DOWNLOAD A PDF OF THIS REPORT pdf(0.3MB)

Contact

Daniel LaddinFounding Partner [email protected] 212-921-9359 Roman Beleuta

Principal [email protected] 646-532-5932

Each year CAP analyzes non-employee director compensation programs among the 100 largest companies. These companies can provide early insights into trends for compensation practices. This report reflects a summary of pay levels and pay practice trends based on 2019 proxy disclosure.

CAP Findings

Board Compensation.

pay levels remained generally flat

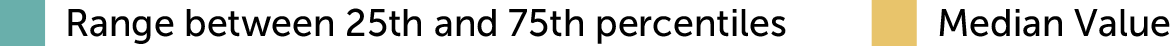

- Total Fees. Board compensation continues to be in a steady state with low single-digit annual increases. Median is now $305K, up from $300K last year. This is the lowest year over year increase we have seen recently.

- Pay Structure. Companies rely mainly on annual retainers (cash and equity) to compensate directors. Pay programs for large companies are simple and tend to rely less on meeting fees or committee member retainers. We support this approach as it simplifies administration and eliminates the need to define what counts as a meeting, though this simplified approach may not be appropriate in all situations.

- Meeting Fees. Consistent with prior years, only 12 percent of companies studied provide meeting fees. Companies could consider having a mechanism for paying meeting fees if the number of meetings in a single year far exceeds the norm (“hybrid approach”). Also consistent with prior years, 5 percent of companies studied used this “hybrid approach” to meeting fees, with the threshold number of meetings ranging between 6 and 10.

- Equity. 98 percent of companies used full-value awards (shares/units) and only 4 percent used stock options (3 of the 4 companies granting stock options used both vehicles). Almost all companies denominated equity awards using a fixed value, versus a fixed number of shares. Using fixed value is generally considered best practice as it manages the “target” value awarded each year.

- Pay Mix. On average, total pay is comprised of 62 percent equity and 38 percent cash, which is consistent with findings in other recent years.

- Process. One-third of companies disclosed increases to board cash and/or equity retainers versus prior year.

Committee Member1 Compensation.

prevalence continues to slowly decline

- Overall Prevalence. 45 percent of companies paid committee-specific member fees for Audit Committee service, 28 percent paid member fees for Compensation Committee service, and 26 percent paid member fees for Nominating/Governance Committee service. Companies rely more on board-level compensation to recognize committee member (non-Chair) service, with the general expectation that all independent directors contribute to committee service needs.

- Total Fees. Of the companies that paid committee member compensation, the median was $13K in total, down from $16k in prior year.

Committee Chair2 Compensation.

little/no change

- Overall Prevalence. More than 90 percent of companies studied provided additional compensation to committee Chairs to recognize additional time requirements, responsibilities, and reputational risk.

- Fees. Median additional compensation remained at $25K for Audit Committee Chairs, $20K for Compensation Committee Chairs, and increased to $20K for Nominating/Governance Committee Chairs. In the past, Nominating/Governance Chairs were paid around $15K. Most often, such fees were delivered through an additional cash retainer.

Independent Board Leader Compensation.

little/no change

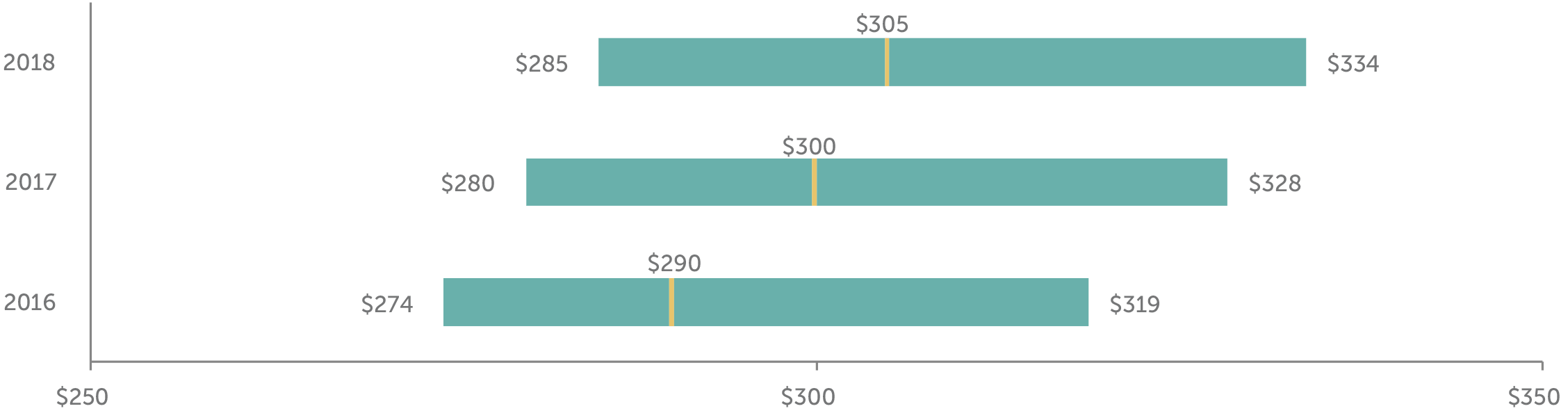

- Non-Exec Chair. Additional compensation is provided by nearly all companies with this role. Median additional compensation was $225K. As a multiple of total Board Compensation, total Board Chair pay was 1.75x a standard Board member, at median.

- Lead Director. Median additional compensation was $35K, consistent with prior year. Additional compensation is provided by nearly all companies with this role3. The differential in pay versus non-executive Chairs is in line with typical differences in responsibilities.

Pay Limits.

prevalence continues to increase

- 62 percent of companies have an award limit for director compensation, up from 54 percent in the prior year.

- Director pay limits are largely due to advancement of litigation where the issue has been that directors approve their own annual compensation and are therefore deemed to be inherently conflicted.

- Similar to last year, limits range from $250K to $4.75 million, with a median limit of $750K. Companies that denominate the limit in shares tend to have a higher dollar-equivalent limit, with a median of $925K. The median for the companies with value-based limits is $675K.

Limit Range Prevalence <= $500,000 29% $500,001 – $1,000,000 50% $1,000,001 – $2,000,000 16% > $2,000,000 5% - The limits are generally much higher than annual equity grants. Approximately one-third of limits are equivalent to more than 5x the annual equity grants.

Limit Multiple Range Prevalence <= 3x annual equity 37% 3.01x – 5x annual equity 31% 5.01x – 7x annual equity 17% > 7x annual equity 15% - Approximately 60 percent of companies with limits apply it to just equity-based compensation, compared to 70 percent last year. We anticipate the prevalence of limits that apply to both cash and equity-based compensation (i.e., total pay) will continue to increase.

- Some companies exclude initial at-election equity awards and/or additional pay for Board leadership roles from the limit.

- The higher limits above likely are intended to address the possibility of having a non-executive Chair. However, in terms of potential perceived conflict of interest when it comes to setting pay for the non-executive Chair, the incumbent can be recused from discussions and the vote on their pay.

Some Changes CAP Suggests Companies Consider (Looking Ahead).

- Recruiting New Directors. As boards look to refresh and diversify their membership, this may be the time to re-visit initial at-election equity awards for new directors. There has been a considerable “move to the middle” with director pay programs, and at-elections grants can be a way to differentiate your company’s pay program in the recruiting process without a broader, more costly, increase to standard director pay levels.

- Board Leadership Roles. Taking on the role of non-executive Chair, Lead Director or Chair of a major Board committee can come with considerable additional time requirements, responsibilities, and reputational risk, yet additional compensation provided for most of these roles only reflects a market premium on the standard director pay program. Providing greater additional compensation for the role of non-executive Chair, Lead Director of Chair of a major Board committee should be considered, in recognition of the typical time requirements, responsibilities and reputational risk individuals in these roles take on.

- Stock Ownership Requirements. Many boards, especially among the largest companies, require equity-based compensation be deferred until retirement (i.e., termination of board service). While we encourage further aligning director and shareholder interests through equity ownership, another approach is maintaining a standard stock ownership guideline (e.g., multiple of annual cash retainer). A stock ownership guideline may be a competitive advantage when recruiting new directors who may be more focused on current compensation, versus having to hold all equity-based compensation until termination of board service.

Appendix

Total Board Compensation ($000s)4

Additional Compensation for Independent Board Leaders ($000s)

1 Audit, Compensation and/or Nominating and Governance committees.

2 Audit, Compensation and/or Nominating and Governance committees.

3 Excludes controlled companies. Also excludes instances where Lead Director role is assumed by Chair of Nominating and Governance Committee, who receives compensation for the role.

4 Total Board Compensation reflects all cash and equity compensation for Board and committee service, excluding compensation for leadership roles such as committee Chair, Lead/Presiding Director, or non-executive Board Chair.