DOWNLOAD A PDF OF THIS REPORT pdf(0.1MB)

Contact

Melissa BurekFounding Partner [email protected] 212-921-9354 Shaun Bisman

Principal [email protected] 212-921-9365

Compensation Advisory Partners (“CAP”) reviewed 2012 proxy disclosure at a sample of 114 companies representing ten industry groups. The industry groups reviewed include Aerospace and Defense, Automotive, Consumer Products, Financial Services, Health Care, Insurance, Manufacturing, Pharmaceuticals, Retail, and Technology. Our research of these Fortune 500 companies examines changes in executive compensation practices in 2011, observations on current trends, and annual and long-term incentive plan design practices. This CAPFlash, along with our September 14, 2012 CAPFlash, continues to explore changes in executive compensation observed in our research.

For the 114 company sample, median revenue was $30B, median market capitalization was $29B and median Total Shareholder Return (TSR) was 3% for 2011.

What We Found

With the majority of companies in our sample holding annual Say-on-Pay votes, we are seeing companies review various aspects of their pay programs/practices more frequently and make incremental changes. Given the intense pressure from shareholders and proxy advisory firms, companies and their Compensation Committees and outside consultants are annually re-evaluating pay programs. Companies need to stay ahead of the curve and track emerging “best practices” in order to satisfy shareholders. In line with our findings last year, we are continuing to see comprehensive risk assessments, modification of clawback policies and elimination of perquisites and supplemental retirement benefits.

Compensation Risk Disclosure

Of the 114 companies in our study, 113, or 99% made some type of affirmative disclosure on risk assessment in the most recent proxy. This is up from 95% of companies in our 2010 analysis. This affirmative disclosure responds to shareholders who want to be assured that compensation programs are not encouraging risky behavior. Similar to 2010, none of the companies disclosed that their incentive programs create material adverse risks.

Most companies make their risk-related disclosure in the CD&A of the proxy statement, with the corporate governance section of the proxy statement ranking as the second most common place to provide risk disclosure. The table below summarizes where risk disclosures were made:

|

|

2011 |

2010 |

||

|

Section of the Proxy Statement |

No. of Cos. |

% of Cos. n=113 |

No. of Cos. |

% of Cos. n=105 |

|

CD&A |

45 |

40% |

49 |

47% |

|

Corporate Governance Section (Section 407) |

31 |

27% |

25 |

24% |

|

CD&A and Corporate Governance Section (Section 407) |

19 |

17% |

14 |

13% |

|

Separate Stand Alone Section |

13 |

12% |

11 |

10% |

|

CD&A and Compensation Committee Report |

4 |

3% |

4 |

4% |

|

Compensation Committee Report |

1 |

1% |

2 |

2% |

Responsibility for completing the risk assessment process varies by company. Of the companies disclosing a risk assessment, 40 companies (35%) reported that management and the Compensation Committee worked together to conduct the assessment, while 25 companies (23%) reported that the Compensation Committee worked alone to conduct the assessment. This year 96% of companies disclosed who conducted the risk assessment. The table below provides further detail on which groups were involved in the compensation risk review.

|

|

2011 |

2010 |

||

|

Approach to Compensation Risk Reviews |

No. of Cos. |

% of Cos. n=113 |

No. of Cos. |

% of Cos. n=105 |

|

Management and Compensation Committee |

40 |

35% |

35 |

33% |

|

Compensation Committee |

25 |

23% |

17 |

16% |

|

Compensation Committee and Consultant |

17 |

15% |

15 |

14% |

|

Management, Compensation Committee and Consultant |

15 |

13% |

12 |

11% |

|

Management |

8 |

7% |

13 |

12% |

|

Not Disclosed |

5 |

4% |

5 |

5% |

|

Management & Consultant |

3 |

3% |

8 |

8% |

Clawbacks

While the SEC initially planned to implement rules for recouping executive compensation during the first half of 2012, their proposed schedule has been eliminated and no new timetable has been set. Even with no SEC timetable, companies continue to be proactive in adopting clawback policies that go beyond Section 304 of Sarbanes-Oxley, which applies to CEOs and CFOs and the top 25 executives at companies under TARP. Further, while most companies were waiting for final rules, before changing their programs, we are seeing many companies make changes now to respond to the intensifying executive compensation environment.

A significant majority of our research companies – 98 of 114 (86%) – have some form of clawback provision, compared to 80% in 2010. In 2011, 16 of the 98 companies adopted a new clawback policy or amended their existing one: 8 companies adopted a new policy and the other 8 modified existing provisions.

As was the case in 2009 and 2010, a financial restatement is required to trigger a clawback in nearly all cases (84 companies or 86% of those with a clawback, compared to 83% in 2010). Further, 78 companies (80% of those with a clawback, compared to 74% in 2010) disclosed that misconduct is a triggering event and 49 companies (50% of those with a clawback, compared to 51% in 2010) disclosed fraud as a trigger.

It is most common for companies with a clawback policy to include the ability to clawback or recoup compensation previously granted. While it is not currently prevalent for companies to adjust future incentive compensation, this may change based on final rules by the SEC.

|

2011 |

2010 |

|||

|

Compensation Subject to Clawback |

No. of Cos. |

% of Cos. n=98 |

No. of Cos. |

% of Cos. n=89 |

|

Prior LTI |

95 |

97% |

79 |

89% |

|

Prior Annual Incentive |

92 |

94% |

81 |

91% |

|

Adjust Future Annual Incentive |

16 |

16% |

20 |

22% |

|

Adjust Future LTI |

15 |

15% |

14 |

16% |

Note: Percentages add up to greater than 100% due to multiple responses.

Clawback policies cover proxy named executive officers (“NEOs”) in 92% of companies, similar to our findings in 2010, with company’s typically defining coverage as, “executive officers, officers, senior executives or senior management.” The other 8% of companies do not define specific coverage. It is not, however, required to disclose this level of program detail in the proxy, and at many companies the use of clawbacks is broad-based.

Similar to our findings for 2010, a minority of companies (22 companies or 22%) indicate the time period which compensation can be recovered after a financial restatement. Of the 22 companies that disclosed a time frame, the most common is 1 year (41% of companies) from the date of restatement and the range is 1-3 years. Interestingly, some companies are also disclosing different time periods for annual incentives and long-term incentives.

The most comprehensive clawback policies seen in our research apply to executives in financial services companies. Large banks now typically have provisions that extend well beyond those required by SOX or suggested in Dodd-Frank. These detailed programs are likely due to the regulators involvement in the compensation design process, as a result of the financial crisis and TARP. Many of the large banks have multiple programs that can impact different employee populations or pay elements for varying reasons (i.e. financial restatement, fraud, misconduct, inattention to risk, inaccurate performance measurement or unacceptable performance). Morgan Stanley’s policy serves as an example of a comprehensive policy:

Morgan Stanley: “The clawback can be triggered if an individual’s act or omission causes a restatement of the Company’s consolidated financial results or constitutes a violation of the Company’s risk policies and standards, whether such action results in a favorable or unfavorable impact to the Company’s financial results. PSUs are subject to clawback following payment if the Committee determines that the payout was based on materially inaccurate financial statements or other performance metric criteria. Deferred-cash based awards are subject to clawback if an individual’s act or omission causes, or is reasonable expected to cause, a substantial financial loss on trading strategy, investment, commitment or holding in either the current year or any prior year.”

We believe most companies are waiting for the SEC to adopt final rules before changing their clawback provisions. But in light of the SEC’s delayed schedule and the attention of shareholders and the media on this topic, companies will continue to modify their programs to respond to current conditions. Currently, the proposed rules apply to both current and former executives and cover all incentive compensation within 3 years of a financial restatement, regardless of whether intentional misconduct exists.

Perquisites

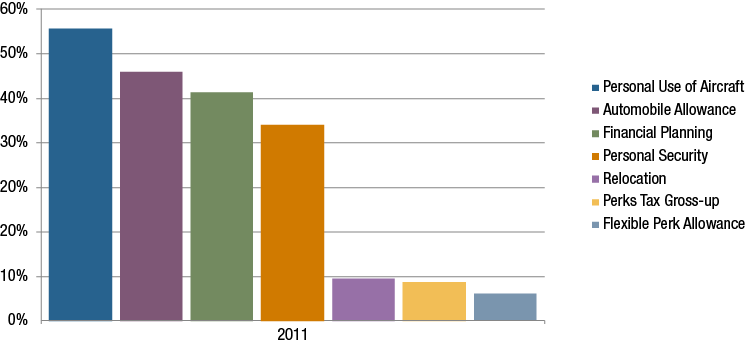

Notwithstanding the trend of decreasing executive perquisites, nearly all companies in our research provide some perquisites to CEOs that extend beyond the benefits provided to the broad employee population. Typical perquisites provided to the CEO include personal use of aircraft (54%), automobile allowance (46%), financial planning (41%) and personal security (35%).

While select perquisites are still somewhat prevalent for CEOs, the trend of reducing executive perks has continued in 2011. It is not surprising that as shareholders express concerns through annual Say-on-Pay votes, one area where companies are responding is by reducing perquisite programs in favor of more performance-based pay. Perquisites are often fairly low in total costs, but high in visibility and sensitivity. In 2011, 14 of 114 companies (12%) disclosed making a change to perquisite programs. Similar to 2009 and 2010, the most prevalent change was the elimination of certain perquisites.

|

|

2011 |

2010 |

||

|

Type of Change Reported in 2011 CD&A |

No. of Cos. |

% of Cos. n=14 |

No. of Cos. |

% of Cos. n=20 |

|

Eliminated perquisites |

9 |

64% |

11 |

55% |

|

Eliminated tax gross-ups on perquisites |

6 |

43% |

8 |

40% |

|

Reduced perquisites |

1 |

7% |

2 |

10% |

|

Changed perquisites |

0 |

0% |

3 |

15% |

Note: Percentages add up to greater than 100% due to multiple responses.

Among companies eliminating perquisites, the most common (in 4 of 9 companies) involved eliminating personal travel on the corporate aircraft or use of company automobile/automobile allowance. 2 of 9 (22%) eliminated home security benefits. Further, of the 9 companies that eliminated perquisites, 3 made up for the lost value in either annual base salary going forward or a one-time payment to cover the loss of the benefit.

Executive Retirement Benefits

16 of 114 companies (14%) disclosed making some type of change to executive retirement plans/benefits in 2011, a slight decrease from 2010 where 17% of companies disclosed a change. As was the case in 2010, t