainers for independent Board leadership roles are most often delivered through additional cash compensation.

CAP Observation:

- We expect cash to continue to be the dominant vehicle for delivering additional compensation for serving in an independent Board leadership role, with the possibility for an increase in equity-based compensation in coming years

Other Program Design Considerations

- Total Company Cost (of Board oversight)

- Board Membership and Meetings

- Committee Membership and Meetings

- Stock Ownership Guidelines (requirements)

- Benefits and Perquisites

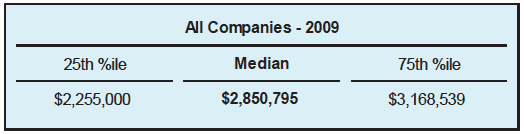

Other Program Design Considerations | Total Company Cost (of Board oversight)

Total Company Cost can be a useful secondary reference point when reviewing non-employee director compensation.

- Includes the sum of cash retainers, equity awards, committee fees, and Board leadership fees received by each non-employee director

CAP Observation:

- Generally, the cost of Board oversight drops as the size of an organization increases, measured as a percent of revenue

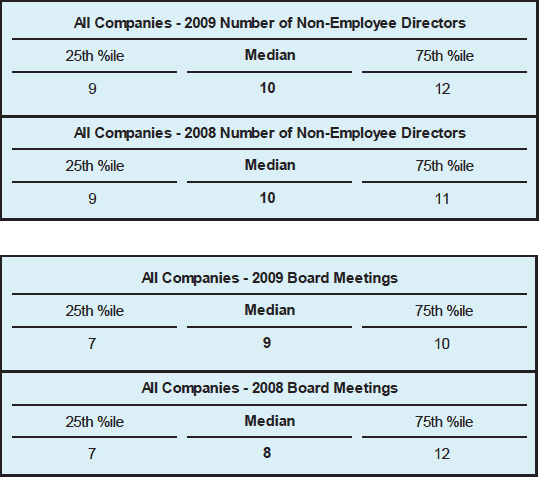

Other Program Design Considerations | Board Membership and Meetings

Between 2008 and 2009, at median, the size of Boards remained constant; however, Board activity marginally increased based on median number of meetings.

CAP Observation:

- Over the past decade, the typical size of a Board shrunk, in part based on new proxy disclosure requirements; i.e., increased discussion of qualifications, required discussion of any director attending less than 75 percent of meetings, etc.

- As the year-over-year data shows, the size of Boards seems to have stabilized

- Currently, the size of Boards is manageable

- Work loads have generally been increasing

- It is typical for all directors to be take part in Board work / activities / decision making

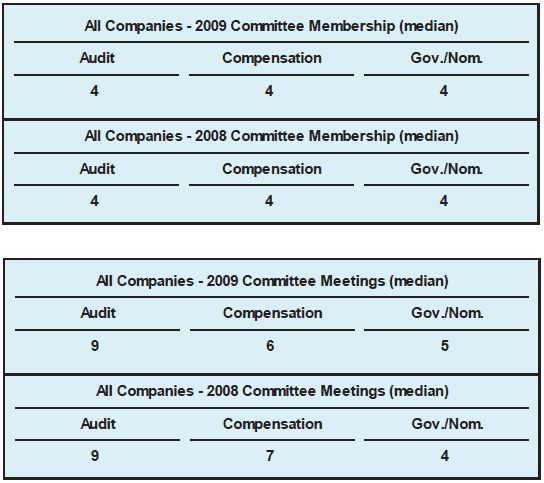

Other Program Design Considerations | Committee Membership and Meetings

Across the 3 major committees, membership / size is consistent; however, activity based on median number of meetings is not consistent, with the Audit Committee being the most active.

CAP Observation:

- An increasing amount of work is being done outside of official committee meetings, and not all meetings are created equal (in terms of time spent, topics covered, etc.)

- Therefore, we find that number of meetings is only one component of judging total committee activity / time commitment / workload

Other Program Design Considerations | Stock Ownership Guidelines (requirements)

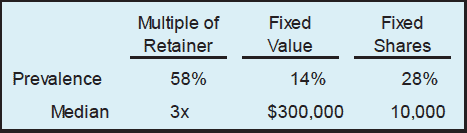

Nearly 90 percent of companies studied have stock ownership guidelines, and nearly 80 percent of companies studied have formal stock ownership guidelines.

- Formal stock ownership guidelines reflect requirements stated as either: (i) a multiple of the annual Board cash retainer, the annual Board equity retainer, or both; (ii) a fixed value; or (iii) a fixed number of shares

- Most often, formal stock ownership guidelines are defined as a multiple of the annual cash retainer

- Most companies with formal stock ownership guidelines require non-employee directors to meet the ownership hurdle within 5 years of joining the Board; the next most common period is 3 years

- Non-formal stock ownership guidelines reflect retention ratios and equity awards that are held/deferred until retirement

- The number of companies with retention ratios and/or deferring equity awards until retirement, in addition to formal stock ownership guidelines, has been increasing

CAP Observation:

- Due to volatility, some companies that use either a fixed value-based or fixed share-based formal stock ownership guideline have been implementing an either or approach; either a certain dollar value or a certain number of shares must be owned within a certain number of years

- Other design features that can alleviate the volatility issue are the idea of ownership value vs. investment value and measuring stock price over an extended period of time, rather than at fiscal year-end

- ISS (formerly RiskMetrics Group), regarding non-omnibus director-specific equity plans, expects a minimum ownership multiple of 3 times the annual retainer to be achieved within 5 years of joining a Board

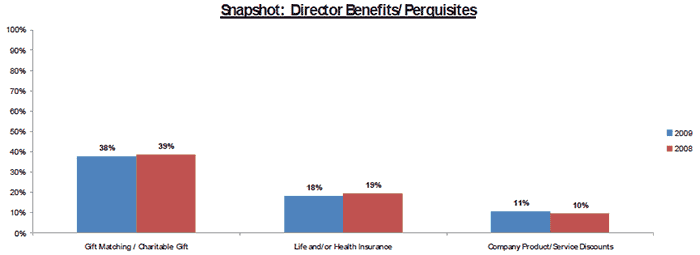

Other Program Design Considerations | Benefits and Perquisites

While there was a small decrease in the prevalence of certain director benefit / perquisites (below) over the past year, during both 2009 and 2008 about two thirds of companies studied provided directors with some form of benefit /perquisite.

CAP Observation:

- Many companies have reduced or eliminated perquisites and benefit programs for outside directors, similar to their executives

- We expect that both the prevalence and value of benefits and perquisites will continue to decline; however, where a business case exits, some perquisites / benefits will be maintained

Appendix

- Board Member Total Compensation (industry medians)

- Methodology

- Public Fortune 100 Companies

- Company Profile

Appendix | Board Member Total Compensation (industry medians)

Pay levels and practices were also reviewed, and differ somewhat, by industry.

Appendix | Methodology

- It was assumed that every director served on the Board for the entire year and attended all meetings

- Meeting fees were calculated based on the actual number of meetings held

- Annual equity awards were assumed to have occurred on the annual meeting date; stock options were valued based on the FASB Topic 718 (FAS 123R) Black-Scholes value

- Initial at-election equity awards were annualized over 5 years

- Committee compensation includes all Board committees, reflecting actual committee assignments

- If the proxy statement disclosed forward-looking information regarding changes to the compensation structure, the most recent data was used

Appendix | Public Fortune 100 Companies

Company Names & Industry

- IndustryAbbott Laboratories (H/C)

- Costco Wholesale Corporation (C/S)

- Intel Corporation (I/T)

- Prudential Financial, Inc. (F)

- Aetna Inc. (H/C)

- CVS Caremark Corporation (C/S)

- International Assets Holding Corporation (F)

- Publix Super Markets, Inc. (C/S)

- Allstate Corporation, The (F)

- Dell Inc. (I/T)

- International Business Machines Corporation (I/T)

- Raytheon Company (I)

- Amazon.com, Inc. (C/D)

- Delta Air Lines, Inc. (I)

- Johnson & Johnson (H/C)

- Rite Aid Corporation (C/S)

- American Express Company (F)

- Dow Chemical Company, The (M)

- Johnson Controls, Inc. (C/D)

- Safeway Inc. (C/S)

- American International Group, Inc. (F)

- E. I. du Pont de Nemours and Company (M)

- JPMorgan Chase & Co. (F)

- Sears Holdings Corporation (C/D)

- AmerisourceBergen Corporation (H/C)

- Enterprise GP Holdings L.P. (E)

- Kraft Foods Inc. (C/S)

- Sprint Nextel Corporation (T/S)

- Apple Inc. (I/T)

- Express Scripts, Inc. (H/C)

- Kroger Co., The (C/S)

- Sunoco, Inc. (E)

- Archer-Daniels-Midland Company (C/S)

- Exxon Mobil Corporation (E)

- Lockheed Martin Corporation (I)

- SUPERVALU Inc. (C/S)

- AT&T Inc. (T/S)

- Federal Home Loan Mortgage Corporation, The (F)

- Lowe’s Companies, Inc. (C/D)

- Sysco Corporation (C/S)

- Bank of America Corporation (F)

- Federal National Mortgage Association, The (F)

- Marathon Oil Corporation (E)

- Target Corporation (C/D)

- Berkshire Hathaway, Inc. (F)

- FedEx Corp. (I)

- McKesson Corporation (H/C)

- Time Warner Inc. (C/D)

- Best Buy Co., Inc. (C/D)

- Ford Motor Company (C/D)

- Medco Health Solutions, Inc. (H/C)

- Travelers Companies, Inc., The (F)

- Boeing Company, The (I)

- General Dynamics Corporation (I)

- Merck & Co., Inc. (H/C)

- Tyson Foods, Inc. (C/S)

- Cardinal Health, Inc. (H/C)

- General Electric Company (I)

- MetLife, Inc. (F)

- United Parcel Service, Inc. (I)

- Caterpillar Inc. (I)

- Goldman Sachs Group, Inc., The (F)

- Microsoft Corporation (I/T)

- United Technologies Corporation (I)

- Chevron Corporation (E)

- Hartford Financial Services (F)

- Morgan Stanley (F)

- UnitedHealth Group Incorporated (H/C)

- CHS Inc. (C/S)

- Hess Corporation (E)

- News Corporation (C/D)

- Valero Energy Corporation (E)

- Cisco Systems, Inc. (I/T)

- Hewlett-Packard Company (I/T)

- Northrop Grumman Corporation (I)

- Verizon Communications Inc. (T/S)

- Citigroup Inc. (F)

- Home Depot, Inc., The (C/D)

- PepsiCo, Inc. (C/S)

- Walgreen Company (C/S)

- Coca-Cola Company, The (C/S)

- Honeywell International Inc. (I)

- Pfizer Inc. (H/C)

- Wal-Mart Stores, Inc. (C/S)

- Comcast Corporation (C/D)

- Humana Inc. (H/C)

- Philip Morris International Inc. (C/S)

- Walt Disney Company, The (C/D)

- ConocoPhillips (E)

- Ingram Micro Inc. (I/T)

- Procter & Gamble Company, The (C/S)

- WellPoint Inc. (H/C)

- Wells Fargo & Company (F)

Key

- Energy (E)

- Materials (M)

- Industrials (I)

- Consumer Discretionary (C/D)

- Consumer Staples (C/S)

- Health Care (H/C)

- Financials (F)

- Information Technology (I/T)

- Telecommunication Services (T/S)

Appendix | Company Profile

Compensation Advisory Partners LLC (CAP) is an independent consulting firm specializing in executive and director compensation, and related corporate governance matters, with a unique combination of deep expertise and intense client focus. Comprised of senior industry veterans from Mercer and KPMG, CAP’s consultants have served as independent advisor to Boards and senior management at many of the world’s largest and leading companies in the areas of compensation governance, strategy and program design.

- Formed in 2009, CAP’s founding principle is that compensation should be a management tool to help support business strategy. Our consulting experience enables our team to assist companies in creating and implementing defensible, performance-oriented executive compensation programs that meet high governance standards in a changing regulatory environment

- The staff has strong industry sector knowledge and a broad client base, ranging from the largest Fortune 100 multi-nationals to start-up companies across all major industries

- The firm’s breadth of experience and clientele keep it at the forefront of trends and practices in all areas of executive and director compensation

- Compensation Advisory Partners provides Boards of Directors and Compensation Committees best-in-class advice, while also meeting the increasing need to demonstrate the independence and objectivity of that advice from a truly independent platform

- Please contact us at 212-921-9350 if you would like to discuss your own executive or director compensation issues. You can also access our website at www.capartners.com for more information

[1]Sum of cash retainer, total Board meeting fees and average committee member compensation.

[2] Total Board Cash Compensation includes committee member compensation (but excludes additional/premium meeting fees or retainers paid for chairing a committee) as the trend is towards companies building fees for basic committee service into annual Board fees/retainers. Further, committee member compensation is typically cash-based.

[3] Nearly 75 percent of companies studied allow directors the option of exchanging their cash retainer for additional equity-based compensation; this refers to a voluntary value-for-value exchange/deferral, and does not reflect any premium.

[4] Reflects both annual equity awards and initial at-election equity awards.

[5] Reflects both annual equity awards and initial at-election equity awards.

[6] Prevalence at companies with formal stock ownership guidelines.

[7] Due to limited number of companies, data/value reflects an average rather than a median.